- METHOD TYPEReal-Time Bank Transfer

- PAYMENTS

- PAYOUTS

- REFUNDS

- RECURRING

Introduction

Interac eCashout, a product of Express Connect E-wallet, is a popular alternative payment method in Canada for both businesses and individuals. It allows users to fund their E-wallets and make online payments without having to enter card details every time. It is a flexible and convenient payment processing feature.

Interac eCashout allows your customers to link any number of their Canadian bank accounts to their email address. The Nuvei platform encrypts your customer’s bank account details securely, and provides a userPaymentOptionId (UPO) representing the account for you to use in transactions.

Prerequisites and Notes

- This guide assumes you have completed all account setup prerequisites, and are ready to integrate Interac eCashout into your payment flow.

- Interac eCashout only supports Canadian based IPs.

- Payout (withdrawal) transactions are conducted in Canadian Dollars between Canadian bank accounts.

- Nuvei handles Interac eCashout transactions in “redirection mode”.

- A UPO (user payment option) is an encrypted customer payment method record stored in the Nuvei system, representing a customer bank account or other payment method.

- Test credentials and testing scenarios can be provided by Nuvei if necessary. You can contact Nuvei support for assistance.

Supported Countries

- Canada

Supported Currencies

- CAD

Payout (Withdrawal) Flow

The following two methods can be used to process a /payout request with Interac eCashout:

- By collecting the customer’s bank account details using the

/accountCapturemethod. - By creating a UPO, which represents the customer’s bank account details, with the

/addUPOAPMmethod

Press tab to open…

- Generate a

sessionToken. Press here for details. - Send an

/accountCapturerequest that includes the following mandatory fields as shown in the example request below:userTokenId– Unique customer identifier in merchant system.paymentMethod: “apmgw_Express_Connect“currencyCode: CADcountryCode: CA

Example

/accountCaptureRequest{ "sessionToken": "<sessionToken from /getSessionToken>", "merchantId": "<your merchantId>", "merchantSiteId": "<your merchantSiteId>", "userTokenId": "<unique customer identifier in merchant system>", "paymentMethod": "apmgw_Express_Connect", "currencyCode": "CAD", "countryCode": "CA", }The request returns a

redirectUrl.Example

/accountCaptureResponse{ "reason": "", "redirectUrl": "https://interac.express-connect.com/webflow/verify?token=eyJhbGciOiJIUzI1NiIsInR5cCI6IkpXVCJ9.eyJhbW91bnQiOiIxIiwiYWRkcmVzcyI6IjI5OTIgQ2FtZXJvbiBSb2FkIiwiY2l0eSI6Ik5ld2FyayIsInNhbmRib3giOiJ0cnVlIiwibW9iaWxlIjoiMDg4ODg4ODQzMiIsImxhc3RfbmFtZSI6IkJPQkJFVEhDSEFSTEVTT04iLCJ0eXBlIjoiS1k0IiwidXNlcklkIjoiQ0Q1MDFBRjlGQTg1MDAxN0M5Mzk5QjZGNTlGRDNDMTUiLCJzaXRlIjoidGVzdCIsInByb3ZpbmNlIjoiTlkiLCJET0IiOiIxOTk3LTA5LTI2IiwidXNlcklwIjoiMTE0LjEzLjEyLjExIiwiY3VycmVuY3kiOiJDQUQiLCJwb3N0YWxfY29kZSI6IjE0MjM2IiwibGFuZyI6ImVuIiwiZmlyc3RfbmFtZSI6IkFMQkVSVEEiLCJlbWFpbCI6ImFjY291bnR0ZXN0bWFpbEBnbS5jb20iLCJ0cmFuc2FjdGlvbiI6IkNENTAxQUY5RkE4NTAwMTdDOTM5OUI2RjU5RkQzQzE1IiwidXNlciI6ImJmMGRhODViZjgyOTMyZWVmMjFhY2ZhNzM0YjZmNjA1IiwiY2FtcGFpZ24iOiI2YWMwZmYzYzY5NTdiNmY4ZTVkMDgxM2Y1MjY4OWNlMyIsImVudGl0eUlkIjoxLCJpYXQiOjE3MDE3OTIyMjAsImV4cCI6MTcwMTg3ODYyMH0.YeG1n2gTpA37JLDZSntpbnhTZkb2lLMDendqihF3Lx4", "merchantId": "2502136204546424962", "errCode": 0, "sessionToken": "aff5c587-6d76-42f5-bcbe-934209753951", "internalRequestId": 35455681, "userTokenId": "42WPMSNLOBAT", "version": "1.0", "status": "SUCCESS", "merchantSiteId": "126006" }

- Use

redirectUrlto redirect the customer to the APM’s account details capture interface for them to enter their account details. - Once the information is captured, Nuvei stores the data in a

userPaymentOptionIdidentifier, and sends a Direct Merchant Notification (DMN) back to you with the newly createduserPaymentOptionId. - Send a /payout request and include the

userPaymentOptionId, which contains the user’s previously stored APM account details. Press here for an example.

After the transaction is processed, Nuvei sends a DMN that includes the result of the transaction to the URL provided inurlDetails.notificationUrl, which Nuvei recommends including in the/payoutrequest.

1. Register a userTokenId

A userTokenId is a field in the Nuvei system containing the user’s identifier in the merchant system.

If you do not have a userTokenId registered in the Nuvei system for this user, then register one by sending a /createUser request, including email, countryCode, firstName, and lastName.

Example /createUser Request

{

"merchantId": "<your merchantId>",

"merchantSiteId": "<your merchantSiteId>",

"userTokenId": "<unique customer identifier in merchant system>",

"clientUniqueId": "<unique transaction ID in merchant system>",

"clientRequestId": "<unique request ID in merchant system>",

"currency": "CAD",

"amount": "100",

"userPaymentOption": {

"userPaymentOptionId": "<ID of a previously stored payment option>"

},

"deviceDetails": {

"ipAddress": "<customer's IP address>"

},

"urlDetails": {

"notificationUrl": "<URL to which DMNs are sent>"

},

"timeStamp": "<YYYYMMDDHHmmss>",

"checksum": "<calculated checksum>"

}

Example /createUser Response

{

"transactionStatus": "APPROVED",

"clientRequestId": "W1Q3SBGE4",

"internalRequestId": 17817071,

"version": "1.0",

"transactionId": "2110000000004333013",

"merchantSiteId": "126006",

"merchantId": "2502136204546424962",

"clientUniqueId": "695701003",

"errCode": 0,

"userPaymentOptionId": "8054521",

"paymentMethodErrorCode": 0,

"userTokenId": "CEBQK9OVSLJA",

"externalTransactionId": "2110000000068709",

"status": "SUCCESS"

}

2. Create the UPO

Create a UPO by sending an /addUPOAPM request and include:

userTokenId– The unique user identifier in your system.paymentMethodName: “apmgw_Express_Connect“apmDataclass containing:accountNumber– User account numberinstitutionNumber– User institution numbertransitNumber– User account transmit number

billingAddressclass containing:countryandemail

Example /addUPOAPM Request

{

"merchantSiteId":"<your merchantSiteId>",

"merchantId":"<your merchantId>",

"userTokenId":"<unique customer identifier in merchant system>",

"clientRequestId":"<unique request ID in merchant system>",

"paymentMethodName":"apmgw_Express_Connect",

"apmData":{

"accountNumber":"<1234567>",

"institutionNumber": "<123>",

"transitNumber": "<12345>"

},

"billingAddress":{

"country":"CA",

"email":"[email protected]"

},

"timeStamp":"<YYYYMMDDHHmmss>",

"checksum":"<calculated checksum>"

}

Example /addUPOAPM Response

{

"userPaymentOptionId":2152829771,

"internalRequestId":25129841,

"status":"SUCCESS",

"errCode":0,

"reason":"",

"merchantId":"1102398682906145682",

"merchantSiteId":"228311",

"version":"1.0",

"clientRequestId":"20230228133537"

}

3. Send a /payout Request

Send a /payout request and include the userPaymentOptionId, which contains the user’s previously stored APM account details. Press here for an example.

After the transaction is processed, Nuvei sends a DMN that includes the result of the transaction to the URL provided in urlDetails.notificationUrl, which Nuvei recommends including in the /payout request.

-

/accountCapture -

- Generate a

sessionToken. Press here for details. - Send an

/accountCapturerequest that includes the following mandatory fields as shown in the example request below:userTokenId– Unique customer identifier in merchant system.paymentMethod: “apmgw_Express_Connect“currencyCode: CADcountryCode: CA

Example

/accountCaptureRequest{ "sessionToken": "<sessionToken from /getSessionToken>", "merchantId": "<your merchantId>", "merchantSiteId": "<your merchantSiteId>", "userTokenId": "<unique customer identifier in merchant system>", "paymentMethod": "apmgw_Express_Connect", "currencyCode": "CAD", "countryCode": "CA", }The request returns a

redirectUrl.Example

/accountCaptureResponse{ "reason": "", "redirectUrl": "https://interac.express-connect.com/webflow/verify?token=eyJhbGciOiJIUzI1NiIsInR5cCI6IkpXVCJ9.eyJhbW91bnQiOiIxIiwiYWRkcmVzcyI6IjI5OTIgQ2FtZXJvbiBSb2FkIiwiY2l0eSI6Ik5ld2FyayIsInNhbmRib3giOiJ0cnVlIiwibW9iaWxlIjoiMDg4ODg4ODQzMiIsImxhc3RfbmFtZSI6IkJPQkJFVEhDSEFSTEVTT04iLCJ0eXBlIjoiS1k0IiwidXNlcklkIjoiQ0Q1MDFBRjlGQTg1MDAxN0M5Mzk5QjZGNTlGRDNDMTUiLCJzaXRlIjoidGVzdCIsInByb3ZpbmNlIjoiTlkiLCJET0IiOiIxOTk3LTA5LTI2IiwidXNlcklwIjoiMTE0LjEzLjEyLjExIiwiY3VycmVuY3kiOiJDQUQiLCJwb3N0YWxfY29kZSI6IjE0MjM2IiwibGFuZyI6ImVuIiwiZmlyc3RfbmFtZSI6IkFMQkVSVEEiLCJlbWFpbCI6ImFjY291bnR0ZXN0bWFpbEBnbS5jb20iLCJ0cmFuc2FjdGlvbiI6IkNENTAxQUY5RkE4NTAwMTdDOTM5OUI2RjU5RkQzQzE1IiwidXNlciI6ImJmMGRhODViZjgyOTMyZWVmMjFhY2ZhNzM0YjZmNjA1IiwiY2FtcGFpZ24iOiI2YWMwZmYzYzY5NTdiNmY4ZTVkMDgxM2Y1MjY4OWNlMyIsImVudGl0eUlkIjoxLCJpYXQiOjE3MDE3OTIyMjAsImV4cCI6MTcwMTg3ODYyMH0.YeG1n2gTpA37JLDZSntpbnhTZkb2lLMDendqihF3Lx4", "merchantId": "2502136204546424962", "errCode": 0, "sessionToken": "aff5c587-6d76-42f5-bcbe-934209753951", "internalRequestId": 35455681, "userTokenId": "42WPMSNLOBAT", "version": "1.0", "status": "SUCCESS", "merchantSiteId": "126006" }

- Use

redirectUrlto redirect the customer to the APM’s account details capture interface for them to enter their account details. - Once the information is captured, Nuvei stores the data in a

userPaymentOptionIdidentifier, and sends a Direct Merchant Notification (DMN) back to you with the newly createduserPaymentOptionId. - Send a /payout request and include the

userPaymentOptionId, which contains the user’s previously stored APM account details. Press here for an example.

After the transaction is processed, Nuvei sends a DMN that includes the result of the transaction to the URL provided inurlDetails.notificationUrl, which Nuvei recommends including in the/payoutrequest.

- Generate a

-

/addUPOAPM -

1. Register a

userTokenIdA

userTokenIdis a field in the Nuvei system containing the user’s identifier in the merchant system.If you do not have a

userTokenIdregistered in the Nuvei system for this user, then register one by sending a/createUserrequest, includingemail,countryCode,firstName, andlastName.Example

/createUserRequest{ "merchantId": "<your merchantId>", "merchantSiteId": "<your merchantSiteId>", "userTokenId": "<unique customer identifier in merchant system>", "clientUniqueId": "<unique transaction ID in merchant system>", "clientRequestId": "<unique request ID in merchant system>", "currency": "CAD", "amount": "100", "userPaymentOption": { "userPaymentOptionId": "<ID of a previously stored payment option>" }, "deviceDetails": { "ipAddress": "<customer's IP address>" }, "urlDetails": { "notificationUrl": "<URL to which DMNs are sent>" }, "timeStamp": "<YYYYMMDDHHmmss>", "checksum": "<calculated checksum>" }Example

/createUserResponse{ "transactionStatus": "APPROVED", "clientRequestId": "W1Q3SBGE4", "internalRequestId": 17817071, "version": "1.0", "transactionId": "2110000000004333013", "merchantSiteId": "126006", "merchantId": "2502136204546424962", "clientUniqueId": "695701003", "errCode": 0, "userPaymentOptionId": "8054521", "paymentMethodErrorCode": 0, "userTokenId": "CEBQK9OVSLJA", "externalTransactionId": "2110000000068709", "status": "SUCCESS" }2. Create the UPO

Create a UPO by sending an

/addUPOAPMrequest and include:userTokenId– The unique user identifier in your system.paymentMethodName: “apmgw_Express_Connect“apmDataclass containing:accountNumber– User account numberinstitutionNumber– User institution numbertransitNumber– User account transmit number

billingAddressclass containing:countryandemail

Example

/addUPOAPMRequest{ "merchantSiteId":"<your merchantSiteId>", "merchantId":"<your merchantId>", "userTokenId":"<unique customer identifier in merchant system>", "clientRequestId":"<unique request ID in merchant system>", "paymentMethodName":"apmgw_Express_Connect", "apmData":{ "accountNumber":"<1234567>", "institutionNumber": "<123>", "transitNumber": "<12345>" }, "billingAddress":{ "country":"CA", "email":"[email protected]" }, "timeStamp":"<YYYYMMDDHHmmss>", "checksum":"<calculated checksum>" }Example

/addUPOAPMResponse{ "userPaymentOptionId":2152829771, "internalRequestId":25129841, "status":"SUCCESS", "errCode":0, "reason":"", "merchantId":"1102398682906145682", "merchantSiteId":"228311", "version":"1.0", "clientRequestId":"20230228133537" }3. Send a

/payoutRequestSend a

/payoutrequest and include theuserPaymentOptionId, which contains the user’s previously stored APM account details. Press here for an example.After the transaction is processed, Nuvei sends a DMN that includes the result of the transaction to the URL provided in

urlDetails.notificationUrl, which Nuvei recommends including in the/payoutrequest.

User Experience

- The user is redirected to third-party page to log in to their bank and confirm the request.

A withdrawal request is created. - The merchant processes the withdrawal via API or from the back office Control Panel.

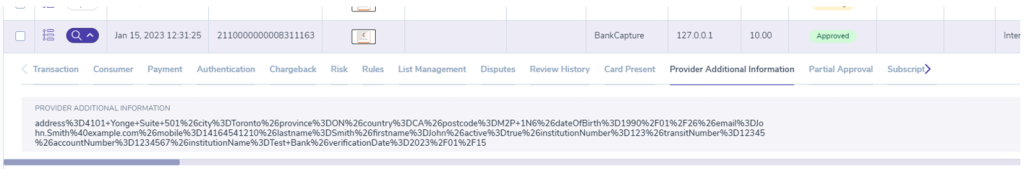

The merchant is able to see the bank capture transaction on the Control Panel, as well as the details that were provided by the bank. The merchant can then decide whether to process the payout or not.

Testing

User details for the KYC flow:

| first_name | John |

| last_name | Smith |

| address | 4101 Yonge Suite 501 |

| city | Toronto |

| province | ON |

| country | CA |

| postal_code | M2P 1N6 |

| DOB | 1990-01-26 00:00:00 |

| [email protected] | |

| mobile | 14164541210 |

Last modified August 2024

Last modified August 2024