Overview

The following summarized high-level Nuvei payment flows are described in this topic:

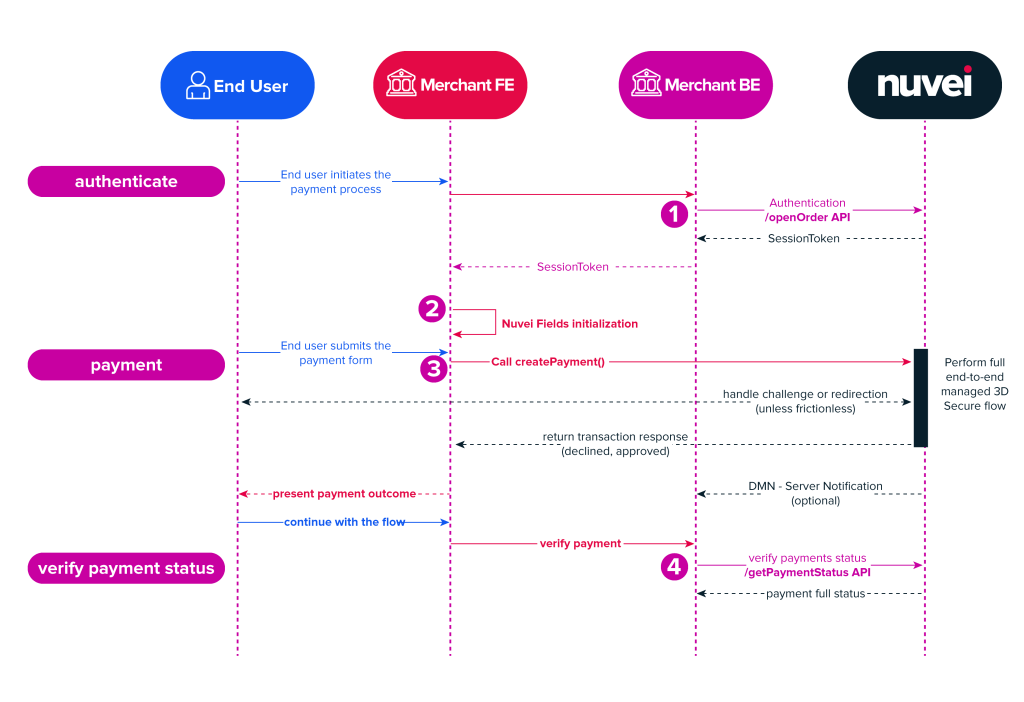

Web SDK Flow

This is the basic Web SDK flow. In most cases, it is “best practice” to implement this flow.

Summary of the Web SDK Flow

The process starts when the customer decides to make a payment:

- From your backend, you need to initiate the flow by posting the

/openOrderAPI. In addition to passing the authentication credentials, you must also passamountandcurrency.

The/openOrdermethod retrieves thesessionTokenthat authenticates for this session. - From your front end, you need to initiate the Web SDK. Use the Nuvei Fields guide and the Styling guide to set them up in your payment form.

- After the customer enters their payment details on your payment form and submits it for payment, call the Web SDK

createPayment()method.

This method runs the payment flow end-to-end and performs any 3D Secure (3DS) requirements – both server side and client side.

ThecreatePayment()method does the following:- Determine and handle the relevant 3DS action.

- Handle the 3DS fingerprinting and send the results to the issuer.

- If the issuer’s response is not frictionless, then the method redirects to perform the relevant challenge.

- Returns the 3DS authentication information from the issuer –

cavv,eci, etc.

- When the payment process is complete, you receive the payment status response. You can display the relevant message to the customer.

Remember that this is not a verified response. - When your server receives the indication from your client side (on form submission), you should either:

- Send a

/getPaymentStatusAPI request to validate the response. - Alternatively, you can set up DMNs in async mode directly to your server.

- Send a

Web SDK Flow

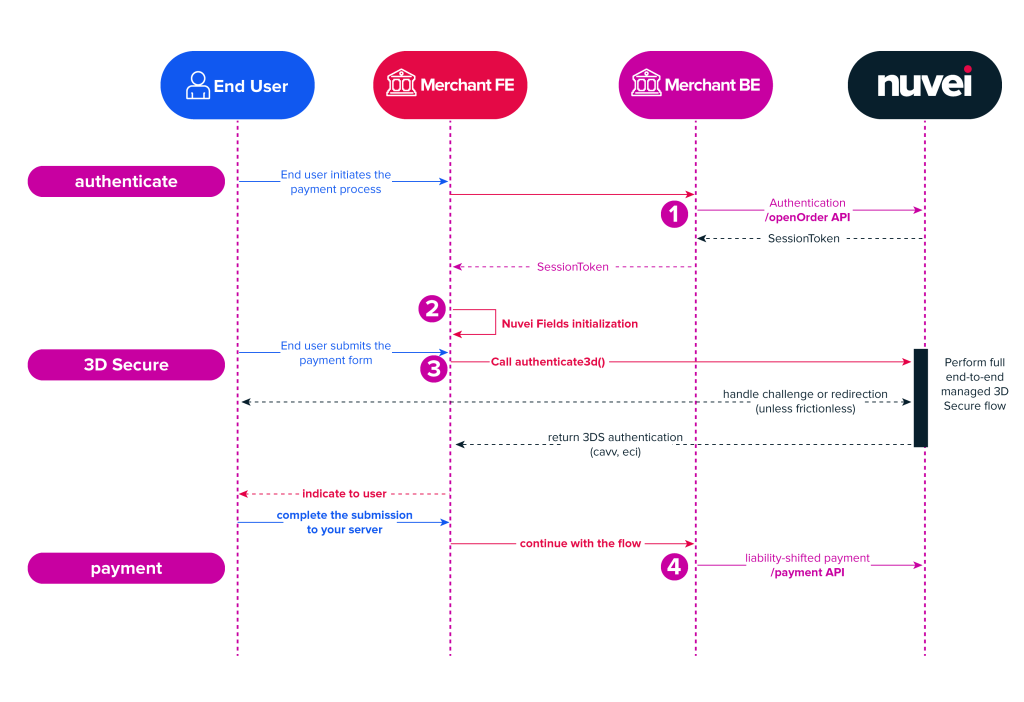

3DS MPI-Only Flow for Web SDK

The 3DS MPI-Only flow for Web SDK combines Web SDK (for 3DS and PCI descoping) and API for performing the payment itself.

Summary of the 3DS MPI-Only Flow for Web SDK

- From your backend, you need to initiate the flow by posting the

/openOrderAPI. In addition to passing the authentication credentials, you must also passamountandcurrency.

The/openOrdermethod retrieves asessionTokenwhich authenticates the session. - Initiate the Web SDK from your front end. Embed the relevant Nuvei Fields in your payment form and customize their styling to match your UI/UX.

- After the customer enters their payment details on your payment form and submits it for payment, call the Web SDK

authenticate3d()method.

This method does not perform the payment, but it runs the 3DS end-to-end flow and performs any 3DS requirements – both server side and client side.

Theauthenticate3d()method does the following:- Determine and handle the relevant 3DS action.

- Handle the 3DS fingerprinting and send the results to the issuer.

- If the issuer’s response is not frictionless, then the method redirects to perform the relevant challenge.

- Returns the 3DS authentication information from the issuer –

cavv,eci, etc.

- When you receive the authentication response from the issuer, you can display the relevant message to the customer.

- If the authentication returned success, then continue by sending a liability-shifted

/paymentAPI request.

3DS MPI-Only Flow for Web SDK

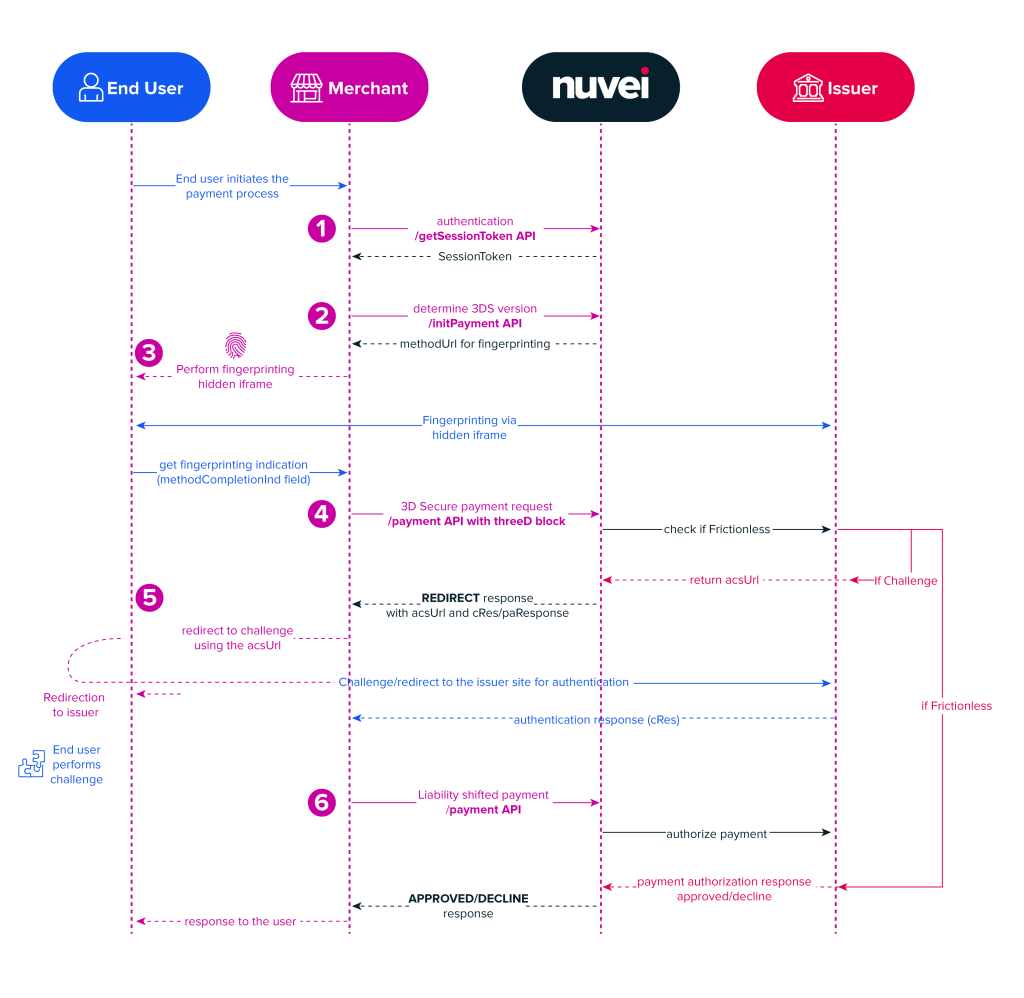

Server-to-Server Flow

The Server-to-Server flow for accepting payments uses the Nuvei Server SDKs (Java, PHP, .NET, Node.JS) and Nuvei APIs.

Summary of the Server-to-Server Flow

-

- From your backend, you need to initiate the flow by posting the

/getSessionTokenAPI to pass the authentication credentials.

This returns asessionTokenthat is needed to authenticate subsequent steps in this session. - Call the

/initPaymentAPI request to determine if the card supports 3DS, initialize the payment in the Nuvei system, return themethodUrl, and other details required for the 3DS fingerprinting. - Perform the 3DS fingerprinting to authenticate the client-side device.

- Perform the 3DS payment request by submitting the

/paymentAPI request that includes athreeDinput class.

If a frictionless response is returned (APPROVED or DECLINED), then display the response to the customer and the payment flow ends here. - If the response returns REDIRECT, then redirect to the customer to perform a 3DS challenge.

- If a 3DS challenge was performed and if the issuer approved the payment, then perform a liability-shift payment by sending a

/paymentcall (without athreeDclass).

This returnsapprovedordeclinedresponse for the payment, which you can display to the customer.

- From your backend, you need to initiate the flow by posting the

Last modified February 2025

Last modified February 2025