- METHOD TYPEReal-Time Bank Transfer

- PAYMENTS

- PAYOUTS

- REFUNDS

- RECURRING

Introduction

MX Payouts is a withdrawal-only method that combines options to process payouts either via STPMEX or via BBVA (Paymentez integration). The traffic split can be done according to the end user bank by using a traffic management rule.

Supported Countries

- Mexico

Supported Currencies

- MXN

Payout (Withdrawal) Flow

REST API

The following two methods can be used to process a /payout request with STPmex:

- By collecting the customer’s bank account details using the

/accountCapturemethod. - By creating a UPO, which represents the customer’s bank account details, with the

/addUPOAPMmethod.

Press tab to open…

- Generate a

sessionToken. Press here for details. - Send an

/accountCapturerequest that includes the following mandatory fields as shown in the example request below:userTokenId– Unique customer identifier in merchant system.paymentMethod: “apmgw_MX_Payouts“currencyCode: MXNcountryCode: MX

Example

/accountCaptureRequest{ "sessionToken": "<sessionToken from /getSessionToken>", "merchantId": "<your merchantId>", "merchantSiteId": "<your merchantSiteId>", "userTokenId": "<unique customer identifier in merchant system>", "paymentMethod": "apmgw_MX_Payouts", "currencyCode": "MXN", "countryCode": "MX", }The request returns a

redirectUrl.Example

/accountCaptureResponse{ "redirectUrl":"https://ppp-test.safecharge.com/ppp/acs/get.do?cccid=111&country=MX&language=en&amount=100¤cy=MXN&ReturnURL=https%3a%2f%2ftest.safecharge.com%2fAPMNotificationGateway%2fSTPmex%2fSTPmexRedirectWithdrawResponse.ashx&APMTransactionID=404EE9CD3BBDDD2622BECE95DA936FF1&AccountInfo5=+", "userTokenId":"1810test", "sessionToken":"89c762b7-06c6-45f4-8517-0e335350d0e3", "internalRequestId":603948068, "status":"SUCCESS", "errCode":0, "reason":"", "merchantId":"221195993304907999", "merchantSiteId":"232618", "version":"1.0" }

- Use

redirectUrlto redirect the customer to the APM’s account details capture interface for them to enter their account details. - Once the information is captured, Nuvei stores the data in a

userPaymentOptionId(UPO) identifier, and sends a with the newly createduserPaymentOptionIdtourlDetails.notificationUrl, which Nuvei recommends including in the/accountCapturerequest. - Send a

/payoutrequest and include theuserPaymentOptionId, which contains the user’s previously stored APM account details. Press here for an example.

1. Register a userTokenId

A userTokenId is a field in the Nuvei system containing the user’s identifier in the merchant system.

If you do not have a userTokenId registered in the Nuvei system for this user, then register one by sending a /createUser request, including email, countryCode, firstName, and lastName.

Example /createUser Request

{

"merchantId":"<your merchantId>",

"merchantSiteId":"<your merchantSiteId>",

"clientRequestId":"<unique request ID in merchant system>",

"userTokenId":"<unique user identifier in merchant system>",

"email":"[email protected]",

"countryCode":"<2-letter ISO country code>",

"firstName":"John",

"lastName":"Smith",

"timeStamp":"<YYYYMMDDHHmmss>",

"checksum":"<calculated checksum>"

}

Example /createUser Response

{

"userId":78403498,

"internalRequestId":552360538,

"status":"SUCCESS",

"errCode":0,

"reason":"",

"merchantId":"2439523627382132721",

"merchantSiteId":"224428",

"version":"1.0",

"clientRequestId":"20221108130736"

}

The request registers the userTokenId (userId) in the Nuvei system, which is needed to generate a userPaymentOptionId in the next step.

2. Create the UPO

Create a UPO by sending an /addUPOAPM request and include:

userTokenId– The unique user identifier in your system.paymentMethodName: “apmgw_MX_Payouts“apmDataclass containing:beneficiaryBank– Press here to see list of supportedbeneficiaryBankcodes.beneficiaryNamebeneficiaryNumberbeneficiaryType

billingAddressclass containing:countryandemail

Example /addUPOAPM Request

{

"merchantId":"<your merchantId>",

"merchantSiteId":"<your merchantSiteId>",

"clientRequestId":"<unique request ID in merchant system>",

"userTokenId":"<unique customer identifier in merchant system>",

"paymentMethodName":"apmgw_MX_Payouts",

"apmData": {

"beneficiaryBank": "<supported beneficiary bank code>",

"beneficiaryName": "John Smith",

"beneficiaryNumber": "<CLABE number>",

"beneficiaryType": "40"

},

"billingAddress":{

"country":"MX",

"email":"[email protected]"

},

"timeStamp":"<YYYYMMDDHHmmss>",

"checksum":"<calculated checksum>"

}

The request returns an encrypted userPaymentOptionId representing the user’s APM account details.

Example /addUPOAPM Response

{

"userPaymentOptionId":83458468,

"internalRequestId":553078068,

"status":"SUCCESS",

"errCode":0,

"reason":"",

"merchantId":"2439523627382132721",

"merchantSiteId":"224428",

"version":"1.0",

"clientRequestId":"20221109154215"

}

3. Send a /payout Request

Send a /payout request and include the userPaymentOptionId, which contains the user’s previously stored APM account details. Press here for an example.

-

/accountCapture -

- Generate a

sessionToken. Press here for details. - Send an

/accountCapturerequest that includes the following mandatory fields as shown in the example request below:userTokenId– Unique customer identifier in merchant system.paymentMethod: “apmgw_MX_Payouts“currencyCode: MXNcountryCode: MX

Example

/accountCaptureRequest{ "sessionToken": "<sessionToken from /getSessionToken>", "merchantId": "<your merchantId>", "merchantSiteId": "<your merchantSiteId>", "userTokenId": "<unique customer identifier in merchant system>", "paymentMethod": "apmgw_MX_Payouts", "currencyCode": "MXN", "countryCode": "MX", }The request returns a

redirectUrl.Example

/accountCaptureResponse{ "redirectUrl":"https://ppp-test.safecharge.com/ppp/acs/get.do?cccid=111&country=MX&language=en&amount=100¤cy=MXN&ReturnURL=https%3a%2f%2ftest.safecharge.com%2fAPMNotificationGateway%2fSTPmex%2fSTPmexRedirectWithdrawResponse.ashx&APMTransactionID=404EE9CD3BBDDD2622BECE95DA936FF1&AccountInfo5=+", "userTokenId":"1810test", "sessionToken":"89c762b7-06c6-45f4-8517-0e335350d0e3", "internalRequestId":603948068, "status":"SUCCESS", "errCode":0, "reason":"", "merchantId":"221195993304907999", "merchantSiteId":"232618", "version":"1.0" }

- Use

redirectUrlto redirect the customer to the APM’s account details capture interface for them to enter their account details. - Once the information is captured, Nuvei stores the data in a

userPaymentOptionId(UPO) identifier, and sends a with the newly createduserPaymentOptionIdtourlDetails.notificationUrl, which Nuvei recommends including in the/accountCapturerequest. - Send a

/payoutrequest and include theuserPaymentOptionId, which contains the user’s previously stored APM account details. Press here for an example.

- Generate a

-

/addUPOAPM -

1. Register a

userTokenIdA

userTokenIdis a field in the Nuvei system containing the user’s identifier in the merchant system.If you do not have a

userTokenIdregistered in the Nuvei system for this user, then register one by sending a/createUserrequest, includingemail,countryCode,firstName, andlastName.Example

/createUserRequest{ "merchantId":"<your merchantId>", "merchantSiteId":"<your merchantSiteId>", "clientRequestId":"<unique request ID in merchant system>", "userTokenId":"<unique user identifier in merchant system>", "email":"[email protected]", "countryCode":"<2-letter ISO country code>", "firstName":"John", "lastName":"Smith", "timeStamp":"<YYYYMMDDHHmmss>", "checksum":"<calculated checksum>" }Example

/createUserResponse{ "userId":78403498, "internalRequestId":552360538, "status":"SUCCESS", "errCode":0, "reason":"", "merchantId":"2439523627382132721", "merchantSiteId":"224428", "version":"1.0", "clientRequestId":"20221108130736" }The request registers the

userTokenId(userId) in the Nuvei system, which is needed to generate auserPaymentOptionIdin the next step.2. Create the UPO

Create a UPO by sending an

/addUPOAPMrequest and include:userTokenId– The unique user identifier in your system.paymentMethodName: “apmgw_MX_Payouts“apmDataclass containing:beneficiaryBank– Press here to see list of supportedbeneficiaryBankcodes.beneficiaryNamebeneficiaryNumberbeneficiaryType

billingAddressclass containing:countryandemail

Example

/addUPOAPMRequest{ "merchantId":"<your merchantId>", "merchantSiteId":"<your merchantSiteId>", "clientRequestId":"<unique request ID in merchant system>", "userTokenId":"<unique customer identifier in merchant system>", "paymentMethodName":"apmgw_MX_Payouts", "apmData": { "beneficiaryBank": "<supported beneficiary bank code>", "beneficiaryName": "John Smith", "beneficiaryNumber": "<CLABE number>", "beneficiaryType": "40" }, "billingAddress":{ "country":"MX", "email":"[email protected]" }, "timeStamp":"<YYYYMMDDHHmmss>", "checksum":"<calculated checksum>" }The request returns an encrypted

userPaymentOptionIdrepresenting the user’s APM account details.Example

/addUPOAPMResponse{ "userPaymentOptionId":83458468, "internalRequestId":553078068, "status":"SUCCESS", "errCode":0, "reason":"", "merchantId":"2439523627382132721", "merchantSiteId":"224428", "version":"1.0", "clientRequestId":"20221109154215" }3. Send a

/payoutRequestSend a

/payoutrequest and include theuserPaymentOptionId, which contains the user’s previously stored APM account details. Press here for an example.

After the transaction is processed, Nuvei sends a DMN that includes the result of the transaction to the URL provided in urlDetails.notificationUrl, which Nuvei recommends including in the /payout request.

Web SDK

When performing a Withdrawal with SPEI, the following two methods can be used to process a Withdrawal request: accountCapture() or addApmUpo().

For information about the Withdrawal flow for WebSDK, see Withdrawal.

Press tab to open…

The following flow describes how to capture a user’s account details before processing a payout request using Nuvei Web SDK integration.

1. Initiate a Session

Before you can submit payment using the client-side Nuvei Web SDK, you need to send the /openOrder API call.

2. Initialize the Web SDK

Instantiate the Web SDK with the sessionToken received from the server call to /openOrder.

3. Send an accountCapture() request

a. Send an accountCapture() request that includes the following mandatory fields (as shown in the example request below):

userTokenId– Unique customer identifier in merchant system.paymentMethod: “apmgw_MX_Payouts“currencyCodecountryCode

Example accountCapture() Request

sfc.accountCapture({

sessionToken: "<sessiontoken>",

merchantId: "<your merchantId>",

merchantSiteId: "<your merchantSiteId>",

paymentMethod: "apmgw_MX_Payouts",

userTokenId: "<unique customer identifier in merchant system>",

currencyCode: "MXN",

countryCode: "MX",

languageCode: "en",

urlDetails:{

successUrl:"<URL the customer is directed to after a successful transaction>",

pendingUrl:"<URL the customer is directed to when the transaction response is pending>",

failureUrl:"<URL the customer is directed to after an unsuccessful transaction>",

notificationUrl:"<URL to which DMNs are sent>"

},

sourceApplication: "WebSDK"

}, function(accountRes) {

console.log(accountRes);

})

The request returns a redirectUrl.

Example accountCapture() Response

{

"redirectUrl": "<redirect URL to enter account details>",

"userTokenId": "bankCaptureUser4",

"sessionToken": "e44a932a-e9fc-4482-a570-cf07175408e0",

"internalRequestId": 23238261,

"status": "SUCCESS",

"errCode": 0,

"reason": "",

"merchantId": "8256777005602846935",

"merchantSiteId": "112106",

"version": "1.0"

}

b. Use the redirectUrl to redirect the customer to the APM’s account details interface, to enter their account details.

c. Once the information is captured, Nuvei stores the data in a UPO record, and sends a DMN with the newly created userPaymentOptionId to urlDetails.notificationUrl, which Nuvei recommends including in the /accountCapture request.

4. Send a /payout Request

Send a /payout request and include the userPaymentOptionId, which contains the user’s previously stored APM account details. Press here for an example.

1. Register a userTokenId

A userTokenId is a field in the Nuvei system containing the user’s identifier in the merchant system.

If you do not have a userTokenId registered in the Nuvei system for this user, then register one by sending a /createUser request, including email, countryCode, firstName, and lastName.

Example /createUser Request

{

"merchantId":"<your merchantId>",

"merchantSiteId":"<your merchantSiteId>",

"clientRequestId":"<unique request ID in merchant system>",

"userTokenId":"<unique user identifier in merchant system>",

"email":"[email protected]",

"countryCode":"<2-letter ISO country code>",

"firstName":"John",

"lastName":"Smith",

"timeStamp":"<YYYYMMDDHHmmss>",

"checksum":"<calculated checksum>"

}

Example /createUser Response

{

"userId":78403498,

"internalRequestId":552360538,

"status":"SUCCESS",

"errCode":0,

"reason":"",

"merchantId":"2439523627382132721",

"merchantSiteId":"224428",

"version":"1.0",

"clientRequestId":"20221108130736"

}

The request registers the userTokenId (userId) in the Nuvei system, which is needed to generate a userPaymentOptionId in the next step.

2. Create the UPO

Create a UPO by sending an addApmUpo() request and include:

userTokenId– The unique user identifier in your system.paymentMethodName: “apmgw_MX_Payouts“apmDataclass containing:beneficiaryBank– Press here to see list of supportedbeneficiaryBankcodes.beneficiaryNamebeneficiaryNumberbeneficiaryType

billingAddressclass containing:countryandemail

Example addApmUpo() Request

function addApmUpo() {

sfc.addApmUpo({

"paymentMethodName": "apmgw_MX_Payouts",

"apmData": {

"beneficiaryBank": "<supported beneficiary bank code>",

"beneficiaryName": "John Smith",

"beneficiaryNumber": "<CLABE number>",

"beneficiaryType": "40"

},

billingAddress: { // optional

email: '[email protected]',

country: 'MX'

} },

function(result) {

console.log(result);

})

The request returns an encrypted userPaymentOptionId representing the user’s APM account details.

Example addApmUpo() Response

{

"result": "ADDED",

"errCode": 0,

"errorDescription": "",

"userPaymentOptionId": "14958143",

"cancelled": false

}

3. Send a /payout Request

Send a /payout request and include the userPaymentOptionId, which contains the user’s previously stored APM account details. Press here for an example.

-

accountCapture() -

The following flow describes how to capture a user’s account details before processing a payout request using Nuvei Web SDK integration.

1. Initiate a Session

Before you can submit payment using the client-side Nuvei Web SDK, you need to send the /openOrder API call.

2. Initialize the Web SDK

Instantiate the Web SDK with the

sessionTokenreceived from the server call to/openOrder.3. Send an

accountCapture()requesta. Send an

accountCapture()request that includes the following mandatory fields (as shown in the example request below):userTokenId– Unique customer identifier in merchant system.paymentMethod: “apmgw_MX_Payouts“currencyCodecountryCode

Example

accountCapture()Requestsfc.accountCapture({ sessionToken: "<sessiontoken>", merchantId: "<your merchantId>", merchantSiteId: "<your merchantSiteId>", paymentMethod: "apmgw_MX_Payouts", userTokenId: "<unique customer identifier in merchant system>", currencyCode: "MXN", countryCode: "MX", languageCode: "en", urlDetails:{ successUrl:"<URL the customer is directed to after a successful transaction>", pendingUrl:"<URL the customer is directed to when the transaction response is pending>", failureUrl:"<URL the customer is directed to after an unsuccessful transaction>", notificationUrl:"<URL to which DMNs are sent>" }, sourceApplication: "WebSDK" }, function(accountRes) { console.log(accountRes); })The request returns a

redirectUrl.Example

accountCapture()Response{ "redirectUrl": "<redirect URL to enter account details>", "userTokenId": "bankCaptureUser4", "sessionToken": "e44a932a-e9fc-4482-a570-cf07175408e0", "internalRequestId": 23238261, "status": "SUCCESS", "errCode": 0, "reason": "", "merchantId": "8256777005602846935", "merchantSiteId": "112106", "version": "1.0" }b. Use the

redirectUrlto redirect the customer to the APM’s account details interface, to enter their account details.c. Once the information is captured, Nuvei stores the data in a UPO record, and sends a DMN with the newly created

userPaymentOptionIdtourlDetails.notificationUrl, which Nuvei recommends including in the/accountCapturerequest.4. Send a

/payoutRequestSend a

/payoutrequest and include theuserPaymentOptionId, which contains the user’s previously stored APM account details. Press here for an example. -

addApmUpo() -

1. Register a

userTokenIdA

userTokenIdis a field in the Nuvei system containing the user’s identifier in the merchant system.If you do not have a

userTokenIdregistered in the Nuvei system for this user, then register one by sending a/createUserrequest, includingemail,countryCode,firstName, andlastName.Example

/createUserRequest{ "merchantId":"<your merchantId>", "merchantSiteId":"<your merchantSiteId>", "clientRequestId":"<unique request ID in merchant system>", "userTokenId":"<unique user identifier in merchant system>", "email":"[email protected]", "countryCode":"<2-letter ISO country code>", "firstName":"John", "lastName":"Smith", "timeStamp":"<YYYYMMDDHHmmss>", "checksum":"<calculated checksum>" }Example

/createUserResponse{ "userId":78403498, "internalRequestId":552360538, "status":"SUCCESS", "errCode":0, "reason":"", "merchantId":"2439523627382132721", "merchantSiteId":"224428", "version":"1.0", "clientRequestId":"20221108130736" }The request registers the

userTokenId(userId) in the Nuvei system, which is needed to generate auserPaymentOptionIdin the next step.2. Create the UPO

Create a UPO by sending an

addApmUpo()request and include:userTokenId– The unique user identifier in your system.paymentMethodName: “apmgw_MX_Payouts“apmDataclass containing:beneficiaryBank– Press here to see list of supportedbeneficiaryBankcodes.beneficiaryNamebeneficiaryNumberbeneficiaryType

billingAddressclass containing:countryandemail

Example

addApmUpo()Requestfunction addApmUpo() { sfc.addApmUpo({ "paymentMethodName": "apmgw_MX_Payouts", "apmData": { "beneficiaryBank": "<supported beneficiary bank code>", "beneficiaryName": "John Smith", "beneficiaryNumber": "<CLABE number>", "beneficiaryType": "40" }, billingAddress: { // optional email: '[email protected]', country: 'MX' } }, function(result) { console.log(result); })The request returns an encrypted

userPaymentOptionIdrepresenting the user’s APM account details.Example

addApmUpo()Response{ "result": "ADDED", "errCode": 0, "errorDescription": "", "userPaymentOptionId": "14958143", "cancelled": false }3. Send a

/payoutRequestSend a

/payoutrequest and include theuserPaymentOptionId, which contains the user’s previously stored APM account details. Press here for an example.

After the transaction is processed, Nuvei sends a DMN that includes the result of the transaction to the URL provided in urlDetails.notificationUrl, which Nuvei recommends including in the /payout request.

User Experience

Payout

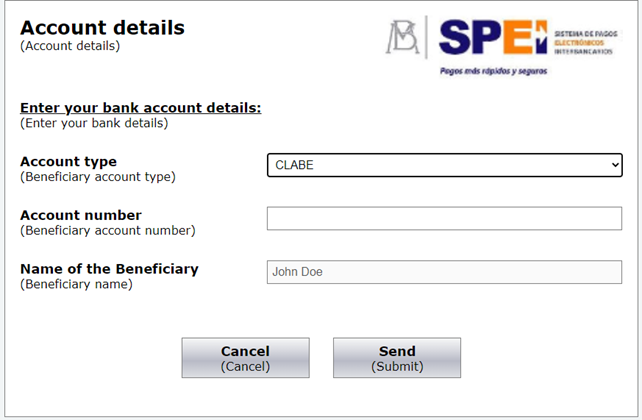

- The user is redirected to an account capture page.

- In Account type, the user selects CLABE and then enters the CLABE number.

- Once the user submits the form, a withdrawal request is created.

Testing

Full flow testing is not possible in an integration environment.

Appendix

Bank Codes

The supported codes for beneficiaryBank are presented in the table below.

| Bank | Code |

|---|---|

| BANXICO | 2001 |

| BANCOMEXT | 37006 |

| BANOBRAS | 37009 |

| BANJERCITO | 37019 |

| NAFIN | 37135 |

| BaBien | 37166 |

| HIPOTECARIA FED | 37168 |

| BANAMEX | 40002 |

| BBVA MEXICO | 40012 |

| SANTANDER | 40014 |

| HSBC | 40021 |

| BAJIO | 40030 |

| INBURSA | 40036 |

| MIFEL | 40042 |

| SCOTIABANK | 40044 |

| BANREGIO | 40058 |

| INVEX | 40059 |

| BANSI | 40060 |

| AFIRME | 40062 |

| BANORTE | 40072 |

| BANK OF AMERICA | 40106 |

| MUFG | 40108 |

| JP MORGAN | 40110 |

| BMONEX | 40112 |

| VE POR MAS | 40113 |

| AZTECA | 40127 |

| AUTOFIN | 40128 |

| BARCLAYS | 40129 |

| COMPARTAMOS | 40130 |

| MULTIVA BANCO | 40132 |

| ACTINVER | 40133 |

| INTERCAM BANCO | 40136 |

| BANCOPPEL | 40137 |

| UALA | 40138 |

| CONSUBANCO | 40140 |

| VOLKSWAGEN | 40141 |

| CIBANCO | 40143 |

| BBASE | 40145 |

| BANKAOOL | 40147 |

| PAGATODO. | 40148 |

| INMOBILIARIO | 40150 |

| DONDE. | 40151 |

| BANCREA | 40152 |

| BANCO COVALTO | 40154 |

| ICBC | 40155 |

| SABADELL | 40156 |

| SHINHAN | 40157 |

| MIZUHO BANK | 40158 |

| BANK OF CHINA | 40159 |

| BANCO S3 | 40160 |

| MONEXCB | 90600 |

| GBM | 90601 |

| MASARI | 90602 |

| VALUE | 90605 |

| VECTOR | 90608 |

| FINAMEX | 90616 |

| VALMEX | 90617 |

| PROFUTURO | 90620 |

| CB INTERCAM | 90630 |

| CI BOLSA | 90631 |

| FINCOMUN | 90634 |

| NU MEXICO | 90638 |

| REFORMA | 90642 |

| STP | 90646 |

| CREDICAPITAL | 90652 |

| KUSPIT | 90653 |

| UNAGRA | 90656 |

| ASP INTEGRA OPC | 90659 |

| ALTERNATIVOS | 90661 |

| LIBERTAD | 90670 |

| CAJA POP MEXICA | 90677 |

| CRISTOBAL COLON | 90680 |

| CAJA TELEFONIST | 90683 |

| TRANSFER | 90684 |

| FONDO (FIRA) | 90685 |

| INVERCAP | 90686 |

| FOMPED | 90689 |

| TESORED | 90703 |

| ARCUS | 90706 |

| NVIO | 90710 |

| Mercado Pago W | 90722 |

| CUENCA | 90723 |

| INDEVAL | 90902 |

| CoDi Valida | 90903 |

| SANTANDER2* | 90814 |

| BANAMEX2 | 91802 |

| BBVA BANCOMER2* | 91812 |

| SANTANDER2* | 91814 |

| HSBC2* | 91821 |

| BANORTE2* | 91872 |

| AZTECA2* | 91927 |

| SPIN BY OXXO | 90728 |

| FONDEADORA | 90699 |

| ALBO | 90721 |

| HEY BANCO | 40167 |

Last modified October 2025

Last modified October 2025