Overview

This page presents many functions that can be performed using Nuvei Web SDKs.

Tokenization

Returning User – No Collection

Many merchants keep accounts for their users (customers) and would like to charge them on multiple occasions. Using Nuvei Gateway (GW) Tokenization, customer cardholder information only needs to be collected once, and becomes available for use in future payments from then on.

Collecting cardholder information – Calling Web SDK createPayment() or authenticate3d() methods return a userPaymentOptionId, representing the customer’s full cardholder information collected during that transaction. From then on, you can offer “returning customers” the option to select a payment method from one of their previously stored payment methods.

Retrieving stored cardholder information – To retrieve the userPaymentOptionId, specify the userTokenId field when calling the createPayment() or authenticate3d() methods. The response identifies the customer, and guarantees that the payment methods (cards) returned, belong to that customer.

(The userPaymentOptionId and the userTokenId parameters should be included in the initial calls and any subsequent calls.)

Handling card expiration – Store card expiration details together with the userPaymentOptionId. To set a new expiration date, send a createPayment() call, as shown in the example below.

Example createPayment() Request

var sfc = SafeCharge({

env: 'int', // Nuvei API environment – 'int' (integration) or 'prod' (production – default if omitted)

merchantId: '<your merchantId>', // your Merchant ID provided by Nuvei

merchantSiteId: '<your merchantSiteId>' // your Merchant Site ID provided by Nuvei

});

function main() {

sfc.createPayment({

sessionToken: '7db38b03-c1ae-45fc-8fce-8a55cfa4a6e0', //as received from /openOrder

userTokenId: "487106",

clientUniqueId: "695701003", // optional

paymentOption: {

userPaymentOptionId: "53622598",

card: {

expirationMonth: "12", //optional – sets a new expiration date

expirationYear: "26", //optional

CVV: "217"

}

},

billingAddress: {

email: "[email protected]",

country: "GB"

}

}, function(res) {

console.log(res);

});

}

Returning User – CVV

As explained in the previous section, the Web SDK can process tokenized cardholder information using only the userPaymentOptionId field.

Authenticating payments with the CVV/CVC verification codes – To authenticate a payment with the CVV/CVC verification codes, send a createPayment() or authenticate3d() request to collect the CVV from Nuvei Fields.

Handling card expiration – Store card expiration details together with the userPaymentOptionId. To set a new expiration date, send a createPayment() call, as shown in the example below.

Example createPayment() Request – without Nuvei Fields

var sfc = SafeCharge({

env: 'int', // Nuvei API environment - 'int' (integration) or 'prod' (production - default if omitted)

merchantId: '<your merchantId>', // your Merchant ID provided by Nuvei

merchantSiteId: '<your merchantSiteId>' // your Merchant Site ID provided by Nuvei

});

function main() {

sfc.createPayment({

sessionToken: "7db38b03-c1ae-45fc-8fce-8a55cfa4a6e0", //as received from /openOrder

userTokenId: "487106",

clientUniqueId: "695701003", // optional

paymentOption: {

userPaymentOptionId: "53622598",

card: {

expirationMonth: "12", //optional – sets a new expiration date

expirationYear: "26", //optional

CVV: "112"

}

},

billingAddress: {

email: "[email protected]",

country: "GB"

}

}, function(res) {

console.log(res);

});

}

Example createPayment() Request – with Nuvei Fields

var sfc = SafeCharge({

env: 'int', // Nuvei API environment - 'int' (integration) or 'prod' (production - default if omitted)

merchantId: '<your merchantId>', // your Merchant ID provided by Nuvei

merchantSiteId: '<your merchantSiteId>' // your Merchant Site ID provided by Nuvei

});

var ScFields = sfc.fields({

fonts: [{

cssUrl: 'https://fonts.googleapis.com/css?family=Roboto'

}, // include your custom fonts

]

});

var ScFieldStyles = {

base: {

color: '#32325D',

fontWeight: 500,

fontFamily: 'Roboto, Consolas, Menlo, monospace',

fontSize: '16px',

fontSmoothing: 'antialiased',

'::placeholder': {

color: '#CFD7DF',

},

':-webkit-autofill': {

color: '#e39f48',

'-webkit-text-fill-color': '#e3b85d',

},

},

invalid: {

color: '#E25950',

'::placeholder': {

color: '#FFCCA5',

},

},

};

var ScFieldClasses = {

focus: 'focused',

empty: 'empty',

invalid: 'invalid',

complete: 'complete',

};

var cardCvc = ScFields.create('ccCvc', {

style: ScFieldStyles,

classes: ScFieldClasses

});

cardCvc.attach('#card-cvc');

function main() {

sfc.createPayment({

sessionToken: "7db38b03-c1ae-45fc-8fce-8a55cfa4a6e0", //as received from /openOrder

userTokenId: "487106",

paymentOption: {

userPaymentOptionId: "13084323",

card: {

expirationMonth: "12", // optional – sets a new expiration date expirationYear: "2026",

// optional CVV: cardCvc

}

}

},

function(result) {

console.log(result);

});

}

Authorization-Only

Authorization is the first step in an Auth-Settle flow. It applies a temporary hold on funds in the customer’s selected payment method (card) account, for a limited time frame, to ensure there are sufficient funds to settle the payment.

To complete the purchase, the authorization must be followed by one or more REST API /settleTransaction requests.

For example, a travel agent can send an authorization-only transaction when booking an airplane ticket. Later, they can send a REST API /settleTransaction request to complete the transaction.

Alternatively, you can send a REST API /voidTransaction request to cancel the temporary hold.

Perform an authorization-only transaction as follows:

- First, send an

/openOrderrequest and settransactionType="Auth".

Example

/openOrderRequest{ "merchantId":"<your merchantId goes here>", "merchantSiteId":"<your merchantSiteId goes here>", "clientUniqueId":"<unique transaction ID in merchant system>", "clientRequestId":"<unique request ID in merchant system>", "currency":"USD", "amount":"200", "userTokenId": "<unique customer identifier in merchant system>", "transactionType": "Auth", "timeStamp":"<YYYYMMDDHHmmss>", "checksum":"<calculated checksum>" }<?php $safecharge = new \SafeCharge\Api\RestClient([ 'environment' => \SafeCharge\Api\Environment::INT, 'merchantId' => '<your merchantId>', 'merchantSiteId' => '<your merchantSiteId>', 'merchantSecretKey' => '<your merchantSecretKey>', ]); $openOrderRequest = $SafeCharge->getPaymentService()->openOrder([ 'clientUniqueId' => '<unique transaction ID in merchant system>', 'clientRequestId' => '<unique request ID in merchant system>', 'currency' => 'USD', 'amount' => '500', 'userTokenId' => '<unique customer identifier in merchant system>', 'transactionType' => 'Auth', ]); ?>public static void main(String[] args) { // for initialization String merchantId = "<your merchantId>"; String merchantSiteId = "<your merchantSiteId>"; String merchantKey = "<your merchantKey>"; safecharge.initialize(merchantId, merchantSiteId, merchantKey, APIConstants.Environment.INTEGRATION_HOST.getUrl(), Constants.HashAlgorithm.SHA256); //for openOrder String userTokenId = "<unique customer identifier in merchant system>"; String clientUniqueId = "<unique transaction ID in merchant system>"; String clientRequestId = "<unique request ID in merchant system>"; String currency = "USD"; String amount = "500"; String transactionType = "Auth"; Safecharge safecharge = new Safecharge(); SafechargeResponse response = safecharge.openOrder(userTokenId, clientRequestId, clientUniqueId, null, null, null, null, currency, amount, null, null, null, null, null, null, null, null, null, null, null, null, null, null, null, null, null, null, null, null, null, null); }var safecharge = new Safecharge( "<your merchantKey>", "<your merchantId>", "<your merchantSiteId>", "<your server host value>", HashAlgorithmType.SHA256 ); var response = safecharge.OpenOrder( "USD", "500", transactionType: "Auth", userTokenId: "<unique customer identifier in merchant system>", clientUniqueId: "<unique transaction ID in merchant system>", clientRequestId: "<unique request ID in merchant system>", );

const safecharge = require('safecharge'); safecharge.initiate(<merchantId>, <merchantSiteId>, <merchantSecretKey>, <env>); safecharge.paymentService.openOrder({ 'clientUniqueId' : '<unique transaction ID in merchant system>', 'clientRequestId' : '<unique request ID in merchant system>', 'currency' : 'USD', 'amount' : '500' 'transactionType' : 'Auth', 'userTokenId' : '230811147', }, function (err, result) { console.log(err, result) }); - Then, from your client side, use the

sessionTokenreturned from the/openOrderto send acreatePayment()or anauthenticate3d()request, and settransactionType="Auth".

Zero-Authorization

Send a zero-amount transaction to verify a card, or add a card to your customer’s account for future use (tokenize the card).

Perform a zero-amount transaction as follows:

- First, send an

/openOrderrequest and setamount=0 andtransactionType=“Auth“.

Example

/openOrderRequest{ "merchantId":"<your merchantId goes here>", "merchantSiteId":"<your merchantSiteId goes here>", "clientUniqueId":"<unique transaction ID in merchant system>", "clientRequestId":"<unique request ID in merchant system>", "currency":"USD", "amount":"0", "userTokenId": "<unique customer identifier in merchant system>", "transactionType": "Auth", "timeStamp":"<YYYYMMDDHHmmss>", "checksum":"<calculated checksum>" }<?php $safecharge = new \SafeCharge\Api\RestClient([ 'environment' => \SafeCharge\Api\Environment::INT, 'merchantId' => '<your merchantId>', 'merchantSiteId' => '<your merchantSiteId>', 'merchantSecretKey' => '<your merchantSecretKey>', ]); $openOrderRequest = $SafeCharge->getPaymentService()->openOrder([ 'clientUniqueId' => '<unique transaction ID in merchant system>', 'clientRequestId' => '<unique request ID in merchant system>', 'currency' => 'USD', 'amount' => '0', 'userTokenId' => '<unique customer identifier in merchant system>', 'transactionType' => 'Auth', ]); ?>public static void main(String[] args) { // for initialization String merchantId = "<your merchantId>"; String merchantSiteId = "<your merchantSiteId>"; String merchantKey = "<your merchantKey>"; safecharge.initialize(merchantId, merchantSiteId, merchantKey, APIConstants.Environment.INTEGRATION_HOST.getUrl(), Constants.HashAlgorithm.SHA256); //for openOrder String userTokenId = "<unique customer identifier in merchant system>"; String clientUniqueId = "<unique transaction ID in merchant system>"; String clientRequestId = "<unique request ID in merchant system>"; String currency = "USD"; String amount = "0"; String transactionType = "Auth"; Safecharge safecharge = new Safecharge(); SafechargeResponse response = safecharge.openOrder(userTokenId, clientRequestId, clientUniqueId, null, null, null, null, currency, amount, null, null, null, null, null, null, null, null, null, null, null, null, null, null, null, null, null, null, null, null, null, null); }var safecharge = new Safecharge( "<your merchantKey>", "<your merchantId>", "<your merchantSiteId>", "<your server host value>", HashAlgorithmType.SHA256 ); var response = safecharge.OpenOrder( "USD", "0", transactionType: "Auth", userTokenId: "<unique customer identifier in merchant system>", clientUniqueId: "<unique transaction ID in merchant system>", clientRequestId: "<unique request ID in merchant system>", );

const safecharge = require('safecharge'); safecharge.initiate(<merchantId>, <merchantSiteId>, <merchantSecretKey>, <env>); safecharge.paymentService.openOrder({ 'clientUniqueId' : '<unique transaction ID in merchant system>', 'clientRequestId' : '<unique request ID in merchant system>', 'currency' : 'USD', 'amount' : '0' 'transactionType' : 'Auth', 'userTokenId' : '230811147', }, function (err, result) { console.log(err, result) }); - Then, from your client side, use the

sessionTokenreturned from the/openOrderto send acreatePayment()or anauthenticate3d()request, and set theamount=0 andtransactionType=”Auth“.

For full details, see Zero-Authorization with Web SDK.

Without Nuvei Fields

You can send the card details directly in a createPayment() request without using Nuvei Fields, as shown in the example below.

Example createPayment() Request

// Instantiate Nuvei API

var sfc = SafeCharge({

env: 'int', // Nuvei API environment - 'int' (integration) or 'prod' (production - default if omitted)

merchantId: '<your merchantId>', // your Merchant ID provided by Nuvei

merchantSiteId: '<your merchantSiteId>' // your Merchant Site ID provided by Nuvei

});

function main() {

sfc.createPayment({

sessionToken: "7db38b03-c1ae-45fc-8fce-8a55cfa4a6e0", //as received from /openOrder

clientUniqueId: "695701003", // optional

paymentOption: {

card: {

cardNumber: "5333302221254276",

cardHolderName: "john smith",

expirationMonth: "12",

expirationYear: "25",

CVV: "217"

}

},

billingAddress: {

email: "[email protected]",

country: "GB"

}

}, function(res) {

console.log(res)

});

}

Tokenization-Only

The tokenization-only flow uses the Nuvei Web SDK getToken() method to tokenize a card and CVV. It returns a ccTempToken which can then be used to process the payment using the /payment API method.

The ccTempToken is a temporary one-time token that is valid only for that API session. It can be used to process payments with the Nuvei server-to-server API, and still be PCI descoped.

The tokenization-only integration is suited to merchants who:

- Want to be descoped from PCI, but still be in control of the complete flow from their server side.

- Perform complete 3D Secure (3DS) flows, both server side and client side.

- Want to be able to choose between 3DS frictionless and challenge modes.

See the full integration in the Tokenization-Only Flow topic.

3DS Authentication-Only

You can use the Web SDK to perform a 3DS authentication-only request, where Nuvei only authorizes and authenticates your customer, but does not process payments.

Invoke this 3DS authentication-only service by sending an authenticate3d() request. The input parameters for this method are identical to the createPayment() method, but instead of performing a payment, the method returns a 3DS response that includes these authentication values:

eci– Upon successful authentication, theecivalue is either 5 (Visa) or 2 (Mastercard).cavv– Upon successful authentication, this contains the encrypted authentication value; otherwise, it is either empty or null.

Example authenticate3d() Request

// Instantiate Nuvei API

var sfc = SafeCharge({

env: 'int', // Nuvei API environment - 'int' (integration) or 'prod' (production - default if omitted)

merchantId: '<your merchantId>', // your Merchant ID provided by Nuvei

merchantSiteId: '<your merchantSiteId>' // your Merchant Site ID provided by Nuvei

});

function main(){

sfc.authenticate3d({

"sessionToken": "7db38b03-c1ae-45fc-8fce-8a55cfa4a6e0", //as received from /openOrder

"clientUniqueId": "695701003",

"paymentOption": {

"card": {

"cardNumber": "5333302221254276",

"cardHolderName": "john smith",

"expirationMonth": "12",

"expirationYear": "22",

"CVV": "217"

}

}, "billingAddress": {

"email": "[email protected]",

"country": "GB"

}

}, function(result) {

console.log(result.cavv)

});

}

Currency Conversion

MCP for Web SDK

Integrating MCP is relatively simple because the regular payment workflow remains unchanged, with a few additional steps.

See the full integration in the MCP for Web SDK topic.

DCC for Web SDK

Integrating DCC is relatively simple because the regular payment workflow remains unchanged, with a few additional steps.

See the full integration in the DCC for Web SDK topic.

APM Special Functions

APM Recurring Billing

The subMethod class can be used in a createPayment() request method to access the APM Recurring Billing special APM feature.

The createPayment() example below shows:

- An APM payment using the

paymentMethodparameter to specify the"apmgw_expresscheckout"PayPal APM. - The optional

subMethodparameter is used to specify the"ReferenceTransaction"flag, which indicates the “PayPal – Billing Agreement“, in a special APM Recurring Billing flow.

Example createPayment() Request

sfc.createPayment({

sessionToken: "<sessiontoken>",

merchantId: "<your merchantId>",

merchantSiteId: "<your merchantSiteId>",

clientUniqueId: "695701003",

paymentOption: {

alternativePaymentMethod: {

paymentMethod: "apmgw_expresscheckout"

},

subMethod: {

subMethod: "ReferenceTransaction" // APM provider who supports the APM Recurring Billing feature

}

},

billingAddress: {

country: "GB",

email: "[email protected]"

}

}, function(res) {

console.log(res);

if (res.cancelled === true) {

example.querySelector('.token').innerText = 'cancelled';

} else {

example.querySelector('.token').innerText = res.transactionStatus + ' – Reference: ' + res.transactionId;

}

example.classList.add('submitted');

});

Customer Registration via APM

The subMethod class can be used in a createPayment() request method to access the Customer Registration via APM special APM feature.

The createPayment() example below shows:

- An APM payment using the

paymentMethodparameter to specify the"apmgw_expresscheckout"PayPal APM. - The optional

subMethodparameter is used to specify the"QuickRegistration"flag, which indicates PayPal as the Customer Registration provider, in an advanced Customer Registration via APM flow.

Example createPayment() Request

sfc.createPayment({

sessionToken: "<sessiontoken>",

merchantId: "<your merchantId>",

merchantSiteId: "<your merchantSiteId>",

clientUniqueId: "695701003",

paymentOption: {

alternativePaymentMethod: {

paymentMethod: "apmgw_expresscheckout"

},

subMethod: "QuickRegistration" // APM provider who supports the Customer Registration feature

},

billingAddress: {

country: "GB",

email: "[email protected]"

}

}, function(res) {

console.log(res);

if (res.cancelled === true) {

example.querySelector('.token').innerText = 'cancelled';

} else {

example.querySelector('.token').innerText = res.transactionStatus + ' – Reference: ' + res.transactionId;

}

example.classList.add('submitted');

});

APM Functions

apmWindowType

This allows you to specify the window type (popup, newTab, or redirect (modal window)) for the system to redirect the customer to their APM provider. Alternatively, by specifying customRedirect, the system provides you with the redirectUrl for you to initiate the redirect.

Possible values:

- popup (default): A pop-up window opens automatically, redirecting the customer to their APM provider’s page.

- newTab: A new tab opens automatically, redirecting the customer to their APM provider’s page.

- redirect: A modal window opens automatically on top of the current payment page, redirecting the customer to their APM provider’s page.

- customRedirect: You (the merchant) must redirect your customer to their APM provider’s page, as follows:

- The response from the request is included a

redirectUrl.

Redirect your customer to thisredirectUrlusing a type of window of your choice, for example, IFrame, popup, a new tab, etc. - Your customer submits their APM details and closes the window.

- Check the transaction status either by sending a

/getPaymentStatusrequest, or by setting up a DMN to receive a direct notification (at the webhook endpoint on your system, which you provided in theurlDetails.notificationUrlin the original/openOrderrequest).

- The response from the request is included a

sfc.createPayment({

sessionToken: sessionData.sessionToken,

apmWindowType: 'redirect',

paymentOption: {

alternativePaymentMethod: {

paymentMethod: "apmgw_MoneyBookers",

account_id: document.getElementById('accountId').value

},

},

billingAddress: {

country: "DE",

email: "[email protected]"

}

}, function(res) {

console.log(res)

})

}

Apple Pay and Google Pay

Apple Pay Using Web SDK

Nuvei offers the following Apple Pay Integration solutions using Web SDK for adding the Apple Pay payment method to your websites and applications.

See full integration details in these topics:

Google Pay Using Web SDK

Nuvei offers a Google Pay Integration solution using Web SDK for adding the Google Pay payment method to your websites and applications.

See full integration detail, see the Google Pay (Web SDK) topic.

Scan Card

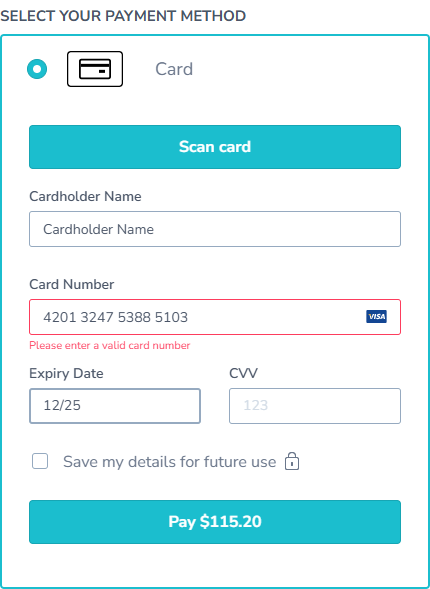

Scan Card is an SDK that integrates with native mobile apps and allows users to scan a payment card for details instead of manually entering them. The SDK retrieves the full card number, expiration date, and cardholder name. The user only needs to manually enter the card’s CVV.

User Experience

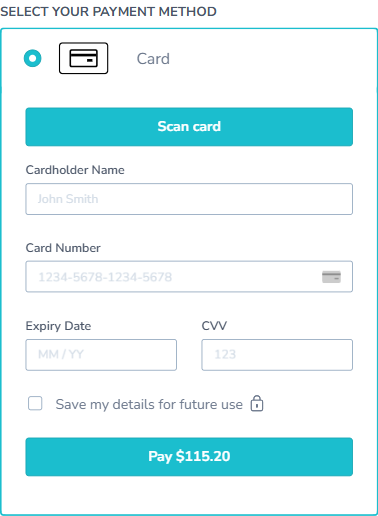

- On the payment page of a merchant’s mobile app integrated with Web SDK and Scan Card, the user selects the Card payment method and then taps Scan card.

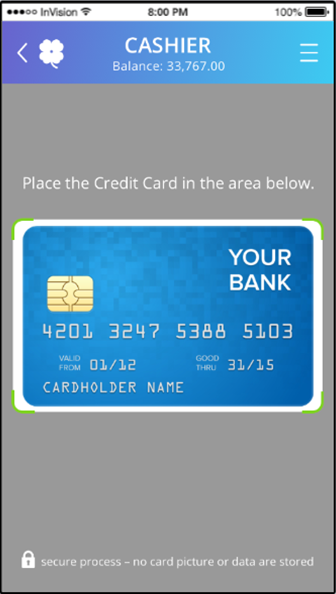

- A Nuvei Cashier camera interface appears with a rectangle showing where to place the card.

- The user places the card in the designated area.

- The interface detects the card and visually indicates the detection by showing the scanned data.

- The mobile app payment page reappears with the scanned card details filled in.

- The user enters the CVV and continues with the payment.

Web SDK Features

Blocking Cards

You can block cards from being included in requests, or from being processed, as well as from being displayed to the customer in the list of payment methods.

This can be done while initiating Web SDK when you create the SafeCharge() object.

Include the blockCards array parameter and specify the blocking list.

For full details, see Blocking and Whtelisting Cards.

Example SafeCharge() Function Specifying a blockCards Array

sfc = SafeCharge({

env: 'int', // Nuvei API environment - 'int' (integration) or 'prod' (production - default if omitted)

merchantId: '<your merchantId>',

merchantSiteId: '<your merchantSiteId>',

blockCards: [["visa","credit","corporate"],["amex","GB","prepaid"]] // Visa corporate credit cards and British prepaid Amex cards are blocked

});

Future requests (for example, the createPayment() and authenticate3d() requests), which are called in this session using this object, block the cards specified in the blocking list.

Open Amount

This feature supports merchants in industries where the payment amount is not known at the beginning of the payment flow or needs to be updated on the client-side device, for example, in the gambling industry.

The Open Amount feature allows you to:

- Set amount limits (

minandmax) in the/openOrderrequest. - Call the

setOpenAmount()method to set/change theamount(after sending the/openOrderrequest but before calling thecreatePayment()request).

Set Amount Limits

You can set “payment amount limits” in the/openOrder request by including the openAmount{min,max} object.

Send an /openOrder request with its mandatory parameters, and include an openAmount{min,max} object (and the optional amount), as shown below:

Example /openOrder Request with an openAmount{min,max} Object

{

"merchantId": "<your merchantId goes here>",

"merchantSiteId": "<your merchantSiteId goes here>",

"clientUniqueId": "<unique transaction ID in merchant system>",

"clientRequestId": "<unique request ID in merchant system>",

"currency": "USD",

"openAmount": {

"min": "1",

"max": "100"

},

"amount": "50",

"timeStamp": "<YYYYMMDDHHmmss>",

"checksum": "<calculated checksum>"

}

disableNuveiAnalytics

When set to true, analytics are disabled to prevent the analytics tool from conflicting with the merchant code.

The default value is false.

let sfc = SafeCharge({

sessionToken : orderObj.sessionToken, // sessionToken generated by your server

env: 'int', // the environment you’re running on

merchantId: orderObj.merchantId, // your Merchant ID provided by Nuvei

merchantSiteId : orderObj.merchantSiteId, // your merchantsite id provided by Nuvei

disableNuveiAnalytics: true,

});

showAccountCapture

When set to true, the bank capture redirectUrl is opened in a pop-up window. If the urlDetails class is empty (no URLs received), then the redirect pop-up is closed automatically.

The default value is false.

var sfc = SafeCharge({

"sessionToken":"orderObj.sessionToken",

"env":"int",

"merchantId":"orderObj.merchantId",

"merchantSiteId":"orderObj.merchantSiteId",

"showAccountCapture":true //false (default)

});

Web SDK Methods

Press here to see all Web SDK methods, which provide additional ways to control the payment process and/or perform custom actions during the payment process, in our API Reference.

Withdrawal Methods

You can use Web SDK methods to submit and manage withdrawal requests. For more information, see Withdrawal.

Web SDK Process Events

onPaymentEvent Event Callback

This event callback provides maximum transparency for the payment flow, by reporting back to you at each stage of the payment flow. You can use this information for analytics or to perform some custom action.

Example onPaymentEventCall

onPaymentEvent: function(result) {

console.log('onPaymentEvent =>', result);

},

The following response information is passed via the event callback when it is triggered:

pm

Example values:- cc_card

- apmgw_neteller

eventType

Possible values:- initiated (once payment initiated)

- tokenized (after initAuth3D)

- paymentStarted (after clientPayment() / clientAuthorize3D())

- challengeStarted (before redirection)

- challengeEnded (after finalizePayment())

- redirectionStarted (for APM)

- redirectionEnded (for APM)

threeD(only when 3DS is applicable – no need for the irrelevant events)versionflow

Possible values:- frictionless

- challenge

Example onPaymentEvent Response

{

"eventType": "paymentStarted",

"threeD": {

"version": "",

"flow": ""

},

"pm": "cc_card"

}

Last modified March 2025

Last modified March 2025