Overview

This guide describes the steps to integrate Google Pay as a Nuvei alternative payment method (APM) into your payment flow using the Nuvei Server-to-Server REST API platform.

Google Pay Integrations

Setting Up the Google Pay UI

Setting up the Google Pay UI is the first step of all the implementations.

Nuvei supports these integrations:

- Payments

- Payments – Nuvei Decrypts the Token

You can send the Google Pay token “as-is” in the following types of/paymentrequests, and “behind the scenes”, Nuvei decrypts and uses the relevant data extracted from the token:- Non-3DS Payments

This allows you to send the Google Pay token in a/paymentrequest (without 3DS). - 3DS Payments

Performs 3DS authentication on the card using Nuvei (in addition to the Google Pay authentication).

- Non-3DS Payments

- Payments – Merchant Decrypts the Token

You can decrypt the Google Pay token, and then use the relevant data extracted from the token to send the following types of/paymentrequests:- Non-3DS Payments

This allows you to send a/paymentrequest without performing any additional 3DS authentication on the card. - External 3DS Provider

If you use an external (third-party) 3DS provider to perform additional 3DS card authentication, then you can include the 3DS authentication data provided by them, in the/paymentrequest. - Nuvei as the 3DS Provider

This allows you to send the relevant data extracted from the Google Pay token a/paymentrequest, as well as perform 3DS authentication on the card using Nuvei (in addition to the Google Pay authentication).

- Non-3DS Payments

- Payments – Nuvei Decrypts the Token

- Recurring Payments

You can perform both Initial Recurring Payments and Subsequent Recurring Payments using the encrypted Google Pay token.

Prerequisites and Notes

- This guide assumes you have completed all account setup prerequisites, and are ready to integrate Google Pay into your payment flow.

- Use these gateway credentials in requests:

- For the test (sandbox) environment:

gatewayMerchantId: “googletest“ - For the production environment:

gatewayMerchantId: “nuveidigital“

- For the test (sandbox) environment:

- The Google Pay Web environment must be set up according to the Google Pay guidelines:

- Google Pay Web Developer Documentation

- Google Pay Brand Promoting Guidelines

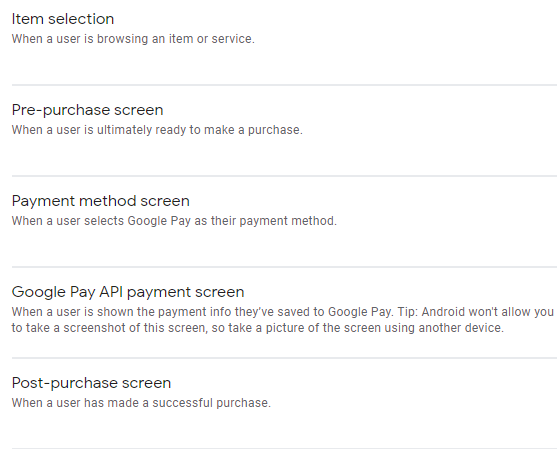

For your domain to be verified with Google, the merchant must send Nuvei’s Integration Team screenshots (like the one shown below) of your payment flow along with your domain URL:

- Google Pay Test Card Suite

- Google Pay Web Integration Checklist

- The Google account used for testing should be linked to a relevant test card. Google Pay provides test cards, see Google Pay Test Card Suite for details.

- The first time a card is used in the Google Pay system, Google Pay performs a 3DS authentication and stores the 3DS values from the successful Google Pay authentication in a Google Pay token.

- Google Pay supports recurring payments only if you (the merchant) conform to the following policies:

- The merchant must comply with the network rules, especially the merchant-initiated transactions (MIT) rules.

- The merchant must disclose the “Terms of payment” within the Merchant’s “buyflow”, and the customer must accept the “Terms of payment”.

Google Pay as an “External token provider”

An external token provider is a type of entity in the payment industry with its own flow (for example Google Pay and Apple Pay).

These providers typically:

- Collect the customer payment method and transaction details.

- In some cases, they perform 3DS authentication and provide the 3DS authentication values.

Set Up the Google Pay UI

1. Authentication

Perform the standard authentication by sending a /getSessionToken request by following the steps, in the Step 1: Authentication topic.

2. The Google Pay UI Button

- Create the Google Pay UI button according to the instructions in the Google Pay for Web Payments Brand Guidelines Guide.

- On your payment page, define the

tokenizationSpecificationconstant as shown below.

(When the customer presses the Google Pay button, this parameter identifies your gateway and your site’s gateway merchant identifier.)Example

tokenizationSpecificationRequestconst tokenizationSpecification = { type: "PAYMENT_GATEWAY", parameters: { "gateway": "nuveidigital", "gatewayMerchantId": "googletest", //'googletest' for test or 'nuveidigital' for production } };

3. Collect the Card Details

Pressing the Google Pay button collects your customer’s card details and returns them to you as an encrypted Google Pay token.

- The customer triggers the Google Pay payment flow by pressing the Google Pay button.

- Google Pay displays all the cards associated with the customer’s Google account, or asks the customer to “Add new credit or debit card” details.

- The customer selects a payment method and Google Pay returns the encrypted Google Pay token (containing the

paymentMethodclass in JSON format).

Nuvei Decrypts Token

Use this integration when you manage the Google Pay Button yourself in your own payment flow, and now you want to send a payment request.

The Google Pay token contains Google Pay authentication values from a successful Google Pay authentication. You can send the Google Pay token “as-is” in a /payment request, and “behind the scenes”, Nuvei decrypts and uses the relevant data contained in the token.

Perform these steps:

1. Initialize the Payment

The /initPayment request determines if the card supports 3DS and initializes the payment in the Nuvei system.

Send an /initPayment request with its mandatory parameters and include these additional parameters:

userTokenIdpaymentOption.card.externalToken.externalTokenProvider: “GooglePay“paymentOption.card.externalToken.mobileToken

- paymentOption.card.threeD.

"methodNotificationUrl"

Including this is required for 3DS Web Browser Fingerprinting. (The issuer uses this URL to return fingerprinting notifications.)

Example /initPayment Request

{

"sessionToken": "<sessionToken from /getSessionToken>",

"merchantId": "<your merchantId>",

"merchantSiteId": "<your merchantSiteId>",

"clientRequestId": "<unique request ID in merchant system>",

"clientUniqueId": "<unique transaction ID in merchant system>",

"amount": "200",

"currency": "USD",

"userTokenId": "<unique customer identifier in merchant system – required for UPO creation>",

"paymentOption": {

"card": {

"externalToken": {

"externalTokenProvider": "GooglePay",

"mobileToken": "<encrypted GooglePay Token converted to a string>"

},

"threeD": {

"methodNotificationUrl": "<methodNotificationURL>"

}

}

},

"billingAddress": {

"email": "[email protected]",

"country": "US"

},

"deviceDetails": {

"ipAddress": "<customer's IP address>"

}

}

Example /initPayment Response with v2supported: “true”

{

"reason": "",

"orderId": "33704071",

"transactionStatus": "APPROVED",

"customData": "merchant custom data",

"internalRequestId": 10036001,

"version": "1.0",

"transactionId": "2110000000000587378",

"merchantSiteId": "142033",

"transactionType": "InitAuth3D",

"gwExtendedErrorCode": 0,

"gwErrorCode": 0,

"merchantId": "427583496191624621",

"clientUniqueId": "12345",

"errCode": 0,

"paymentOption": {

"card": {

"ccCardNumber": "5****5761",

"bin": "511142",

"ccExpMonth": "12",

"ccExpYear": "25",

"last4Digits": "5761",

"threeD": {

"methodPayload": "eyJ0aHJlZURTU2VydmVyVHJhbnNJRCI6ImVkNGZlNTkzLWUzMWUtNDEyMC05M2EwLTBkNDBhNzUxNzEzMSIsInRocmVlRFNNZXRob2ROb3RpZmljYXRpb25VUkwiOiJ3d3cuVGhpc0lzQU1ldGhvZE5vdGlmaWNhdGlvblVSTC5jb20ifQ==",

"methodUrl": "https://srv-azr-acq2:4435/api/ThreeDSMethod/threeDSMethodURL",

"v2supported": "true",

"version": "2.1.0",

"serverTransId": "ed4fe593-e31e-4120-93a0-0d40a7517131",

"directoryServerId": "A000000003",

"directoryServerPublicKey": "MIIFrjCCBJagAwIBAgIQB2rJm.."

}

}

},

"sessionToken": "e524e7c5-9855-4ce9-b0f9-1045f34fd526",

"userTokenId": "230811147",

"cardAuthMethod": "PAN_ONLY",

"status": "SUCCESS"

}

Example /initPayment Response with v2supported: “false”

{

"reason":"",

"clientRequestId":"E3YD6LSZD",

"internalRequestId":19125711,

"version":"1.0",

"merchantSiteId":"126006",

"merchantId":"2502136204546424962",

"clientUniqueId":"695701003",

"errCode":0,

"paymentOption":{

"card":{

"threeD":{

"v2supported":"false"

}

}

},

"sessionToken":"3056e85e-6272-4c1c-999a-0519def10020",

"userTokenId":"OHJD9R9CNLCF",

"status":"SUCCESS"

}

2. Handling /initPayment

The /initPayment response determines the next step:

paymentOption.card.threeD.v2supported: “false”

This means the card does not support 3DS at all.

Process the payment in the 3.1 Payments – Non-3DS flow.paymentOption.card.threeD.v2supported: “true”

Process the payment in the 3.2 Payments – 3DS flow.

3. Processing a Payment

Perform the relevant payment processing flow (as determined in the previous step – Handling /initPayment):

3.1 Non-3DS Payments

This allows you to send the Google Pay token in a /payment request without sending any 3DS values.

Call the /payment REST API request with its mandatory parameters. Include the data received on your server, in the externalToken class with these parameters:

paymentOption.card.externalToken.externalTokenProvider: “GooglePay“paymentOption.card.externalToken.mobileToken

userTokenId

Example /payment Request for Non-3DS

{

"sessionToken": "<sessionToken from /getSessionToken>",

"merchantId": "<your merchantId>",

"merchantSiteId": "<your merchantSiteId>",

"clientRequestId": "<unique request ID in merchant system>",

"clientUniqueId": "<unique transaction ID in merchant system>",

"amount": "200",

"currency": "USD",

"userTokenId": "<unique customer identifier in merchant system – required for UPO creation>",

"paymentOption": {

"card": {

"externalToken": {

"externalTokenProvider": "GooglePay",

"mobileToken": "<encrypted GooglePay Token converted to a string>"

}

}

},

"billingAddress":{

"email": "[email protected]",

"country": "US"

},

"deviceDetails":{

"ipAddress": "<customer's IP address>"

},

"timeStamp": "<YYYYMMDDHHmmss>",

"checksum": "<calculated checksum>"

}

Example /payment Response for Non-3DS

{

"reason": "",

"authCode": "0E5E04",

"orderId": "36726421",

"transactionStatus": "APPROVED",

"clientRequestId": "V8UE4312Y",

"customData": "Custom Data for Control Panel Reports",

"internalRequestId": 19054731,

"version": "1.0",

"transactionId": "2110000000005034514",

"merchantSiteId": "126006",

"transactionType": "Sale",

"gwExtendedErrorCode": 0,

"gwErrorCode": 0,

"merchantId": "2502136204546424962",

"clientUniqueId": "695701003",

"errCode": 0,

"paymentOption": {

"userPaymentOptionId": "8107431",

"card": {

"issuerBankName": "Legence Bank",

"ccCardNumber": "4****1112",

"externalTokenProvider": "GooglePay",

"bin": "417577",

"avsCode": "",

"threeD": {

},

"ccExpMonth": "08",

"ccExpYear": "25",

"isPrepaid": "false",

"acquirerId": "18",

"cardBrand": "VISA",

"cvv2Reply": "",

"last4Digits": "1112"

}

},

"sessionToken": "f3b77f95-d126-40bc-b1a9-2cf24fff811d",

"userTokenId": "9XL74BK99KBW",

"externalTransactionId": "",

"fraudDetails": {

"score": "0",

"system": {

"systemId": "1",

"decision": "None"

},

"finalDecision": "Accept"

},

"status": "SUCCESS"

}

3.2 3DS Payments

This allows you to perform 3DS authentication on the card using Nuvei (in addition to the Google Pay authentication).

The remaining steps to process a 3DS payment for a Google Pay payment, are almost identical to the standard server-to-server REST payment flow.

Perform the following standard REST payment flow steps by pressing the link to see the steps, and perform the steps together with any changes indicated below:

- 3DS Fingerprinting

Perform steps as-is (no changes). - 3DS Payment Request

Perform the standard steps and include the relevant data from the 3DS Fingerprinting, and the following parameters (as shown below):userTokenIdrelatedTransactionId- Instead of “actual card details“ or a

paymentOption.userPaymentOptionId, substitute the following:paymentOption.card.externalToken.externalTokenProvider: “GooglePay“paymentOption.card.externalToken.mobileToken

paymentOption.card.threeDclass containing relevant data returned from the 3DS Fingerprinting.billingAddressandpaymentOptionclasses that contain mandatory parameters.

Example

/paymentRequest with 3DS Parameters{ "sessionToken": "<sessionToken from /getSessionToken>", "merchantId": "<your merchantId>", "merchantSiteId": "<your merchantSiteId>", "clientRequestId": "<unique request ID in merchant system>", "amount": "200", "currency": "USD", "userTokenId": "<unique customer identifier in merchant system – required for UPO creation>", "clientUniqueId": "<unique transaction ID in merchant system>", "relatedTransactionId": "<initPayment TransactionId>", "paymentOption": { "card": { "externalToken": { "externalTokenProvider": "GooglePay", "mobileToken": "<encrypted GooglePay Token converted to a string>" }, "threeD": { "methodCompletionInd": "Y", "version": "2.1.0", "notificationURL": "<notificationURL>", "merchantURL": "<merchantURL>", "platformType": "02", "v2AdditionalParams": { "challengeWindowSize": "05" }, "browserDetails": { "acceptHeader": "text/html,application/xhtml+xml", "ip": "192.168.1.11", "javaEnabled": "TRUE", "javaScriptEnabled": "TRUE", "language": "EN", "colorDepth": "48", "screenHeight": "400", "screenWidth": "600", "timeZone": "0", "userAgent": "Mozilla" } } } }, "billingAddress": { "country": "US", "email": "[email protected]" }, "deviceDetails": { "ipAddress": "<customer's IP address>" }, "timeStamp": "<YYYYMMDDHHmmss>", "checksum": "<calculated checksum>" } - 3DS Challenge

Conditional – Only when a challenge is required. - Final Payment Request

Conditional – Based on the outcome of the 3DS Challenge, you may need to send a final Liability Shift /payment request:Sending a final Liability Shift/paymentRequest

Complete the payment by sending a /payment request with its mandatory parameters and include these additional parameters:userTokenIdrelatedTransactionId- Instead of “actual card details“ or a

paymentOption.userPaymentOptionId, substitute the following:paymentOption.card.externalToken.externalTokenProvider: “GooglePay“paymentOption.card.externalToken.mobileToken

Example Liability Shift

/paymentRequest (3DS){ "sessionToken": "<sessionToken from /getSessionToken>", "merchantId": "<your merchantSiteId>", "merchantSiteId": "<your merchantId>", "clientRequestId": "<unique request ID in merchant system>", "clientUniqueId": "<unique transaction ID in merchant system>", "amount": "200", "currency": "USD", "userTokenId": "<unique customer identifier in merchant system – required for UPO creation>", "relatedTransactionId": "<TransactionId of the first payment request>", "paymentOption": { "card": { "externalToken": { "externalTokenProvider": "GooglePay", "mobileToken": "<encrypted GooglePay Token converted to a string>" } }, "billingAddress": { "country": "US", "email": "[email protected]" }, "deviceDetails": { "ipAddress": "<customer's IP address>" }, "timeStamp": "<YYYYMMDDHHmmss>", "checksum": "<calculated checksum>" } }Liability Shift

/payment(3DS) ResponseA Direct Merchant Notification (DMN) is sent to you containing the response details of the request:

Example Liability Shift

/payment(3DS) DMN...'ppp_status=FAIL&Status=ERROR&ExErrCode=1289&ErrCode=-1100&errApmCode=0&errApmDescription=&errScCode=0&errScDescription=&Reason=Issuer+data+is+not+available%2C+please+try+again+later&ReasonCode=1289&PPP_TransactionID=37893001&userid=ZDMIYVPRAJCB&merchant_unique_id=695701003&customData=Custom+Data%21&productId=MAH3ST7266GM&first_name=Wxjtyskuuj&last_name=Pauwbeuyid&email=jhahn.jhnui%40srzaw.cb¤cy=EUR&clientUniqueId=695701003&customField1=customField1-valueU&customField2=customField2-valueU&customField3=&customField4=&customField5=&customField6=&customField7=&customField8=&customField9=&customField10=&customField11=&customField12=&customField13=&customField14=&customField15=&invoice_id=&address1=340689+Billing+Str.+Updated.&address2=&country=Germany&state=&city=Billing+City+Updated&zip=BNE+4895U&phone1=359888797070&phone2=&phone3=&client_ip=93.146.254.172&nameOnCard=CL-BRW1&cardNumber=5****0902&bin=535275&noCVV=&acquirerId=99&expMonth=12&expYear=25&Token=SABHAGUAUABuAFAAMAAwAGQAZAAwAEYAbgAyAEgAZwBoADYARgAlACgAUABFAF0ANgB0AHgAVgBSAHkANABbAHoAJQBTAFMAeQAsAEMAeABjAHQAcgBfADgAPgBnAE0AXABiAGwAMwA%3D&tokenId=1688429575&AuthCode=&AvsCode=&Cvv2Reply=&shippingCountry=US&shippingState=&shippingCity=Shipping+City+Updated&shippingAddress=33+Shipping+Str.+Updated.&shippingZip=SDC+33334U&shippingFirstName=Mlxdwieffa&shippingLastName=Uvnoirngbg&shippingPhone=359888576900&shippingCell=359887576903&shippingMail=gmwch.bphmv%40ducdb.qz&total_discount=0.00&total_handling=0.00&total_shipping=0.00&total_tax=0.00&buyButtonProductBundleId=&merchant_site_id=126006&merchant_status=&action=&requestVersion=&message=ERROR&merchantLocale=&unknownParameters=&payment_method=cc_card&ID=&merchant_id=2502136204546424962&responseTimeStamp=2022-08-01.07%3A57%3A52&buyButtonProductId=&webMasterId=9IFAQ4ARB0IX&appliedPromotions=&uniqueCC=RHZ4oBPNguWJuqKZFoGGpmzIDw0%3D&transactionType=Auth&externalEmail=&cardCompany=MasterCard&eci=2&user_token_id=ZDMIYVPRAJCB&userPaymentOptionId=8303261&TransactionID=2110000000006785046&externalAccountDescription=nameOnCard%3ACL-BRW1&finalFraudDecision=Accept&fraudScore=0&systemID=1&systemDecision=None&totalAmount=35.0&dynamicDescriptor=Cashier+API+U&item_name_1=Item+1U&item_number_1=&item_amount_1=35.00&item_quantity_1=1&item_discount_1=0.00&item_handling_1=0.00&item_shipping_1=0.00&feeAmount=&houseNumber=&customCurrency=&externalToken_blockedCard=0&externalToken_cardAcquirerId=0&externalToken_cardAcquirerName=&externalToken_cardBin=0&externalToken_cardBrandId=0&externalToken_cardBrandName=&externalToken_cardExpiration=0&externalToken_cardLength=0&externalToken_cardMask=&externalToken_cardName=&externalToken_cardTypeId=0&externalToken_cardTypeName=&externalToken_clubName=&externalToken_creditCompanyId=0&externalToken_creditCompanyName=&externalToken_extendedCardType=&externalToken_Indication=&externalToken_tokenValue=&externalToken_tokenProvider=&ECIRaw=5&upoRegistrationDate=20220801&cavv=kHQxQjBDQTAyRDlDNEE0NzRFMTc%3D&shippingCounty=SCountyU&type=DEPOSIT&clientRequestId=16WH99KFX&relatedTransactionId=2110000000006785044&externalTokenProvider=GooglePay&threeDSVersion=2.1.0&isLiabilityOnIssuer=1&challengePreferenceReason=0&lastFourDigits=0902&responsechecksum=36291b228a50daceaeccfb5b563df484&advanceResponseChecksum=c3c6afdf8fdeb352839e28d262d3aec5',

Merchant Decrypts Token

This integration is used when you manage the Google Pay Button by yourself in your own payment flow, and now you want to decrypt the Google Pay token, and then use the relevant data extracted from the token to send a/payment request.

You can decrypt the Google Pay token, which contains Google Pay authentication values from a successful Google Pay authentication.

Decrypt the Google Pay token, and then use the relevant data extracted from the token to send the following types of/payment requests:

- Non-3DS Payments

This allows you to send a/paymentrequest (without 3DS). - External 3DS Provider

If you use an external (third-party) 3DS provider to perform additional 3DS card authentication, then you can include the 3DS authentication data provided by them, in the/paymentrequest. - Nuvei as the 3DS Provider

This allows you to send the relevant data extracted from the Google Pay token a/paymentrequest, as well as perform 3DS authentication on the card using Nuvei (in addition to the Google Pay authentication).

Non-3DS Payments

This allows you to send a /payment request without performing any additional 3DS authentication on the card.

Decrypt the Google Pay token yourself (according to Google Pay’s requirements), and send relevant extracted data by calling a /payment REST API request with its mandatory parameters, and include the following (as shown below):

userTokenIdpaymentOption.card.cardNumberpaymentOption.card.expirationMonthpaymentOption.card.expirationYearpaymentOption.card.brand(press here to see possible values)paymentOption.card.last4DigitspaymentOption.card.externalToken.externalTokenProvider: “GooglePay“paymentOption.card.externalToken.cryptogram: “<cryptogram from Google Pay>” (Conditional, only mandatory for DPAN flows)paymentOption.card.externalToken.eciProvider: “<value from Google Pay>” (Optional)- Any other relevant data received on your server.

Example /payment Request with Decrypted Google Pay Token

{

"sessionToken":"<sessionToken from /getSessionToken>",

"merchantId":"<your merchantId>",

"merchantSiteId":"<your merchantSiteId>",

"clientRequestId":"<unique request ID in merchant system>",

"amount":"200",

"currency":"USD",

"userTokenId":"<unique customer identifier in merchant system – required for UPO creation>",

"clientUniqueId":"<unique transaction ID in merchant system>",

"paymentOption":{

"card":{

"cardNumber":"4390189522010496",

"expirationMonth":"12",

"expirationYear":"25",

"brand":"VISA",

"last4Digits":"0496",

"externalToken":{

"externalTokenProvider":"GooglePay",

"eciProvider":"5",

"cryptogram":"ejJRWG9SWWRpU7I1M28DelozSXU="

}

}

},

"billingAddress":{

"email":"[email protected]",

"country":"US"

},

"deviceDetails":{

"ipAddress":"<customer's IP address>"

},

"userDetails": {

"country":"US"

},

"timeStamp":"<YYYYMMDDHHmmss>",

"checksum":"<calculated checksum>"

}

Example /payment Response for Non-3DS

{

"reason": "",

"authCode": "0E5E04",

"orderId": "36726421",

"transactionStatus": "APPROVED",

"clientRequestId": "V8UE4312Y",

"customData": "Custom Data for Control Panel Reports",

"internalRequestId": 19054731,

"version": "1.0",

"transactionId": "2110000000005034514",

"merchantSiteId": "126006",

"transactionType": "Sale",

"gwExtendedErrorCode": 0,

"gwErrorCode": 0,

"merchantId": "2502136204546424962",

"clientUniqueId": "695701003",

"errCode": 0,

"paymentOption": {

"userPaymentOptionId": "8107431",

"card": {

"issuerBankName": "Legence Bank",

"ccCardNumber": "4****0496",

"externalTokenProvider": "GooglePay",

"bin": "4390189",

"avsCode": "",

"threeD": {

},

"ccExpMonth": "12",

"ccExpYear": "25",

"isPrepaid": "false",

"acquirerId": "18",

"cardBrand": "VISA",

"cvv2Reply": "",

"last4Digits": "0496"

}

},

"sessionToken": "f3b77f95-d126-40bc-b1a9-2cf24fff811d",

"userTokenId": "9XL74BK99KBW",

"externalTransactionId": "",

"fraudDetails": {

"score": "0",

"system": {

"systemId": "1",

"decision": "None"

},

"finalDecision": "Accept"

},

"status": "SUCCESS"

}

External 3DS Provider

If you use an external (third-party) 3DS provider to perform additional 3DS card authentication, then you must include the 3DS authentication data provided by them, in the /payment request.

Decrypt the Google Pay token yourself (according to Google Pay’s requirements), and send the relevant extracted data by calling a /payment REST API request with its mandatory parameters, and include the following (as shown below):

userTokenIdpaymentOption.card.cardNumberpaymentOption.card.expirationMonthpaymentOption.card.expirationYearpaymentOption.card.brand(press here to see possible values)paymentOption.card.last4DigitspaymentOption.card.externalToken.externalTokenProvider: “GooglePay“paymentOption.card.externalToken.cryptogram: “<cryptogram from Google Pay>” (Conditional, only mandatory for DPAN flows)paymentOption.card.externalToken.eciProvider: “<value from Google Pay>” (Optional)paymentOption.card.threeD.externalMpi(class containing relevant data 3DS authentication data provided by the external (third-party) 3DS provider.)paymentOption.card.threeD.externalMpi.ecipaymentOption.card.threeD.externalMpi.cavvpaymentOption.card.threeD.externalMpi.dsTransID- Any other relevant data received on your server.

Example /payment Request with Decrypted Google Pay Token

{

"sessionToken":"<sessionToken from /getSessionToken>",

"merchantId":"<your merchantId>",

"merchantSiteId":"<your merchantSiteId>",

"clientRequestId":"<unique request ID in merchant system>",

"amount":"200",

"currency":"USD",

"userTokenId":"<unique customer identifier in merchant system – required for UPO creation>",

"clientUniqueId":"<unique transaction ID in merchant system>",

"paymentOption":{

"card":{

"cardNumber":"4390189522010496",

"expirationMonth":"12",

"expirationYear":"25",

"brand":"VISA",

"last4Digits":"0496",

"externalToken":{

"externalTokenProvider":"GooglePay",

"eciProvider":"5",

"cryptogram":"ejJRWG9SWWRpU7I1M28DelozSXU="

},

"threeD":{

"externalMpi":{

"eci":"2",

"cavv":"ejJRWG9SWWRpU2I1M21DelozSXU=",

"dsTransID":"9e6c6e9b-b390-4b11-ada9-0a8f595e8600"

}

}

}

},

"billingAddress":{

"email":"[email protected]",

"country":"US"

},

"deviceDetails":{

"ipAddress":"<customer's IP address>"

},

"userDetails": {

"country":"US"

},

"timeStamp":"<YYYYMMDDHHmmss>",

"checksum":"<calculated checksum>"

}

Example /payment Response from Decrypted GooglePay Token

{

"reason": "",

"authCode": "027203",

"orderId": "36876651",

"transactionStatus": "APPROVED",

"clientRequestId": "PFYU0A4FK",

"internalRequestId": 19297641,

"version": "1.0",

"transactionId": "2110000000005327976",

"merchantSiteId": "126006",

"transactionType": "Sale",

"gwExtendedErrorCode": 0,

"gwErrorCode": 0,

"externalSchemeTransactionId": "0302026300910298",

"merchantId": "2502136204546424962",

"clientUniqueId": "695701003",

"errCode": 0,

"paymentOption": {

"userPaymentOptionId": "8128691",

"card": {

"issuerBankName": "Banco Mercantil do Brasil S.A.",

"ccCardNumber": "4****0496",

"bin": "439018",

"avsCode": "G",

"threeD": {},

"cardType": "Credit",

"ccExpMonth": "12",

"ccExpYear": "25",

"issuerCountry": "BR",

"isPrepaid": "false",

"acquirerId": "103",

"cardBrand": "VISA",

"cvv2Reply": "",

"last4Digits": "0496"

}

},

"sessionToken": "50bfe77a-5b0b-498c-b9fc-c6523763715c",

"userTokenId": "D3UERI4KDQK7",

"externalTransactionId": "",

"fraudDetails": {

"score": "0",

"system": {

"systemId": "1",

"decision": "None"

},

"finalDecision": "Accept"

},

"status": "SUCCESS"

}

Nuvei as the 3DS Provider

This allows you to decrypt the Google Pay token and send the relevant data extracted from the Google Pay token a /payment request, as well as perform 3DS authentication on the card using Nuvei (in addition to the Google Pay authentication), as shown below:

1. Decrypt Google Pay Token

Decrypt the Google Pay token according to Google Pay’s requirements.

2. Initialize the Payment

The /initPayment request determines if the card supports 3DS and initializes the payment in the Nuvei system.

Send the relevant data extracted from the Google Pay token in an /initPayment request with its mandatory parameters, and include the following (as shown below):

userTokenIdpaymentOption.card.cardNumberpaymentOption.card.expirationMonthpaymentOption.card.expirationYearpaymentOption.card.brand(press here to see possible values)paymentOption.card.last4DigitspaymentOption.card.externalToken.externalTokenProvider: “GooglePay“paymentOption.card.externalToken.cryptogram: “<cryptogram from Google Pay>” (Conditional, only mandatory for DPAN flows)paymentOption.card.externalToken.eciProvider: “<value from Google Pay>” (Optional)paymentOption.card.threeD.methodNotificationUrl

Including this is required for 3DS Web Browser Fingerprinting. (The issuer uses this URL to return fingerprinting notifications.)- Any other relevant data received on your server.

Example /initPayment Request

{

"sessionToken": "<sessionToken from /getSessionToken>",

"merchantId": "<your merchantId>",

"merchantSiteId": "<your merchantSiteId>",

"clientRequestId": "<unique request ID in merchant system>",

"clientUniqueId": "<unique transaction ID in merchant system>",

"amount": "200",

"currency": "USD",

"userTokenId": "<unique customer identifier in merchant system – required for UPO creation>",

"paymentOption": {

"card":{

"cardNumber":"4390189522010496",

"expirationMonth":"12",

"expirationYear":"25",

"brand":"VISA",

"last4Digits":"0496",

"externalToken":{

"externalTokenProvider":"GooglePay",

"eciProvider":"5",

"cryptogram":"ejJRWG9SWWRpU7I1M28DelozSXU="

},

"threeD": {

"methodNotificationUrl": "<methodNotificationURL>"

}

}

},

"billingAddress": {

"email": "[email protected]",

"country": "US"

},

"deviceDetails": {

"ipAddress": "<customer's IP address>"

}

}

Example /initPayment Response with v2supported: “true”

{

"reason": "",

"orderId": "33704071",

"transactionStatus": "APPROVED",

"customData": "merchant custom data",

"internalRequestId": 10036001,

"version": "1.0",

"transactionId": "2110000000000587378",

"merchantSiteId": "142033",

"transactionType": "InitAuth3D",

"gwExtendedErrorCode": 0,

"gwErrorCode": 0,

"merchantId": "427583496191624621",

"clientUniqueId": "12345",

"errCode": 0,

"paymentOption": {

"card": {

"issuerCountry": "US",

"ccCardNumber": "4****0496",

"bin": "439018",

"threeD": {

"methodPayload": "eyJ0aHJlZURTU2VydmVyVHJhbnNJRCI6ImVkNGZlNTkzLWUzMWUtNDEyMC05M2EwLTBkNDBhNzUxNzEzMSIsInRocmVlRFNNZXRob2ROb3RpZmljYXRpb25VUkwiOiJ3d3cuVGhpc0lzQU1ldGhvZE5vdGlmaWNhdGlvblVSTC5jb20ifQ==",

"methodUrl": "https://srv-azr-acq2:4435/api/ThreeDSMethod/threeDSMethodURL",

"v2supported": "true",

"version": "2.2.0",

"serverTransId": "ed4fe593-e31e-4120-93a0-0d40a7517131",

"directoryServerId": "A000000003",

"directoryServerPublicKey": "MIIFrjCCBJagAwIBAgIQB2rJm.."

},

"cardType": "Credit",

"ccExpMonth": "12",

"ccExpYear": "25",

"last4Digits": "0496"

}

},

"sessionToken": "e524e7c5-9855-4ce9-b0f9-1045f34fd526",

"userTokenId": "230811147",

"status": "SUCCESS"

}

Example /initPayment Response with v2supported: “false”

{

"reason": "",

"clientRequestId": "E3YD6LSZD",

"internalRequestId": 19125711,

"version": "1.0",

"merchantSiteId": "126006",

"merchantId": "2502136204546424962",

"clientUniqueId": "695701003",

"errCode": 0,

"paymentOption": {

"card": {

"threeD": {

"v2supported": "false"

}

}

},

"sessionToken": "3056e85e-6272-4c1c-999a-0519def10020",

"userTokenId": "OHJD9R9CNLCF",

"status": "SUCCESS"

}

3. Handling /initPayment

The /initPayment response determines the next step:

paymentOption.card.threeD.v2supported: “false”

This means the card does not support 3DS at all.

Process the payment in the Non-3DS Payments flow (described above).paymentOption.card.threeD.v2supported: “true”

Process the payment in the 4. Payments – 3DS flow.

4. 3DS Payments

This allows you to perform 3DS authentication on the card using Nuvei (in addition to the Google Pay authentication).

The remaining steps to process a 3DS payment for a Google Pay payment, are almost identical to the standard server-to-server REST payment flow.

Perform the following standard REST payment flow steps by pressing the link to see the steps, and perform the steps together with any changes indicated below:

- 3DS Fingerprinting

Perform steps as-is (no changes). - 3DS Payment Request

Perform the standard steps and include the relevant data extracted from the Google Pay token and from the 3DS Fingerprinting (as shown below):userTokenIdrelatedTransactionIdpaymentOption.card.cardNumberpaymentOption.card.expirationMonthpaymentOption.card.expirationYearpaymentOption.card.brand(press here to see possible values)paymentOption.card.last4DigitspaymentOption.card.externalToken.externalTokenProvider: “GooglePay“paymentOption.card.externalToken.cryptogram: “<cryptogram from Google Pay>” (Conditional, only mandatory for DPAN flows)paymentOption.card.externalToken.eciProvider: “<value from Google Pay>” (Optional)paymentOption.card.threeDclass containing relevant data returned from the 3DS Fingerprinting.- Any other relevant data received on your server.

Example

/paymentRequest with 3DS Parameters{ "sessionToken": "<sessionToken from /getSessionToken>", "merchantId": "<your merchantId>", "merchantSiteId": "<your merchantSiteId>", "clientRequestId": "<unique request ID in merchant system>", "amount":"200", "currency":"USD", "userTokenId":"<unique customer identifier in merchant system – required for UPO creation>", "clientUniqueId":"<unique transaction ID in merchant system>", "relatedTransactionId": "<initPayment TransactionId>", "paymentOption":{ "card":{ "cardNumber":"4390189522010496", "expirationMonth":"12", "expirationYear":"25", "brand":"VISA", "last4Digits":"0496", "externalToken":{ "externalTokenProvider":"GooglePay", "eciProvider":"5", "cryptogram":"ejJRWG9SWWRpU7I1M28DelozSXU=" }, "threeD": { "methodCompletionInd": "Y", "version": "2.2.0", "notificationURL": "<notificationURL>", "merchantURL": "<merchantURL>", "platformType": "02", "v2AdditionalParams": { "challengePreference": "02", "challengeWindowSize": "05" }, "browserDetails": { "acceptHeader": "text/html,application/xhtml+xml", "ip": "192.168.1.11", "javaEnabled": "TRUE", "javaScriptEnabled": "TRUE", "language": "EN", "colorDepth": "48", "screenHeight": "400", "screenWidth": "600", "timeZone": "0", "userAgent": "Mozilla" } } } }, "billingAddress": { "country": "US", "email": "[email protected]" }, "deviceDetails": { "ipAddress": "<customer's IP address>" }, "timeStamp": "<YYYYMMDDHHmmss>", "checksum": "<calculated checksum>" } - 3DS Challenge

Conditional – Only when a challenge is required. - Final Payment Request

Conditional – Based on the outcome of the 3DS Challenge, you may need to send a final Liability Shift /payment request:Sending a final Liability Shift/paymentRequest

Complete the payment by sending a /payment request with its mandatory parameters and include these additional parameters:userTokenIdrelatedTransactionIdpaymentOption.card.cardNumberpaymentOption.card.expirationMonthpaymentOption.card.expirationYearpaymentOption.card.brand(press here to see possible values)paymentOption.card.last4DigitspaymentOption.card.externalToken.externalTokenProvider: “GooglePay“paymentOption.card.externalToken.cryptogram: “<cryptogram from Google Pay>” (Conditional, only mandatory for DPAN flows)paymentOption.card.externalToken.eciProvider: “<value from Google Pay>” (Optional)

Example Liability Shift

/paymentRequest (3DS){ "sessionToken":"<sessionToken from /getSessionToken>", "merchantId":"<your merchantSiteId>", "merchantSiteId":"<your merchantId>", "clientRequestId":"<unique request ID in merchant system>", "clientUniqueId":"<unique transaction ID in merchant system>", "amount":"200", "currency":"USD", "userTokenId":"<unique customer identifier in merchant system – required for UPO creation>", "relatedTransactionId":"<transactionId of the first payment request>", "paymentOption":{ "card":{ "cardNumber":"4390189522010496", "expirationMonth":"12", "expirationYear":"25", "brand":"VISA", "last4Digits":"0496", "externalToken":{ "externalTokenProvider":"GooglePay", "eciProvider":"5", "cryptogram":"ejJRWG9SWWRpU7I1M28DelozSXU=" } } }, "billingAddress":{ "country":"US", "email":"[email protected]" }, "deviceDetails":{ "ipAddress":"<customer's IP address>" }, "timeStamp":"<YYYYMMDDHHmmss>", "checksum":"<calculated checksum>" }Liability Shift

/payment(3DS) ResponseExample Liability Shift

/payment(3DS) DMNA DMN is sent to you containing the response details of the request:

...'ppp_status=FAIL&Status=ERROR&ExErrCode=1289&ErrCode=-1100&errApmCode=0&errApmDescription=&errScCode=0&errScDescription=&Reason=Issuer+data+is+not+available%2C+please+try+again+later&ReasonCode=1289&PPP_TransactionID=37893001&userid=ZDMIYVPRAJCB&merchant_unique_id=695701003&customData=Custom+Data%21&productId=MAH3ST7266GM&first_name=Wxjtyskuuj&last_name=Pauwbeuyid&email=jhahn.jhnui%40srzaw.cb¤cy=EUR&clientUniqueId=695701003&customField1=customField1-valueU&customField2=customField2-valueU&customField3=&customField4=&customField5=&customField6=&customField7=&customField8=&customField9=&customField10=&customField11=&customField12=&customField13=&customField14=&customField15=&invoice_id=&address1=340689+Billing+Str.+Updated.&address2=&country=Germany&state=&city=Billing+City+Updated&zip=BNE+4895U&phone1=359888797070&phone2=&phone3=&client_ip=93.146.254.172&nameOnCard=CL-BRW1&cardNumber=5****0902&bin=535275&noCVV=&acquirerId=99&expMonth=12&expYear=25&Token=SABHAGUAUABuAFAAMAAwAGQAZAAwAEYAbgAyAEgAZwBoADYARgAlACgAUABFAF0ANgB0AHgAVgBSAHkANABbAHoAJQBTAFMAeQAsAEMAeABjAHQAcgBfADgAPgBnAE0AXABiAGwAMwA%3D&tokenId=1688429575&AuthCode=&AvsCode=&Cvv2Reply=&shippingCountry=US&shippingState=&shippingCity=Shipping+City+Updated&shippingAddress=33+Shipping+Str.+Updated.&shippingZip=SDC+33334U&shippingFirstName=Mlxdwieffa&shippingLastName=Uvnoirngbg&shippingPhone=359888576900&shippingCell=359887576903&shippingMail=gmwch.bphmv%40ducdb.qz&total_discount=0.00&total_handling=0.00&total_shipping=0.00&total_tax=0.00&buyButtonProductBundleId=&merchant_site_id=126006&merchant_status=&action=&requestVersion=&message=ERROR&merchantLocale=&unknownParameters=&payment_method=cc_card&ID=&merchant_id=2502136204546424962&responseTimeStamp=2022-08-01.07%3A57%3A52&buyButtonProductId=&webMasterId=9IFAQ4ARB0IX&appliedPromotions=&uniqueCC=RHZ4oBPNguWJuqKZFoGGpmzIDw0%3D&transactionType=Auth&externalEmail=&cardCompany=MasterCard&eci=2&user_token_id=ZDMIYVPRAJCB&userPaymentOptionId=8303261&TransactionID=2110000000006785046&externalAccountDescription=nameOnCard%3ACL-BRW1&finalFraudDecision=Accept&fraudScore=0&systemID=1&systemDecision=None&totalAmount=35.0&dynamicDescriptor=Cashier+API+U&item_name_1=Item+1U&item_number_1=&item_amount_1=35.00&item_quantity_1=1&item_discount_1=0.00&item_handling_1=0.00&item_shipping_1=0.00&feeAmount=&houseNumber=&customCurrency=&externalToken_blockedCard=0&externalToken_cardAcquirerId=0&externalToken_cardAcquirerName=&externalToken_cardBin=0&externalToken_cardBrandId=0&externalToken_cardBrandName=&externalToken_cardExpiration=0&externalToken_cardLength=0&externalToken_cardMask=&externalToken_cardName=&externalToken_cardTypeId=0&externalToken_cardTypeName=&externalToken_clubName=&externalToken_creditCompanyId=0&externalToken_creditCompanyName=&externalToken_extendedCardType=&externalToken_Indication=&externalToken_tokenValue=&externalToken_tokenProvider=&ECIRaw=5&upoRegistrationDate=20220801&cavv=kHQxQjBDQTAyRDlDNEE0NzRFMTc%3D&shippingCounty=SCountyU&type=DEPOSIT&clientRequestId=16WH99KFX&relatedTransactionId=2110000000006785044&externalTokenProvider=GooglePay&threeDSVersion=2.1.0&isLiabilityOnIssuer=1&challengePreferenceReason=0&lastFourDigits=0902&responsechecksum=36291b228a50daceaeccfb5b563df484&advanceResponseChecksum=c3c6afdf8fdeb352839e28d262d3aec5',

Payout (Withdrawal) Flow

A payout is performed using the REST API /payout request.

A /payout request is performed using a previously deposit UPO (representing the customer bank account).

Call the /payout request with its mandatory parameters including:

userTokenId– Unique customer identifier in merchant system.userPaymentOptionclass containing:userPaymentOptionIddeviceDetailsclass containing:ipAddressurlDetailsclass containing:notificationUrl

Example /payout Request

{

"merchantId": "<your merchantId>",

"merchantSiteId": "<your merchantSiteId>",

"userTokenId": "<unique customer identifier in merchant system>",

"clientRequestId": "<unique request ID in merchant system>",

"currency": "USD",

"amount": "100",

"userPaymentOption": {

"userPaymentOptionId": "<UPO received from previous deposit>"

},

"deviceDetails": {

"ipAddress": "<customer's IP address>"

},

"urlDetails": {

"notificationUrl": "<URL to which DMNs are sent>"

},

"timeStamp": "<YYYYMMDDHHmmss>",

"checksum": "<calculated checksum>"

}

The request is processed and returns a transaction notification with the final status.

- If the transaction is successful, then the following is returned:

- A response with

status=APPROVED. - A DMN containing

status=APPROVED.

- A response with

- If the transaction is not successful, then the following is returned:

- A response with

status=DECLINED. - A DMN containing

status=DECLINED.

- A response with

Recurring Payments

Follow these steps to integrate Google Pay recurring payments into your payment flow.

Recurring payments involves two types of payments:

- The Initial recurring payment

- One or more Subsequent recurring payments

Follow these steps in the sections below to integrate Google Pay recurring payments into your payment flow.

Complete the payment using the relevant flow:

For Initial Recurring Payments

Send a /payment request with its mandatory parameters and include these additional parameters:

isRebilling: “0“userTokenId- paymentOption.card.externalToken.

externalTokenProvider: “GooglePay“ - paymentOption.card.externalToken.

mobileToken

Example /payment Request Initial Recurring Payments

{

"sessionToken": "<sessionToken from /getSessionToken>",

"merchantId": "<your merchantId>",

"merchantSiteId": "<your merchantSiteId>",

"clientRequestId": "<unique request ID in merchant system>",

"clientUniqueId": "<unique transaction ID in merchant system>",

"amount": "200",

"currency": "USD",

"userTokenId": "<unique customer identifier in merchant system – required for UPO creation>",

"isRebilling": "0",

"paymentOption": {

"card": {

"externalToken": {

"externalTokenProvider": "GooglePay",

"mobileToken": "<encrypted GooglePay Token converted to a string>"

}

}

},

"billingAddress":{

"email": "[email protected]",

"country": "US"

},

"deviceDetails":{

"ipAddress": "<customer's IP address>"

},

"userDetails": {

"country": "US"

},

"timeStamp": "<YYYYMMDDHHmmss>",

"checksum": "<calculated checksum>"

}

Example /payment Response for Initial Recurring Payments

{

"reason": "",

"authCode": "0E5E04",

"orderId": "36726421",

"transactionStatus": "APPROVED",

"clientRequestId": "V8UE4312Y",

"customData": "Custom Data for Control Panel Reports",

"internalRequestId": 19054731,

"version": "1.0",

"transactionId": "2110000000005034514",

"merchantSiteId": "126006",

"transactionType": "Sale",

"gwExtendedErrorCode": 0,

"gwErrorCode": 0,

"merchantId": "2502136204546424962",

"clientUniqueId": "695701003",

"errCode": 0,

"paymentOption": {

"userPaymentOptionId": "8107431",

"card": {

"issuerBankName": "Legence Bank",

"ccCardNumber": "4****1112",

"externalTokenProvider": "GooglePay",

"bin": "417577",

"avsCode": "",

"threeD": {},

"ccExpMonth": "08",

"ccExpYear": "25",

"isPrepaid": "false",

"acquirerId": "18",

"cardBrand": "VISA",

"cvv2Reply": "",

"last4Digits": "1112"

}

},

"sessionToken": "f3b77f95-d126-40bc-b1a9-2cf24fff811d",

"userTokenId": "9XL74BK99KBW",

"externalTransactionId": "",

"fraudDetails": {

"score": "0",

"system": {

"systemId": "1",

"decision": "None"

},

"finalDecision": "Accept"

},

"status": "SUCCESS"

}

For Subsequent Recurring Payments

To complete the payment flow for subsequent recurring payments, send the /payment requests with their mandatory parameters and include these additional parameters:

userTokenIdisRebilling: “1“relatedTransactionIdpaymentOption.userPaymentOptionId

This represents the original payment method selected by the customer, and links subsequent payments to the initial recurring payment.

Example /payment Request for a Subsequent Recurring Payment

{

"sessionToken": "<sessionToken from /getSessionToken>",

"merchantId": "<your merchantId>",

"merchantSiteId": "<your merchantSiteId>",

"clientRequestId": "<unique request ID in merchant system>",

"clientUniqueId": "<unique transaction ID in merchant system>",

"amount": "200",

"currency": "USD",

"userTokenId": "<unique customer identifier in merchant system – required for UPO creation>",

"isRebilling": "1",

"relatedTransactionId": "<transactionId from the original customer-initiated transaction>",

"paymentOption": {

"userPaymentOptionId": "<userPaymentOptionId returned by the initial recurring payment request>"

},

"billingAddress":{

"email": "[email protected]",

"country": "US"

},

"deviceDetails":{

"ipAddress": "<customer's IP address>"

},

"userDetails": {

"country": "US"

},

"timeStamp": "<YYYYMMDDHHmmss>",

"checksum": "<calculated checksum>"

}

Example /payment Response for a Subsequent Recurring Payment

{

"reason":"",

"authCode":"042323",

"orderId":"36733441",

"transactionStatus":"APPROVED",

"clientRequestId":"6X71VHFI7",

"customData":"Custom Data for Control Panel Reports",

"internalRequestId":19061291,

"version":"1.0",

"transactionId":"2110000000005045501",

"merchantSiteId":"126006",

"transactionType":"Sale",

"gwExtendedErrorCode":0,

"gwErrorCode":0,

"merchantId":"2502136204546424962",

"clientUniqueId":"695701003",

"errCode":0,

"paymentOption":{

"userPaymentOptionId":"8102691",

"card":{

"issuerBankName":"Legence Bank",

"ccCardNumber":"4****1112",

"bin":"401200",

"avsCode":"G",

"threeD":{},

"cardType":"Credit",

"ccExpMonth":"08",

"ccExpYear":"25",

"issuerCountry":"US",

"isPrepaid":"false",

"acquirerId":"103",

"cardBrand":"VISA",

"cvv2Reply":"",

"last4Digits":"1112"

}

},

"sessionToken":"1652b07c-e71e-470c-82be-0ce9c2c4a864",

"userTokenId":"790RAMSZPG7H",

"externalTransactionId":"",

"fraudDetails":{

"score":"0",

"system":{

"systemId":"1",

"decision":"None"

},

"finalDecision":"Accept"

},

"status":"SUCCESS"

}

Appendices

brand Values

Visa

Mastercard

Maestro

AMEX

Diners

Discover

Payment with Decrypted Google Pay Token

This is a description of how the old “Merchant Decrypts Token” integration works.

Old Flow for Payment with Decrypted Google Pay Token

This is used when you want to decrypt the GooglePay Token yourself, and then send the extracted payment details in an externalMPI class in a /payment request.

Perform these steps to process a Google Pay payment:

- Decrypt the GooglePay Token.

- If the values decrypted from the GooglePay Token contain a

cavvvalue, then continue to the next step. - Note, if the values decrypted from the GooglePay Token do not contain a

cavvvalue, then you can send the extracted payment details using a regular “non-GooglePay” payment flow, for example:- See the Initialize 3DS topic.

- See the Non-3DS Payment topic.

- If the values decrypted from the GooglePay Token contain a

- Call the

/paymentREST API request with its mandatory parameters and include the following (as shown below):paymentOption.card.brand(press here to see possible values)paymentOption.card.last4DigitsuserTokenIdpaymentOption.card.threeD.externalMpi(class containing relevant card details extracted from the decrypted token)paymentOption.card.threeD.externalMpi.eci(optional)paymentOption.card.threeD.externalMpi.cavvpaymentOption.card.threeD.externalMpi.externalTokenProvider: “GooglePay“

Example

/paymentRequest only showing the 3DS parameters extracted from the Decrypted Google Pay Token{ ... "paymentOption":{ "card":{ ... "brand":"VISA", "last4Digits":"0496", "threeD":{ "externalMpi":{ "externalTokenProvider":"GooglePay", "eci":"2", "cavv":"ejJRWG9SWWRpU2I1M21DelozSXU=" } } } }, ... }Full Example

/paymentRequest with Decrypted Google Pay Token{ "sessionToken": "<sessionToken from /getSessionToken>", "merchantId": "<your merchantId>", "merchantSiteId": "<your merchantSiteId>", "userTokenId": "<unique customer identifier in merchant system – required for UPO creation>", "clientRequestId": "<unique request ID in merchant system>", "clientUniqueId": "<unique transaction ID in merchant system>", "currency": "EUR", "amount": "35", "paymentOption": { "card": { "cardNumber": "4390189522010496", "expirationMonth": "12", "expirationYear": "25", "brand": "VISA", "last4Digits": "0496", "threeD": { "externalMpi": { "externalTokenProvider": "GooglePay", "eci": "2", "cavv": "ejJRWG9SWWRpU2I1M21DelozSXU=" } } } }, "billingAddress": { "email": "[email protected]", "country": "BR" }, "deviceDetails": { "ipAddress": "<customer's IP address>" }, "userDetails": { "country": "US" }, "timeStamp": "<YYYYMMDDHHmmss>", "checksum": "<calculated checksum>" }Example

/paymentResponse from Decrypted GooglePay Token{ "reason": "", "authCode": "027203", "orderId": "36876651", "transactionStatus": "APPROVED", "clientRequestId": "PFYU0A4FK", "internalRequestId": 19297641, "version": "1.0", "transactionId": "2110000000005327976", "merchantSiteId": "126006", "transactionType": "Sale", "gwExtendedErrorCode": 0, "gwErrorCode": 0, "externalSchemeTransactionId": "0302026300910298", "merchantId": "2502136204546424962", "clientUniqueId": "695701003", "errCode": 0, "paymentOption": { "userPaymentOptionId": "8128691", "card": { "issuerBankName": "Banco Mercantil do Brasil S.A.", "ccCardNumber": "4****0496", "bin": "439018", "avsCode": "G", "threeD": {}, "cardType": "Credit", "ccExpMonth": "12", "ccExpYear": "25", "issuerCountry": "BR", "isPrepaid": "false", "acquirerId": "103", "cardBrand": "VISA", "cvv2Reply": "", "last4Digits": "0496" } }, "sessionToken": "50bfe77a-5b0b-498c-b9fc-c6523763715c", "userTokenId": "D3UERI4KDQK7", "externalTransactionId": "", "fraudDetails": { "score": "0", "system": { "systemId": "1", "decision": "None" }, "finalDecision": "Accept" }, "status": "SUCCESS" }

Last modified February 2025

Last modified February 2025