Overview

To prevent and manage disputes and to fight fraud, merchants can enroll in pre-chargeback programs via Nuvei. These programs offer ways to handle potential chargebacks before they become actual chargebacks. Merchants can enroll in pre-chargeback programs for both Nuvei transactions and non-Nuvei transactions (transactions not processed by Nuvei), allowing them to manage their entire pre-chargeback activity in one platform.

The programs offered by Nuvei are:

- Ethoca Alerts (a Mastercard company)

- Rapid Dispute Resolution (RDR) by Verifi (a Visa company)

Ethoca Alerts

Ethoca network connects issuers, acquirers, and merchants by sharing fraud and dispute data. By receiving real-time fraud alerts (on Mastercard transactions and also on Visa transactions to a certain extent), merchants can quickly identify fraud, adjust disputed orders, issue refunds, and prevent the need for chargebacks.

Upon receiving an alert, merchants have a 48-hour window before a chargeback occurs, during which they can send their decision regarding the case to Ethoca and halt the chargeback process.

Nuvei can easily connect merchants to Ethoca alerts for both transactions that were processed by Nuvei and transactions that were not processed by Nuvei.

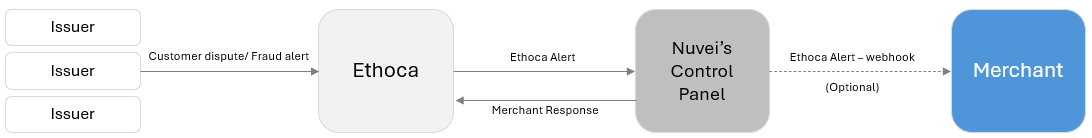

Alerts for Nuvei Transactions

Merchants enrolled in Ethoca alerts via Nuvei receive and handle Ethoca alerts for their transactions via Nuvei’s Control Panel:

Alerts can be handled manually, or merchants can set a rule to automatically refund transactions up to a threshold amount.

Process Flow

- Issuer sends an alert to Ethoca.

- Ethoca sends an alert to Nuvei. Ethoca alerts are displayed in the Pre-chargebacks – Events Report in the Control Panel.

- If the merchant has enabled pre-chargeback alert DMNs, Nuvei sends the merchant a DMN with the Ethoca alert data.

- Based on the alert data received from Ethoca, Nuvei tracks the transaction related to the alert and processes it according to the merchant’s configurations and Nuvei’s rule engine.

- If the alert meets the criteria for automatic response, an automatic response is sent to Ethoca, according to the case.

Example automatic responses:- Automatically process a refund (if the merchant has configured automatic refunds for transactions based on transaction’s amount criteria).

- The transaction was previously refunded.

- The transaction was not found based on the alert data.

- If the alert did not trigger an automated response, merchants are able to respond manually via the Case Management interface in the Control Panel.

- If the alert meets the criteria for automatic response, an automatic response is sent to Ethoca, according to the case.

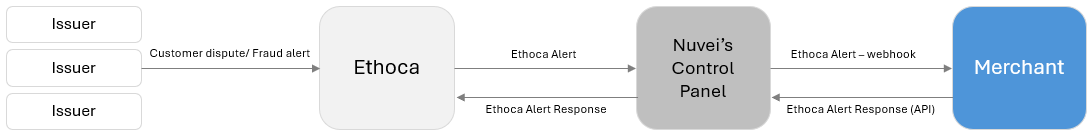

Alerts for Non-Nuvei Transactions

Nuvei allows merchants to handle Ethoca alerts for transactions not processed by Nuvei. If a merchant has enabled external pre-chargeback alert DMNs, Nuvei sends the merchant a DMN with the Ethoca alert data. Upon receiving an alert, the merchant needs to track the transaction related to the alert, and send Nuvei an Ethoca alert response via REST API.

Process Flow

- Issuer sends an alert to Ethoca.

- Ethoca sends an alert to Nuvei. Ethoca alerts are displayed in the Pre-chargebacks – Events Report in the Control Panel.

- If the merchant has enabled external pre-chargeback alert DMNs, Nuvei sends the merchant a DMN with the Ethoca alert data.

- Based on the alert data received in the DMN, the merchant tracks the transaction related to the alert; processes the alert; and sends Nuvei a

/preDisputeDecisionAPI request with its mandatory parameters, includingdecisionDetails.decisionDescriptionanddecisionDetails.refundIndicator. For valid values, see below.

Example

/preDisputeDecisionRequest{ "merchantId":"<your merchantId>", "merchantSiteId":"<your merchantSiteId>", "alertDetails":{ "correlationId":"35b82abb-0c13-4d1d-bc2c-8f3e7d056835", "alertReceivedDate":"2018-02-27T04:33:04.000Z" }, "decisionDetails":{ "decisionDescription":"previously_refunded", "refundIndicator":"refunded" }, "timeStamp":"<YYYYMMDDHHmmss>", "checksum":"<calculated checksum>" } - Nuvei processes the

/preDisputeDecisionrequest and sends the information to Ethoca (synchronously). - Nuvei sends the merchant a response that indicates

result.status: “success” or “failure“. In case of failure, error codes and reasons are included.

Example

/preDisputeDecisionResponse withresult.status: “success”{ "internalRequestId": 2543543, "status": "SUCCESS", "errCode": 0, "reason": "", "version": "1.0", "alertDetails": { "correlationId": "35b82abb-0c13-4d1d-bc2c-8f3e7d056835", "alertReceivedDate": "2018-02-27T04:33:04.000Z" }, "decisionDetails": { "decisionDescription": "previously_refunded", "refundIndicator": "refunded" }, "result": { "status": "success" } }Example

/preDisputeDecisionResponse withresult.status: “failure”{ "internalRequestId": 37652931, "status": "SUCCESS", "errCode": 0, "reason": "", "version": "1.0", "alertDetails": { "correlationId": "35b82abb-0c13-4d1d-bc2c-8f3e7d056835 ", "alertReceivedDate": "2024-02-07T06:14:09.943Z" }, "decisionDetails": { "decisionDescription": "previously_refunded", "refundIndicator": "refunded" }, "result": { "status": "failure", "errors": [ { "code": "10001", "reason": "Alert Not Found" } ] } }The response is displayed in the Pre-chargebacks – Events Report in the Control Panel.

RDR

Rapid Dispute Resolution by Verifi is a fully automated dispute management solution for Visa transactions. It facilitates seller, issuer, and acquirer collaboration to resolve unnecessary disputes at the pre-dispute stage.

When enrolling in RDR, merchants set rules that, if a potential chargeback is raised, determine whether a transaction can be refunded before becoming an actual chargeback.

Merchants can manage all of their RDR activity in one place by enrolling in RDR via Nuvei for transactions processed by Nuvei and for transactions not processed by Nuvei. When enrolled in RDR via Nuvei, cases are handled completely automatically, without merchant involvement, and based on the pre-defined rules.

RDR cases and data are available in the Nuvei Control Panel.

RDR for Nuvei Transactions

Merchants enrolled in RDR via Nuvei can view RDR cases in Control Panel reports:

- Pre-chargebacks – Events

RDR events appear in the context of the original transaction processed by Nuvei.

In Filters, select Event Type > RDR, RDR Failure. - Chargebacks Report

RDR cases appear in this report for merchants that provides information about chargebacks on Nuvei’s legacy chargeback platform.

RDR events appear in the context of the original transaction processed by Nuvei.

In Filters, select Status > RDR-Refund, RDR-Attempt Declined. - Disputes Reports

RDR cases appear in this report for merchants that provides information about chargebacks on Nuvei’s new dispute suite.

RDR events appear in the context of the original transaction processed by Nuvei.

In Filters, select Dispute Status > RDR. - Case Management

RDR cases appear in this report for merchants that provides information about chargebacks on Nuvei’s new dispute suite.

RDR cases appear as Completed, as no action is required from the merchant. The case appears as view-only.

In Case Types, select Pre-Dispute > Rapid Dispute Resolution (RDR).

RDR for non-Nuvei Transactions

Merchants can manage all of their RDR activity in one place by also enrolling in RDR via Nuvei for transactions not processed by Nuvei. RDR cases for non-Nuvei transactions are managed under a designated account. As part of the enrollment process, merchants provide their Visa CAIDs (Card Acceptor IDs).

Merchants enrolled in RDR via Nuvei can view RDR cases in the Pre-chargebacks – Events Control Panel Report. In Filters, select Event Type > External RDR, External RDR Failure.

Appendix

Valid Values for decisionDetails.decisionDescription

For Customer Dispute Alerts (customerdispute_alert)

| Value | Description | Valid Values for decisionDetails.refundIndicator |

|---|---|---|

| resolved | The dispute was resolved with the cardholder. | refunded | not_refunded | not_settled |

| previously_refunded | The transaction was already refunded. | refunded |

| unresolved_dispute | The dispute was not resolved with the cardholder. | not_refunded |

| notfound | The transaction was not found. | not_refunded |

| other | Other. | refunded | not_refunded | not_settled |

For Suspected Fraud Alerts (issuer_alert)

| Value | Description | Valid values for decisionDetails.refundIndicator |

|---|---|---|

| stopped | The merchant stopped providing the goods/service. | refunded | not_settled |

| partially_stopped | The merchant partially stopped providing the goods/service. | refunded | not_refunded | not_settled |

| previously_cancelled | Providing the goods/service was already cancelled. | refunded | not_settled |

| missed | The merchant already provided the goods/service. | refunded | not_refunded | not_settled |

| notfound | The transaction was not found. | not_refunded |

| account_suspended | The cardholder account was suspended. | refunded | not_refunded | not_settled |

| in_progress | Handling the fraud alert is in progress. | refunded | not_refunded | not_settled |

| shipper_contacted | The merchant has contacted the shipper to stop the supply. | refunded | not_refunded | not_settled |

Response Error Codes and Reasons

| Error Code | Reason |

|---|---|

| 10001 | Alert not found |

| 10002 | Decision was received before |

| 10003 | Invalid decision ID |

| 10004 | Ethoca - Unexpected system error |

| 10005 | Ethoca – session error |

| 10006 | Ethoca – validation error |

| 10007 | Invalid refund indicator |

| 10008 | Ethoca – Alert update failure |

| 10009 | Invalid ‘decision code’ – ‘refund indicator’ combination |

Last modified August 2025

Last modified August 2025