- Beneficiary Gaming Owner Confirmation

- Custom Manual Withdrawal

- German Regulation

- Net Deposit

- Partial Approval

- Payment Method Icon Recommendation

- Pending Withdrawals

- Pre-selected Payment Method

- Suggested Amounts and Smart Suggested Amounts

- Restricting Card Types

- UKGC Regulation Support

- US Debit/Credit Card Message

This page presents additional Nuvei Cashier features.

Beneficiary Gaming Owner Confirmation

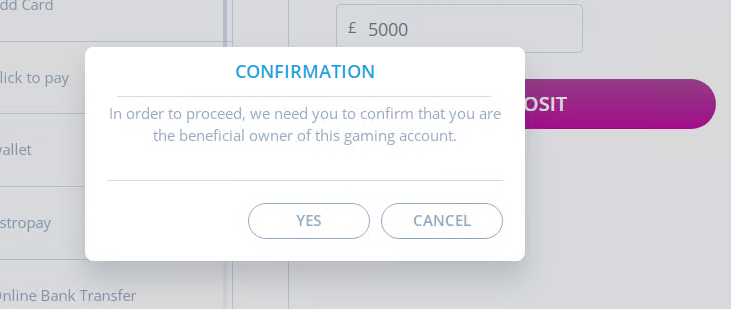

This feature allows the merchant to ask Nuvei to set a deposit limit amount for a gaming account. If a user tries to make a deposit above this amount, the user receives a request to confirm that they are the Beneficiary of that gaming account.

For example, if the merchant asks Nuvei to set the Beneficiary gaming owner confirmation limit to “4444.44” and the user tries to deposit “5000”, the user must confirm through the pop-up message that they are the Beneficiary gaming owner of the account.

If the player confirms, the deposit continues and an approval/declined Direct Merchant Notification (DMN) is sent with BeneficiaryGamingOwner = true.

If the user cancels, the deposit stops, and the decline DMN is sent with BeneficiaryGamingOwner = false.

Example

The user tries to deposit more than 4444.44:

The user needs to confirm that they are the Beneficiary for this gaming account:

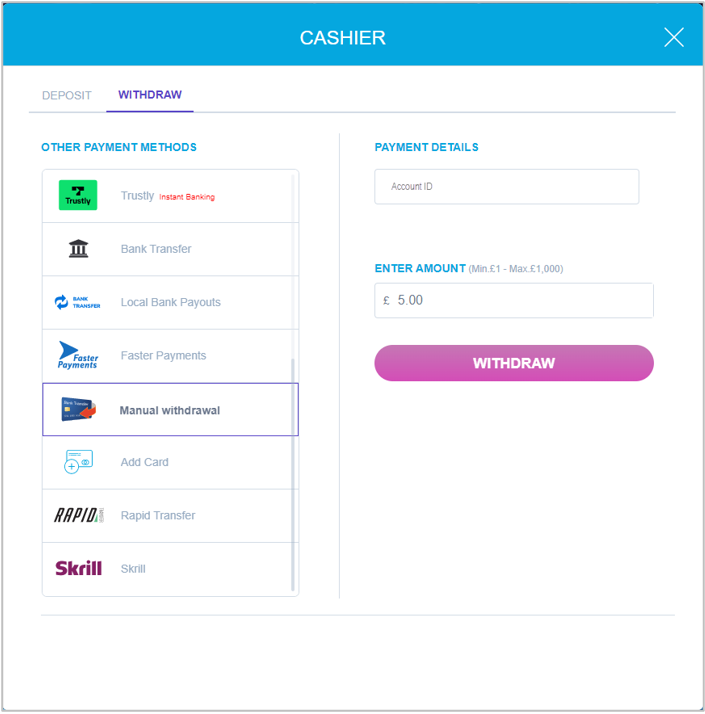

Custom Manual Withdrawal

Nuvei offers to its merchants a way to set up a Custom Manual Withdrawal payment method in their cashier page with specific end user entry fields based on the merchant’s requirements and the information that the merchant would like to collect from the end user.

This payout method can work for specific countries, and the Merchant can duplicate the manual withdrawal method with different end user entry fields per country.

Example

German Regulation

In response to a German regulation, Nuvei provides a solution for verifying the user’s name against the name of the bank account used for the following APMs:

- Klarna Debit Risk

- Sofort

- Trustly

- Rapid Transfer

This regulation is relevant for gaming merchants who operate in Germany and serve German customers.

Possible Actions for Failed Verifications

There are three possible actions if the verification process fails:

- None – No action is taken after a failed name verification.

- Refund/Withdraw – After the money is deposited but the verification failed, the money is automatically withdrawn back to the user due to the failed name verification.

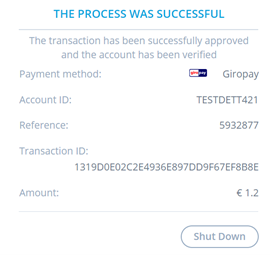

Example of Verification Passing

In this example, the verification passes because the full name of the user is the same as the bank account owner’s name.

Amount: 1.20

User information: FirstName: Meier LastName: Gustav

Bank information: FirstName: Meier LastName: Gustav

DMN for transaction 1110000000013233725 Approved

...'ppp_status=OK&Status=APPROVED&ExErrCode=0&ErrCode=0&errApmCode=0&errApmDescription=&errScCode=0&errScDescription=&Reason=&ReasonCode=0&PPP_TransactionID=283330138&userid=test1234&merchant_unique_id=&customData=ICE+Demo+Test+Multi&productId=Cashier+Test+product+1&first_name=Meier&last_name=Gustav&email=test%40test.com¤cy=EUR&customField1=&customField2=&customField3=&customField4=&customField5=&customField6=&customField7=&customField8=&customField9=&customField10=&customField11=&customField12=&customField13=&customField14=&customField15=&invoice_id=&address1=test&address2=&country=Germany&state=&city=test&zip=123456&phone1=123456&phone2=&phone3=&client_ip=213.137.87.148&nameOnCard=&cardNumber=&bin=&acquirerId=&expMonth=&expYear=&Token=&tokenId=&AuthCode=&AvsCode=&Cvv2Reply=&shippingCountry=&shippingState=&shippingCity=&shippingAddress=&shippingZip=&shippingFirstName=&shippingLastName=&shippingPhone=&shippingCell=&shippingMail=&total_discount=0.00&total_handling=0.00&total_shipping=0.00&total_tax=0.00&buyButtonProductBundleId=&merchant_site_id=119823&merchant_status=&action=&requestVersion=&message=APPROVED&merchantLocale=de_DE&unknownParameters=&payment_method=apmgw_Sofort&ID=&merchant_id=8860255768659021142&responseTimeStamp=2021-04-18.11:55:58&buyButtonProductId=&webMasterId=&appliedPromotions=&uniqueCC=&transactionType=Sale&externalEmail=&cardCompany=&eci=&user_token_id=Test_1090827562&user_token=auto&userPaymentOptionId=67501438&TransactionID=1110000000013233725&externalTransactionId=5932877&APMReferenceID=1319D0E02C2E4936E897DD9F67EF8B8E&orderTransactionId=1070131858&totalAmount=1.20&dynamicDescriptor=ICE+Demo+Test&item_name_1=Cashier+Test+product+1&item_number_1=&item_amount_1=1.20&item_quantity_1=1&item_discount_1=0.00&item_handling_1=0.00&item_shipping_1=0.00&feeAmount=&amountWithoutFee=&houseNumber=&customCurrency=&upoRegistrationDate=20210418&type=DEPOSIT&clientRequestId=&relatedTransactionId=&apmPayerInfo=%7B%22AccountNumber%22:%2282271%22%2C%22AccountHolder%22:%22Meier+%28%C3%A4%C3%84%2C+%C3%B6%C3%96%2C+%C3%BC%C3%9C%2C+%C3%9F%29+Gustav+%28%C3%A4%C3%84%2C+%C3%B6%C3%96%2C+%C3%BC%C3%9C%2C+%C3%9F%29%22%2C%22IBAN%22:%22DE52940594210000082271%22%2C%22BIC%22:%22TESTDETT421%22%7D&accountVerificationStatus=verified&responsechecksum=ef0b3780e788d84258bd82134fad99bd&advanceResponseChecksum=1b10b2a03cbfe3d067c3fe9f09f8a762',

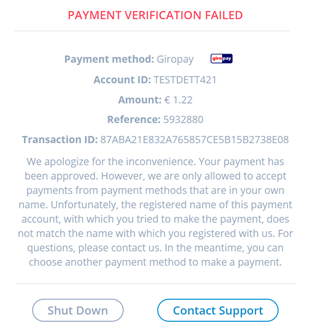

Example of Verification Failing

In this example, the verification fails because the full name of the user contains a unique symbol while the name of the bank account is without any symbols.

Amount: 1.22

User information: FirstName: Me1er LastName: Gu$tav

Bank information: FirstName: Meier LastName: Gustav

DMN for transaction 1110000000013233845 Approved

...'ppp_status=OK&Status=APPROVED&ExErrCode=0&ErrCode=0&errApmCode=0&errApmDescription=&errScCode=0&errScDescription=&Reason=&ReasonCode=0&PPP_TransactionID=283330518&userid=test1234&merchant_unique_id=&customData=ICE+Demo+Test+Multi&productId=Cashier+Test+product+1&first_name=Me1er&last_name=Gu%24tav&email=test%40test.com¤cy=EUR&customField1=&customField2=&customField3=&customField4=&customField5=&customField6=&customField7=&customField8=&customField9=&customField10=&customField11=&customField12=&customField13=&customField14=&customField15=&invoice_id=&address1=test&address2=&country=Germany&state=&city=test&zip=123456&phone1=123456&phone2=&phone3=&client_ip=213.137.87.148&nameOnCard=&cardNumber=&bin=&acquirerId=&expMonth=&expYear=&Token=&tokenId=&AuthCode=&AvsCode=&Cvv2Reply=&shippingCountry=&shippingState=&shippingCity=&shippingAddress=&shippingZip=&shippingFirstName=&shippingLastName=&shippingPhone=&shippingCell=&shippingMail=&total_discount=0.00&total_handling=0.00&total_shipping=0.00&total_tax=0.00&buyButtonProductBundleId=&merchant_site_id=119823&merchant_status=&action=&requestVersion=&message=APPROVED&merchantLocale=de_DE&unknownParameters=&payment_method=apmgw_Sofort&ID=&merchant_id=8860255768659021142&responseTimeStamp=2021-04-18.12:05:57&buyButtonProductId=&webMasterId=&appliedPromotions=&uniqueCC=&transactionType=Sale&externalEmail=&cardCompany=&eci=&user_token_id=Test_0711504766&user_token=auto&userPaymentOptionId=67501508&TransactionID=1110000000013233845&externalTransactionId=5932880&APMReferenceID=87ABA21E832A765857CE5B15B2738E08&orderTransactionId=1070132248&totalAmount=1.22&dynamicDescriptor=ICE+Demo+Test&item_name_1=Cashier+Test+product+1&item_number_1=&item_amount_1=1.22&item_quantity_1=1&item_discount_1=0.00&item_handling_1=0.00&item_shipping_1=0.00&feeAmount=&amountWithoutFee=&houseNumber=&customCurrency=&upoRegistrationDate=20210418&type=DEPOSIT&clientRequestId=&relatedTransactionId=&apmPayerInfo=%7B%22AccountNumber%22:%2282271%22%2C%22AccountHolder%22:%22Meier+%28%C3%A4%C3%84%2C+%C3%B6%C3%96%2C+%C3%BC%C3%9C%2C+%C3%9F%29+Gustav+%28%C3%A4%C3%84%2C+%C3%B6%C3%96%2C+%C3%BC%C3%9C%2C+%C3%9F%29%22%2C%22IBAN%22:%22DE52940594210000082271%22%2C%22BIC%22:%22TESTDETT421%22%7D&accountVerificationStatus=not_verified&responsechecksum=130d77c2eaacbc5b3847e017be0c7881&advanceResponseChecksum=c476d98de7bc2cecf10b3cdd15db09bc',

DMN for transaction 1110000000013233846 Pending Credit

...'ppp_status=OK&Status=PENDING&ExErrCode=0&ErrCode=0&errApmCode=0&errApmDescription=&errScCode=0&errScDescription=&Reason=&ReasonCode=0&PPP_TransactionID=283330518&userid=test1234&merchant_unique_id=&customData=ICE+Demo+Test+Multi&productId=Cashier+Test+product+1&first_name=Me1er&last_name=Gu%24tav&email=test%40test.com¤cy=EUR&customField1=&customField2=&customField3=&customField4=&customField5=&customField6=&customField7=&customField8=&customField9=&customField10=&customField11=&customField12=&customField13=&customField14=&customField15=&invoice_id=&address1=test&address2=&country=Germany&state=&city=test&zip=123456&phone1=123456&phone2=&phone3=&client_ip=213.137.87.148&nameOnCard=&cardNumber=&bin=&acquirerId=&expMonth=&expYear=&Token=&tokenId=&AuthCode=&AvsCode=&Cvv2Reply=&shippingCountry=&shippingState=&shippingCity=&shippingAddress=&shippingZip=&shippingFirstName=&shippingLastName=&shippingPhone=&shippingCell=&shippingMail=&total_discount=0.00&total_handling=0.00&total_shipping=0.00&total_tax=0.00&buyButtonProductBundleId=&merchant_site_id=119823&merchant_status=&action=&requestVersion=&message=PENDING&merchantLocale=de_DE&unknownParameters=&payment_method=apmgw_Sofort&ID=&merchant_id=8860255768659021142&responseTimeStamp=2021-04-18.12:05:58&buyButtonProductId=&webMasterId=&appliedPromotions=&uniqueCC=&transactionType=Refund&externalEmail=&cardCompany=&eci=&user_token_id=Test_0711504766&user_token=auto&userPaymentOptionId=67501508&TransactionID=1110000000013233846&orderTransactionId=1070132258&totalAmount=1.22&dynamicDescriptor=ICE+Demo+Test&item_name_1=Cashier+Test+product+1&item_number_1=&item_amount_1=1.22&item_quantity_1=1&item_discount_1=0.00&item_handling_1=0.00&item_shipping_1=0.00&feeAmount=&amountWithoutFee=&houseNumber=&customCurrency=&upoRegistrationDate=20210418&type=DEPOSIT&clientRequestId=&relatedTransactionId=&responsechecksum=130d77c2eaacbc5b3847e017be0c7881&advanceResponseChecksum=0aacb1c45c93bdb7f0958014071b9434',

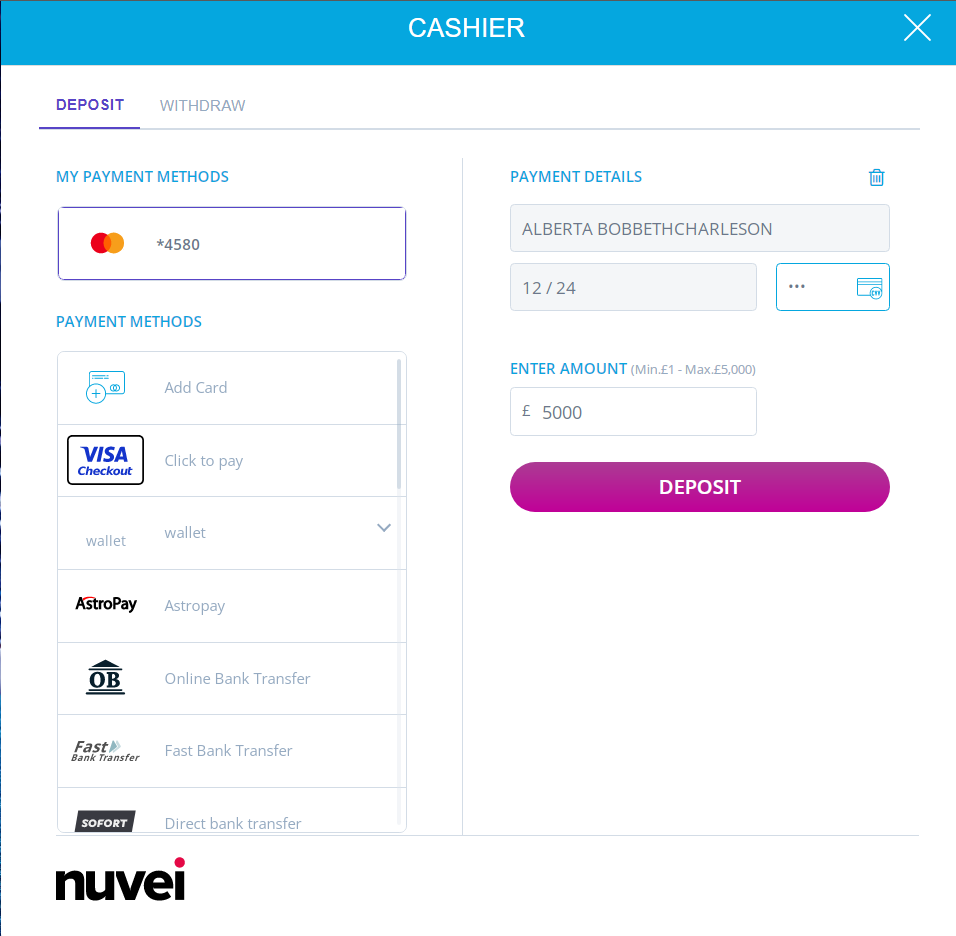

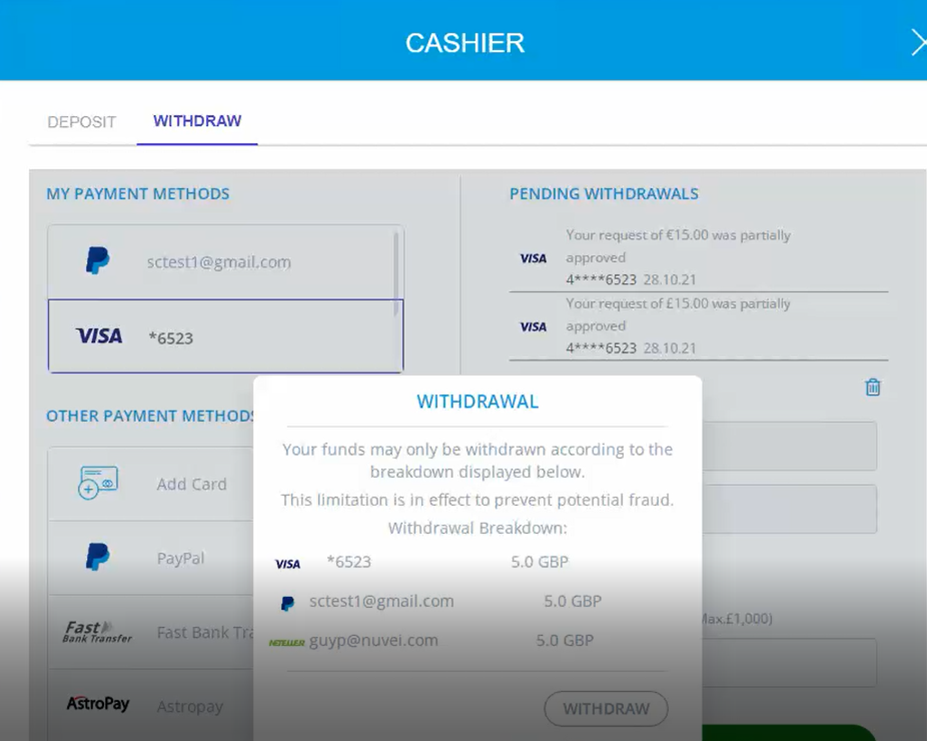

Net Deposit

The Net Deposit algorithm is utilized in the Gaming industry during withdrawal requests. Its purpose is to route withdrawal requests to the respective payment methods’ funding sources as a preventive measure against money laundering.

While the withdrawal request is submitted by end user, the algorithm suggests to the user to either split the withdrawal among several payment methods (which were the funding source of their deposits) or to transfer the requested amount to a fallback payment method.

Example Net Deposit Flow

- The end user submits a 15 GBP withdrawal request.

- The system notifies the user that the 15 GBP withdrawal was split between their Visa Card, PayPal account, and Neteller account, which can be viewed in the following screenshot:

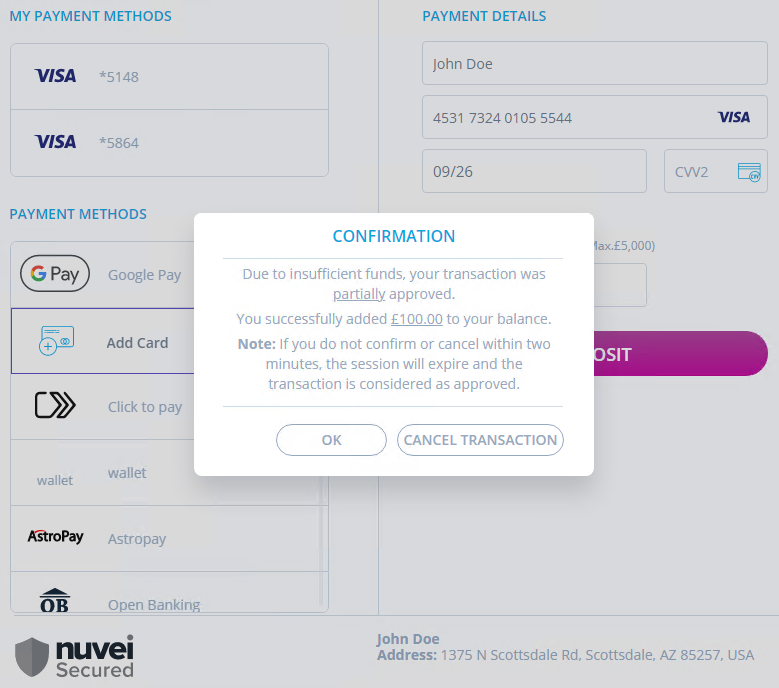

Partial Approval

Partial Approval allows an end user to complete a full deposit flow even if there are insufficient funds in their card account to complete the transaction. Instead, the customer is asked if they would like to deposit the amount of funds remaining available on their card.

Partial Approval can be enabled in two ways:

- The merchant can ask Nuvei to configure it from their side.

- The merchant can send

isPartialApproval: “1” in the request to trigger the feature (isPartialApproval: “0” indicates that the transaction was not approved partially).

In addition, the merchant can ask to Nuvei to configure a limitation for partial approval requests, which voids transactions when the approved amount is below the specified minimum amount.

Reversing a Partial Approval

A situation may arise where the customer is not interested in continuing with a transaction if it can only be carried out partially. Since the partial approval is authenticated automatically, it is incumbent on the merchant to be prepared for this scenario and to offer the customer to back out of the transaction. The partial approval transaction cannot be reversed. Instead, it must be voided by the merchant. Therefore, merchants should provide easy options to reimburse their customer’s funds, if needed.

The Checkout Page allows the customer to void the partially approved transaction by presenting a dialog with confirm and cancel buttons. Pressing CANCEL TRANSACTION issues a void transaction for the partially approved amount and currency by sending two DMNs to the merchant, one at the beginning of the transaction and the second one after the customer presses the cancellation button.

In addition, the user has two minutes to confirm or cancel the partial approval, and this is the message that is displayed:

“Due to insufficient funds, your transaction was only partially approved.

Please confirm that you would like [x] added to your balance.

Note: If you do not confirm or cancel within two minutes, the session will expire, and the transaction will be considered as approved.”

After two minutes, the dialog is changed to display the successful deposit message with the partial approval amount.

In the background, there is a scheduler that checks every two minutes for the unconfirmed partial approval transactions and sends an approved partial approval DMN to the merchant.

Example DMN – Approved

'ppp_status=OK&Status=APPROVED&ExErrCode=0&ErrCode=0&errApmCode=0&errApmDescription=&errScCode=0&errScDescription=&Reason=&ReasonCode=0&PPP_TransactionID=487216348&userid=&merchant_unique_id=&customData=ICE+Demo+Test+Multi&productId=Cashier+Test+product&first_name=John&last_name=Doe&email=johndoe%40gmail.com¤cy=GBP&pmDisplayName=4****5544&cardType=Debit&isPrepaid=false&cardIssuerCountry=GE&customField1=1&customField2=&customField3=&customField4=&customField5=&customField6=&customField7=&customField8=&customField9=&customField10=&customField11=&customField12=&customField13=&customField14=&customField15=&invoice_id=&address1=6th+Floor%2C+2+Kingdom+Street&address2=&country=United+Kingdom&state=&city=London&zip=W2+6BD&phone1=441234567890&phone2=&phone3=&client_ip=87.120.11.235&nameOnCard=John+Doe&cardNumber=4****5544&bin=453173&noCVV=&acquirerId=19&acquirerBank=Nuvei+Demo+Bank&expMonth=09&expYear=26&Token=awBRAG8ARgBGAGQAZAAwAG4AbgBGAFAATAAwAEwAUAAxAE8AMQBHAEQAaQAzADAATwBWAHkAWQBjACgAQQAzAG0AMwA3AG4AMQBuAGUAPQA7ACUAeQBKAFcAKgBHAD4AKgBZACsAMwA%3D&tokenId=1941897049&AuthCode=111581&AvsCode=&Cvv2Reply=&shippingCountry=GB&shippingState=&shippingCity=London&shippingAddress=6th+Floor%2C+2+Kingdom+Street&shippingZip=W2+6BD&shippingFirstName=John&shippingLastName=Doe&shippingPhone=441234567890&shippingCell=441234567890&shippingMail=johndoe%40gmail.com&total_discount=0.00&total_handling=0.00&total_shipping=0.00&total_tax=0.00&buyButtonProductBundleId=&merchant_site_id=119823&merchant_status=&action=&requestVersion=4.0.0&message=Success&merchantLocale=en_GB&unknownParameters=&payment_method=cc_card&ID=&merchant_id=8860255768659021142&responseTimeStamp=2024-09-01.09%3A47%3A04&buyButtonProductId=&webMasterId=&appliedPromotions=&uniqueCC=KsQT5TiarABqV5bhwah26JHtNtk%3D&transactionType=Sale&externalEmail=&cardCompany=Visa&test=1&eci=&user_token_id=28c8edde3d61a0411511&user_token=auto&userPaymentOptionId=126617678&TransactionID=7110000000004431690&LifeCycleId=7110000000004431690&3Dflow=1&orderTransactionId=1332593068&totalAmount=50.00&dynamicDescriptor=ICE+Demo+Test&item_name_1=Cashier+Test+product&item_number_1=&item_amount_1=100.00&item_quantity_1=1&item_discount_1=0.00&item_handling_1=0.00&item_shipping_1=0.00&feeAmount=&amountWithoutFee=&houseNumber=&customCurrency=&externalToken_blockedCard=&externalToken_cardAcquirerId=&externalToken_cardAcquirerName=&externalToken_cardBin=&externalToken_cardBrandId=&externalToken_cardBrandName=&externalToken_cardExpiration=&externalToken_cardLength=&externalToken_cardMask=&externalToken_cardName=&externalToken_cardTypeId=&externalToken_cardTypeName=&externalToken_clubName=&externalToken_creditCompanyId=&externalToken_creditCompanyName=&externalToken_extendedCardType=&externalToken_Indication=&externalToken_tokenValue=&externalToken_tokenProvider=&ECIRaw=&cryptogram=&maskedNetworkTokenNumber=&allow_installments=false&max_num_installments=64&upoRegistrationDate=20240901&isPartialApproval=1&requestedAmount=100&requestedCurrency=GBP&type=DEPOSIT&clientRequestId=&relatedTransactionId=&partialApprovalStatus=PENDING&cardBrand=visa&processedCardBrand=visa&lastFourDigits=5544&sessionId=cf88dd7777b242ed1164962ed9c7&responsechecksum=81186073bc9a1b92fdab0f07b5d445ea&advanceResponseChecksum=0e483dd1330e86879038ded8be260a0f&isFastFunds=0',

Example DMN – Void

'ppp_status=CANCEL&Status=APPROVED&ExErrCode=0&ErrCode=0&errApmCode=0&errApmDescription=&errScCode=0&errScDescription=&Reason=&ReasonCode=&PPP_TransactionID=487216498&userid=&merchant_unique_id=&customData=ICE+Demo+Test+Multi&productId=Cashier+Test+product&first_name=John&last_name=Doe&email=johndoe%40gmail.com¤cy=GBP&pmDisplayName=4****5544&cardType=Debit&isPrepaid=false&cardIssuerCountry=GE&customField1=1&customField2=&customField3=&customField4=&customField5=&customField6=&customField7=&customField8=&customField9=&customField10=&customField11=&customField12=&customField13=&customField14=&customField15=&invoice_id=&address1=6th+Floor%2C+2+Kingdom+Street&address2=&country=United+Kingdom&state=&city=London&zip=W2+6BD&phone1=441234567890&phone2=&phone3=&client_ip=87.120.11.235&nameOnCard=John+Doe&cardNumber=4****5544&bin=453173&noCVV=&acquirerId=19&expMonth=09&expYear=26&Token=awBvAG8AMABuAEYAUABuAG4AMAAwAFAAaABLADEAVgBLAFkAUABOAGAAWgBtAGIAMABCAFkAWgBrAG4APgBOACwAfAA9ADIAOAA5AEcATQBcACcAXQBMAHYAOABLADwALwBuAGsAMwA%3D&tokenId=1059683145&AuthCode=&AvsCode=&Cvv2Reply=&shippingCountry=GB&shippingState=&shippingCity=London&shippingAddress=6th+Floor%2C+2+Kingdom+Street&shippingZip=W2+6BD&shippingFirstName=John&shippingLastName=Doe&shippingPhone=441234567890&shippingCell=441234567890&shippingMail=johndoe%40gmail.com&total_discount=0.00&total_handling=0.00&total_shipping=0.00&total_tax=0.00&buyButtonProductBundleId=&merchant_site_id=119823&merchant_status=&action=&requestVersion=4.0.0&message=Success&merchantLocale=en_GB&unknownParameters=&payment_method=cc_card&ID=&merchant_id=8860255768659021142&responseTimeStamp=2024-09-01.09%3A47%3A29&buyButtonProductId=&webMasterId=&appliedPromotions=&uniqueCC=KsQT5TiarABqV5bhwah26JHtNtk%3D&transactionType=Void&externalEmail=&cardCompany=Visa&eci=&user_token_id=28c8edde3d61a0411511&user_token=register&userPaymentOptionId=126617698&TransactionID=7110000000004431715&3Dflow=1&orderTransactionId=1332593178&totalAmount=50.00&dynamicDescriptor=ICE+Demo+Test&item_name_1=Cashier+Test+product&item_number_1=&item_amount_1=50.00&item_quantity_1=1&item_discount_1=0.00&item_handling_1=0.00&item_shipping_1=0.00&feeAmount=&amountWithoutFee=&houseNumber=&customCurrency=&externalToken_blockedCard=&externalToken_cardAcquirerId=&externalToken_cardAcquirerName=&externalToken_cardBin=&externalToken_cardBrandId=&externalToken_cardBrandName=&externalToken_cardExpiration=&externalToken_cardLength=&externalToken_cardMask=&externalToken_cardName=&externalToken_cardTypeId=&externalToken_cardTypeName=&externalToken_clubName=&externalToken_creditCompanyId=&externalToken_creditCompanyName=&externalToken_extendedCardType=&externalToken_Indication=&externalToken_tokenValue=&externalToken_tokenProvider=&ECIRaw=&cryptogram=&maskedNetworkTokenNumber=&allow_installments=false&max_num_installments=64&upoRegistrationDate=20240901&type=DEPOSIT&clientRequestId=&relatedTransactionId=7110000000004431714&partialApprovalStatus=CANCELED&lastFourDigits=5544&sessionId=cf88dd7777b242ed1164962ed9c7&responsechecksum=98a2e42b15239b85e1e7c12ad1f30fc5&advanceResponseChecksum=d4b3cd9caddb762f43aafafe4060ca13',

Example DMN – Redirect after Finish – Success Call from nuvei.com

https://www.nuvei.com/?ppp_status=OK&LifeCycleId=7110000000004435052¤cy=GBP&merchant_site_id=119823&merchant_id=8860255768659021142&merchantLocale=en_GB&requestVersion=4.0.0&PPP_TransactionID=487238088&productId=Cashier+Test+product&userid=UserID_4301915434&customData=ICE+Demo+Test+Multi&payment_method=cc_card&responseTimeStamp=2024-09-01.13%3A00%3A19&message=Success&Error=Success&3Dflow=1&userPaymentOptionId=126620468&externalToken_cardExpiration=&externalToken_cardMask=&externalToken_extendedCardType=&externalToken_Indication=&externalToken_tokenValue=&Status=APPROVED&ExErrCode=0&ErrCode=0&AuthCode=111026&ReasonCode=0&Token=VwBRAEcARgBuADAAbgBuAEYAZABGAGQAbABoAGgARgA2ADMAZABFAD0AMAAlAF0AdABZAGcAJQBHACUARwBHAFcASwAmAHgAcgBQAEIAcgBxAF4AawBpAGkAdAApACwAPgBPADgAMwA%3D&tokenId=548741351&responsechecksum=0aadc482b46e85f8fd84499fa5b8010d&advanceResponseChecksum=fd6341f089c0caea55620bae5231ff57&totalAmount=50&requestedAmount=100.00&TransactionID=7110000000004435052&dynamicDescriptor=ICE+Demo+Test&uniqueCC=KsQT5TiarABqV5bhwah26JHtNtk%3D&orderTransactionId=1332612798&item_amount_1=100.00&item_quantity_1=1&

Example DMN – Redirect after Finish – Void Call from nuvei.com

https://www.nuvei.com/?ppp_status=CANCEL¤cy=GBP&merchant_site_id=119823&merchant_id=8860255768659021142&merchantLocale=en_GB&requestVersion=4.0.0&PPP_TransactionID=487238558&productId=Cashier+Test+product&userid=UserID_4301915434&customData=ICE+Demo+Test+Multi&payment_method=cc_card&responseTimeStamp=2024-09-01.13%3A02%3A45&message=Success&Error=Success&3Dflow=1&userPaymentOptionId=126620468&externalToken_cardExpiration=&externalToken_cardMask=&externalToken_extendedCardType=&externalToken_Indication=&externalToken_tokenValue=&Status=APPROVED&ExErrCode=0&ErrCode=0&Token=dQBlADEAbgBQAEYAMABkAFAAUABQADAASgA1ADEAagBzAG0AZABiAEgAdABoAEUAKAB0AFEANgBDADUAawArAGsAfABXAFwAVQBYAEgALgAsAFcAIwAsACYAJwBiACwALgA0AEQAMwA%3D&tokenId=1358636964&responsechecksum=fd8e112ed84ecfeab21b25d1c99c08e7&advanceResponseChecksum=071836df48166069b3649c9a821aca91&totalAmount=50.00&TransactionID=7110000000004435125&approvedAmount=25&dynamicDescriptor=ICE+Demo+Test&uniqueCC=KsQT5TiarABqV5bhwah26JHtNtk%3D&orderTransactionId=1332613388&item_amount_1=50.00&item_quantity_1=1&

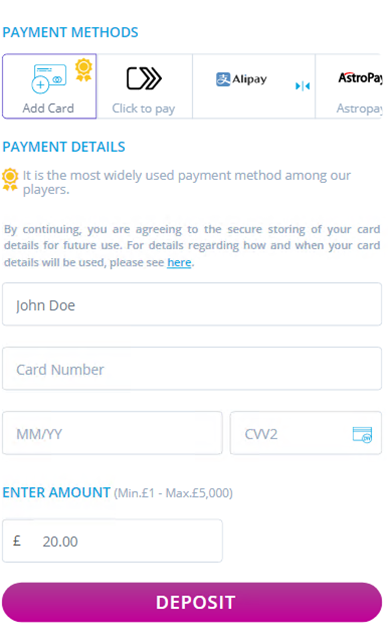

Cashier Example

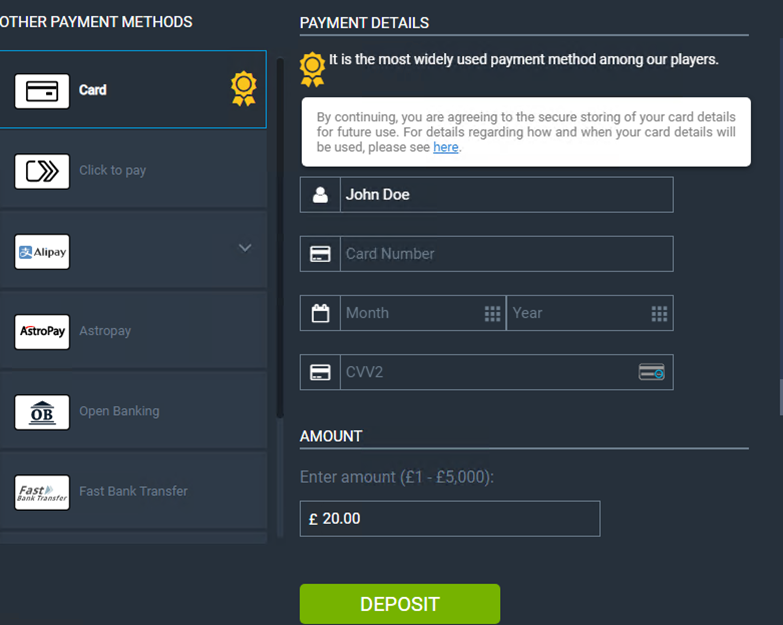

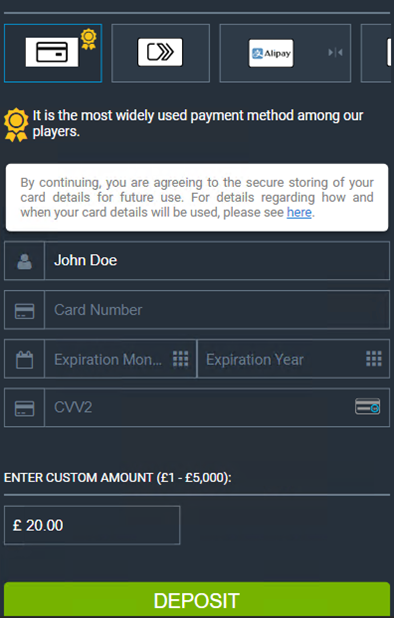

Payment Method Icon Recommendation

This feature allows Merchants to promote their payment methods to the end user. By analyzing user behavior over time, it has been determined that the most effective way to influence a user’s choice is by visually prioritizing the desired payment.

To facilitate the promotion of payment methods, Merchants can ‘mark’ the desired payment methods for promotion.

Hot Ice

Desktop Example

Mobile Example

Lucky Day

Desktop Example

Mobile Example

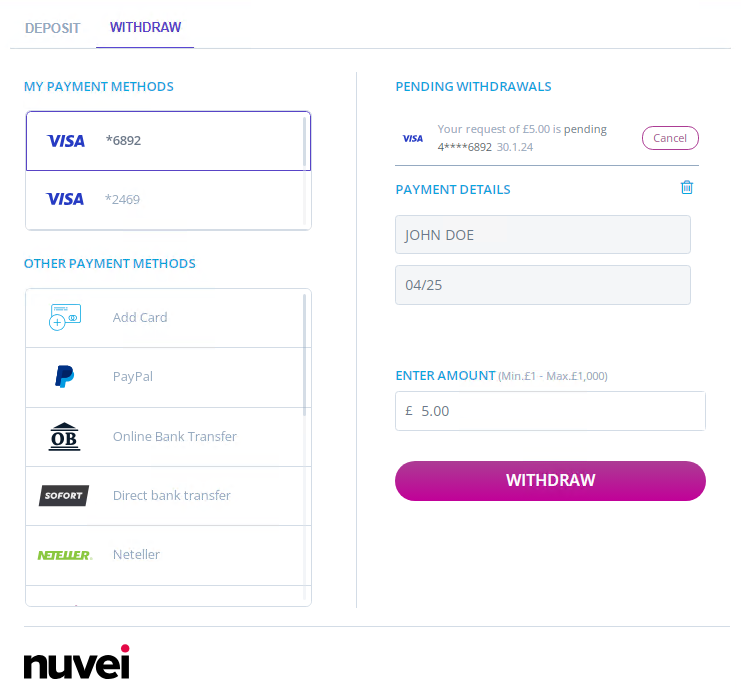

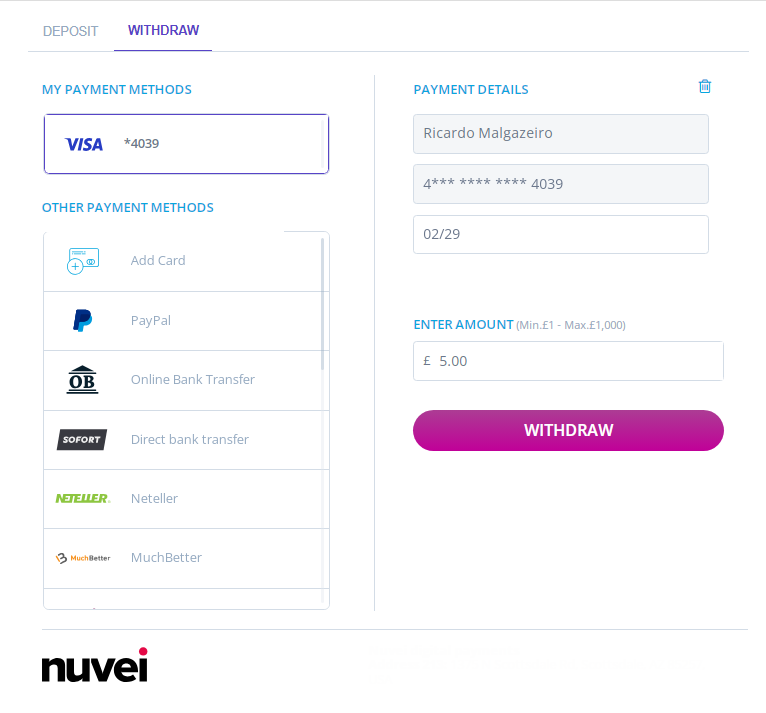

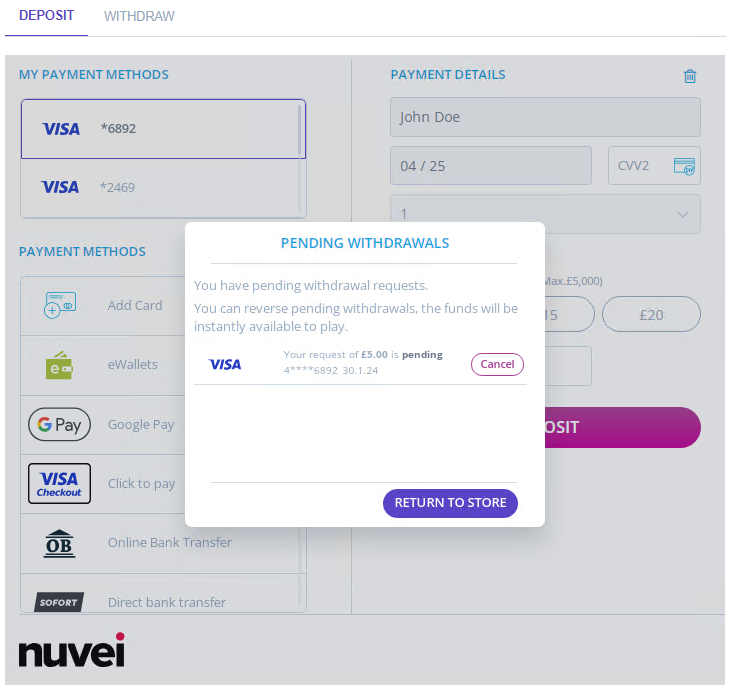

Pending Withdrawals

Pending Withdrawals Section on the Withdraw Page

The merchant can determine whether a Pending Withdrawals section appears on the Withdraw page, and can offer users the option of cancelling pending withdrawals. This allows users to control their withdrawal transactions, and allows the merchant to reduce redundant transactions that carry fees and operational effort.

By default, a Pending Withdrawals section appears on the Withdraw page, with the option to cancel any pending withdrawals:

To configure whether and how the Pending Withdrawals section appears on the Withdraw page, and whether the user has the option to cancel pending withdrawals, include the following parameters in the Withdrawal Payment Page URL call:

| Parameter | Description |

|---|---|

| Layout | Determines whether and how the Pending Withdrawal section appears on the withdrawal page. Values: 0 – The Pending Withdrawals section does not appear on the withdrawal page. 1 – Only the Pending Withdrawals section appears on the withdrawal page. 2 – The Pending Withdrawals section appears in full on the withdrawal page. 3 – The Pending Withdrawals section appears collapsed on the withdrawal page. The user can show the Pending Withdrawals section by pressing Show. |

| showCancelButton | Determines whether the user can cancel pending withdrawals. Values: true/empty – The Cancel button appears. false/0 – The Cancel button does not appear. |

Layout=0 Example

showCancelButton=false/0 Example

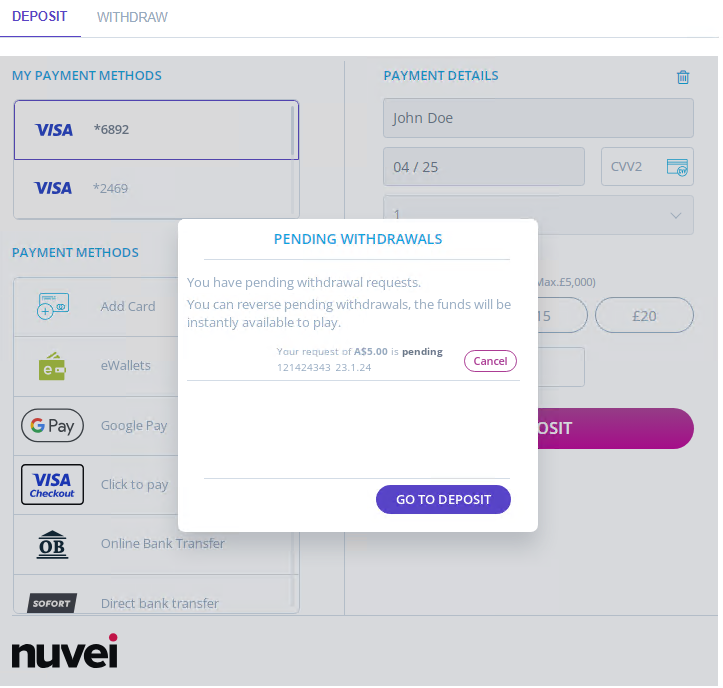

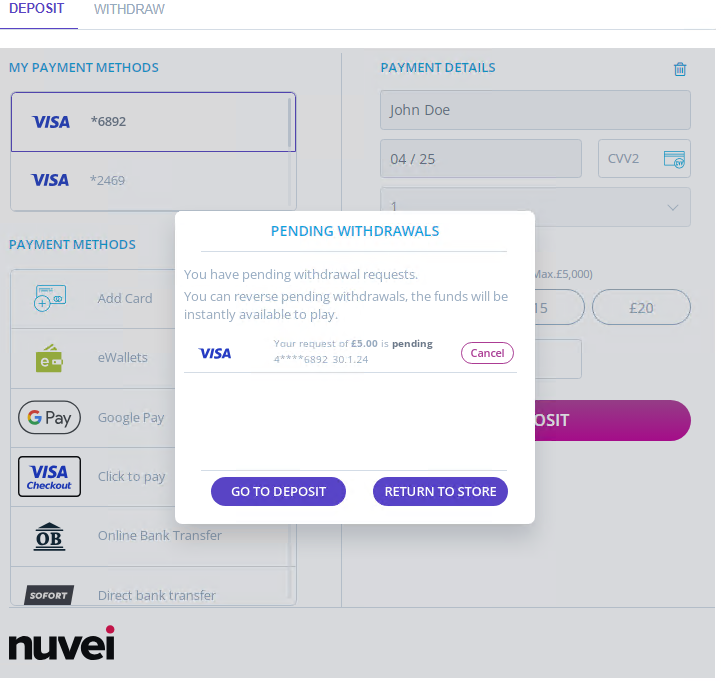

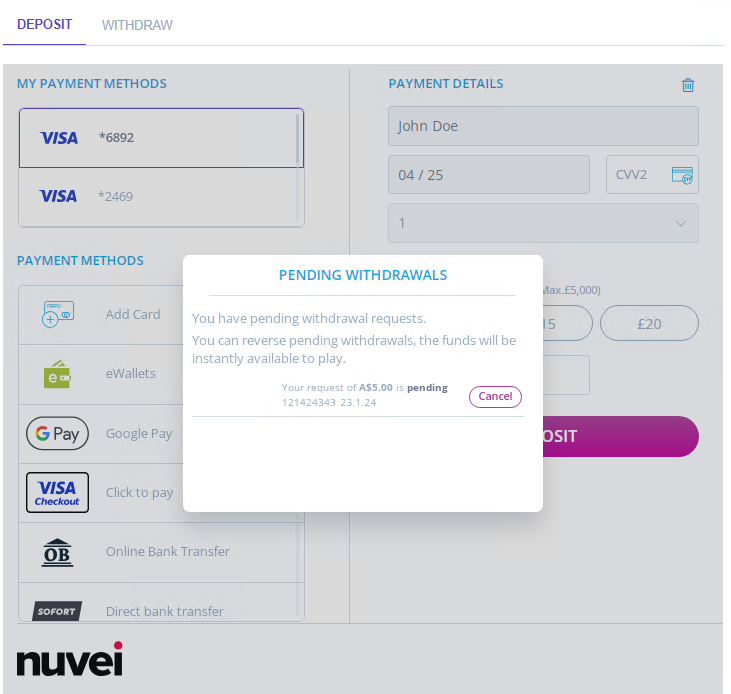

Pending Withdrawals on the Deposit Page

Before the Deposit page is available, pending withdrawals appear. The merchant can determine which of the following options are available to the user:

- The user can cancel pending withdrawals or continue to the Deposit page.

- The user can cancel pending withdrawals or return to the merchant site. The user cannot continue to the Deposit page.

- The user can cancel pending withdrawals, continue to the Deposit page, or return to merchant site.

- The user can only cancel pending withdrawals. Before continuing to the Deposit page, the user must cancel pending withdrawals.

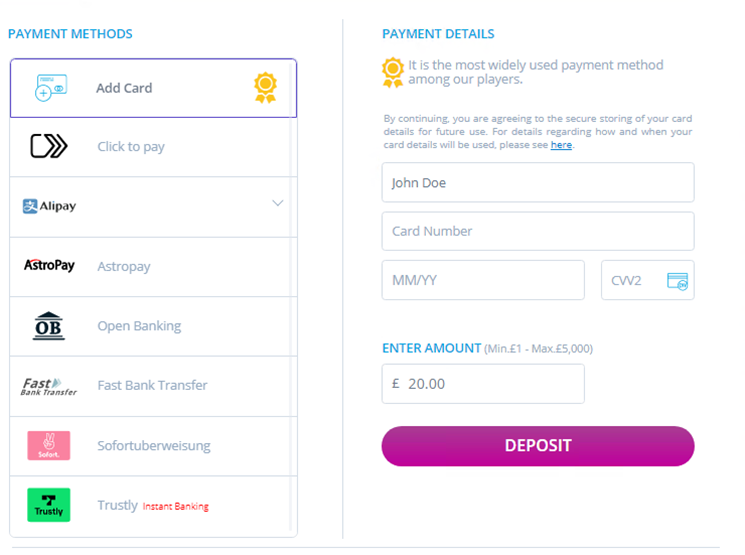

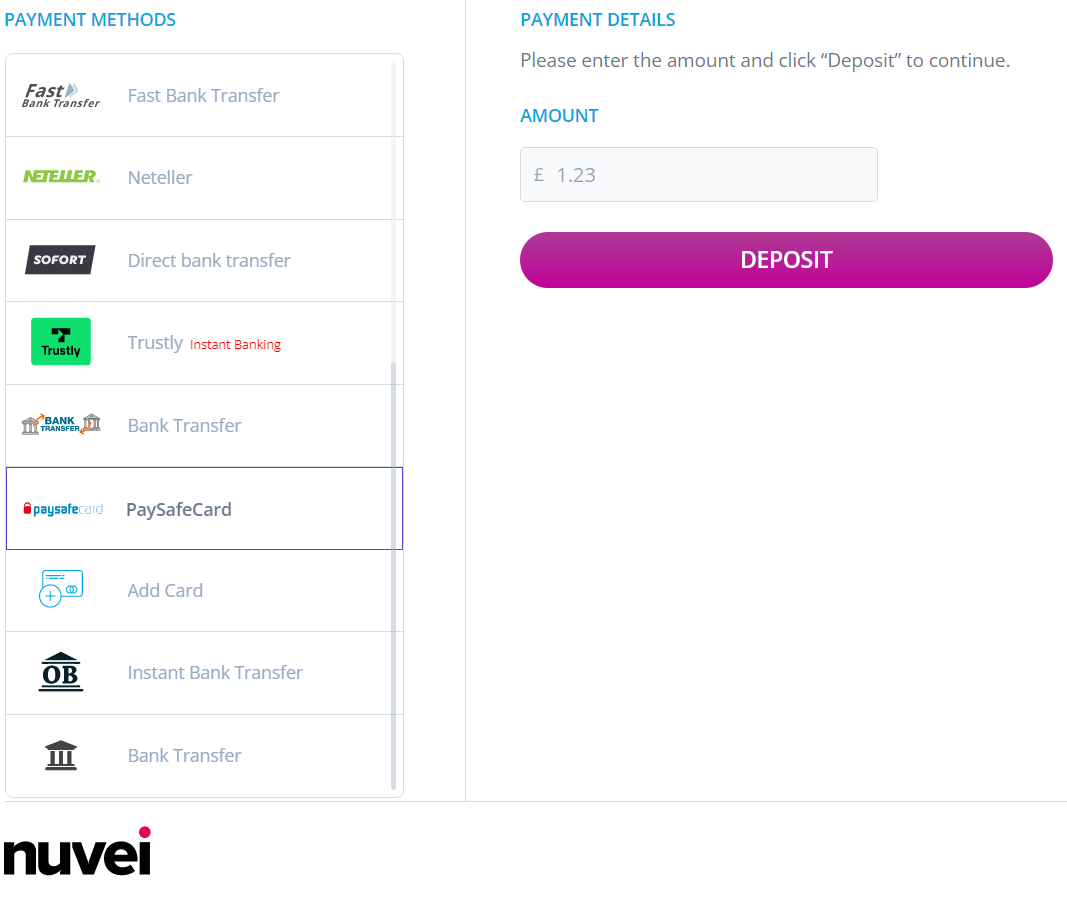

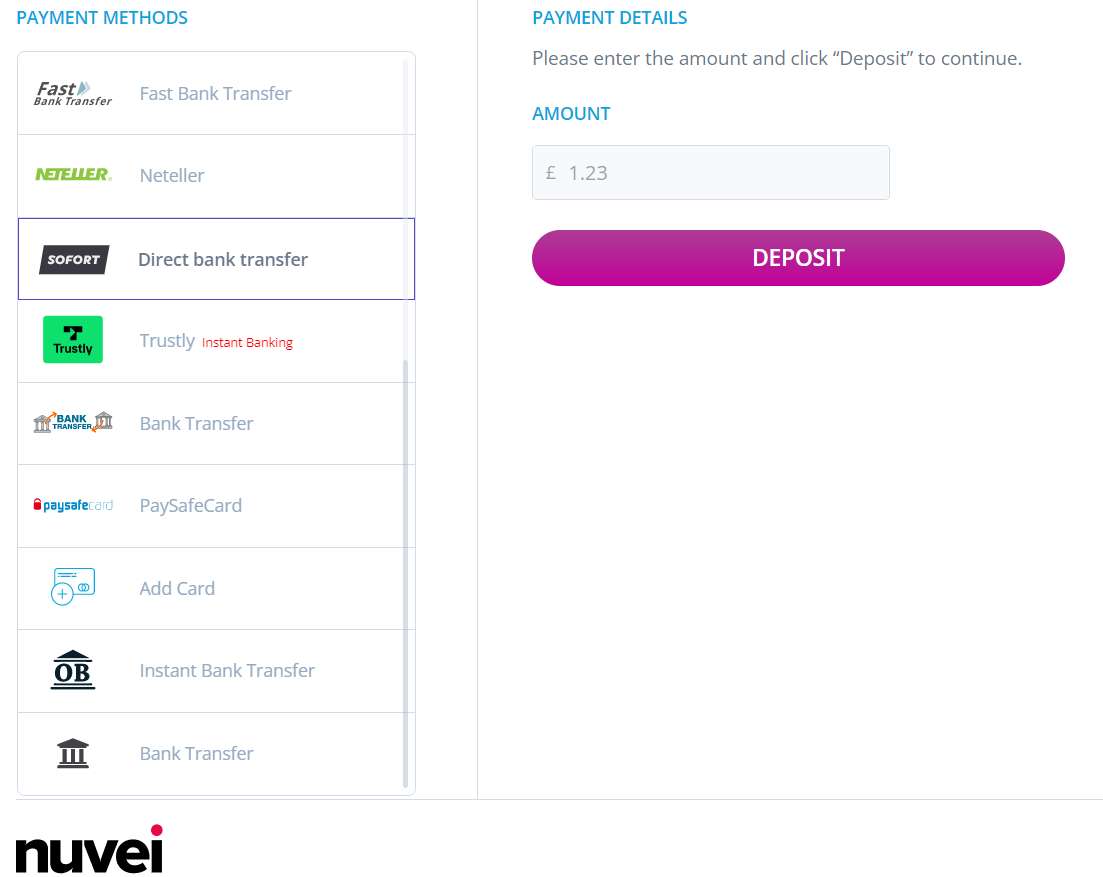

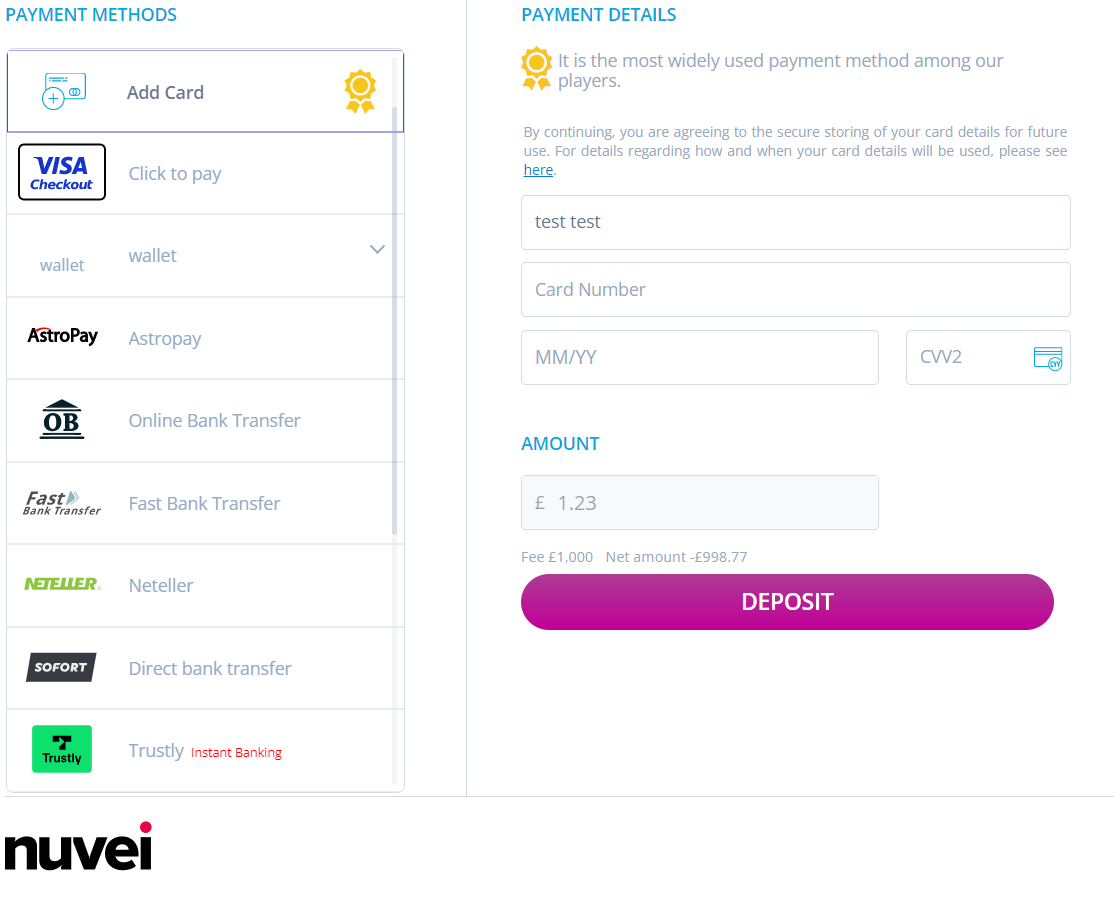

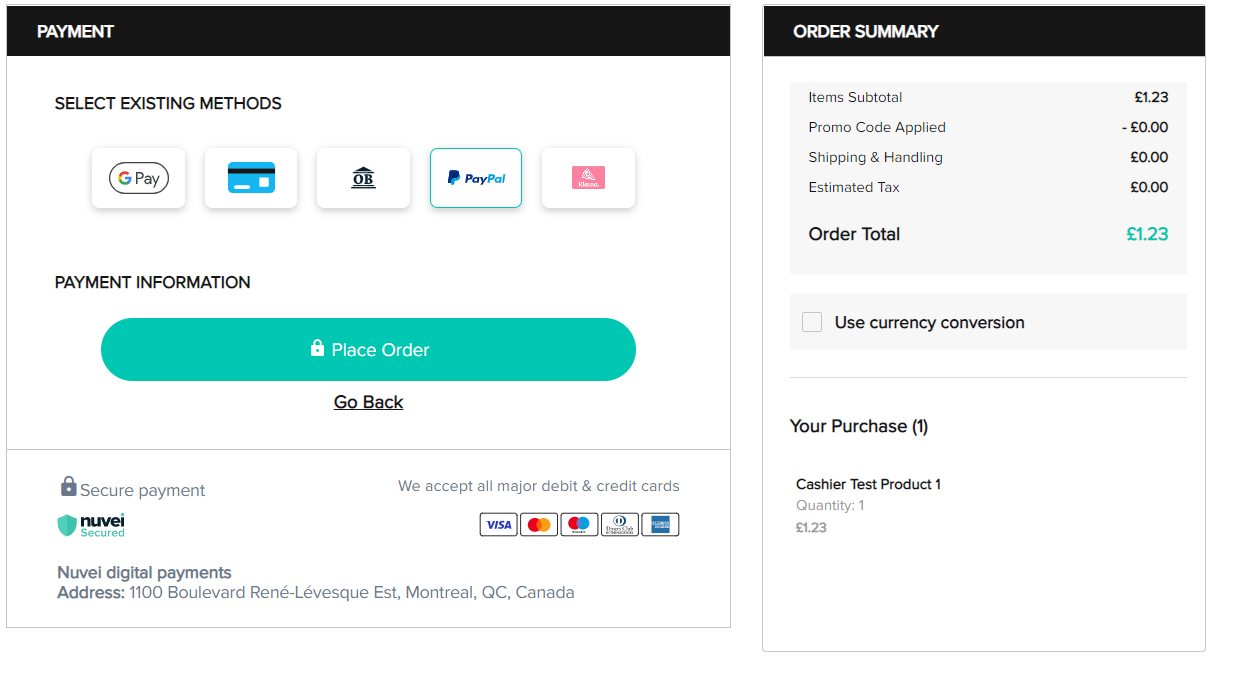

Pre-selected Payment Method

This feature allows the merchant to pre-select the payment method for the user when the Cashier page opens for both deposits and withdrawals.

This is done by adding “payment_method=<PAYMENT METHOD NAME>” to the Cashier call (deposit or withdraw).

The parameter is entered without the angle brackets and with the full Nuvei payment methods name.

Gaming Examples

PaySafeCard

Klarna Pay Now (formerly known as Sofort)

Credit Card

E-Commerce Examples

PayPal

Credit Card

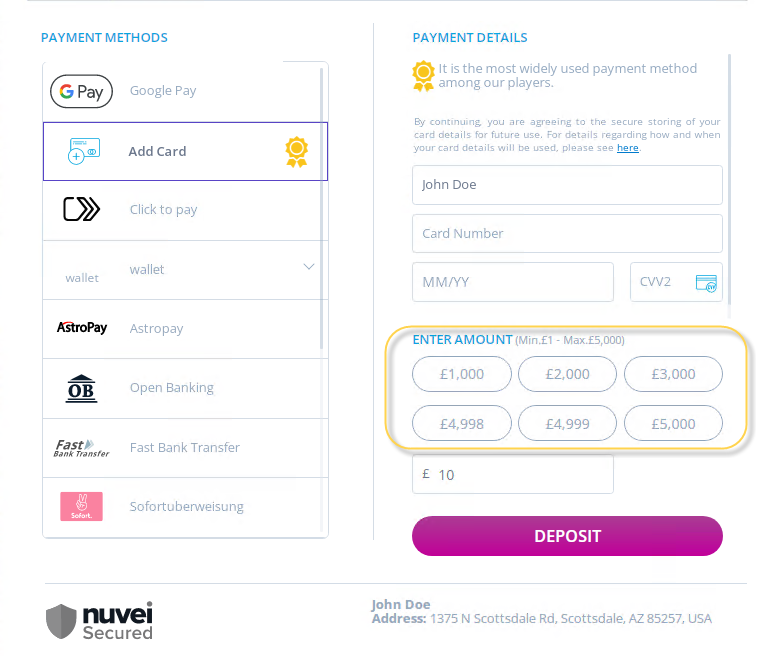

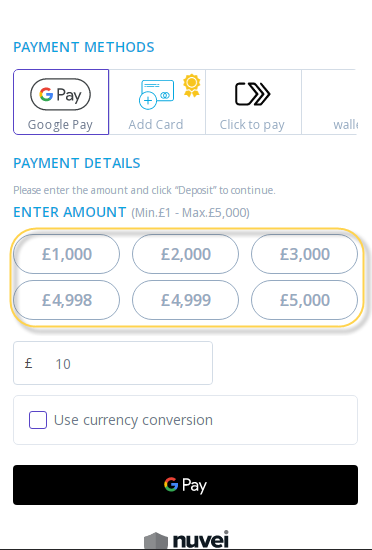

Suggested Amounts and Smart Suggested Amounts

Suggested Amounts

The Suggested Amount feature allows the merchant to configure up to six buttons that display suggested amounts on the Cashier page. The suggested amounts can be configured manually by the Nuvei team based on the merchant’s preference in the backend system.

In this way, the merchant makes the deposit flow more intuitive and fluid by allowing the user to choose one of the suggested amounts instead of manually entering the amount to deposit.

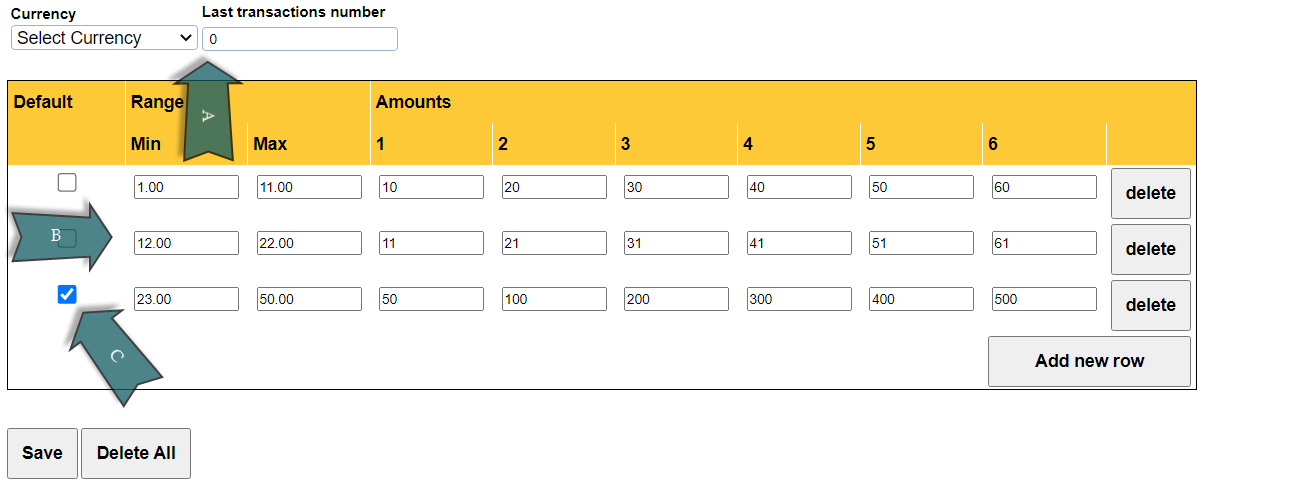

Smart Suggested Amounts

The Smart Suggested Amount feature allows the merchant to configure a list of up to six suggested amounts buttons to be presented on the Nuvei Payment Page based on the user’s deposit history.

The suggested amounts are determined by the number of recent successful transactions performed by the end user (A in the figure below), as configured by the merchant in the backend system. This number (X) is used to calculate the average amount that the end user deposited during their past transactions.

If the average amount falls within one of the preconfigured ranges (B in the figure below), the system presents the pre-selected suggested amounts from the triggered range.

If the average value does not fall within any preconfigured ranges, the system shows the suggested amounts from the default range chosen by the merchant (C in the figure below).

For the Smart Suggested Amount feature to work properly, the merchant must provide the following information in advance:

- The number of last transactions performed by the end user. This value is used to calculate the average amount (X).

- The currency that triggers the Smart Suggested Amount feature.

- The information for each range:

- The minimum and maximum amounts (the range that triggers the specific range)

- The preselected suggested amounts are displayed for this range in the six buttons.

- The default range is displayed if the average amount does not fall within any of the ranges configured in the backend.

The suggested amount buttons are not the same as the buttons configured in the Nuvei backend system if the base currency is different than the currency in the Deposit page. The suggested amounts configured in the Nuvei backend system are converted to the currency from the Deposit Request and are rounded to 5 according to the nearest digit.

This example shows how the average amount is calculated when the number of transactions deposited by the end user is larger than X.

Number of the last successful transactions is 3.

Base Currency: EUR

1st successful transaction – 5 EUR

2nd successful transaction – 4 EUR

3rd successful transaction – 2 EUR

4th successful transaction – 1 EUR

Average amount is calculated as the average of the last 3 transactions:

Average Amount = (1 EUR+ 2 EUR+4 EUR)/3

This example shows how the average amount is calculated when the number of transactions deposited by the end user is less than X. The average amount is calculated based on the number of existing successful transactions.

Number of the last successful transactions is 5.

Base Currency: EUR

1st successful transaction – 4 USD -> 4 * 0.8817(rate) = 3.5268 EUR

2nd successful transaction – 2 EUR -> conversion for this transaction is not need because the transaction currency matches with base currency from Nuvei backend system.

3rd successful transaction – 1 GBP ->1 * 1.1333(rate)-> 1.1333 EUR

Average amount is calculated as the average of the last 3 transactions:

Average Amount = (3.5268 EUR + 2 EUR + 1.1333 EUR) = 6.6601 EUR /3 = 2.2200 EUR -> rounded to 2.22 EUR

This example shows how the converted suggested amounts are rounded to 5 according to the nearest digit.

Converted Suggested Amount – 11,25 -> rounded to 10

Converted Suggested Amount – 12,50 -> rounded to 15

Converted Suggested Amount – 12,70 -> rounded to 15

Desktop Example – Suggested Amounts

Mobile Example – Suggested Amounts

Controlling Suggested Amounts in a Deposit/Withdrawal Cashier Request

Nuvei has also improved the Suggested Amounts feature by allowing the merchant to control the following:

- The total amount for the Suggested amounts.

- The amount of the Suggested Amounts buttons.

- The payment range (minimum and maximum amounts) for the end user.

The merchant sends the new values in the cashier request call as follows:

Deposit Flow

- For the total amount, the merchant sends “total_amount=X“, where “X” is the desired value for the total amount.

- For the amounts of the Suggested Amounts buttons, the merchant sends “suggestedAmountN = X“, where “N” specifies the number of the suggested amount (up to 3 suggested amount buttons are allowed) and “X” specifies the amount for the suggested amount button.

- For the minimum and maximum values, the merchant must send two different values:

- “item_max_amount_1=N“, where “N” represents the desired maximum value

- “item_min_amount_1=N“, where “N” represents the desired minimum value

Withdrawal Flow

- For the total amount, the merchant sends “wd_amount=X“, where “X” is the desired value for the total amount.

- For the amounts of the Suggested Amounts buttons, the merchant sends “suggestedAmountN = X“, where “N” specifies the number of the suggested amount (up to 3 suggested amount buttons are allowed) and “X” specifies the amount for the suggested amount button.

- For the minimum and maximum values, the merchant must send two different values:

- “wd_max_amount_1=N“, where “N” represents the desired maximum value

- “wd_min_amount_1=N“, where “N” represents the desired minimum value

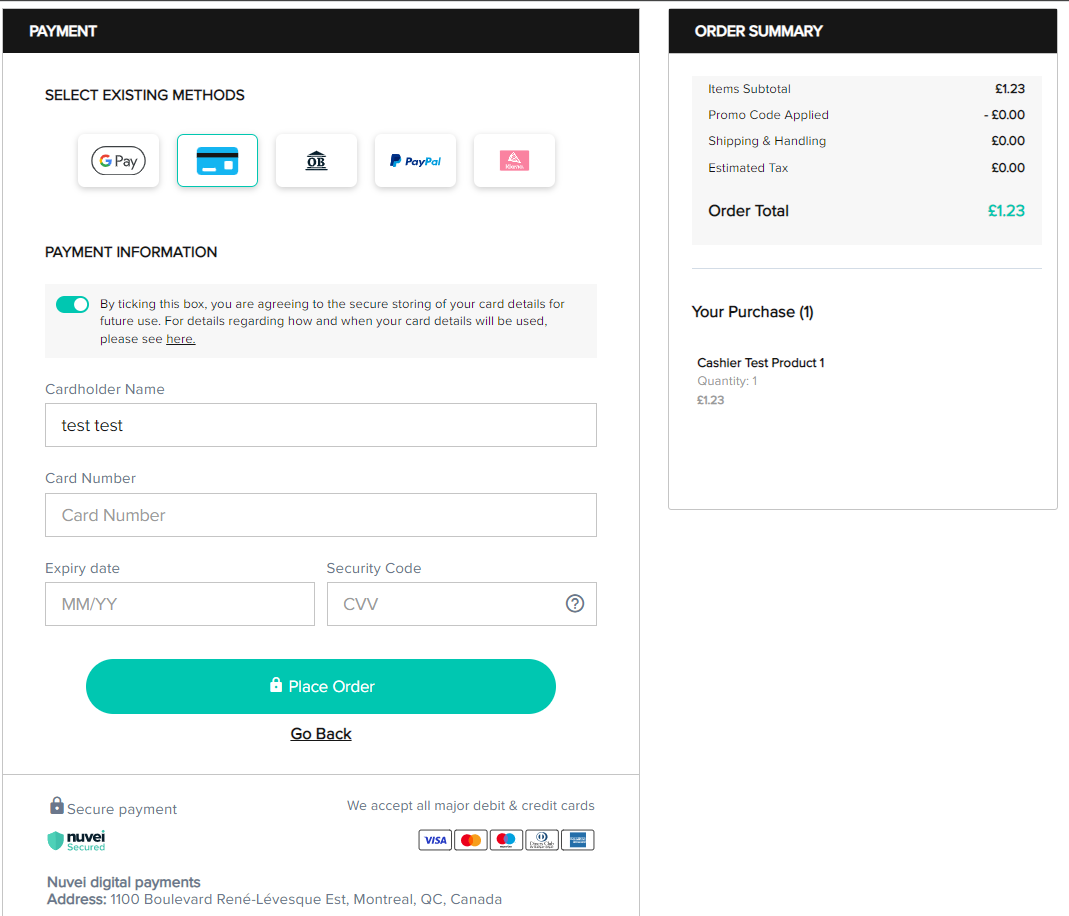

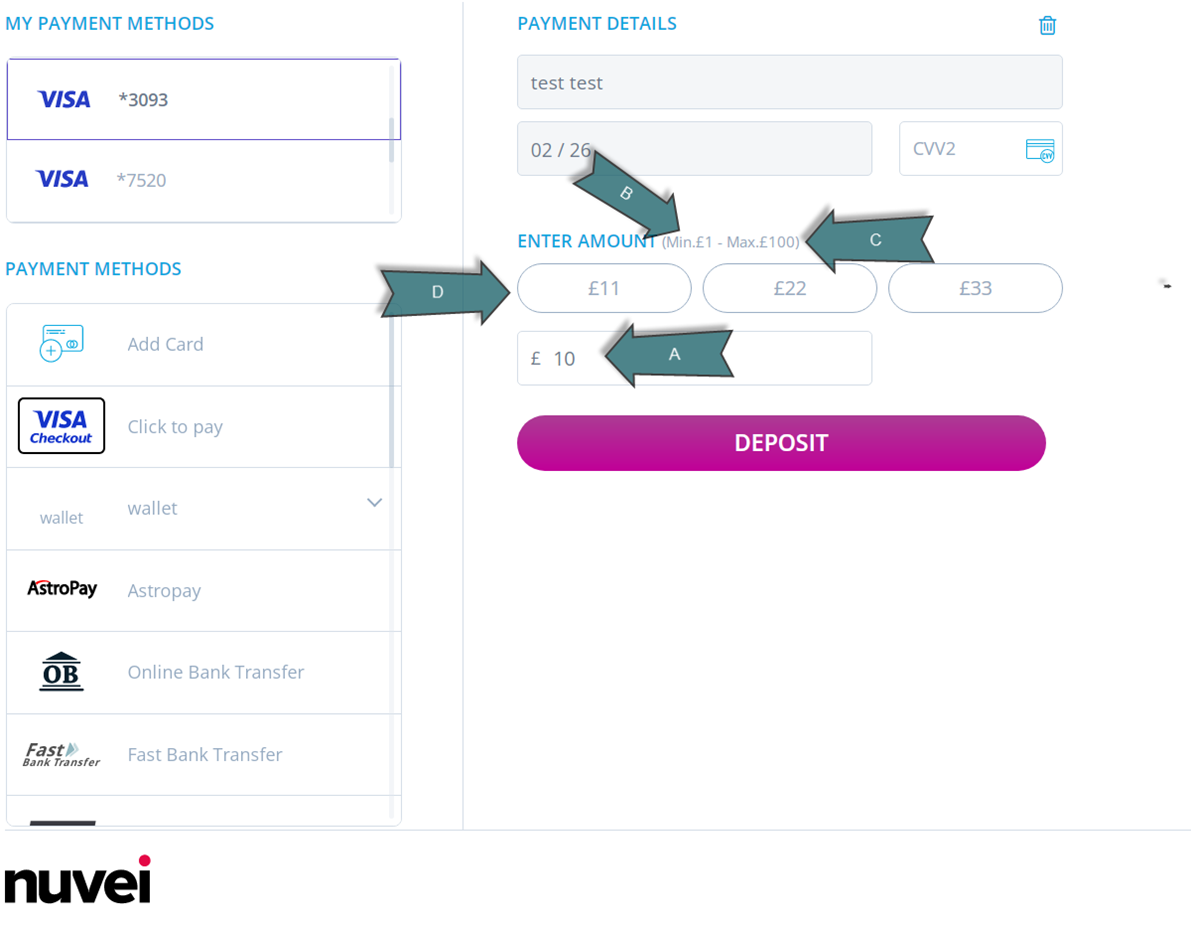

Deposit Example

A – “total_amount=10”

B – “item_min_amount_1=1”

C – “item_max_amount_1=100”

D – “suggestedAmount1=11”, “suggestedAmount2=22”, “suggestedAmount3=33”

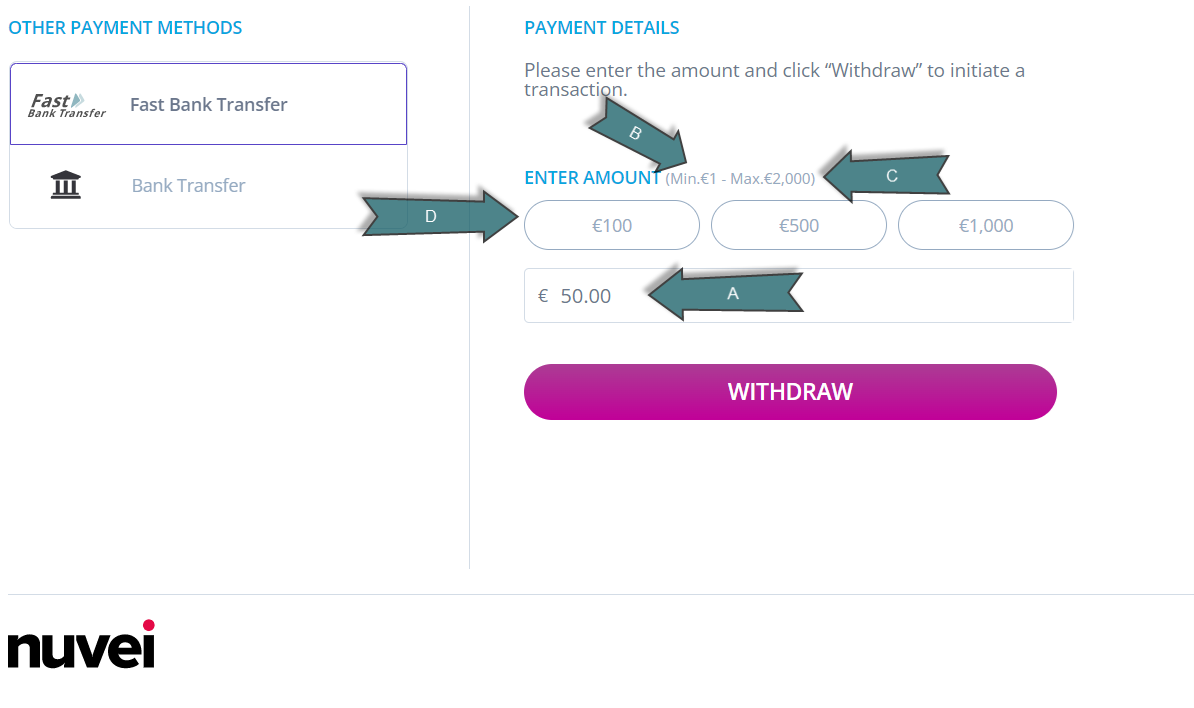

Withdrawal Example

https://ppp-test.safecharge.com/ppp/withdrawal/withdraw.do?checksum=50a0512cae4802e9341b808754092b6f&suggestedAmount3=1000&merchantLocale=en_US&time_stamp=2022-07-04.08%3A32%3A46&wd_amount=50&merchant_site_id=119823&merchant_id=8860255768659021142&version=4.0.0&user_token_id=Test_&suggestedAmount2=500&suggestedAmount1=100&wd_max_amount=2000&wd_currency=EUR&wd_min_amount=1&user_token=auto

A – “wd_amount=50”

B – “item_min_amount_1=1”

C – “item_max_amount_1=2000”

D – “suggestedAmount1=100”, “suggestedAmount2=500”, “suggestedAmount3=1000”

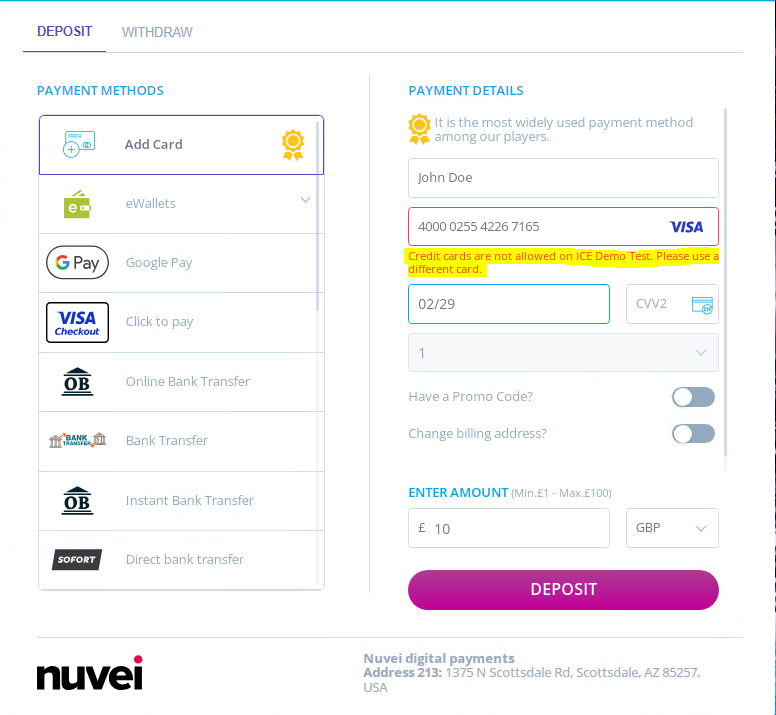

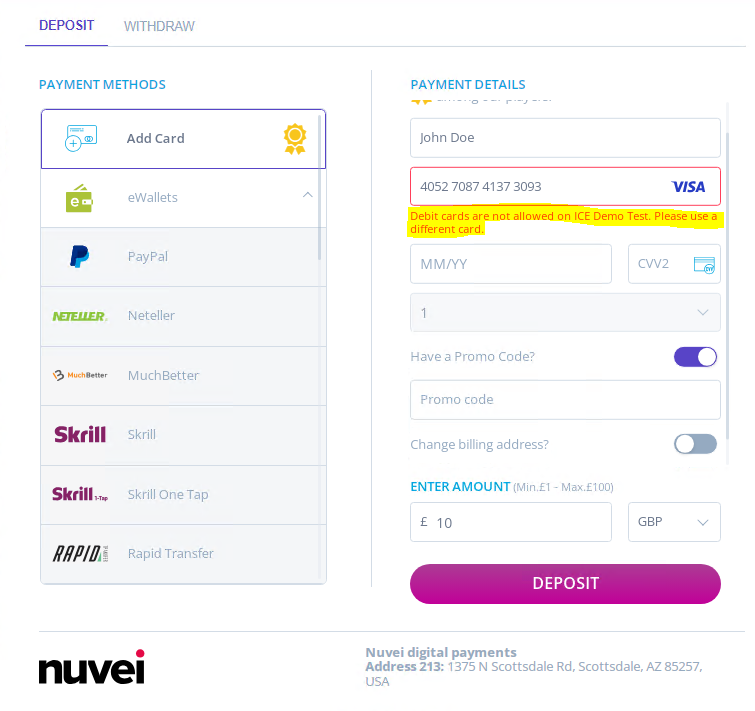

Restricting Card Types

Merchants can specify that the following types of cards are not available to users:

- Credit cards – For example, to comply with UKGC regulations.

- Debit cards

- Consumer – Cards issued to individual cardholders for personal use.

- Corporate – Cards employers provide to their employees for business use.

- Prepaid cards

Merchants can also restrict cards according to one or both of the following:

- User country – Users in the specified countries are restricted from using the specified card types.

- Card issuer country – Users are restricted from using cards issued in the specified countries.

Credit Cards Restricted Example

Debit Cards Restricted Example

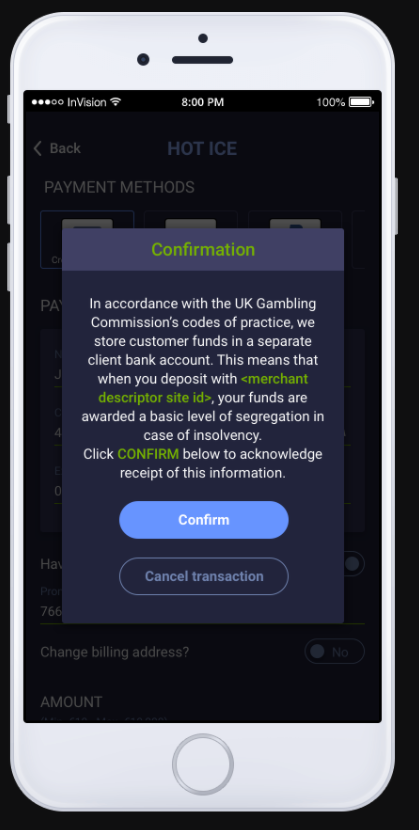

UKGC Regulation Support

To comply with UK Gaming Commission regulations:

- Merchants cannot offer the capability to cancel withdrawals.

- Credit cards cannot be used for gambling.

- Prior to the first deposit, users must consent to fund segregation. Merchants deposit user funds in separate client bank accounts to ensure a basic level of segregation in case of insolvency.

Ban on Cancelling Withdrawal Requests

Merchants can configure the withdrawal page with the following options:

- Hide the pending withdrawals section – When opening the withdrawal page, the merchant can add

Layoutto the URL with the value zero (Layout=0). - Hide the Cancel/Reverse button from pending withdrawals – When opening the withdrawal page, the merchant can add

showCancelButtonto the URL with the value false (showCancelButton=false).

For more information about these pending withdrawal options, press here.

Ban on Credit Cards

Merchants can specify that credit cards are not available in Cashier. For more information about restricting card types, press here.

Fund Segregation Consent

Merchants can specify that users must consent to fund segregation prior to their first deposit.

Desktop Example

Mobile Example

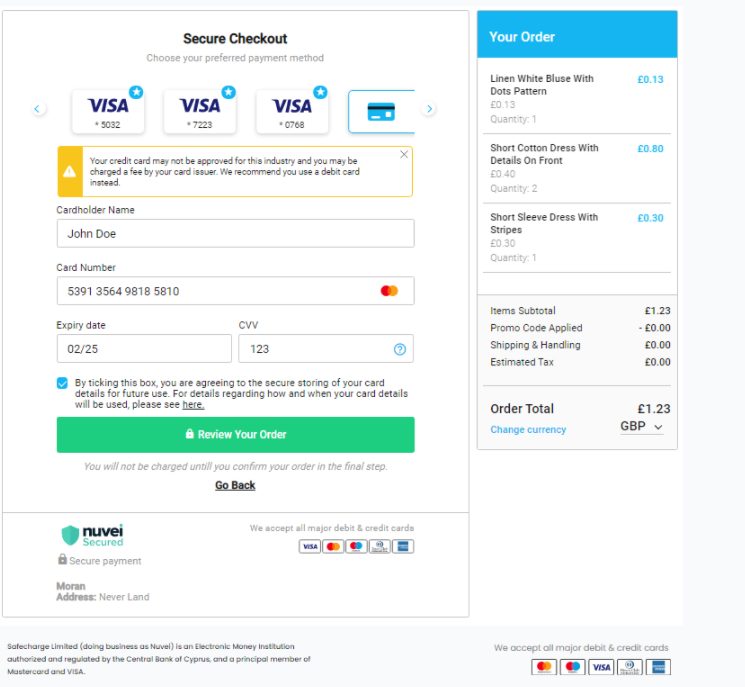

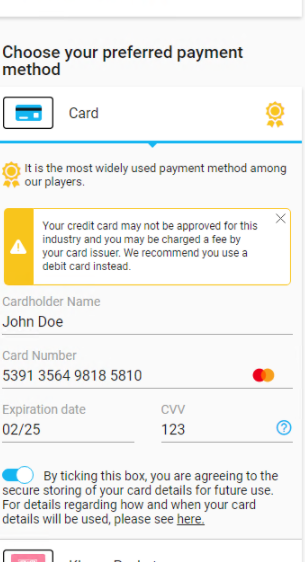

US Debit/Credit Card Message

This feature was created specifically for the US market and allows the merchant to present a message when the end user is trying to use a credit card with an unfriendly issuer bank.

This feature can improve the approval ratio with just one simple text:

“Your credit card may not be approved for this industry and you may be charged a fee by your card issuer.

We recommend you use a debit card instead.”

This indicates to the end user that they should use a different credit card to avoid rejection and associated fees.

Desktop Example

Mobile Example

Last modified October 2024

Last modified October 2024