- METHOD TYPELocal Payments

- PAYMENTS

- PAYOUTS

- REFUNDS

- RECURRING

Introduction

Local Payments Africa is a leading payment method provider for Africa, offering a comprehensive range of payment solutions, including Cash, Vouchers, Mobile, and eWallets.

Supported Countries

- Benin (Payout)

- Burkina Faso (Deposit)

- Cameroon (Deposit)

- Central African Republic (Payout)

- Chad (Payout)

- Egypt (Deposit)

- Gabon (Payout and Deposit)

- Ghana (Payout)

- Ivory Coast (Payout and Deposit)

- Nigeria(Payout)

- Rwanda (Deposit)

- Senegal (Payout and Deposit)

- South Africa (Payout and Deposit)

- Tanzania (Payout and Deposit)

- Uganda (Payout and Deposit)

- Zambia(Payout)

Supported Currencies

- EGP (Deposit)

- GHS (Payout and Deposit)

- NGN (Payout and Deposit)

- RWF (Deposit)

- TZS (Payout and Deposit)

- UGX (Deposit)

- USD (Payout)

- XAF (Payout and Deposit)

- ZAR (Payout and Deposit)

- ZM (Payout and Deposit)

Payment (Deposit) Flow

Follow these steps to perform a payment using Nuvei REST API integration:

1. Generate a sessionToken

Press here for details.

2. Send a /payment Request

Perform the payment by sending a /payment request with its mandatory parameters including:

userTokenIdamountcurrencypaymentOption.alternativePaymentMethodclass containing:paymentMethod: “apmgw_Local_payments_Africa“

deviceDetailsclass containing:ipAddressbillingAddressclass containing:firstName,lastName,country,email,phoneuserDetailsclass containing:firstName,lastName,country,email,phone

Example /payment Request

{

"sessionToken":"<sessionToken from /getSessionToken>",

"merchantId":"<your merchantId>",

"merchantSiteId":"<your merchantSiteId>",

"clientRequestId":"<unique request ID in merchant system>",

"amount":"100",

"currency":"EGP",

"userTokenId":"<unique customer identifier in merchant system>",

"clientUniqueId":"<unique transaction ID in merchant system>",

"paymentOption":{

"alternativePaymentMethod":{

"paymentMethod":"apmgw_Local_payments_Africa"

}

},

"deviceDetails":{

"ipAddress":"<customer's IP address>"

},

"billingAddress":{

"firstName": "John",

"lastName": "Smith",

"country":"EG",

"email":"[email protected]",

"phone": "201162552644"

},

"userDetails":{

"firstName": "John",

"lastName": "Smith",

"country":"EG",

"email":"[email protected]",

"phone": "201162552644"

},

"timeStamp":"<YYYYMMDDHHmmss>",

"checksum":"<calculated checksum>"

}

The response generates and returns a redirect URL (redirectUrl) to redirect the customer to the payment page, as well as a UPO (userPaymentOptionId) for use in future transactions.

Example /payment Response

{

"internalRequestId": 1192167198,

"status": "SUCCESS",

"errCode": 0,

"reason": "",

"merchantId": "979047831696752006",

"merchantSiteId": "217268",

"version": "1.0",

"clientRequestId": "20240801143414",

"sessionToken": "bd847f27-cb4d-4756-b2f1-85d8c3ea952a",

"clientUniqueId": "20180327175242",

"orderId": "475814288",

"userTokenId": "TestToken",

"paymentOption": {

"redirectUrl": "https://gw-apm-globalpayapi.nuvei.com/Home?PaymentToken=8DCDBC1EEBF71920A098E35778CCDB1B.29114979",

"userPaymentOptionId": "122922378",

"card": {}

},

"transactionStatus": "REDIRECT"

}

After the transaction is processed, Nuvei sends a Direct Merchant Notification (DMN) that includes the result of the transaction to urlDetails.notificationUrl, which Nuvei recommends including in the /payment request.

Payout (Withdrawal) Flow

Follow these steps to perform a payout:

1. Register a userTokenId

A userTokenId is a field in the Nuvei system containing the user’s identifier in the merchant system.

If you do not have a userTokenId registered in the Nuvei system for this user, then register one by sending a /createUser request, including email, countryCode, firstName, and lastName.

Example /createUser Request

{

"merchantId":"<your merchantId>",

"merchantSiteId":"<your merchantSiteId>",

"clientRequestId":"<unique request ID in merchant system>",

"userTokenId":"<unique user identifier in merchant system>",

"email":"[email protected]",

"countryCode":"<2-letter ISO country code>",

"firstName":"John",

"lastName":"Smith",

"timeStamp":"<YYYYMMDDHHmmss>",

"checksum":"<calculated checksum>"

}

Example /createUser Response

{

"userId":78403498,

"internalRequestId":552360538,

"status":"SUCCESS",

"errCode":0,

"reason":"",

"merchantId":"2439523627382132721",

"merchantSiteId":"224428",

"version":"1.0",

"clientRequestId":"20221108130736"

}

The request registers the userTokenId (userId) in the Nuvei system, which is needed to generate a UPO in the next step.

2. Create the UPO

Create a UPO by sending an /addUPOAPM request and include:

userTokenId– The unique user identifier in your system.paymentMethodName: “apmgw_Local_payments_Africa“billingAddressclass containing:countryCodeandemail

Example /addUPOAPM Request

{

"merchantId": "<your merchantId>",

"merchantSiteId": "<your merchantSiteId>",

"clientRequestId": "<unique request ID in merchant system>",

"userTokenId": "<unique customer identifier in merchant system>",

"paymentMethodName": "apmgw_Local_payments_Africa",

"billingAddress": {

"countryCode": "EG",

"email": "[email protected]"

},

"timeStamp": "<YYYYMMDDHHmmss>",

"checksum": "<calculated checksum>"

}

The request returns an encrypted userPaymentOptionId (UPO) representing the user’s APM account details.

Example /addUPOAPM Response

{

"userPaymentOptionId":83458468,

"internalRequestId":553078068,

"status":"SUCCESS",

"errCode":0,

"reason":"",

"merchantId":"2439523627382132721",

"merchantSiteId":"224428",

"version":"1.0",

"clientRequestId":"20221109154215"

}

3. Send a /payout Request

Send a /payout request and include the userPaymentOptionId, which contains the user’s previously stored APM account details. Press here for an example.

After the transaction is processed, Nuvei sends a DMN that includes the result of the transaction to urlDetails.notificationUrl, which Nuvei recommends including in the /payout request.

User Experience

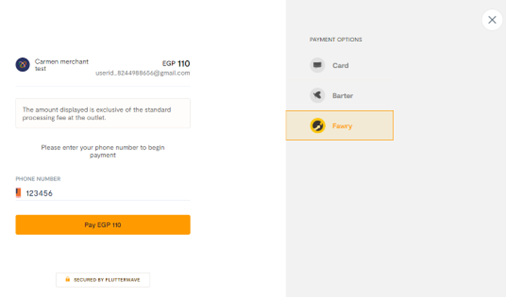

Payment with Fawry

- The user selects the payment option they want to use from the available options, such as Card and Fawry, and others based on country and provider settings.

- It generates a reference number for making the payment.

- The custome uses this reference number to complete the payment with their Fawry app or at a Fawry outlet.

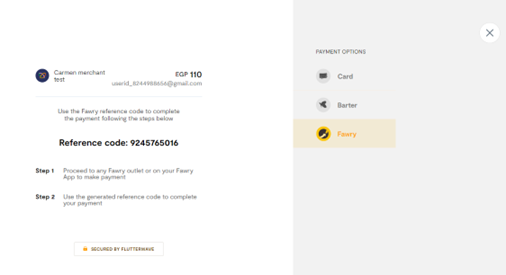

Payment with Card

- The user is redirected to the card payment page, where they fill in the card details and press Pay.

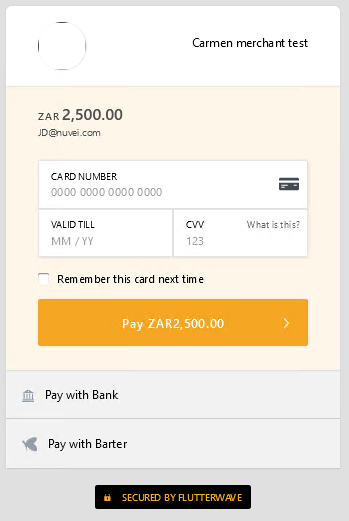

Payment with QR Code

- The user selects QR payment; this option is automatically available for all transactions in NGN.

- The user scans the QR code using their bank’s mobile app and confirms the payment.

- Once the payment is confirmed, the user is redirected to the merchant’s page.

Withdrawal

- The user selects one of the three payout options available for their country.

- The user enters the required information on the cashier according to the selected payout channels. All user details are prefilled if provided.

- Mobile money: First name, Last name, Email, Phone, Mobile provider (dropdown list)

- Bank Transfer: First name, Last name, City, Street, Email, Phone, Bank name (dropdown list), Account number.

- Barter: First name, Last name, Email, Phone

- The user enters the withdrawal amount.

- After the customer presses the withdrawal button, they receive a confirmation message that the payout has been successfully sent.

Testing

Access Bank

Account number: 0690000031

OTP: 12345

Access Bank 2

Account number: 0690000032

OTP: 12345

Access Bank 3

Account number: 0690000033

OTP: 12345

Access Bank 4

Account number: 0690000034

OTP: 12345

Test Mastercard PIN Authentication

Card number: 5531 8866 5214 2950

cvv: 564

Expiry: 09/32

Pin: 3310

OTP: 12345

Test Visa Card 3DS authentication (VBVSECURECODE)

Card number: 4187 4274 1556 4246

cvv: 828

Expiry: 09/32

Pin: 3310

OTP: 12345

Address Verification (AVS) Card

Card number: 4556052704172643

cvv: 899

Expiry: 09/32

Pin: 3310

OTP: 12345

Test Mastercard 3DS Authentication (VBVSECURECODE)

Card number: 5438 8980 1456 0229

cvv: 564

Expiry: 10/31

Pin: 3310

OTP: 12345

Test Mastercard PIN 2

Card number: 5399 8383 8383 8381

cvv: 470

Expiry: 10/31

Pin: 3310

OTP: 12345

Test VBVSECURECODE Card

Card number: 4751 7632 3669 9647

Expiry: 09/35

Test Visa Card 3DS Authentication

Card number: 4242 4242 4242 4242

cvv: 812

Expiry: 01/31

Pin: 3310

OTP: 12345

Test Verve Card (PIN)

Card number: 5061 4604 1012 0223 210

cvv: 780

Expiry Month: 12

Expiry Year: 31

Pin: 3310

OTP: 12345

Test Card Declined (Address Verification)

Card number: 5143 0105 2233 9965

cvv: 276

Expiry: 08/32

Pin: 3310

Test Card Fraudulent

Card number: 5590 1317 4329 4314

cvv: 887

Expiry: 11/32

Pin: 3310

OTP: 12345

Test Card Insufficient Funds

Card number: 5258 5859 2266 6506

cvv: 883

Expiry: 09/31

Pin: 3310

OTP: 12345

Card number: 5377 2836 4507 7450

cvv: 789

Expiry: 09/31

Pin: 3310

Test Card – Do Not Honour

Card number: 5143010522339965

cvv: 276

Expiry: 08/31

Pin: 3310

Test Card – Insufficient Funds

Card number: 5258585922666506

cvv: 883

Expiry: 09/31

Pin: 3310

OTP: 12345

Test Card – Invalid Transaction

Card number: 5551658157653822

cvv: 276

Expiry: 08/31

Test Card – Restricted Card, Retain Card

Card number: 5551651630381384

cvv: 276

Expiry: 08/31

Test Card – Function Not Permitted to Cardholder

Card number: 5258582054729020

cvv: 887

Expiry: 11/30

Test Card – Function Not Permitted to Terminal

Card number: 5258588264565682

cvv: 887

Expiry: 11/30

Test Card – Transaction Error

Card number: 5258589130149016

cvv: 887

Expiry: 11/30

Test Card – Incorrect PIN

Card number: 5399834697894723

cvv: 883

Expiry: 09/31

Pin: 3310

OTP: 12345

Test Verve Card – Card Enrollment

Card number: 5531882884804517

cvv: 564

Expiry: 10/32

Pin: 3310

Last modified February 2025

Last modified February 2025