- METHOD TYPEReal-Time Bank Transfer

- PAYMENTS

- PAYOUTS

- REFUNDS

- RECURRING

Introduction

BLIK is a mobile payment system in Poland that allows users to make payments using their mobile phone. It can be used to make purchases in stores, online and to transfer money to other users.

It is a secure, fast, and convenient way to make payments and it is widely accepted by retailers and businesses in Poland.

Supported Countries

- Poland

Supported Currencies

- PLN

UX Requirements

- Use the most up-to-date logo.

- The method name is BLIK and the input field is blik_code.

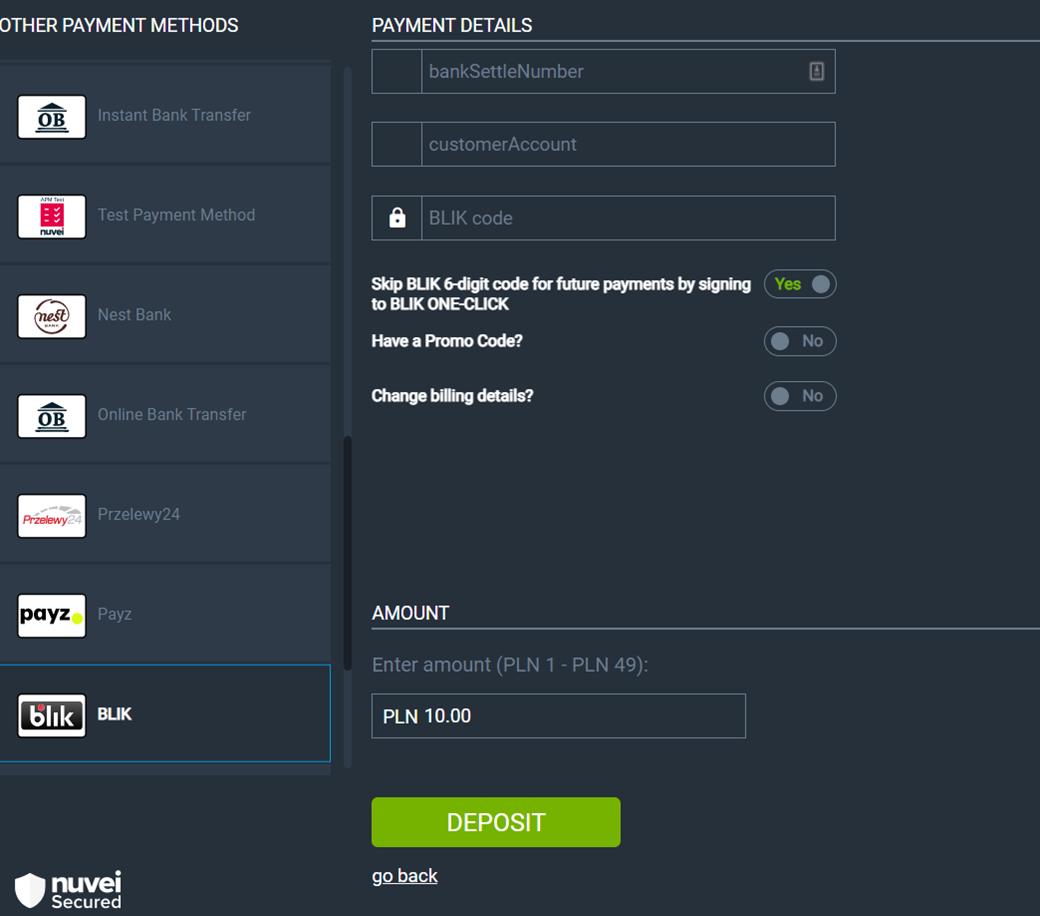

- BLIK code validation: only 6 digits are allowed.

- When entering the 6-digit code, the cashier should display it to the user as [3digits][space][3digits].

- The 6-digit code should prompt the numeric keyboard on a mobile device.

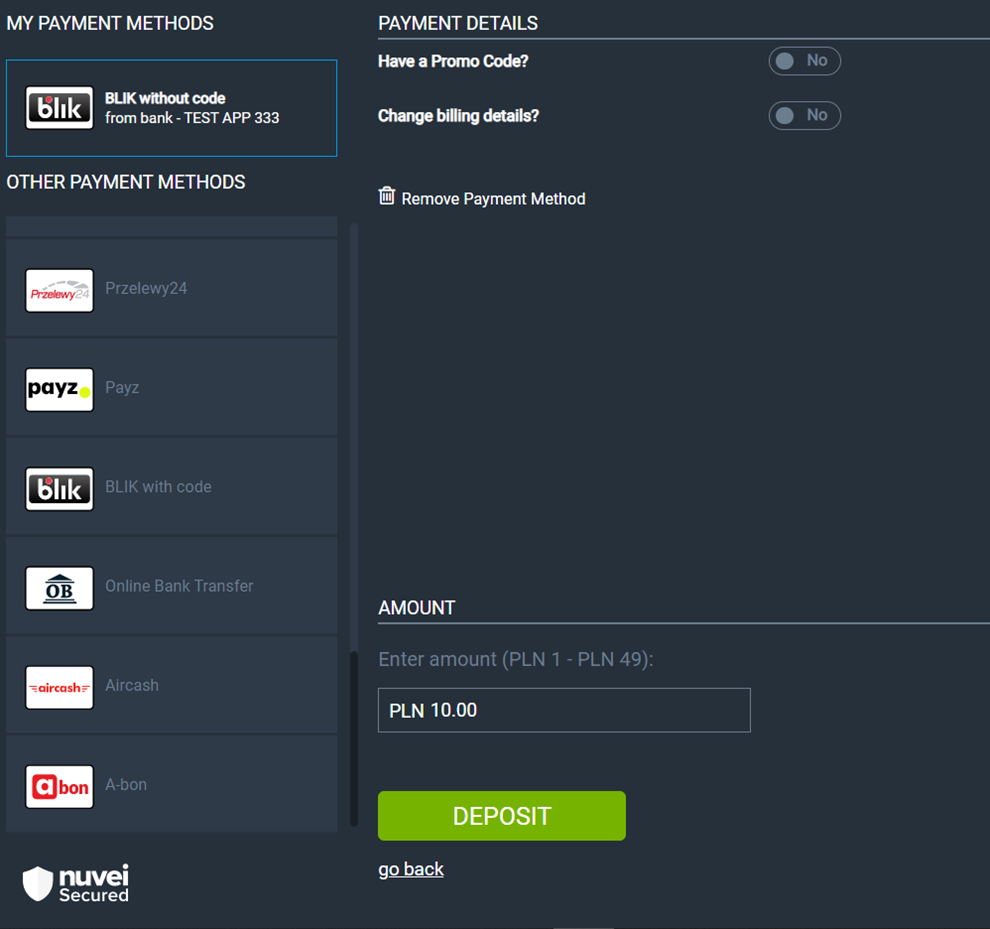

- Once a One-Click account is created (after a successful transaction), the cashier should display two BLIK options:

- The “original method” is renamed to “BLIK with code”.

- The saved account appears as “BLIK without code” (press here for details).

- After initiating a deposit, the user needs to see this message:

- PL: “Potwierdź płatność w aplikacji swojego banku.”

- ENG: “Confirm the payment in your bank’s app.”

Payment (Deposit) Flow

Follow these steps to perform a payment using Nuvei REST API integration:

1. Generate a sessionToken

Press here for details.

2. Send a /payment Request

Perform the payment by sending a /payment request with its mandatory parameters including:

userTokenIdamountcurrencypaymentOption.alternativePaymentMethodclass containing:paymentMethod: “apmgw_BLIK“blik_code

deviceDetailsclass containing:ipAddressbillingAddressclass containing:firstName,lastName,country,emailuserDetailsclass containing:firstName,lastName,country,email

Example /payment Request

{

"sessionToken":"<sessionToken from /getSessionToken>",

"merchantId":"<your merchantId>",

"merchantSiteId":"<your merchantSiteId>",

"clientRequestId":"<unique request ID in merchant system>",

"amount":"200",

"currency":"PLN",

"userTokenId":"<unique customer identifier in merchant system>",

"clientUniqueId":"<unique transaction ID in merchant system>",

"paymentOption":{

"alternativePaymentMethod":{

"paymentMethod":"apmgw_BLIK"

"blik_code":"<blik_code>"

}

},

"deviceDetails":{

"ipAddress":"<customer's IP address>"

},

"billingAddress": {

"firstName": "John",

"lastName": "Smith",

"country": "PL",

"email": "[email protected]"

},

"userDetails":{

"firstName": "John",

"lastName": "Smith",

"country": "PL",

"email": "[email protected]"

},

"timeStamp":"<YYYYMMDDHHmmss>",

"checksum":"<calculated checksum>"

}

BLIK processes the transaction and returns a transaction notification and status.

Example /payment Response

{

"internalRequestId": 913985339,

"status": "SUCCESS",

"errCode": 0,

"reason": "",

"merchantId": "4273555827014385119",

"merchantSiteId": "222058",

"version": "1.0",

"clientRequestId": "20240212132854",

"sessionToken": "103fe11e-06b2-4af7-b494-724b44bc4e8b",

"clientUniqueId": "20180327175242",

"orderId": "420274599",

"userTokenId": "TestToken2",

"paymentOption": {

"userPaymentOptionId": "104082698",

"card": {}

},

"transactionStatus": "PENDING",

"transactionId": "711000000032057913"

}

After the transaction is processed, Nuvei sends a Direct Merchant Notification (DMN) that includes the result of the transaction to the URL provided in urlDetails.notificationUrl, which Nuvei recommends including in the /payment request.

Example /payment DMN with status=APPROVED

...'ppp_status=OK&Status=APPROVED&ExErrCode=0&ErrCode=0&errApmCode=0&errApmDescription=&errScCode=0&errScDescription=&Reason=&ReasonCode=0&PPP_TransactionID=49999999999&userid=7129999999990408448&merchant_unique_id=P991115001029224930BPG&customData=&productId=&first_name=John&last_name=Smith&email=john.smith%40email.com¤cy=PLN&clientUniqueId=P231111111111111111&customField1=&customField2=&customField3=&customField4=&customField5=&customField6=&customField7=&customField8=&customField9=&customField10=&customField11=&customField12=&customField13=&customField14=&customField15=&invoice_id=&address1=&address2=&country=Poland&state=&city=&zip=&phone1=48-500038756&phone2=&phone3=&client_ip=188.123.211.13&nameOnCard=&cardNumber=&bin=&noCVV=&acquirerId=&acquirerBank=BLIK-PI&expMonth=&expYear=&Token=&tokenId=&AuthCode=&AvsCode=&Cvv2Reply=&shippingCountry=&shippingState=&shippingCity=&shippingAddress=&shippingZip=&shippingFirstName=&shippingLastName=&shippingPhone=&shippingCell=&shippingMail=&total_discount=0.00&total_handling=0.00&total_shipping=0.00&total_tax=0.00&buyButtonProductBundleId=&merchant_site_id=253318&merchant_status=&action=&requestVersion=&message=APPROVED&merchantLocale=&unknownParameters=&payment_method=apmgw_BLIK&ID=&merchant_id=5855689376797576890&responseTimeStamp=2023-11-15.22%3A50%3A09&buyButtonProductId=&webMasterId=&appliedPromotions=&uniqueCC=&transactionType=Sale&externalEmail=&cardCompany=&eci=&user_token_id=7124648678530408448&userPaymentOptionId=3343678286&TransactionID=2130000003751688921&ExternalaccountID=009040&externalTransactionId=77335772831&APMReferenceID=641AEA29FD681BD156CC5F798C539FA3&orderTransactionId=49934074126&totalAmount=303.99&dynamicDescriptor=NuveiDescriptor&item_name_1=NA&item_number_1=&item_amount_1=100.00&item_quantity_1=1&item_discount_1=0.00&item_handling_1=0.00&item_shipping_1=0.00&feeAmount=&amountWithoutFee=&houseNumber=&customCurrency=&externalToken_blockedCard=&externalToken_cardAcquirerId=&externalToken_cardAcquirerName=&externalToken_cardBin=&externalToken_cardBrandId=&externalToken_cardBrandName=&externalToken_cardExpiration=&externalToken_cardLength=&externalToken_cardMask=&externalToken_cardName=&externalToken_cardTypeId=&externalToken_cardTypeName=&externalToken_clubName=&externalToken_creditCompanyId=&externalToken_creditCompanyName=&externalToken_extendedCardType=&externalToken_Indication=&externalToken_tokenValue=&externalToken_tokenProvider=&ECIRaw=&cryptogram=&upoRegistrationDate=20231116&type=DEPOSIT&clientRequestId=P231115001029224930BPG&relatedTransactionId=&sessionId=52d54fb30876dabfd3248ac87402&responsechecksum=5cc71c96c150f2ddeaad0112f9be686e073a26809caa36f45a685f2179633c1b&advanceResponseChecksum=db1fb6d1256d5b230756c8f80e413b040f93e8e558b582ad295c772e4d4d9e77',

User Experience (Direct)

- The user selects the BLIK payment option on the Merchant’s payment page.

- The user logs in to their bank application to get their 6-digit BLIK code.

- The user enters the 6-digit code in the Cashier.

- The user must confirm the transaction on their bank application.

Testing

Testing payments using the BLIK channel requires an authorization code. For test payments, a valid authorization code starts with 777 (such as 777654). A code that does not start with 777 (such as 332885) is considered invalid and the payment is declined.

To test one-click, use amount *.04 PLN

Appendix – BLIK One-Click

The one-click payment method is an extension of the regular BLIK payment, with the ability to remember the device that the customer most often uses to finalize the transaction. The user interface is extended by the option to pay with a one-click flow. In the one-click flow, the user only needs to enter their 6-digit code once. For future deposits, the code is not required.

To select the one-click flow, the user needs to select the payment option in the cashier (there is also a mode when one-click is preselected and the checkbox is hidden):

The saved UPO shows the user’s registered bank (for the direct integration) or the BLIK token (for the other providers):

REST API

To initiate one-click, include subMethod.subMethod: “oneClick” in a /payment request.

Example One-Click /payment Request

{

"sessionToken": "<sessionToken from /getSessionToken>",

"merchantId": "<your merchantId>",

"merchantSiteId": "<your merchantSiteId>",

"clientRequestId": "<unique request ID in merchant system>",

"amount": "200",

"currency": "PLN",

"userTokenId": "<unique customer identifier in merchant system>",

"clientUniqueId": "<unique transaction ID in merchant system>",

"paymentOption": {

"alternativePaymentMethod": {

"paymentMethod": "apmgw_BLIK",

"blik_code": "<blik_code>"

},

"subMethod": {

"subMethod": "oneClick"

},

"deviceDetails": {

"ipAddress": "<customer's IP address>"

},

"billingAddress": {

"firstName": "John",

"lastName": "Smith",

"country": "PL",

"email": "[email protected]"

},

"userDetails": {

"firstName": "John",

"lastName": "Smith",

"country": "PL",

"email": "[email protected]"

},

"timeStamp": "<YYYYMMDDHHmmss>",

"checksum": "<calculated checksum>"

}

}

The response and the DMN include the userPaymentOptionId to use in subsequent BLIK one-click transaction requests. Include subMethod.subMethod: “oneClick” in those requests. However, do not include the alternativePaymentMethod class.

Example Subsequent /payment Request with UPO

{

"sessionToken": "<sessionToken from /getSessionToken>",

"merchantId": "<your merchantId>",

"merchantSiteId": "<your merchantSiteId>",

"clientRequestId": "<unique request ID in merchant system>",

"amount": "200",

"currency": "PLN",

"userTokenId": "<unique customer identifier in merchant system>",

"clientUniqueId": "<unique transaction ID in merchant system>",

"paymentOption": {

"subMethod": {

"subMethod": "oneClick"

},

"userPaymentOptionId": "2153496261"

},

"deviceDetails": {

"ipAddress": "<customer's IP address>"

},

"billingAddress": {

"firstName": "John",

"lastName": "Smith",

"country": "PL",

"email": "[email protected]"

},

"userDetails": {

"firstName": "John",

"lastName": "Smith",

"country": "PL",

"email": "[email protected]"

},

"timeStamp": "<YYYYMMDDHHmmss>",

"checksum": "<calculated checksum>"

}

Last modified November 2024

Last modified November 2024