- METHOD TYPECash Payment

- PAYMENTS

- PAYOUTS

- REFUNDS

- RECURRING

Introduction

A financial service provider that offers various financial services such as money transfers, bill payments, and more. It’s particularly popular in Colombia.

Supported Countries

- Colombia

Supported Currencies

- COP

- USD

Payment (Deposit) Flow

Follow these steps to perform a payment using Nuvei REST API integration:

1. Generate a sessionToken

Press here for details.

2. Send a /payment Request

Perform the payment by sending a /payment request with its mandatory parameters, including:

userTokenIdamountcurrencypaymentOption.alternativePaymentMethodclass containing:paymentMethod: “apmgw_Efecty“

deviceDetailsuserDetailsclass containing:firstName,lastName,country,email

You can also include the dynamicDescriptor class and its parameters:

merchantNamemerchantPhone

Example /payment Request (without UPO)

{

"sessionToken": "<sessionToken from /getSessionToken>",

"merchantId": "<your merchantId>",

"merchantSiteId": "<your merchantSiteId>",

"amount": "100",

"currency": "COP",

"userTokenId": "<unique customer identifier in merchant system>",

"dynamicDescriptor": {

"merchantName": "<merchantName>",

"merchantPhone": "<merchantPhone>"

},

"paymentOption": {

"alternativePaymentMethod": {

"paymentMethod": "apmgw_Efecty"

},

"deviceDetails": {}

},

"userDetails": {

"firstName": "John",

"lastName": "Smith",

"country": "CO",

"email": "[email protected]"

},

"timeStamp": "<YYYYMMDDHHmmss>",

"checksum": "<calculated checksum>"

}

The response generates and returns a redirect URL (redirectUrl) to redirect the customer to the payment page, as well as a UPO (userPaymentOptionId) for use in future transactions.

Example /payment Response (without UPO)

{

"internalRequestId": 34998931,

"status": "SUCCESS",

"errCode": 0,

"reason": "",

"merchantId": "1102398682906145682",

"merchantSiteId": "228311",

"version": "1.0",

"sessionToken": "34bf2082-eb4d-43a8-813e-92e779f14a63",

"orderId": "41464281",

"userTokenId": "testefectydeposit01",

"paymentOption": {

"redirectUrl": "https://apmtest.gate2shop.com/ppp/resources/cdn/v1/payment-details-22193.html?purchaseDate=2023-11-20T08%3A25%3A34.148Z&agreement=110342&transactionStatus=pending&buyerEmail=test%40test.com&description=test&methodName=efecty&language=EN&paymentAmount=5000.0&transactionId=PV-0000000372334&paymentNumber=90984050558",

"userPaymentOptionId": "2153086441",

"card": {}

},

"transactionStatus": "REDIRECT"

}

After the transaction is processed, Nuvei sends a Direct Merchant Notification (DMN) that includes the result of the transaction to the URL provided in urlDetails.notificationUrl, which Nuvei recommends including in the /payment request.

Payout (Withdrawal) Flow

Follow these steps to perform a payout:

1. Register a userTokenId

A userTokenId is a field in the Nuvei system containing the user’s identifier in the merchant system.

If you do not have a userTokenId registered in the Nuvei system for this user, then register one by sending a /createUser request, including email, countryCode, firstName, and lastName.

Example /createUser Request

{

"merchantSiteId":"<your merchantSiteId>",

"merchantId":"<your merchantId>",

"userTokenId":"<unique user identifier in merchant system>",

"clientRequestId":"<unique request ID in merchant system>",

"firstName":"John",

"lastName":"Smith",

"address":"22 Main Street",

"email":"[email protected]",

"countryCode":"CO",

"timeStamp":"<YYYYMMDDHHmmss>",

"checksum":"<calculated checksum>"

}

Example /createUser Response

{

"userId":139798011,

"internalRequestId":25129831,

"status":"SUCCESS",

"errCode":0,

"reason":"",

"merchantId":"1102398682906145682",

"merchantSiteId":"228311",

"version":"1.0",

"clientRequestId":"20230228133513"

}

The request registers the userTokenId (userId) in the Nuvei system, which is needed to generate a UPO in the next step.

2. Create the UPO

Create a UPO by sending an /addUPOAPM request and include:

userTokenId– The unique user identifier in your system."paymentMethodName": “apmgw_Efecty“apmDataclass containing: “efecty_personal_id“billingAddressclass containing:countryandemail

Example /addUPOAPM Request

{

"merchantSiteId":"<your merchantSiteId>",

"merchantId":"<your merchantId>",

"userTokenId":"<unique customer identifier in merchant system>",

"clientRequestId":"<unique request ID in merchant system>",

"paymentMethodName":"apmgw_Efecty",

"apmData":{

"personal_id":"<personal ID>"

},

"billingAddress":{

"country":"CO",

"email":"[email protected]"

},

"timeStamp":"<YYYYMMDDHHmmss>",

"checksum":"<calculated checksum>"

}

Example /addUPOAPM Response

{

"userPaymentOptionId":2152829771,

"internalRequestId":25129841,

"status":"SUCCESS",

"errCode":0,

"reason":"",

"merchantId":"1102398682906145682",

"merchantSiteId":"228311",

"version":"1.0",

"clientRequestId":"20230228133537"

}

3. Send a /payout Request

Send a /payout request and include the userPaymentOptionId, which contains the user’s previously stored APM account details. Press here for an example.

You can also include the dynamicDescriptor class and its parameters:

merchantNamemerchantPhone

After the transaction is processed, Nuvei sends a DMN that includes the result of the transaction to the URL provided in urlDetails.notificationUrl, which Nuvei recommends including in the /payout request.

Example /payout DMN with status=APPROVED

...'ppp_status=OK&Status=APPROVED&ExErrCode=0&ErrCode=0&errApmCode=0&errApmDescription=&errScCode=0&errScDescription=&Reason=&ReasonCode=&PPP_TransactionID=38837311&userid=martoken999&merchant_unique_id=12345&customData=MartinakTEST&productId=&first_name=&last_name=&email=¤cy=COP&clientUniqueId=12345&customField1=&customField2=&customField3=&customField4=&customField5=&customField6=&customField7=&customField8=&customField9=&customField10=&customField11=&customField12=&customField13=&customField14=&customField15=&invoice_id=&address1=&address2=&country=&state=&city=&zip=&phone1=&phone2=&phone3=&client_ip=&nameOnCard=&cardNumber=&bin=&noCVV=&acquirerId=&expMonth=&expYear=&Token=&tokenId=&AuthCode=&AvsCode=&Cvv2Reply=&shippingCountry=&shippingState=&shippingCity=&shippingAddress=&shippingZip=&shippingFirstName=&shippingLastName=&shippingPhone=&shippingCell=&shippingMail=&total_discount=0.00&total_handling=0.00&total_shipping=0.00&total_tax=0.00&buyButtonProductBundleId=&merchant_site_id=228311&merchant_status=&action=&requestVersion=&message=APPROVED&merchantLocale=&unknownParameters=&payment_method=apmgw_Efecty&ID=&merchant_id=1102398682906145682&responseTimeStamp=2023-03-13.09%3A11%3A47&buyButtonProductId=&webMasterId=&appliedPromotions=&uniqueCC=&transactionType=Credit&externalEmail=&cardCompany=&eci=&user_token_id=martoken999&userPaymentOptionId=2152835931&TransactionID=2110000000008840269&externalTransactionId=H2H-6291&totalAmount=500.0&dynamicDescriptor=Rank+Descriptor&feeAmount=&houseNumber=&customCurrency=&upoRegistrationDate=20230313&type=DEPOSIT&clientRequestId=&relatedTransactionId=&responsechecksum=4ef548d5ca52133be336baa4385d6832&advanceResponseChecksum=b6b97ec989adbb757f27ffe58be9c101',

Example /payout DMN with status=DECLINED

...'ppp_status=FAIL&Status=DECLINED&ExErrCode=0&ErrCode=0&errApmCode=0&errApmDescription=Transaction+Not+Found&errScCode=9999&errScDescription=Default&Reason=&ReasonCode=&PPP_TransactionID=38795501&userid=martoken5&merchant_unique_id=12345&customData=MartinakTEST&productId=&first_name=&last_name=&email=¤cy=COP&clientUniqueId=12345&customField1=&customField2=&customField3=&customField4=&customField5=&customField6=&customField7=&customField8=&customField9=&customField10=&customField11=&customField12=&customField13=&customField14=&customField15=&invoice_id=&address1=&address2=&country=&state=&city=&zip=&phone1=&phone2=&phone3=&client_ip=&nameOnCard=&cardNumber=&bin=&noCVV=&acquirerId=&expMonth=&expYear=&Token=&tokenId=&AuthCode=&AvsCode=&Cvv2Reply=&shippingCountry=&shippingState=&shippingCity=&shippingAddress=&shippingZip=&shippingFirstName=&shippingLastName=&shippingPhone=&shippingCell=&shippingMail=&total_discount=0.00&total_handling=0.00&total_shipping=0.00&total_tax=0.00&buyButtonProductBundleId=&merchant_site_id=228311&merchant_status=&action=&requestVersion=&message=DECLINED&merchantLocale=&unknownParameters=&payment_method=apmgw_Efecty&ID=&merchant_id=1102398682906145682&responseTimeStamp=2023-02-28.13%3A11%3A23&buyButtonProductId=&webMasterId=&appliedPromotions=&uniqueCC=&transactionType=Credit&externalEmail=&cardCompany=&eci=&user_token_id=martoken5&userPaymentOptionId=2152829771&TransactionID=2110000000008738580&totalAmount=5000.0&dynamicDescriptor=Rank+Descriptor&feeAmount=&houseNumber=&customCurrency=&upoRegistrationDate=20230228&type=DEPOSIT&clientRequestId=&relatedTransactionId=&responsechecksum=dafa5f1a020f7a19e31d40c6b82844a1&advanceResponseChecksum=8b959157318559f41d59677da2ccb555',

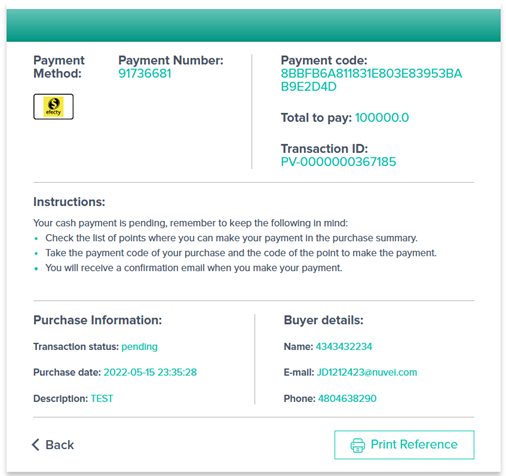

User Experience

Deposit

- The user is redirected to the third party page to see the payment instructions.

- The user completes the deposit offline using the code they receives.

- Once the user completes the deposit offline, a notification with status is sent.

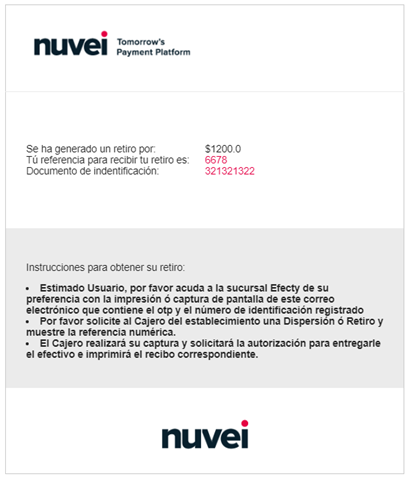

Withdrawal

- The user selects the Efecty payment method, enters personal ID, withdrawal amount, and presses Withdraw.

- Once the withdraw request is successful, a message is displayed on the Cashier page.

- After payout is confirm by the merchant, user receives an email with “reference” number.

- The user goes to the physical location, and with the reference from the email and ID number (Cédula), they can collect cash (ID must be physically presented).

- Upon expiration time or after the user collects their cash, a notification with status is sent.

Last modified October 2024

Last modified October 2024