- METHOD TYPEE-wallet

- PAYMENTS

- PAYOUTS

- REFUNDS

- RECURRING

Introduction

Skrill (formerly known as Moneybookers) is a well-known eWallet brand worldwide and highly popular in the gaming, forex and gambling industries. Skrill acquired Paysafecard in 2013 to extend its services with prepaid cards. This payment method is accessible in nearly 200 countries with over 40 million account holders. Skrill is part of the Paysafe Group that includes other companies, such as Neteller and Paysafecard.

Supported Countries

- Aland Islands

- Albania

- Algeria

- Andorra

- Angola

- Anguilla

- Antarctica

- Argentina

- Armenia

- Aruba

- Australia

- Austria

- Azerbaijan

- Bahamas

- Bahrain

- Bangladesh

- Barbados

- Belarus

- Belgium

- Benin

- Bermuda

- Bhutan

- Bolivia

- Bosnia-Herzegovina

- Botswana

- Brazil

- British Indian Ocean Territory

- Brunei

- Bulgaria

- Burkina Faso

- Burundi

- Cambodia

- Cameroon

- Canada

- Cape Verde

- Cayman Islands

- Chile

- China

- Christmas Island

- Colombia

- Comoros

- Cook Islands

- Costa Rica

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Djibouti

- Dominica

- Dominican Republic

- Ecuador

- Egypt

- El Salvador

- Equatorial Guinea

- Eritrea

- Estonia

- Ethiopia

- Falkland Islands

- Faroe Islands

- Fiji

- Finland

- France

- French Guiana

- French Polynesia

- Gabon

- Gambia

- Georgia

- Germany

- Ghana

- Gibraltar

- Greece

- Greenland

- Grenada

- Guadeloupe

- Guam

- Guatemala

- Guernsey

- Guinea

- Guyana

- Honduras

- Hong Kong

- Hungary

- Iceland

- India

- Indonesia

- Iraq

- Ireland

- Isle of Man

- Israel

- Italy

- Jamaica

- Jersey

- Jordan

- Kazakhstan

- Kenya

- Kiribati

- Kuwait

- Kyrgyzstan

- Laos

- Latvia

- Lesotho

- Liberia

- Libya

- Liechtenstein

- Lithuania

- Luxembourg

- Macau

- Macedonia

- Madagascar

- Malawi

- Malaysia

- Maldives

- Mali

- Malta

- Marshall Islands

- Martinique

- Mauritania

- Mauritius

- Mexico

- Moldova

- Monaco

- Mongolia

- Montenegro

- Montserrat

- Morocco

- Mozambique

- Namibia

- Nauru

- Nepal

- Netherlands

- New Caledonia

- New Zealand

- Nicaragua

- Niger

- Nigeria

- Niue

- Norway

- Oman

- Pakistan

- Palau

- Panama

- Papua New Guinea

- Paraguay

- Peru

- Philippines

- Poland

- Portugal

- Puerto Rico

- Qatar

- Reunion

- Romania

- Russia

- Saint Kitts and Nevis

- Saint Pierre and Miquelon

- Saint Thomas

- Saint Vincent

- Samoa

- San Marino

- Saudi Arabia

- Senegal

- Serbia

- Singapore

- Slovakia

- Slovenia

- Solomon Islands

- South Africa

- South Georgia and South Sandwich Islands

- South Korea

- Spain

- Sri Lanka

- Suriname

- Svalbard and Jan Mayen Islands

- Swaziland

- Sweden

- Switzerland

- Taiwan

- Tajikistan

- Tanzania

- Thailand

- Timor-Leste

- Togo

- Trinidad and Tobago

- Tunisia

- Turkey

- Turkmenistan

- Uganda

- Ukraine

- United Arab Emirates

- United Kingdom

- Uruguay

- Uzbekistan

- Vanuatu

- Vietnam

- Zambia

Supported Currencies

- AED

- AUD

- CAD

- CHF

- CZK

- DKK

- EEK

- EUR

- GBP

- HKD

- HUF

- ILS

- INR

- ISK

- JOD

- JPY

- KRW

- LTL

- LVL

- MAD

- MYR

- NOK

- NZD

- OMR

- PLN

- QAR

- RON

- RSD

- RUB

- SAR

- SEK

- SGD

- SKK

- THB

- TND

- TRY

- TWD

- USD

- ZAR

Payment (Deposit) Flow

Press tab to open…

Follow these steps to perform a payment using Nuvei REST API integration:

1. Generate a sessionToken

Press here for details.

2. Send a /payment Request

Perform the payment by sending a /payment request with its mandatory parameters including:

userTokenIdamountcurrencypaymentOption.alternativePaymentMethodclass containing:paymentMethod: “apmgw_MoneyBookers“account_id

deviceDetailsclass containing:ipAddressbillingAddressclass containing:firstName,lastName,country,emailuserDetailsclass containing:firstName,lastName,country,email

Example /payment Request

{

"sessionToken":"<sessionToken from /getSessionToken>",

"merchantId":"<your merchantId>",

"merchantSiteId":"<your merchantSiteId>",

"clientRequestId":"<unique request ID in merchant system>",

"amount":"200",

"currency":"USD",

"userTokenId":"<unique customer identifier in merchant system>",

"clientUniqueId":"<unique transaction ID in merchant system>",

"paymentOption":{

"alternativePaymentMethod":{

"paymentMethod":"apmgw_MoneyBookers",

"account_id":"<Skrill account>"

}

},

"deviceDetails":{

"ipAddress":"<customer's IP address>"

},

"billingAddress":{

"firstName": "John",

"lastName": "Smith",

"country":"US",

"email":"[email protected]"

},

"userDetails":{

"firstName": "John",

"lastName": "Smith",

"country":"US",

"email":"[email protected]"

},

"timeStamp":"<YYYYMMDDHHmmss>",

"checksum":"<calculated checksum>"

}

After the transaction is processed, Nuvei sends a Direct Merchant Notification (DMN) that includes the result of the transaction to the URL provided in urlDetails.notificationUrl, which Nuvei recommends including in the /payment request.

Payout (Withdrawal) Flow

Send a /payout request and include the userPaymentOptionId, which contains the user’s previously stored APM account details. Press here for an example.

After the transaction is processed, Nuvei sends a DMN that includes the result of the transaction to the URL provided in urlDetails.notificationUrl, which Nuvei recommends including in the /payout request.

Follow these steps to perform a payment using Nuvei Web SDK integration.

1. Initiate a Session

Before you can submit payment using the client-side Nuvei Web SDK, you need to send the /openOrder API call.

2. Initialize the Web SDK

Instantiate the Web SDK with the sessionToken received from the server call to /openOrder.

3. Create an APM Payment

Send a createPayment() request with its mandatory parameters including:

paymentOption.alternativePaymentMethodclass containing:paymentMethod: “apmgw_MoneyBookers“account_id

deviceDetailsclass containing:ipAddressbillingAddressclass containing:firstName,lastName,country,emailuserDetailsclass containing:firstName,lastName,country,email

Example createPayment() Request

sfc.createPayment({

sessionToken: '<sessiontoken>',

paymentOption: {

alternativePaymentMethod: {

paymentMethod: 'apmgw_MoneyBookers',

account_id: '<Skrill account>'

},

subMethod: {

subMethod: 'skrill1Tap'

}

},

deviceDetails: {

ipAddress: "<customer's IP address>"

},

billingAddress: {

firstName: 'John',

lastName: 'Smith',

country: 'US',

email: '[email protected]'

},

userDetails: {

firstName: 'John',

lastName: 'Smith',

country: 'US',

email: '[email protected]'

}

}, function (res) {

console.log(res)

})

After the transaction is processed, Nuvei sends a Direct Merchant Notification (DMN) that includes the result of the transaction to the URL provided in urlDetails.notificationUrl, which Nuvei recommends including in the /openOrder request.

Withdrawal Flow

For information about the Withdrawal flow for WebSDK, see Withdrawal.

Example Payment Page Request

After the transaction is processed, Nuvei sends a Direct Merchant Notification (DMN) that includes the result of the transaction to notify_url, which Nuvei recommends including in the request.

To perform a payment using Nuvei Simply Connect integration:

1. Initiate a Session

Before submitting a Simply Connect payment request, you need to submit a server-side /openOrder API request.

2. Create an HTML Placeholder

Import the checkout.js library for building payment flows and create an HTML placeholder on your payment page for the Simply Connect UI element.

3. Submit a checkout() Request

Send a checkout() request with its mandatory input parameters, along with any other relevant parameters and customizations. For more information, see Quick Start to Simply Connect.

Fast Flow (Optional)

To offer customers the option to skip the PayPal payment confirmation page for future payments, include in the checkout() request:

savePm: “always“, “true“, or “force” – Fast flow requires a saved payment method. Other possiblesavePmvalues do not support fast flow.apmConfigclass containing:apmgw_MoneyBookersclass containing:fastFlow: true

subMethod: [“ReferenceTransaction”,”AliasRegistration”,”Skrill1Tap”] – Array of submethods that support fast flow.

checkout ({...

savePm: 'true',

apmConfig: {

apmgw_MoneyBookers: {

fastFlow: true

},

},

subMethod: ["ReferenceTransaction","AliasRegistration","Skrill1Tap"],...

});

- REST API

-

Follow these steps to perform a payment using Nuvei REST API integration:

1. Generate a

sessionTokenPress here for details.

2. Send a

/paymentRequestPerform the payment by sending a

/paymentrequest with its mandatory parameters including:userTokenIdamountcurrencypaymentOption.alternativePaymentMethodclass containing:paymentMethod: “apmgw_MoneyBookers“account_id

deviceDetailsclass containing:ipAddressbillingAddressclass containing:firstName,lastName,country,emailuserDetailsclass containing:firstName,lastName,country,email

Example

/paymentRequest{ "sessionToken":"<sessionToken from /getSessionToken>", "merchantId":"<your merchantId>", "merchantSiteId":"<your merchantSiteId>", "clientRequestId":"<unique request ID in merchant system>", "amount":"200", "currency":"USD", "userTokenId":"<unique customer identifier in merchant system>", "clientUniqueId":"<unique transaction ID in merchant system>", "paymentOption":{ "alternativePaymentMethod":{ "paymentMethod":"apmgw_MoneyBookers", "account_id":"<Skrill account>" } }, "deviceDetails":{ "ipAddress":"<customer's IP address>" }, "billingAddress":{ "firstName": "John", "lastName": "Smith", "country":"US", "email":"[email protected]" }, "userDetails":{ "firstName": "John", "lastName": "Smith", "country":"US", "email":"[email protected]" }, "timeStamp":"<YYYYMMDDHHmmss>", "checksum":"<calculated checksum>" }After the transaction is processed, Nuvei sends a Direct Merchant Notification (DMN) that includes the result of the transaction to the URL provided in

urlDetails.notificationUrl, which Nuvei recommends including in the/paymentrequest.Payout (Withdrawal) Flow

Send a

/payoutrequest and include theuserPaymentOptionId, which contains the user’s previously stored APM account details. Press here for an example.After the transaction is processed, Nuvei sends a DMN that includes the result of the transaction to the URL provided in

urlDetails.notificationUrl, which Nuvei recommends including in the/payoutrequest. - Web SDK

-

Follow these steps to perform a payment using Nuvei Web SDK integration.

1. Initiate a Session

Before you can submit payment using the client-side Nuvei Web SDK, you need to send the

/openOrderAPI call.2. Initialize the Web SDK

Instantiate the Web SDK with the

sessionTokenreceived from the server call to/openOrder.3. Create an APM Payment

Send a

createPayment()request with its mandatory parameters including:paymentOption.alternativePaymentMethodclass containing:paymentMethod: “apmgw_MoneyBookers“account_id

deviceDetailsclass containing:ipAddressbillingAddressclass containing:firstName,lastName,country,emailuserDetailsclass containing:firstName,lastName,country,email

Example

createPayment()Requestsfc.createPayment({ sessionToken: '<sessiontoken>', paymentOption: { alternativePaymentMethod: { paymentMethod: 'apmgw_MoneyBookers', account_id: '<Skrill account>' }, subMethod: { subMethod: 'skrill1Tap' } }, deviceDetails: { ipAddress: "<customer's IP address>" }, billingAddress: { firstName: 'John', lastName: 'Smith', country: 'US', email: '[email protected]' }, userDetails: { firstName: 'John', lastName: 'Smith', country: 'US', email: '[email protected]' } }, function (res) { console.log(res) })After the transaction is processed, Nuvei sends a Direct Merchant Notification (DMN) that includes the result of the transaction to the URL provided in

urlDetails.notificationUrl, which Nuvei recommends including in the/openOrderrequest.Withdrawal Flow

For information about the Withdrawal flow for WebSDK, see Withdrawal.

- Payment Page

-

Example Payment Page Request

After the transaction is processed, Nuvei sends a Direct Merchant Notification (DMN) that includes the result of the transaction to

notify_url, which Nuvei recommends including in the request. - Simply Connect

-

To perform a payment using Nuvei Simply Connect integration:

1. Initiate a Session

Before submitting a Simply Connect payment request, you need to submit a server-side

/openOrderAPI request.2. Create an HTML Placeholder

Import the

checkout.jslibrary for building payment flows and create an HTML placeholder on your payment page for the Simply Connect UI element.3. Submit a

checkout()RequestSend a

checkout()request with its mandatory input parameters, along with any other relevant parameters and customizations. For more information, see Quick Start to Simply Connect.Fast Flow (Optional)

To offer customers the option to skip the PayPal payment confirmation page for future payments, include in the

checkout()request:savePm: “always“, “true“, or “force” – Fast flow requires a saved payment method. Other possiblesavePmvalues do not support fast flow.apmConfigclass containing:apmgw_MoneyBookersclass containing:fastFlow: true

subMethod: [“ReferenceTransaction”,”AliasRegistration”,”Skrill1Tap”] – Array of submethods that support fast flow.

checkout ({... savePm: 'true', apmConfig: { apmgw_MoneyBookers: { fastFlow: true }, }, subMethod: ["ReferenceTransaction","AliasRegistration","Skrill1Tap"],... });After the transaction is processed, Nuvei sends a DMN that includes the result of the transaction.

User Experience

Payment

- The user is redirected to the Skrill payment page.

- The user logs in to their account and completes the deposit.

Configuration Requirements

To complete the addition of Skrill to your account:

- Enable secure

return_url. Contact [email protected] to request secure return URL activation for your merchant account. - Configure the mandatory parameters in the Skrill back office:

- Log in to the Skrill merchant portal from here.

- Navigate to Settings>Developer settings> API / MQI / GSR / CVT Management page.

- Enable the Automated Payment Interface (API) toggle and add the IPs from which the service may be reached as follows:

- 194.247.167.0/24 (production)

- 195.28.166.0/24 (production)

- 195.28.167.0/24 (production)

- 87.120.10.1/24 (production)

- 87.120.11.1/24 (production)

- 91.220.189.1/24 (production)

- 52.16.211.57 (integration)

- 52.17.110.204 (integration)

- 52.112.39.133 (integration)

- 54.242.232.64 (integration)

- Set a new API/MQI password.

- Set a new Secret word value.

Required Details for Skrill MID Setup

- ClientId [per currency] – This is the merchant ID of your Skrill merchant account.

- PayoutPassword (MQI/API password) [per currency] – This is the md5 hash of the API/MQI password as set in your Skrill merchant account.

- SecretWord [per currency] – This is the md5 hash of the secret word as set in your Skrill merchant account.

- UserName [per currency] – This is the processing email of your merchant account in Skrill.

Skrill Customer Verification

Prior to redirecting the user to the Skrill page, Nuvei makes a “Skrill Customer Verification” call using the user’s email account as entered on the cashier or as supplied in the account information.

Nuvei checks with Skrill that all the information below is provided by the merchant:

- First Name

- Last Name

- Date of Birth

- Country

- Post Code

The verification call uses these client profile parameters:

APM_ClientId(according to the correct currency)APM_Secret_Word(according to the correct currency)

Example Verification Request

{

"merchantId":"276261218",

"password":"9f535b6ae672f627e4e5f79f2b7c63fe",

"customerId":"276261219",

"firstName":"John",

"lastName":"Smith",

"postCode":"CR12BN"

}

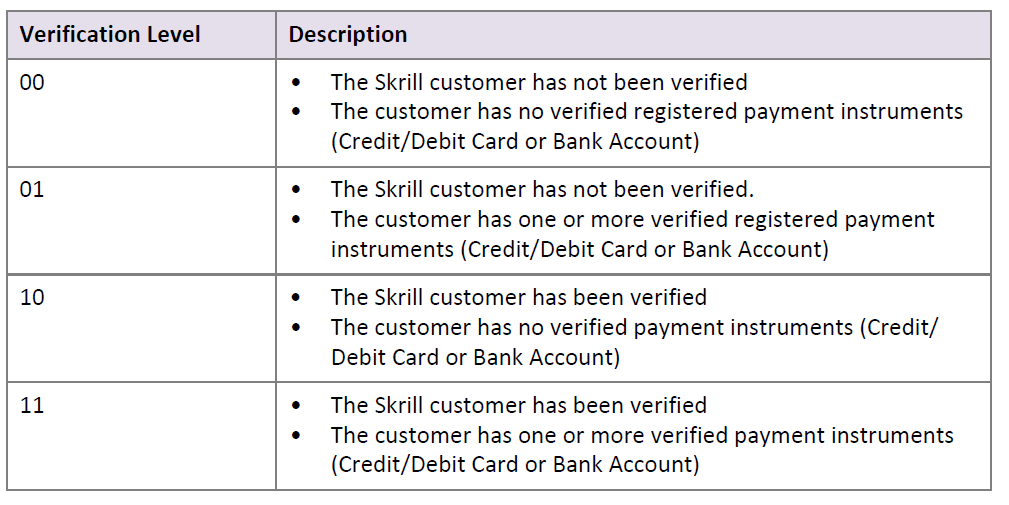

Skrill responds with “MATCH” / “NO MATCH” to the parameters that Nuvei sends and in addition they provide Nuvei the user verification level:

Example Verification Response

{

"firstName":"MATCH",

"lastName":"NO_MATCH",

"postCode":"NO_MATCH",

"verificationLevel":"10"

}

The result from Skrill should be sent to the Risk system, which according to the merchant rules, decides if the transaction continues or not.

Skrill 1‐Tap

Skrill 1‐Tap is a single‐press payment service that enables the merchants to automatically debit transactions from their customer’s Skrill account without having to log in to their account to authorize the request each time.

In the 1-Tap flow, the user is redirected to the Skrill payment page like any regular deposit, but they sign an agreement to use the 1-Tap service during their first deposit. All subsequent deposits are in Direct mode, with the user being redirected again to the Skrill payment page.

1-Tap can be used in 2 modes:

- Via the regular Moneybookers – Users can select if they wish to use the regular flow or the 1-Tap flow. (recommended)

- Via separate payment method, Skrill One-Tap – The flow is always 1-Tap. (not recommended)

Technical Requirements

The 1-Tap feature should be enabled for the merchant account by Skrill.

To initiate the first deposit for APM Recurring Billing, merchants need to send submethod = “skrill1Tap“.

Example 1-Tap Request

{

"sessionToken":"<sessionToken from /getSessionToken>",

"merchantId":"<your merchantId>",

"merchantSiteId":"<your merchantSiteId>",

"clientRequestId":"<unique request ID in merchant system>",

"amount":"200",

"currency":"USD",

"userTokenId":"<unique customer identifier in merchant system>",

"clientUniqueId":"<unique transaction ID in merchant system>",

"paymentOption":{

"alternativePaymentMethod":{

"paymentMethod":"apmgw_MoneyBookers",

"account_id":"<Skrill account>"

},

"subMethod":{

"subMethod":"Skrill1Tap"

}

},

"billingAddress":{

"country":"US",

"email":"[email protected]"

},

"deviceDetails":{

"ipAddress":"<customer's IP address>"

},

"timeStamp":"<YYYYMMDDHHmmss>",

"checksum":"<calculated checksum>"

}

Last modified January 2026

Last modified January 2026