Overview

The Movement Report allows you to view all your financial movements for any given currency in one consolidated report.

See Guidelines to Data Retrieval for Financial Reports.

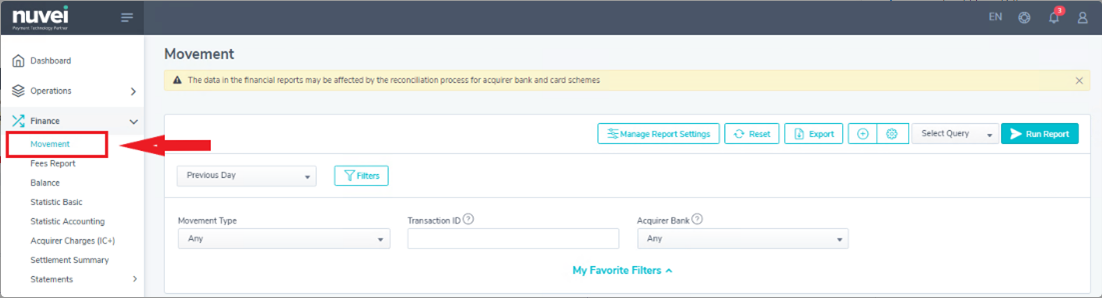

Generating a Movement Report

Refer to the Reports page that explains the basic format of the reports that can be generated using the Control Panel. The page also describes how to use the various settings and filters that allow you to generate a report with only the most relevant data, how to export your report, as well as create, schedule, and manage queries.

To generate a Movements Report:

- From the main menu, select Finance > Movement Report.

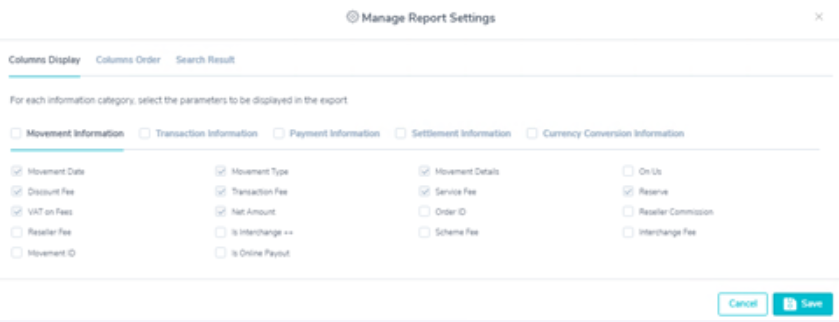

- Press Manage Page Settings to set which and how parameters are displayed in the report.

- Select the date range of the report from the dropdown.

- Press Filters if you wish to narrow the search parameters for your report.

- Press Run Report. The report is displayed according to the settings and filters you have defined or selected.

Movement Report

The results are displayed in descending order according to date. For information regarding an icon displayed in the report, scroll over the icon to display a tooltip.

Above the Search Result section, the filters that were used in the search are presented, and these can be used to further refine your search.

Details Column

Press ![]() to show a summary of all the movement details arranged by informational tabs.

to show a summary of all the movement details arranged by informational tabs.

Report Parameters

This section provides tables that describe the parameters that can be selected to be displayed in the report arranged by tabs using Manage Report Settings.

Movement

| Parameter | Description | Notes |

|---|---|---|

| Movement Date | The date the movement occurred. | |

| Movement Type | The type of financial activity that took place in your account. | For example, a sale is a type of transaction movement. |

| Movement Details | The details related to the movements that you are searching for. | |

| On Us | Indicates whether or not the transaction was processed using On Us. | |

| Discount Fee | The amount of any discount fees (commissions) applied to your transaction as per your contract. | |

| Transaction Fee | The fees related to your transactions as per your contract. | |

| Service Fee | Any fees applied for added value services required as part of your contract. | Examples:

|

| Reserve | The amount added or removed for your Reserve Balance. | |

| VAT on Fees | The value added tax taken for the fees. | |

| Net Amount | The total net amount of the transition. | |

| Order ID | The ID of the order generated by Nuvei. | |

| Reseller Commission | Represents commission to be paid to a third-party reseller. | |

| Reseller Fee | Fees to be paid to a third-party reseller. | |

| Is Interchange++ | This indicates whether or not interchange pricing applies. | |

| Scheme Fee | The card scheme fee in the event that interchange pricing applies. | |

| Interchange Fee | The interchange fee in the event that interchange pricing applies. | |

| Movement ID | An ID generated by Nuvei for the movement. | |

| Is Online Payout | Indicates if the transaction was processed using the online payout service. Possible values: Yes No | |

| Jurisdiction | Displays the general location of the consumer. | |

| Plus Commission | This figure shows the commission collected by Nuvei from the merchant for providing its processing services, as agreed upon between Nuvei and the merchant. | |

| Mode | Indicates if Nuvei was a connector or collector during the processing of the transaction. | This field is visible in the Details window only. |

| Bank | The acquirer bank or APM involved in the movement. | This field is visible in the Details window only. |

| Commissions | The fixed percentage taken from your approved transaction amount. | This field is visible in the Details window only. |

| Settlement Reserve Amount | The amount removed from the settlement for your Reserve Balance. | This field is visible in the Details window only. |

| Settlement Conversion Rate | The conversion rate used for converting the net payment to the settlement currency. | This field is visible in the Details window only. |

| Is IC Separate Fee | Indicates if the fee related to the movement being charged separately. | This field is visible in the Details window only. |

| IC Separate Related Movement ID | For movements under the IC Separate Fee model, it is indicated on the related movement (fee for sale, and the sale for the fee). | This field is visible in the Details window only. |

| IC Separate Related Movement Date | For movements under the IC Separate Fee model, indicates the related movement date (fee for sale, and the sale for the fee). | This field is visible in the Details window only. |

| VAT Applicable Commission | The amount of the charged commission, from the services provided by Nuvei, which are applicable for VAT according to the local VAT rules. | Relevant for UK merchants who have an agreement with Nuvei Financial Services, the column is presenting the amount of charges in accordance with local VAT rules. |

| VAT Applicable Fee | The amount of the charged fee, from services provided by Nuvei, which are applicable for VAT according to the local VAT rules. | Relevant for UK merchants who have an agreement with Nuvei Financial Services, the column is presenting the amount of charges in accordance with local VAT rules. |

| VAT Applicable Service Fee | The amount of the charged service fee, from the services provided by Nuvei, which are applicable for VAT according to the local VAT rules. | Relevant for UK merchants who have an agreement with Nuvei Financial Services, the column is presenting the amount of charges in accordance with local VAT rules. |

| Flight Date | The scheduled flight date. | Relevant only for Airline merchants. |

| Airline Due Date | The airline due date of the movement. | Relevant only for Airline merchants. |

Transaction

| Parameter | Description | Notes |

|---|---|---|

| Multi-client | The name of the multi-client account in which the movement occurred. | |

| Client Name | The available clients linked to your merchant account that are to be queried. | |

| Acquirer Bank | The acquirer bank or APM involved in the movement. | |

| Is 3D | Indicates if the transactions were processed through the Managed 3D flow. | |

| Country | Displays the country from where the transaction originated. | |

| Transaction Result | The result of the transaction. | |

| Transaction ID | The Nuvei transaction ID to locate a single transaction. | You can view a specific movement by entering the related Transaction ID. |

| Client Unique ID | The ID of the transaction in the merchant’s system. | This value must be unique. |

| Currency | The currency that was used for the sale or service (original currency). | |

| Amount | The amount of the movement. | |

| Site ID | Nuvei's internal unique identifier code for the merchant's website. | |

| Site Name | The URL of the site as defined by you through the customSiteName parameter. | If not defined, it is the name as configured in the Nuvei system. |

| Card Product | A high-level credit card product classification. | For example: commercial, consumer, premium, electron, etc. |

| Custom Data | Any custom data you want displayed in the transaction details in the report. | |

| ARN | The transaction ARN associated with the movement. | |

| Payout ID | The ID of the individual payout. | |

| Bank Transaction ID | A transaction ID provided by the APM or bank. | |

| Prepaid | Indicates whether or not a prepaid card is used. Possible values: Yes No | |

| Is AFT | Indicates if the transaction is a Visa Account Funding Transaction (AFT). Possible values: Yes, No | This is a transaction in which funds are pulled from a Visa account and subsequently used to fund another Visa or non-Visa account. |

| Batch ID | Indicates the batch number for clearing. | |

| Processing Channel | Indicates the channel used in the transaction. Possible values: E-commerce: Payment transactions processed online. MOTO: Payment transactions processed by mail or phone. Card-present: Payment transactions where the cardholder is physically present. | |

| BIN | Displays the first six digits of the credit/debit card, which identify the issuing institute. | |

| Record ID | For Ethoca Alerts/RDR, the event ID from the Pre-chargeback event report, which allows merchants to match the movement with the pre-chargeback event. For VAU, the Visa Account Updater record ID, which helps merchants identify the record in their account updater report. | |

| Decline Reason | Decline reason as returned by the Provider’s API. | This field is visible in the Details window only. |

| Auth Code | The transaction's authorization code provided by the issuer bank. | This field is visible in the Details window only. |

| Product ID | The alpha-numeric code that you assigned for a product. | This field is visible in the Details window only. |

| Website | The name of the site as defined by you through the customSiteName parameter. | This field is visible in the Details window only. |

| Is Rebill | Indicates if the transaction is part of a rebilling cycle. | This field is visible in the Details window only. |

| Is Chargeback | Indicates if the transaction was a chargeback. | This field is visible in the Details window only. |

| AVS Code | The AVS processor’s response. | This field is visible in the Details window only. |

| CVV2 Reply | The CVV2 response code. Possible values: D – Invalid security code M – Match N – Not Match P – Not Processed S – CVV should be on the card but the merchant indicates it is not U – User is unregistered Y – Match | This field is visible in the Details window only. |

Payment

| Parameter | Description | Notes |

|---|---|---|

| Payment Method | The payment method used to complete the transaction. | |

| Card Type | The type of card used in the transaction, credit, or debit. | |

| Credit Card Last 4 Digits | Displays the last four digits of the credit card used. | |

| Is Currency Converted | Indicates if the transaction currency was converted. | |

| Payment Sub-method | The payment channel used on the provider side. | |

| External Token Provider | The external provider that provides the token for a credit card transaction. | |

| Card Number | The masked debit or credit card number. | For example: 4***********5354 This field is visible in the Details window only. |

| Expiration Date | The expiration date of the payment card. | This field is visible in the Details window only. |

| Name on Card | The customer's name as it appears on their credit/debit card. | This field is visible in the Details window only. |

Settlement

This tab is populated when the settlement process was used for a transaction.

| Parameter | Description |

|---|---|

| Settlement Currency | The currency of the settlement. |

| Settlement Amount | The amount settled after being converted into the settlement currency. |

| Conversion Rate | The conversion rate used for converting the net payment to the settlement currency. |

| Settlement Reserve | The amount removed from the settlement for your Reserve Balance. |

Currency Conversion

This tab is populated when currency conversion was used when processing a transaction.

| Parameter | Description | Notes |

|---|---|---|

| End User Amount | The amount the end user is charged, which is different from movement amount in case of currency localization. | |

| End User Currency | The currency used for processing by the acquiring bank. | This currency may be different from the original transaction currency if the end user selected another payment currency on the payment page (currency localization\DCC). |

Installments

This tab is populated for payments made with installments.

| Parameter | Description |

|---|---|

| Installment Funding Type | Indicates who obtained or allocated the funds to cover the scheduled installments. Possible values: Issuer Acquirer |

| Anticipation Type | The time when the transaction installments are included in the merchant balance. Possible values: STD – Each payment according to the payment plan. A01 – The total transaction amount after one day. A30 – The total transaction amount after 30 days. |

| Number of Installments | The number of scheduled, evenly-divided payments used to spread out the cost of a purchase over time. |

| Installment Number | Indicates the specific position of the installment in the overall payment schedule. |

End User Billing

This tab is only available in the Details window.

| Parameter | Description |

|---|---|

| The customer's email address. | |

| Name | The customer's first and last name. |

| Address | The customer's address. |

| Phone | The customer's phone number. |

| IP Address | The customer's IP address. |

Chargeback

This tab is only available in the Details window.

| Parameter | Description |

|---|---|

| CBID | The unique ID number of the chargeback. |

| Date | Displays the date the chargeback was initiated. |

| Update Date | Displays the date the transaction was last updated. |

| Amount | The original amount of the transaction. |

| Status | This is the chargeback’s status during the defined time period. Possible values: Regular: Applies to retrievals and chargebacks. The status of a chargeback is Regular when it is the first notification about a specific transaction. Retrievals are always listed as Regular. Soft_CB: A pre-announcement that your account is debited for the specified amount. This type is also referred to as a “soft chargeback”, “photocopy request chargeback”, or “retrieval related to an existing chargeback”. Cancelled: A chargeback that was reversed. Duplicate: A second chargeback for the same transaction. |

| Type | The type of the chargeback. |

| Reason | Chargeback reason codes as per Visa and Mastercard scheme rules. |

GW Only Charges

This tab is only available in the Details window.

| Parameter | Description |

|---|---|

| Comments | Provides a brief, meaningful explanation of the movement, such as adjustments, corrections, or special transaction types. |

| Operation Date | The date on which the movement occurred. |

With Holding Tax (WHT)

This tab is only available in the Details window, and is relevant for merchants who process in LATAM with the Charge Tax pricing configuration.

| Parameter | Description |

|---|---|

| National WHT | National withholding tax on income (when applicable) taken as the rate from the merchant's total sales minus total credits, divided by (1 + VAT rate), reducing the merchant's total due. |

| National WHT Rate | The rate of national withholding tax on income. |

| Local WHT | Local withholding tax on income (when applicable) taken as the rate from the merchant's total sales minus total credits, divided by (1 + VAT rate), reducing the merchant's total due. |

| Local WHT Rate | The rate of local withholding tax on income. |

| VAT WHT | VAT withholding tax (when applicable) taken as the rate from the merchant's total sales minus total credits, divided by (1 + VAT rate) multiply by the VAT rate, reducing the merchant's total due. |

| VAT WHT Rate | The rate of the VAT withholding. |

| Nuvei National WHT | National withholding tax on income (when applicable) paid by Nuvei to the merchant as a rate from Nuvei's income (commission and fee). |

| Nuvei National WHT Rate | The rate of Nuvei national withholding tax on income. |

| Nuvei Local WHT | Local withholding tax on income (when applicable) paid by Nuvei to the merchant as a rate from Nuvei's income (commission and fee). |

| Nuvei Local WHT Rate | The rate of Nuvei local withholding tax on income. |

| Nuvei VAT WHT | VAT withholding tax (when applicable) paid by Nuvei to the merchant as a rate from Nuvei's VAT on income. |

| Nuvei VAT WHT Rate | The rate of the Nuvei VAT withholding. |

Sample Movement Report

Press here to download a sample of an exported report.

Time Zone

When applying the time zone for this report, the movement date is converted on the UI level, as opposed to other reports that convert the data retrieved from the database.

For example, in the London time zone, data is requested for a future presentation – 23:00 on April 05 in London corresponds to 01:00 on April 06 in Jerusalem.

However, the data for April 06 is not yet available since financial data is typically ready by 11:00 in the morning.

Consequently, users in time zones prior to UTC+2, such as London, consistently experience a two-hour gap in the Movement Report since from the server and financial perspective, they are already in the next day.

This behavior affects all users in time zones prior to UTC+2 and cannot be resolved at the UI or distributor level since the issue lies in the data availability.

Users that are using different time zones need to introduce a delay in order to obtain complete data. This could involve receiving data weekly with a two-day delay instead of daily. Alternatively, users could opt to change the report time zone to Jerusalem.

FAQs

- Find the Net Amount and Settlement Amount per transaction.

- Identify the final Transaction Status.

- Determine how much each transaction impacted the Settlement Balance.

- Display the Sale, Credit, Chargeback Amount, Fees, and Reserve per transaction.

- Filtering by Payout ID and relevant date range, all the transactions included in the wire linked to the Payout ID.

By default, all the available fields should be displayed. To check if all fields are displayed or to change the fields displayed, use Manage Report Settings. There are five tabs of fields to select from.

If a column heading is checked, it is displayed.

Selecting any of the five main checkboxes (Movement Information, Transaction Information, Payment Information, Settlement Information, or Currency Conversion Information) causes all the fields under the respective tab to appear in the report.

In Manage Report Settings, confirm the Settlement Information is displayed. Select the Settlement Information checkbox to display the Settlement Currency, Settlement Amount, and Settlement Reserve.

Alternatively, select Manage Report Setting and select the main Settlement Information checkbox to display all the settlement information.

No, once a transaction is displayed in the Movement Report, it does not change.

The Movement Report takes into consideration four decimals per transaction, but the Balance Report takes into account two decimals on the total sum.

Direct bank information is not supported in the Movement Report. Use your gateway to view transactions that are managed by Nuvei.

The Reserve is an amount kept under the Settlement Reserve Amount for risk exposure purposes. A percentage, noted in the contract, is kept from the Sale amount and is added to the Settlement Reserve Amount per transaction. In the 7th month, the Reserve that was collected 6 months ago is released to the Settlement Amount and is settled along with the Settlement Balance in the next payout cycle for the relevant period it was released.

In the Manage Report Setting, select the checkbox next to Movement Information to display all fee information including Scheme Fee and Interchange Fee.

The Transaction Report shows the transaction in many stages until it is finalized, but the Movement Report only shows the transaction at its final stage.

The amount of any discount fees (commissions) applied to the transaction as per the contract. This is where Nuvei’s commission is displayed. If the account is IC++, then the interchange and scheme fee are included along with Nuvei’s commission.

Appendix – Movement Types

| Movement Type | Movement Details | Description |

|---|---|---|

| Auth | Auth | Authorization fee in case it is being charged |

| Auth3D | Auth3D | Auth 3D fee |

| Batch Fee | Batch Fee | For a merchant that submits transactions with batches (usually card present), we may charge a fee per each batch submitted. |

| Cancelled CB | First Chargeback reject | Credit the merchant with the Chargeback amount because the first Chargeback was rejected directly. |

| Cancelled CB | First Chargeback reject request accepted | Credit the merchant with the Chargeback amount because the first Chargeback was rejected after notification. |

| Cancelled CB | Recalled Chargeback | Credit the merchant with the Chargeback amount because the first Chargeback was recalled by the issuer. |

| ChargeBack | Chargeback Regular | Charge the merchant for a regular Chargeback, including a Chargeback fee. |

| ChargeBack | Chargeback Duplicate | Charge the merchant for a duplicate Chargeback, including a Chargeback fee. |

| ChargeBack | Retrieval Fee | Charge a fee for retrieval request. |

| ChargeBack | First Chargeback | Charge the merchant with the Chargeback amount due to first Chargeback, including Chargeback fee. |

| ChargeBack | Issuer Pre-Arbitration Accepted | Charge the merchant with the Chargeback amount due to Issuer Pre-Arbitration, including Chargeback fee. |

| Credits | Credit | Refund |

| Credits fees | Credit Fee | For a merchant with special configuration (usually IC++ pricing with T+1), we create one movement on the gross amount of the transaction and another movement with the fee on the following day, which is the fee charge. |

| Daily Settlement Adjustment | Daily Settlement Balance Adjustment | |

| Daily Settlement Adjustment | Daily Settlement Reserve Adjustment | |

| DCC RevShare | DCC Revenue Share | For merchants with the DCC Revenue Share program, we share the revenue using this movement. |

| DCC Share Fee | DCC Share Fee | For merchants with the DCC Revenue Share program on a connect bank model, the merchant shares the revenue with Nuvei using this movement. |

| Declined | Void | A decline fee charge caused by a Void of a sale transaction. |

| Declined | VoidVoid | A decline fee charge caused by a Void of a Void of a sale transaction. |

| Declined | VoidCredit | A decline fee charge caused by a Void of a credit transaction. |

| Fixed Fee | Fixed Seasonal Fee | Periodic fee – Seasonal (for example: setup fee, annual registration fee). |

| Fixed Fee | Fixed Monthly Fee | Periodic fee – Monthly (for example: setup fee, annual registration fee). |

| Fixed Fee | Fixed Qurterly Fee | Periodic fee – Quarterly (for example: setup fee, annual registration fee). |

| Fixed Fee | Fixed Yearly Fee | Periodic fee – Yearly (for example: setup fee, annual registration fee). |

| Issuer Pre-Arbitration Fee Only | Issuer Pre-Arbitration | Charge the merchant with a fee for an Issuer Pre-arbitration request. |

| Issuer Pre-Arbitration Rejected | Issuer Pre-Arbitration Rejected | Charge the merchant with a fee for rejecting an Issuer Pre-Arbitration request. |

| Merchant pre-arbitration request | First Chargeback reject request | Charge the merchant with a fee for rejecting the first Chargeback. |

| Min Monthly Fee | Min Monthly Fee | Minimum monthly fee charge according to the agreement. |

| Misc. Fee | Misc. Reseller | |

| Misc. Fee | Misc. Setup Fee | A manual movement done by the Finance Team for charging a Setup fee. |

| Misc. Fee | Misc. MC | A manual movement done by the Finance Team for charging a Mastercard fee. |

| Misc. Fee | Misc. Visa | A manual movement done by the Finance Team for charging Visa fee. |

| Misc. Fee | Misc. VAT | A manual movement done by the Finance Team for charging VAT. |

| Misc. Fee | Misc. Chargeback Handling | A manual movement done by the Finance Team for charging a Chargeback handling fee. |

| Misc. Fee | Misc. Transaction Fee | A manual movement done by the Finance Team for charging a Transaction fee. |

| Misc. Fee | Misc. Commission Fee | A manual movement done by the Finance Team for charging a Commission fee. |

| Misc. Fee | Misc. Minimum monthly | A manual movement done by the Finance Team for charging a Minimum monthly fee. |

| Misc. Fee | Misc. Discount Scaling | A manual movement done by the Finance Team for charging a Discount scaling fee. |

| Misc. Fee | Misc. Monthly Fee | A manual movement done by the Finance Team for charging a Monthly fee. |

| Misc. Fee | Misc. Transaction Refund | A manual movement done by the Finance Team for charging a Transaction refund fee. |

| Misc. Fee | Misc. Credit Refund | A manual movement done by the Finance Team for charging a Credit fee. |

| Misc. Fee | Misc. GW Only | A manual movement done by the Finance Team for charging Gateway-only services fee. |

| Misc. Fee | Misc. Annual Fee | A manual movement done by the Finance Team for charging an Annual fee. |

| Misc. Fee | Misc. Movement | A deduction or top up to the merchant balance usually done in parallel with moving funds outside the billing system. |

| Misc. Fee | GW Only Charges | A movement for Gateway-only charges. Available on a monthly basis. |

| OCT | OCT | Original Credit Transaction\ Payout\ Visa Direct\ MC sent. |

| OCT fees | OCT Fee | For a merchant with special configuration (usually IC++ pricing with T+1), we create one movement on the gross amount of the transaction and another movement with the fee on the following day, which is the fee charge. |

| PayOut Fee | Payout Fee | A fee for wiring funds to the merchant. |

| PayOut Fee | Payout Tax | A tax on wiring the funds, as applied in several countries. |

| Pre CHB Services | VerifiOrder Insight inquiry | Charge the merchant for a Pre-chargeback alert from the VerifiOrder Insight platform. |

| Pre CHB Services | Verifi Order Insight Chargeback mitigation | Charge the merchant for a successful Chargeback prevention, using the VerifiOrder Insight platform. |

| Pre CHB Services | Ethoca Chargeback alert | Charge the merchant for a Pre-chargeback alert from the Ethoca platform. |

| Pre CHB Services | Ethoca Chargeback alert reversal | Credit the merchant for a Pre-chargeback alert that did not prevent a Chargeback. |

| Pre CHB Services | Misc Pre Chargeback service | A manual movement done by the the Finance Team for charging Pre-chargeback services fee. |

| Pre-chargeback notification | Collaboration Notification | Charge the merchant for a MC Collaboration Pre-chargeback alert. |

| Pre-Dispute Resolution | RDR-Refund | |

| Pre-Dispute Resolution | RDR Event | Charge the merchant for an RDR pre-dispute resolution, transaction amount + fee. |

| Pre-Dispute Resolution | Collaboration Resolution | Charge the merchant for a Collaboration pre-dispute resolution, transaction amount + fee. |

| Pre-Dispute Resolution | External RDR Event | Charge the merchant for an RDR pre-dispute resolution for transaction not acquired by Nuvei, fee only |

| Reversal | ReversalOnSale | Charge the merchant for reversing a Sale movement + fee. |

| Reversal | ReversalOnOCT | Credit the merchant for reversing an OCT movement + fee charge. |

| Reversal | ReversalOnRefund | Credit the merchant for reversing a Refund movement + fee charge. |

| Sales | Sale | Sale with approval. |

| Sales | Settle | Sale that was submitted as part of the approval. |

| Sales | Sale Installment | Credit the merchant for a single installment from the sale amount (in supported countries only). |

| Sales fees | Sale Fee | For a merchant with special configuration (usually IC++ pricing with T+1), we create one movement on the gross amount of the transaction and another movement with the fee on the following day, which is the fee charge. |

| Sales fees | Sale Fee Event | Charge the merchant for a sale transaction that got a Chargeback or Refund before a Sale movement was created (in supported countries only). |

| Sales fees | Settle Fee | For a merchant with special configuration (usually IC++ pricing with T+1), we create one movement on the gross amount of the transaction and another movement with the fee on the following day, which is the fee charge. |

| Services | AVSOnly | Charge the merchant for an AVS service. |

| Services | Risk Only | Charge the merchant for a risk service. |

| Services | AGVOnly | Charge the merchant for an AGV service. |

| Services | APM Risk | Charge the merchant for an APM risk service. |

| Services | TokenizationOnly | Charge the merchant for a TokenizationOnly service. |

| Services | VerifyAuth3D | Charge the merchant for a VerifyAuth3D service. |

| Services | eKYC | Charge the merchant for an eKYC service. |

| Services | Account Update | Charge the merchant for an Account Update service. |

| Services | InitAuth3D | Charge the merchant for InitAuth3D service |

| Reserve | Reserve Release | Credit the merchant balance for releasing a reserve balance. |

| Reserve | Misc. Reserve | Credit or debit the merchant balance due to a reserve adjustment. |

| Trans Fee Adjustment | Trans Fee Cap Adjustment | |

| Trans Fee Adjustment | Trans Fee Scaling Adjustment | |

| Trans Fee Adjustment | Trans Fee Combined Adjustment | |

| Payout | Payout | Merchant settlement |

Last modified January 2025

Last modified January 2025