Overview

With the Case Management interface, you can manage all dispute operations from one intuitive console so you can make data-driven decisions with in-depth insights.

You can review all chargebacks requiring action. This is centralized and managed by the Nuvei’s Control Panel, which gives you more transparency and minimize your working time.

The Case Management report provides a solution for Chargebacks, Ethoca Alerts, and Rapid Dispute Resolution (RDR).

The roles defined for the Case Management report are Management and Risk_Actions.

Manage Settings

Use this window to determine how the report is organized.

- Queue view – You can select how to group cases:

- Group by email (cardholder email)

- Group by Payment Method

- Group by Transaction ID

- Sort – You must select the queue view before applying the sorting. Sorting can be in descending and ascending order.

- For Group by Email or Group by Payment Method, the sorting options are:

- Total Amount DESC/ASC

- Count DESC/ASC

- For Group by Transaction ID, the sorting options are:

- Amount DESC/ASC

- Case create date DESC/ASC

- Remaining time DESC/ASC

- Dispute status DESC/ASC

- Dispute reason description DESC/ASC

- For Group by Email or Group by Payment Method, the sorting options are:

- Currency Display – When the cases are displayed in a grouped view, you can see the amounts per desired currency (GBP, USD, EUR), and the case amounts are converted. For the transaction level, it is not relevant – the original amount is shown (the selection is greyed out). Default view is USD.

- Page Size – A number of cases displayed on the first page.

Report Filters

The following filters are available for the Case Management interface:

| Parameter | Description | Notes |

|---|---|---|

| PAN | First digit and last four digits of the credit card. | For example: 4***********7917 |

| Case Types | The type of the case. Possible values:

|

Case Types

Ethoca Alerts

Ethoca Alerts is a collaboration-based solution to prevent disputes and fight fraud. Press here for more details.

Dispute

Dispute Requests

For more details on Dispute Requests, refer to Disputes Statuses.

Pre-Arbitration Requests

If merchant rejects the first chargeback, the issuer might escalate the case to pre-arbitration.

If a pre-arbitration request is received, the merchant must accept or reject it within 30 days.

Rejecting the pre-arbitration requires uploading compelling documents in addition to those provided when rejecting the first chargeback.

Credit Dispute Requests

In some cases, issuers might raise a dispute on a credit transaction to reverse the credit.

Disputes on credit transactions debit the cardholder and credit the merchant.

Chargebacks on credit transactions are received with status: “Credit Chargeback – Initiated by Issuer”.

They are then accepted automatically by the system, and the status changes to “Credit Chargeback – Accepted Automatically”.

No action is required from the merchant.

Pre-Dispute

RDR

Rapid Dispute Resolution (RDR) by Verifi is a fully automated dispute management solution for Visa transactions. It facilitates seller, issuer, and acquirer collaboration to resolve unnecessary disputes at the pre-dispute stage. Press here for more details.

Collaboration

Collaboration is a pre-chargeback step taken by Mastercard that allows you to refund a transaction and prevent it from becoming a chargeback.

When you receive a collaboration request, you have 48 hours to respond if you want to send a refund request to Mastercard.

You can also configure an automatic refund decision based on the amount set here.

Inquiry Request

Inquiry is a pre-chargeback step taken by Amex in North America that allows merchants to provide information or refund a transaction and prevent it from becoming a chargeback.

The time frame to respond to an Inquiry request is 20 days.

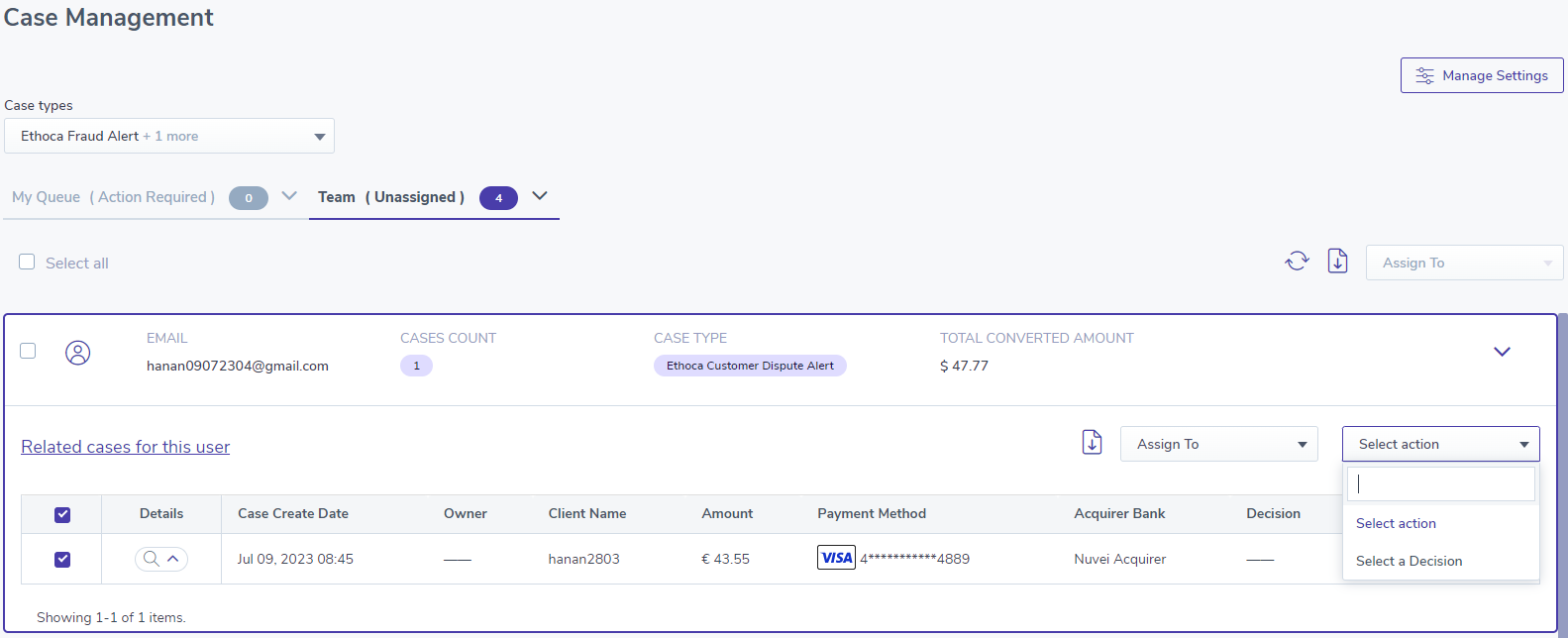

Case Management Report

From the Menu bar, select Risk > Case Management, and the Case Management page opens, consisting of the following elements:

- My Queue dropdown

- Team dropdown

- Assigned To dropdown

- Main grid, Quick grid, Related cases for this user, and Life Cycle.

Main Grid Columns

When either Group by email or Group by Payment Method is selected for Queue View under Manage Settings, the following main grid columns appear:

| Column Name | Description | Notes |

|---|---|---|

| Email or Payment Method | Group all cases under the folder for the specific email or payment method. | You can change type of the group using Manage Settings. |

| Cases Count | Count of the cases. | |

| Case Type | The type of the case. | Some cases appear according to your feature or product configuration. |

| Total Converted Amount | Total cases converted to the currency selected as per the manage settings. |

When Group by Transaction ID is selected for Queue View under Manage Settings, the following main grid columns appear:

| Parameter | Description | Notes |

|---|---|---|

| Details | Drill down to case life cycle. | |

| Case Create Date | Ethoca Alert create date. | |

| Owner | The owner of the case that was assigned for the case. | Once the case was handled, it was automatically assigned to the Control Panel user that handled the case. |

| Client Name | The name of the client linked to your merchant account. | |

| Case Type | The type of the case. | Some cases appear according to your feature or product configuration. |

| Status | The status of the dispute process. | The status changes according to the case type. |

| Decision | Ethoca alert decision for handling the case. | |

| Amount | The case amount in the original currency. | |

| Payment Method | The payment method used by the customer during the transaction. | |

| Acquirer Bank | The acquirer bank or APM that processed the transaction. | |

| Remaining Time | Remaining time for handling the case before expired. See Remaining Time. | |

| Transaction ID | The Nuvei transaction ID. | |

| The customer's email address. | ||

| Client Unique ID | The ID of the transaction in the merchant’s system. | |

| ARN | The Acquirer Reference Number associated with the transaction. | |

| Dispute Reason Description | See Disputes. | |

| Card Holder Name | Name of cardholder. | Relevant for disputes only. |

In addition, you can further search/filter the cases by pressing Open advanced filter and then Run Report.

Quick Grid Columns

Press ![]() on the right to open the case Quick grid. Quick grid columns vary depending on the case type (Ethoca alerts, Disputes, or Pre-disputes).

on the right to open the case Quick grid. Quick grid columns vary depending on the case type (Ethoca alerts, Disputes, or Pre-disputes).

| Column Name | Description | Notes |

|---|---|---|

| Details | Drill down to case life cycle. | |

| Case Create Date | Ethoca Alert create date. | |

| Owner | The owner of the case that was assigned for the case. | Once the case was handled, it was automatically assigned to the Control Panel user that handled the case. |

| Client Name | The name of the client linked to your merchant account. | |

| Collaboration Status | Status of the collaboration dispute process. Possible values: Collaboration – Initiated by Issuer Collaboration – Previously Refunded Collaboration – Refunded by Merchant Collaboration – Expired Collaboration – Rejected by Merchant Collaboration – Automatic Accept | Relevant for Pre-Dispute collaboration request only. |

| Dispute Status | The dispute status. See Dispute Statuses. | Relevant for dispute case type. |

| Amount | The case amount in the original currency. | |

| The customer's email address. | ||

| Payment Method | The payment method used by the customer during the transaction. | |

| Acquirer Bank | The acquirer bank or APM that processed the transaction. | |

| Remaining Time | Remaining time for handling the case before expired. See Remaining Time. | Remaining Time = 0, which could be if handled or expired. |

| Decision | Ethoca alert decision for handling the case. | Relevant for Ethoca alerts case type List of Decision below. |

Remaining Time

Remaining time is the time for handling the case. Each case type has its own time for handling.

- Ethoca – The remaining time for answering a case is 48 hours. The merchant can configure automate handling here; cases are moved to Team (Completed) automatically.

- Dispute – The remaining time for answering a dispute can vary from one issuer to another and its also effected from the case status. For some case types, the remaining time is empty when the merchant is not required to answer. The remaining time in Team (Waiting for Response) shows that time left for the card issuer to answer the rejected cases.

- Collaboration – The remaining time for Collaboration. Collaboration is one of the types for pre-dispute case. The Collaboration process occurs before the first chargeback, which allows issuers, acquirers, and merchants to settle disputes quickly and efficiently. Responding to Collaboration (“Request for Refund” [dependency]) does not risk the merchant getting into a dispute afterward. A case expires after 48 hours and is moved to completed (case status = “Collaboration – Expired”).

- Inquiry request – An inquiry request is raised by Amex in North America before the first chargeback, allowing issuers, acquirers, and merchants to settle disputes before a formal chargeback is initiated. If no response is provided for an Inquiry case, it expires after 20 days and is moved to Team (Completed).

Dispute Statuses

See Dispute Statuses.

Related Cases for This User

Press Related cases for this user to view the grid with all cases of all types related to this specific user (cardholder) grouped and sorted according to Manage Settings.

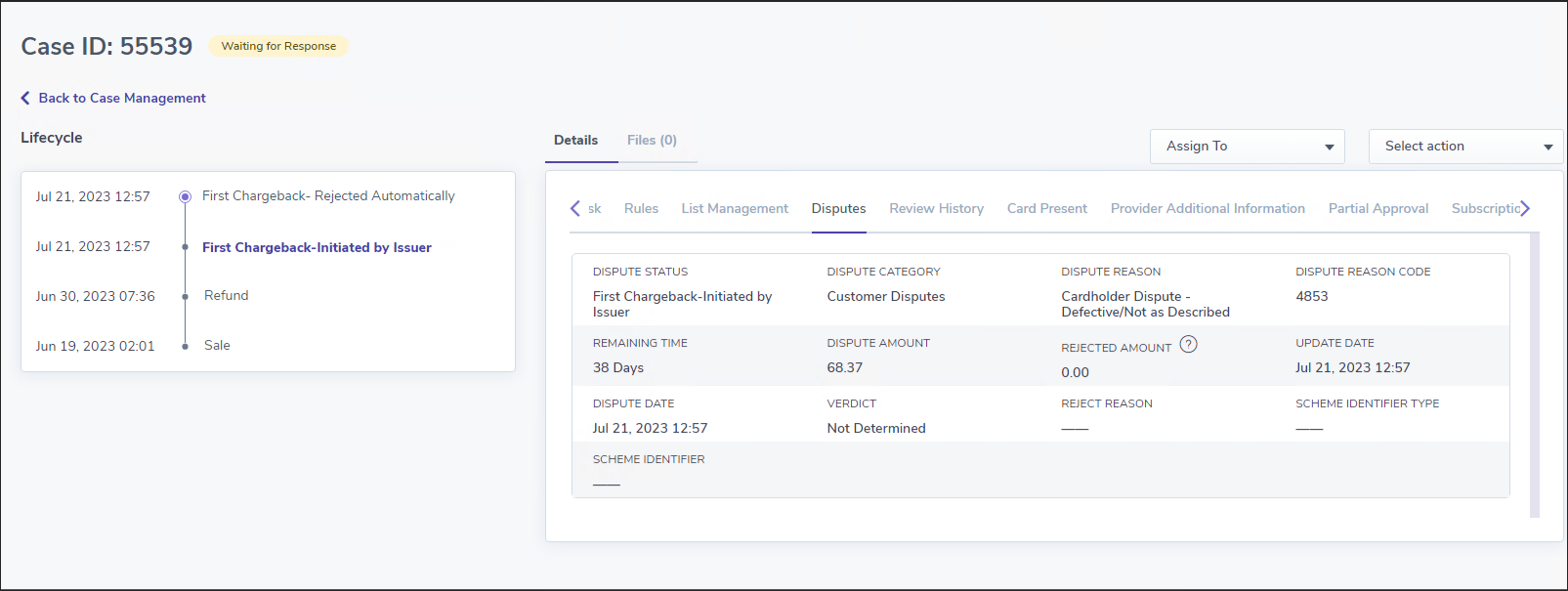

Life Cycle

In the Details column, press ![]() to show a summary of all the transaction details arranged by informational tabs.

to show a summary of all the transaction details arranged by informational tabs.

This window shows the timeline. Above the timeline, the Case ID and status of the transaction selected in the timeline are displayed.

The Details section provides the Disputes details and also contains:

- Assigned to dropdown (Assignment of Cases).

- Select Actions (see Dispute Actions)

- Files ( ) – documents uploaded by the merchant or by card issuer for presenting through the Control Panel.

Assignment of Cases

- The merchant pulls cases from the Team (Unassigned). Cases are opened with case status Action Required.

- Merchants can assign cases to themselves. These cases can be located under My Queue (Action Required).

- Cases assigned to other team members can be located under Team (Action Required).

- Reviewed and handled cases have a new case status of Waiting for response or Completed depending on the case type.

- Unhandled and therefore expired cases (remaining time = 0 Hours) automatically move to Team (Completed).

- The Case Management report default view is Team (Unassigned) if no cases are listed under My Queue (Action Required).

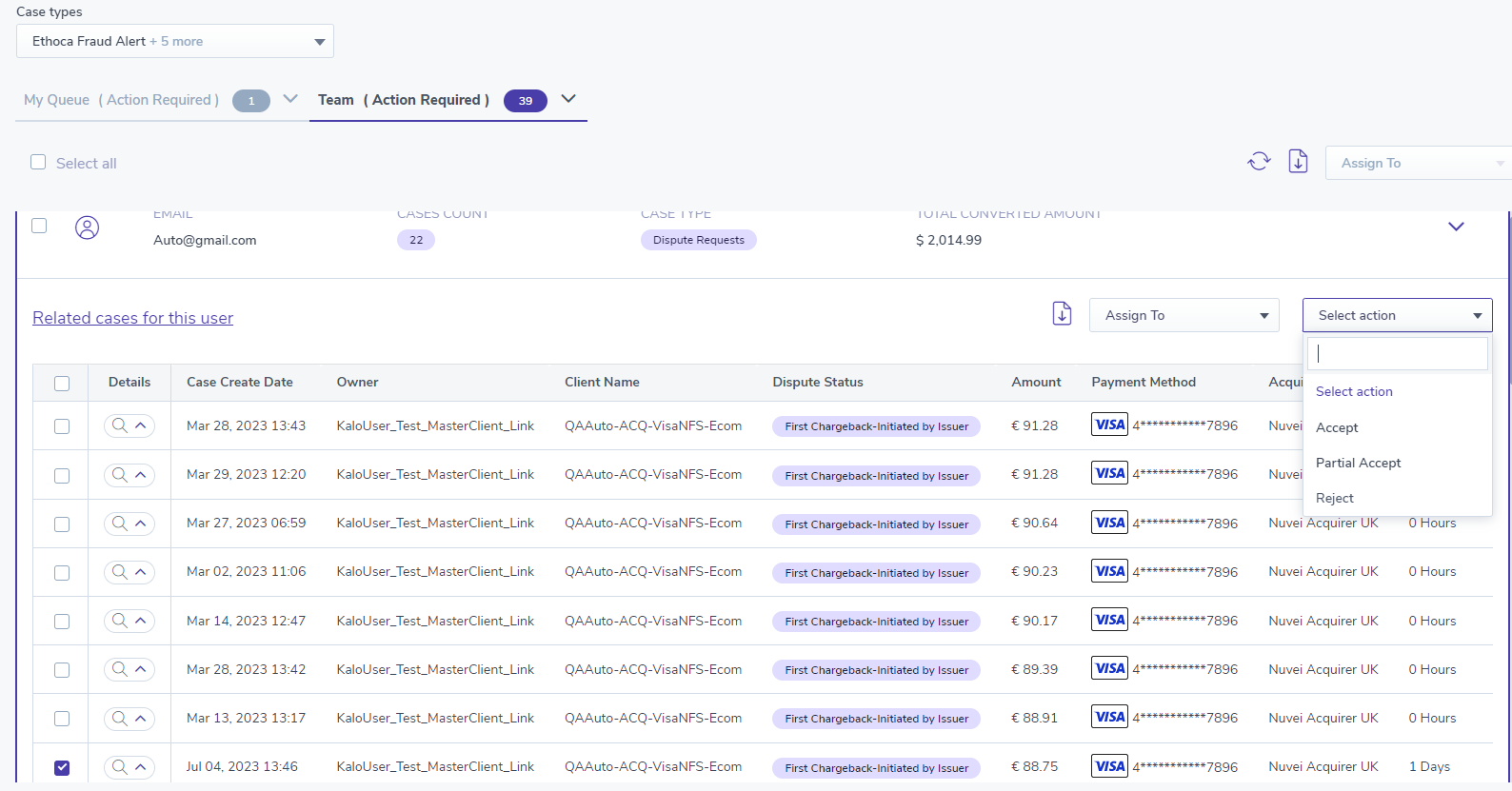

Actions

The Select action dropdown appears in the case Quick grid only until the remaining time is over (= 0).

To activate Actions for the specific case, select the case (select ![]() ).

).

Ethoca Actions

Select a Decision – The merchant needs to answer each case with a valid expiration date, and select a decision about the case. Once a decision is set, the case moves to Team (Completed).

| Case Type | Decision | Description |

|---|---|---|

| Ethoca Customer Dispute Alert | Resolve, already refunded. | The case has been resolved with the customer. No chargeback is expected. Refund is being processed, or no refund is needed. |

| Ethoca Customer Dispute Alert | Resolve, no refund is needed. | |

| Ethoca Customer Dispute Alert | Resolve & process refund. | |

| Ethoca Customer Dispute Alert | Previously refunded. | The case has been automatically resolved, the transaction was already refunded. |

| Ethoca Fraud Alert | Previous Chargeback notification received. | Previous Chargeback notification received. |

| Ethoca Customer Dispute Alert | Previous Chargeback notification received. | Previous Chargeback notification received. |

| Ethoca Fraud Alert | Previous RDR notification received. | Previous RDR notification received. |

| Ethoca Customer Dispute Alert | Previous RDR notification received. | Previous RDR notification received. |

| Ethoca Fraud Alert | Previous Collaboration notification received. | Previous Collaboration notification received. |

| Ethoca Customer Dispute Alert | Previous Collaboration notification received. | Previous Collaboration notification received. |

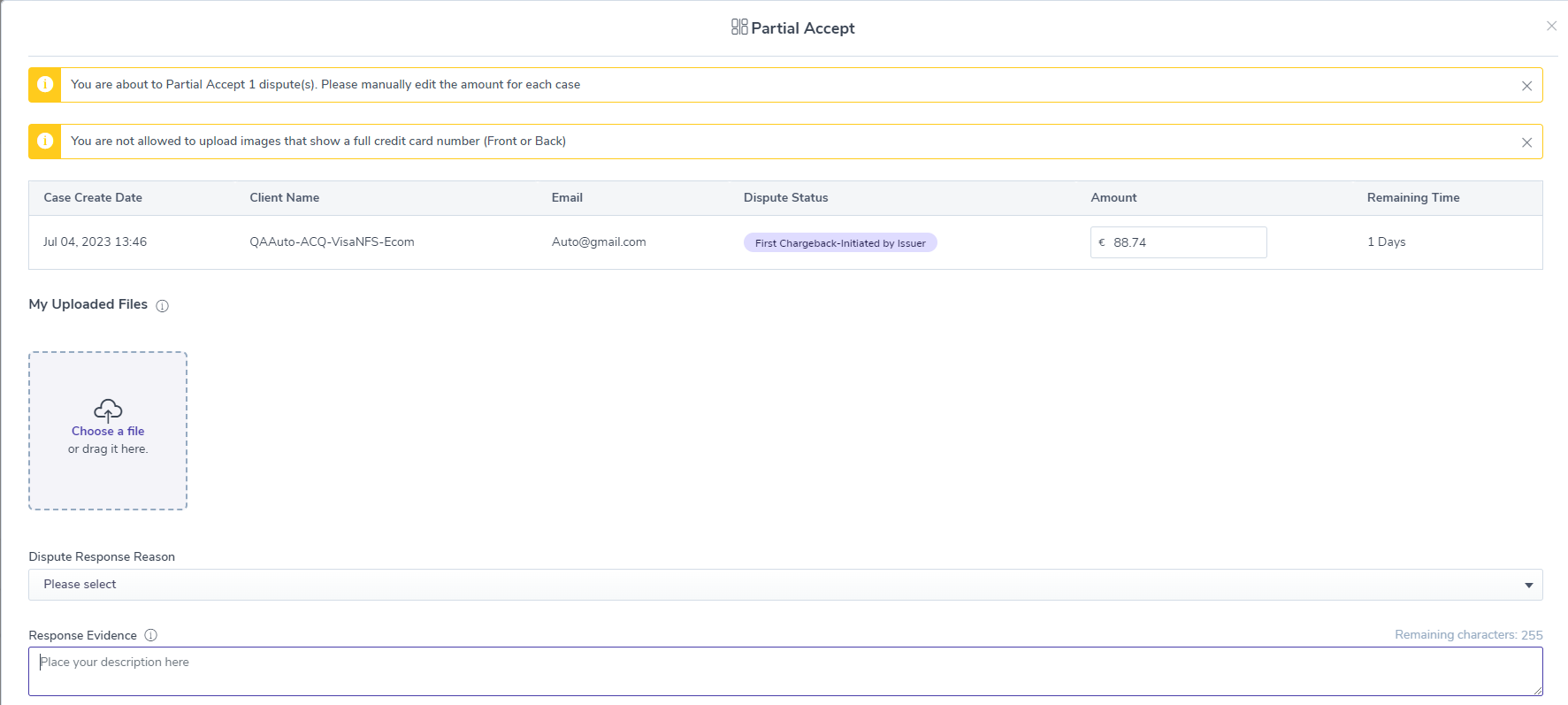

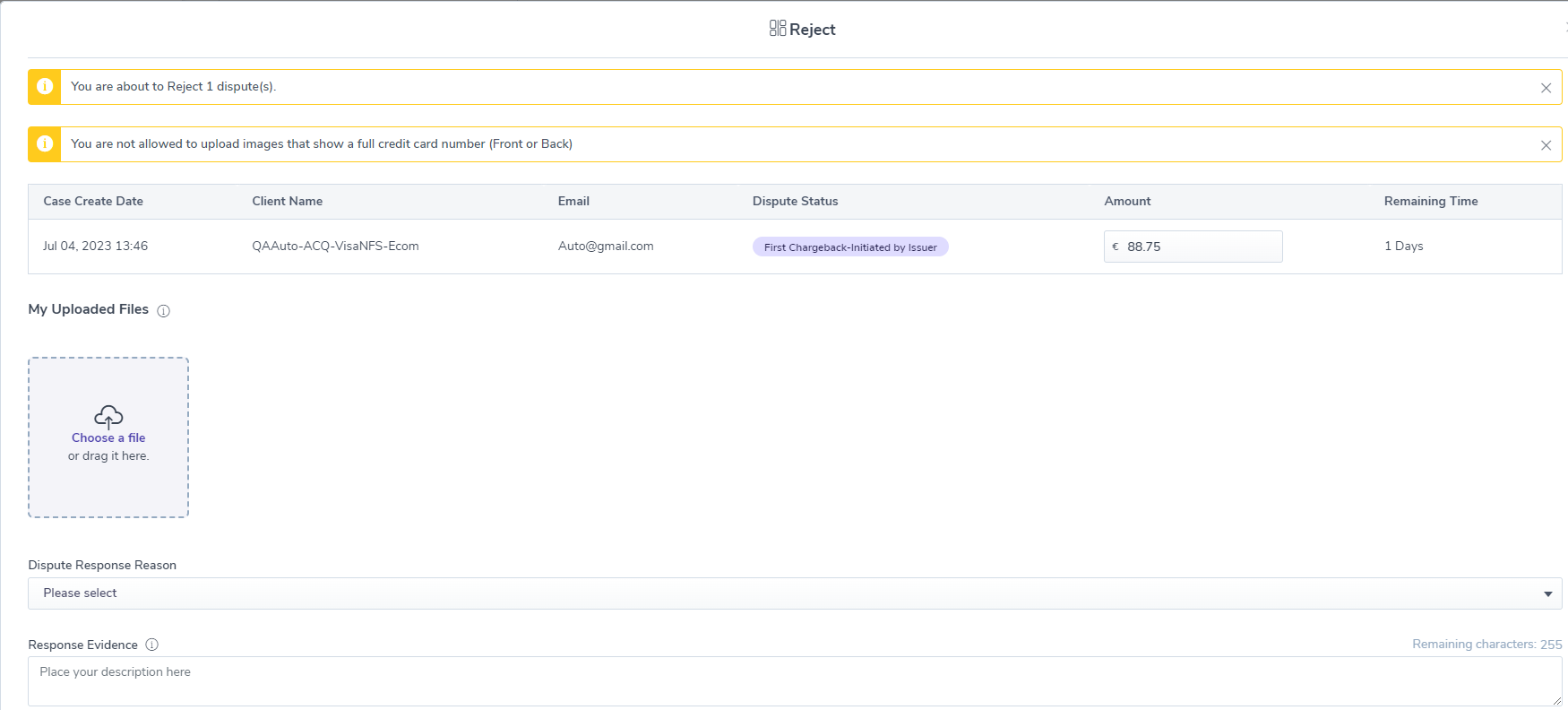

Dispute Actions

Actions are based on the dispute status.

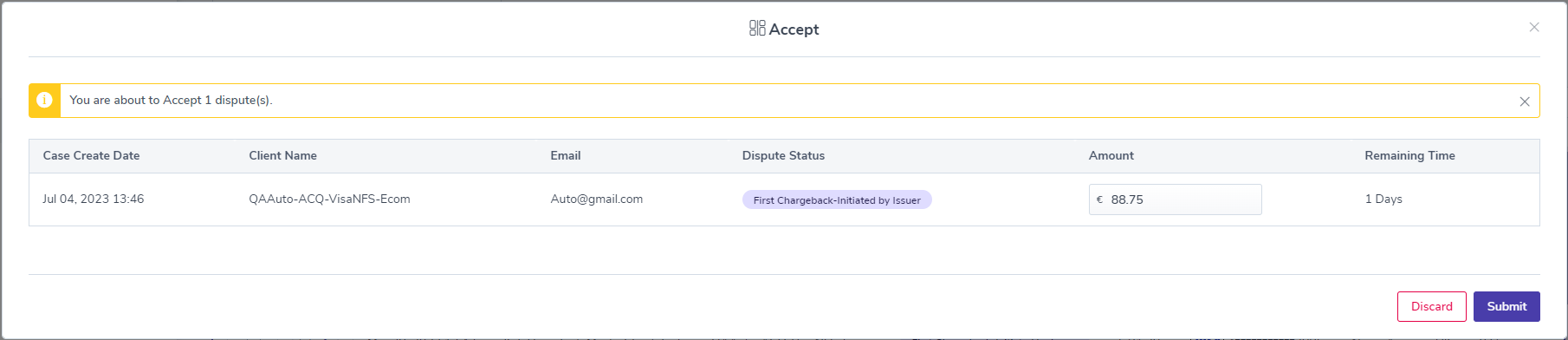

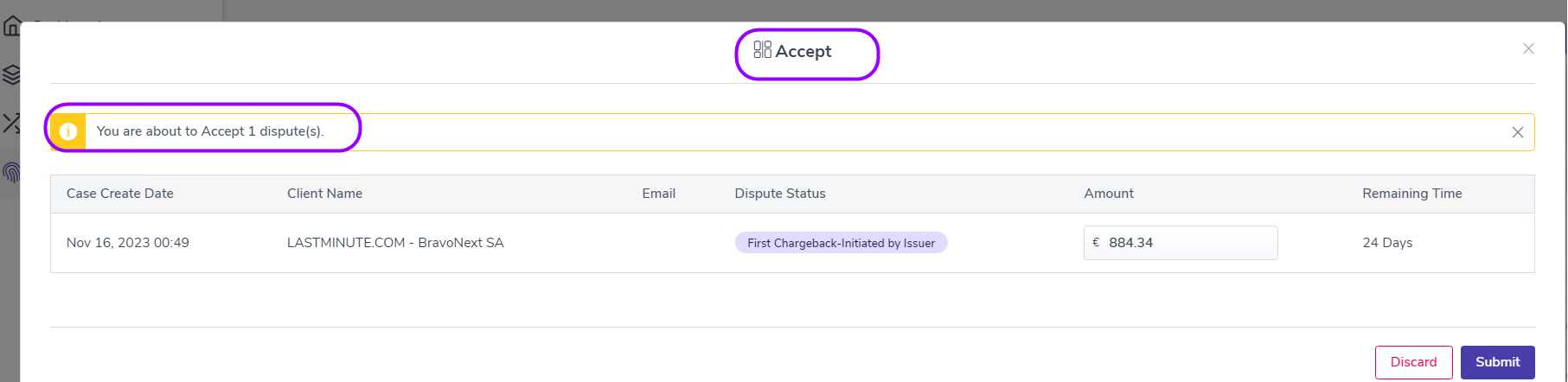

- Accept – The merchant selects accept a dispute and confirms. Once submitted, the dispute is accepted, and the case move to Team (Completed). The dispute is closed in favor of the cardholder.

- Partial Accept – The merchant can accept part of the dispute; the other part is rejected. The merchant needs to edit the dispute amount for the accept. For the reject details, the merchant needs to select a dispute response reason and add response evidence description.

The maximum file size is 10MB. The file name can be up to 45 characters, with no spaces and no special characters (such as @ . /). A maximum of four files can be uploaded.

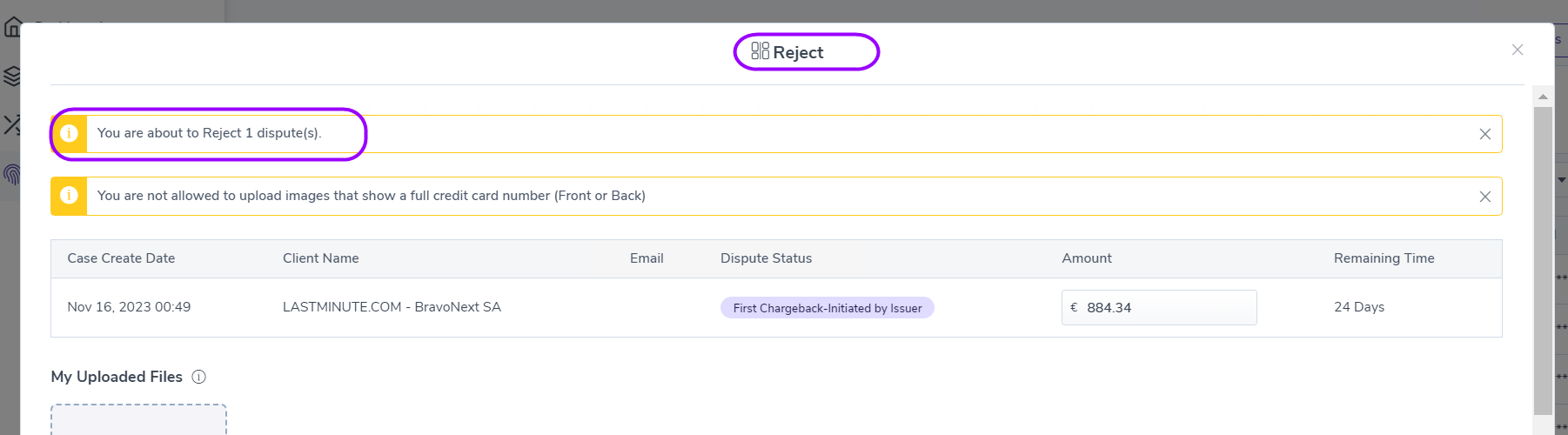

- Reject – The merchant has the ability to challenge a disputed case as long as he submits strong evidence to the issuer that invalidates the dispute claim before the remaining time is over. The merchant selects to reject a dispute and is required to upload supporting documents (PDF file only). In addition, the merchant needs to select a dispute response reason and add a response evidence description.

The maximum file size is 10MB. The file name can be up to 45 characters, with no spaces and no special characters (such as @ . /). A maximum of four files can be uploaded.

Pre-Arbitration Actions

- Reject Pre-Arbitration – The merchant can reject a pre-arbitration case. They must submit compelling documents in addition to those provided when rejecting the first chargeback ( PDF file only). In addition, the merchant needs to select a response reason and add a response evidence description.

The maximum file size is 10MB. The file name can be up to 45 characters, with no spaces and no special characters (such as @ . /). A maximum of four files can be uploaded.

- Accept Pre-Arbitration – The case is closed in favor of the cardholder.

- Partially Accept Pre-Arbitration – The merchant may accept part of the disputed amount. The merchant must enter the accepted amount, and the remaining amount is rejected.

For the rejected amount, they need to submit compelling documents in addition to those provided when rejecting the first chargeback (PDF file only). In addition, the merchant needs to select a response reason and add a response evidence description.The maximum file size is 10MB. The file name can be up to 45 characters, with no spaces and no special characters (such as @ . /). A maximum of four files can be uploaded.

Collaboration Actions

- Request for Refund – Merchant requests to refund a transaction, Mastercard initiates a refund. If the refund is processed successfully, it likely prevents a chargeback for that transaction.

- Ignore Collaboration – Merchant decides to ignore the case, the collaboration request is ignored, and it is likely that a chargeback is raised for the transaction.

Inquiry Request Actions

- Inquiry Response – The merchant sends a response in free text (mandatory), and can upload supporting documents (optional).

The maximum file size is 10MB. The file name can be up to 45 characters, with no spaces and no special characters (such as @ . /). A maximum of 4 files can be uploaded.

- Inquiry – Transaction Refund – The merchant requests to initiate a refund as a response to the inquiry. The refund is initiated automatically following this response.

Bulk Cases Handling

Different case types have different sets of actions. In bulk cases handling, the Select action dropdown is disabled if the user selects different type of cases and attempts to perform a bulk action.

For example, if the user selects two cases with different case type and different statuses, the Select action dropdown is disabled (not clickable) because each case has its own set of actions, which is not applicable to both of the cases simultaneously. So, in this scenario, the merchant needs to handle each case type separately.

Last modified August 2025

Last modified August 2025