Overview

Nuvei processes directly through Visa (Visa Direct) and Mastercard (MoneySend).

Performing a Visa Direct (OCT) action from the Control Panel or using an API is allowed according to Nuvei NA configuration.

The allowed percentage to be taken when performing an OCT action is based on the reserve in the client’s deposit account. By default, 80% of the deposit amount is taken as a reserve and is moved to the OCT account.

For example, if merchant processes $1,000 on day T, and the default configuration for OCT is 80%, the merchant can perform OCT actions up to $800 on T+1.

If the OCT available balance is not fully used, the remaining balance can be used on the following days.

Viewing the OCT Account Balance

To view the OCT account balance, a merchant needs to use the following reports: Transaction Report and Balance Report.

- To view the OCT transaction, go to Transaction Report and apply the following filters:

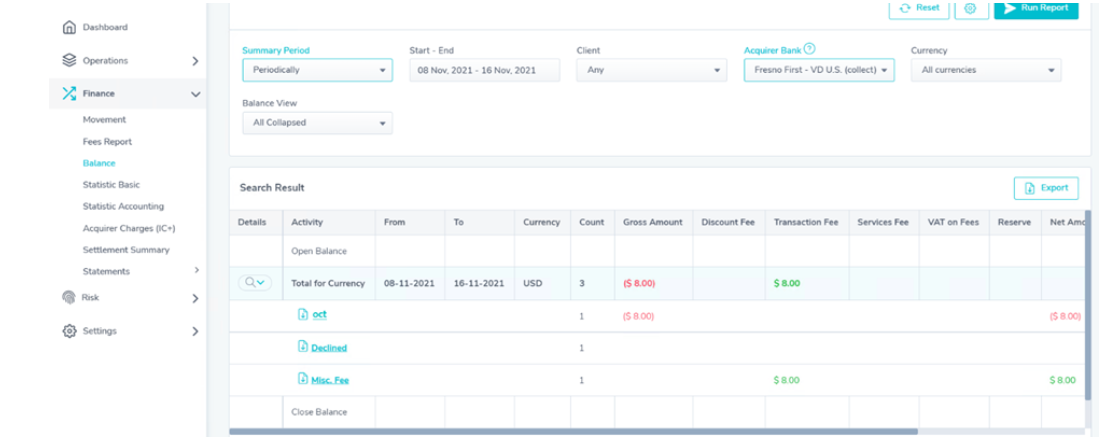

- To view the remaining OCT funds, the merchant should go to the Balance Report and apply the following filter for Acquirer Bank: Fresno First – VD U.S (collect) (when merchant managing company is in US) or Nuvei Acquirer CA (when merchant managing company is in Canada)

- In the Activity column, the value “Misc fee” is the daily reserve amount moved to the OCT account (80% of the amount) presented on transaction fee column.

- In the Activity column, the value “OCT” is the periodical OCT actions that were processed.

- In the Payments Balance column (presented under Close Balance), the value of the remaining OCT funds is presented (= Point 1 minus Point 2)

In the screenshot below, the daily reserve amount on the OCT account is $8. If a merchant performs an OCT transaction for $8, the amount on the OCT account becomes 0 (Close Balance is empty).

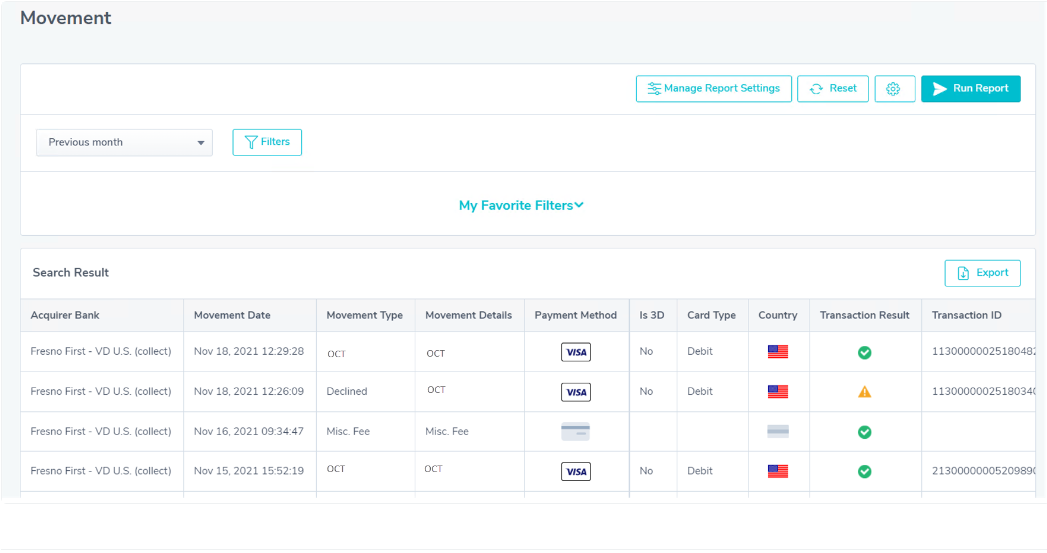

Reconciliation Using the Movement Report

A merchant can also perform reconciliation for OCT transactions using the Movement Report.

Last modified December 2024

Last modified December 2024