Overview

Chargebacks are transactions in which the cardholder has disputed the charges, shifting the financial liability for the transaction from the cardholder back to the merchant. Charges can occur due to:

- Fraud

- Consumer disputes

- Processing errors

When a chargeback occurs, the merchant may lose the amount of the transaction, any merchandise purchased, and incur additional fees. The cost of chargebacks can be quite significant. Nuvei provides several services for preventing chargebacks and disputing chargebacks should they occur.

For chargebacks with the reason “Services Not Provided”, “Goods Not Received,” or “Not as Described/Defective Merchandise”, disputes can be opened:

- Within 120 days of the date the customer expected to receive the goods/services, or

- Within 120 days of the date the customer was notified the goods/services were not provided.

In either case, the dispute must be processed by the card issuer within 540 days of the original transaction date.

Chargeback Types

There are two types of chargebacks in Nuvei’s system. Each chargeback type is described below.

Retrieval Request

A Retrieval Request occurs when a credit cardholder does not recognize a charge in their credit card’s monthly statement and asks their issuer bank for clarification. A retrieval request does not have any financial impact or any fees involved, but it may be a preliminary step before the card issuer initiates a Chargeback. At present, Retrieval Requests are available only for Amex, Diners, and Discover.

When you receive a Retrieval Request, you have two options:

- Crediting the transaction before it becomes a Chargeback – You may use this option when you are convinced that the order is fraudulent and you cannot validate the user’s identity.

- Defending the case by uploading documents for re-presentment through the Control Panel.

The time frame to re-present a Retrieval Request is 30 days after the retrieval date, which includes your time to review, prepare, and provide the documents, and operational time needed by Nuvei to handle the request. We strongly advise you to send us the documents within 7 days to ensure that the request is handled in a timely manner.

If you decide to respond to the Retrieval Request, as it is only a request for more information, it can be represented with fewer documents, like more details on the transaction, your comments, and screenshots from the system.

Regular Chargeback

A Regular Chargeback occurs when a cardholder disputes a charge on their monthly statement. When a Regular Chargeback is received, it means that the issuer bank has already refunded the money back to the cardholder. In the case of a Regular Chargeback the merchant is charged for the Chargeback amount and the Chargeback handling fee.

Chargeback Life Cycle

Visa Dispute Life Cycle

Allocation Dispute Process

Under Allocation disputes are categorized the Fraud related disputes, i.e., the ones with the category Fraud and Authorization.

Under Allocation disputes are categorized the Fraud related disputes, i.e., the ones with the category Fraud and Authorization.

The dispute flow is as follows:

- You have processed a successful transaction called Presentment, and it appears in our system as a Sale/Settle transaction type. The money is transferred to your account through the Acquirer.

- If the cardholder initiates a Dispute, the money is transferred from your account to the Issuer. In our system, it appears as Regular Chargeback.

- In case you are willing to contest the chargeback, you need to send documents to the Acquirer within 30 days from the original Chargeback date. By re-presenting the dispute, you raise a Pre-Arbitration, where the funds are still in the possession of the issuer, i.e., the liability of the dispute is still on the Merchant’s/Acquirer’s side.

- Within 30 days, the Issuer should decide whether to Reject or Accept the Pre-Arbitration.

- If the Issuer accepts the Pre-arbitration, the Chargeback status is updated as canceled in our system.

- If the Issuer rejects the argumentation, they send a Pre-Arbitration response, then the Acquirer decides whether to Accept or Reject this Pre-Arbitration response.

- If the Acquirer/merchant accepts the Pre-Arbitration response, the case would be decided in the Issuer’s favor; then the Issuer keeps the money. In our system, the Chargeback remains with the status Regular.

- If the Acquirer/Merchant rejects the Pre-Arbitration response, there is an option to raise an Arbitration within 10 days of the original Pre-Arbitration Response date, where the case is decided by Visa. By raising an Arbitration, the merchant needs to be sure that the full list of compelling evidence is provided.

- At the Arbitration Stage, when the Dispute and Re-presentments process fails to resolve the case between the Issuer and the Acquirer, it is reviewed by Visa to assign liability for the disputed Transaction. Visa decides in which favor the case is resolved and assigns relevant fees to the liable part:

- If the dispute is closed in the cardholder’s favor, the Chargeback status remains with the status Regular.

- In case Visa rules in Merchant’s/Acquirer’s favor, the status changes to Canceled.

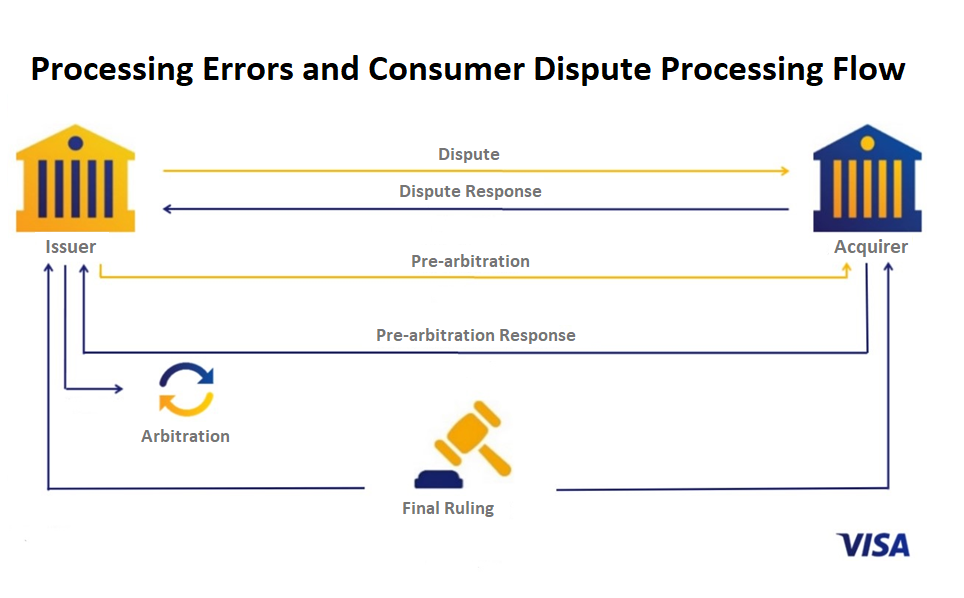

Collaboration Dispute Process

Under Collaboration, disputes are categorized the Service-related disputes, i.e., the ones under the category Processing Errors and Consumer Disputes.

The process is as follows:

- You have a successful transaction, which is called Presentment. In the Nuvei system, it appears as a Sale/Settle transaction type. The money is then transferred to the Merchant account through the Acquirer.

- In case the user initiates a Dispute, the money is transferred from your Merchant’s account to the Issuer. In the Nuvei system, it appears as Regular Chargeback.

- To re-present the dispute, you need to send documents within 30 days of the original dispute date so that a Re-presentment is sent to the Issuer. During this step of the Dispute process, the money is again being transferred to the Acquirer’s/Merchant’s side – the Chargeback is updated with the status “canceled” in the Nuvei system.

- Within 30 days, the Issuer should decide whether to Accept or Reject the argumentation.

- If they Accept it, the case remains with status canceled in our system.

- If they Reject it, they raise a Pre-Arbitration. Then the Acquirer decides whether to accept or reject this Pre-Arbitration.

- If the Acquirer/Merchant accepts the Pre-Arbitration, the case is resolved in the Issuer’s favor; the money is then transferred to the Issuer. In the Nuvei system, such cases are updated as Chargebacks with status Duplicate.

- If the Acquirer/Merchant rejects the Pre-Arbitration, the Merchant must respond within 30 days, and a Pre-Arbitration response must be filed. Within 10 days, the Issuer has the right to escalate the case to Arbitration.

- At the Arbitration Stage, the case is being reviewed by Visa to assign liability for the disputed Transaction. Visa decides in whose favor the case is resolved, and assigns fees to the liable part.

- If the dispute is ruled in the issuer’s favor, the status of the Chargeback changes to Duplicate.

- In case Visa rules in Merchant’s/Acquirer’s favor, the status remains Canceled.

In addition, Visa limits the numbers of raising disputes, and Issuers may charge back a maximum of 35 transactions on a single PAN within a 120-day period.

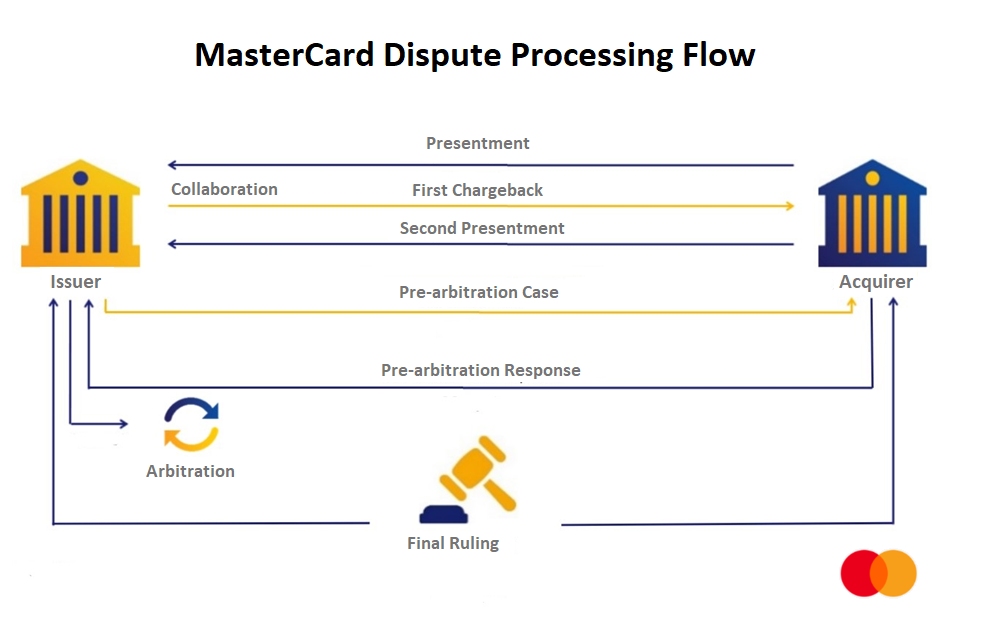

Mastercard Dispute Life Cycle

- You have a successful transaction, which is called First Presentment, and in our system appears as Sale/Settle transaction type. The money is transferred to the Merchant’s account through the Acquirer.

- If the user initiates First Chargeback, the money is transferred from your account to the Issuer. In our system, it appears as a Regular Chargeback.

- To re-present the chargeback, you need to send documents within 45 days so that Second Presentment is sent to the Issuer. During this step of the dispute process, the money is again transferred to the Merchant. The Chargeback is updated with status Canceled in our system.

- If the Issuer rejects the documents, it has 30 days after the Re-presentment to raise a Pre-arbitration.

- If the Acquirer accepts the Pre-arbitration, the case is closed in favor of the Issuer, and the status of the case is changed to Duplicate).

- If the merchant wishes to continue further with the dispute, they could respond with Pre-Arbitration Response along with new evidence. If the Merchant submits a pre-arbitration response, the case likely advances to arbitration.

- Arbitration – At this stage, Mastercard decides which party is liable for the transaction, and relevant fees are applied to the liable part. If Mastercard decides the dispute in the issuer’s favor, the status of the Chargeback is updated to Duplicate. If the case is resolved in the Merchant’s favor, the status remains Canceled.

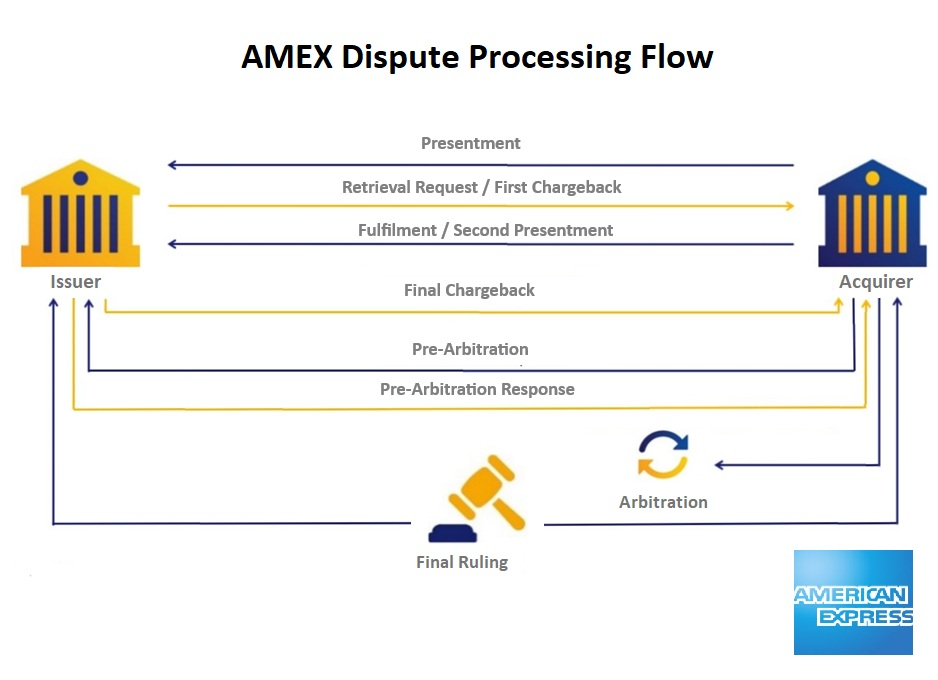

Amex Dispute Life Cycle

The Amex Dispute process consists of the following stages:

1. Retrieval Request

A message sent by the Issuer to the Amex Network by which the Issuer requires a copy of the Record of Charge (ROC) or other Documentation in relation to a dispute claim. The three (3) most common reasons for an Issuer to initiate a Retrieval Request are to:

- Satisfy a Cardholder inquiry

- Substantiate a Chargeback

- Support a legal or fraud investigation

Retrieval requests can be received for a period of one (1) year (or as required by local law) following the Network Processing Date of the Presentment.

2. Fulfilment

Fulfillment is the transfer of Documentation from the Acquirer to the Issuer in response to the Issuer’s Retrieval Request. Failure to provide the necessary response within 30 calendar days of the date of the Retrieval Request will lead to a limitation of the representment rights.

3. First Chargeback

A chargeback may be filed only for those Transactions where financial liability resides with the Issuer at the time of the Chargeback. Any Transaction that is not disputed by the Cardholder may not be charged back to the Acquirer regardless of whether or not it was in violation of Network policies except for processing errors. Issuers must file a First Chargeback within 120 days from the Network Processing Date of the First Presentment of the disputed Transaction, unless otherwise specified in the applicable rule.

4. Second Presentment / Representment

If the Acquirer determines (based on a review of the item, any further supporting Documentation provided by the Merchant, and the relevant Network policies) that there is sufficient justification to dispute the First Chargeback, a Second Presentment may be filed thereby moving the financial liability from the Acquirer back to the Issuer. Acquirers must file a Second Presentment within twenty (20) days from the Network Processing Date of the First Chargeback.

5. Final Chargeback

The Issuer determines (based on a review of the Second Presentment, First Chargeback supporting Documentation, and any further supporting Documentation provided by the Acquirer, and the relevant Network policies) if there is sufficient justification to dispute the Second Presentment. A Final Chargeback can be filed with the Network within forty-five (45) days from the Network Processing Date of the Second Presentment. The Chargeback Policies reason code used for a Final Chargeback does not have to be identical to that used for the First Chargeback, but restrictions may apply to modifications of the reason code if changing from a non-fraud type to a fraud type. If the Documentation supplied with the Second Presentment reveals a more appropriate and better supported reason for charging back the Transaction, the Issuer may use that reason.

6. Pre-Arbitration

Acquirers are strongly encouraged, but not required, to pursue a pre-Arbitration attempt prior to submitting an Arbitration Filing.

7. Arbitration

An Acquirer may submit an Arbitration Filing with the AMEX Arbitration Committee if they determine (based on a review of the Final Chargeback, any further supporting Documentation provided by the Issuer, and the relevant Network policies) that there is sufficient justification to dispute the Final Chargeback. An Arbitration Filing must be submitted through AEGNS Network Disputes Manager with all related Documentation within forty-five (45) days from the Network Processing Date of the Final Chargeback.

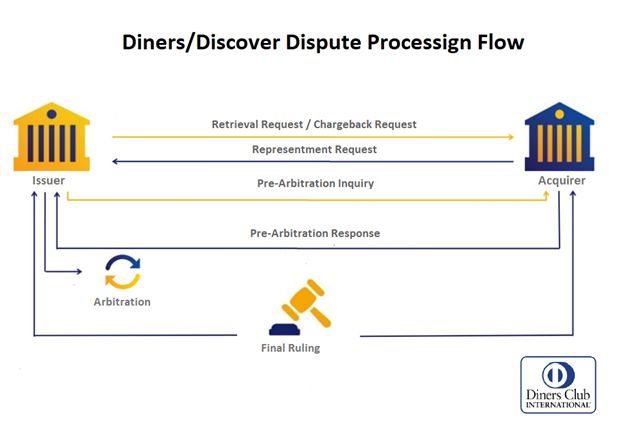

Diners / Discover Dispute Life Cycle

The DCI Chargeback process Consists of five unique stages:

1. Retrieval Request

A request by an Issuer for a copy of the receipt and/or additional documentation related to a card charge. An Issuer has up to 365 days to submit a Retrieval Request. A Retrieval Response is provision of the receipt and/or documentation. The merchant has up to 30 days to respond to a Retrieval Request from the date sent.

2. Chargeback Request

A request by an Issuer submitted to DCI to dispute a settled charge. A Chargeback Request might occur due to an incomplete response or lack of response to a Retrieval Request, or a Cardholder submitting compelling evidence to support a Chargeback. The Issuer has 120 days from the charge date (or 30 days from the Retrieval Request date, if requested), to initiate a Chargeback. A Chargeback is a transaction processed by DCI that reverses the entire amount or a portion of a card charge.

3. Representment Request

A Merchant response to a Chargeback is called a Representment, or a Representment Request. A Representment is a transaction processed by DCI that reverses all or a portion of a Chargeback. The merchant has up to 30 days to initiate a Representment Request in response to a Chargeback.

4. Pre-Arbitration Inquiry

A request by an Issuer for the reversal of a Representment that has been processed by DCI in connection with a Chargeback. The Issuer has up to 30 days to initiate a Pre-Arbitration Inquiry. Then, the merchant has up to 30 days to respond to a Pre-Arbitration Inquiry with an ‘Accept’ or ‘Deny’ response.

If the merchant chooses to accept or does not respond to the Pre Arbitration request, there is a credit to the Issuing Participant and a debit to the merchant. If the merchant denies financial liability, there is no financial impact, and the Issuing Participant may choose to progress to the Arbitration stage.

5. Dispute Arbitration Request

If an Issuer disagrees with the response of the Pre-Arbitration Inquiry, they may submit a Dispute Arbitration request to DCI within 10 days from merchant’s response. The merchant has up to 15 days to provide additional information / documentation, if available.

A Dispute Arbitration is a holistic review conducted by DCI. A dispute Arbitration decision is the final and non-appealable action regarding a disputed charge. Either side may accept financial responsibility within 15 days of the dispute arbitration notice, known as the arbitration acceptance period. The party receiving the favorable Dispute Arbitration decision will receive a credit, whereas the opposing party will receive a debit for the Dispute Arbitration amount.

Dispute Process

Nuvei handles disputes on behalf of clients. When you receive a Chargeback, you are required to supply supporting documents, which are contesting the cardholder’s claims. When successfully disputed, the issuer cancels the Chargebacks, and merchants can view the cancelations in Nuvei’s online reports.

Nuvei recommends that you dispute every Chargeback for which you have sufficient evidence. Nuvei automatically disputes Chargebacks received for previously refunded or fully authenticated transactions. Nuvei still recommends that you upload re-presentment documents if such are available.

If you have any questions on the Chargeback dispute process, please send your inquiries to: [email protected].

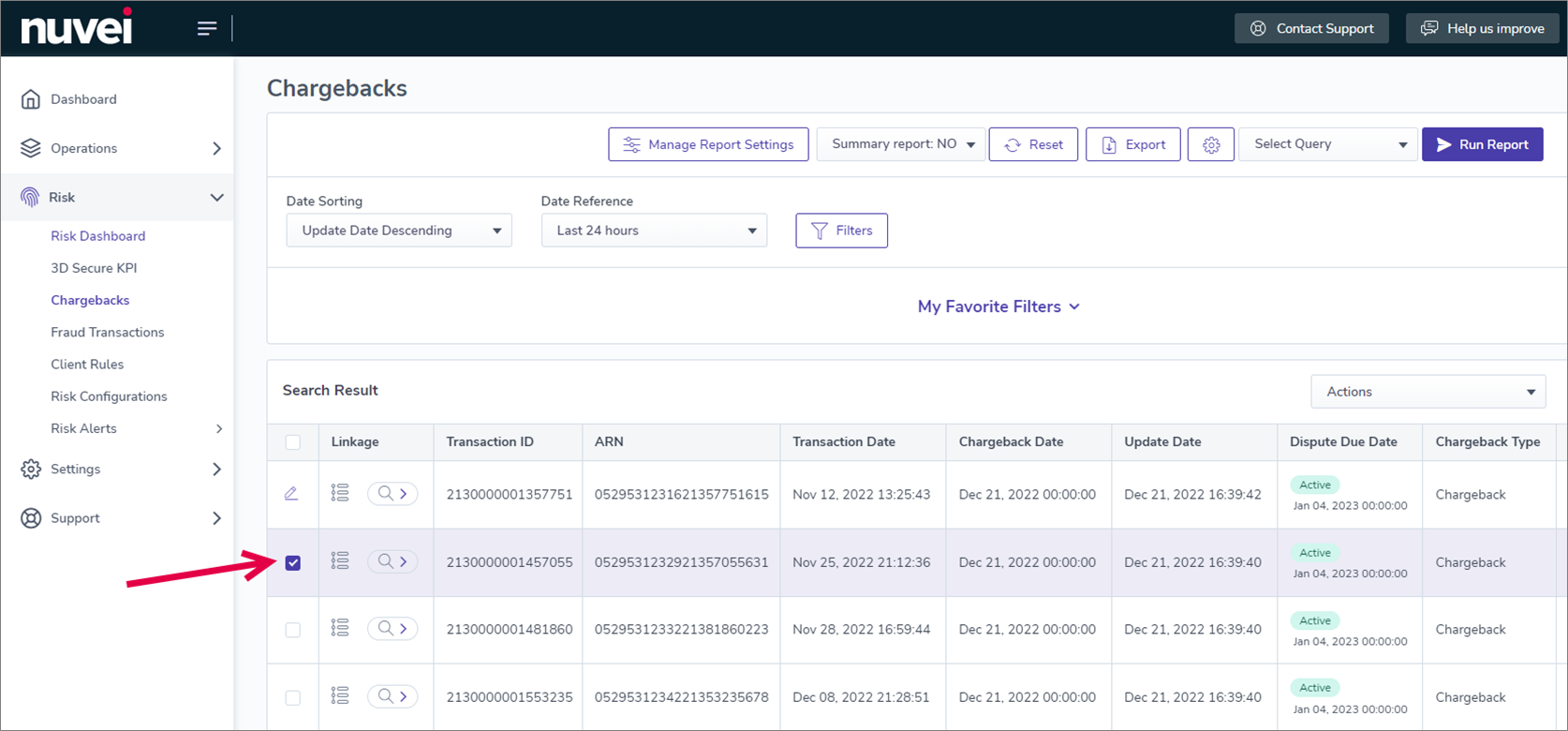

Contesting a Chargeback

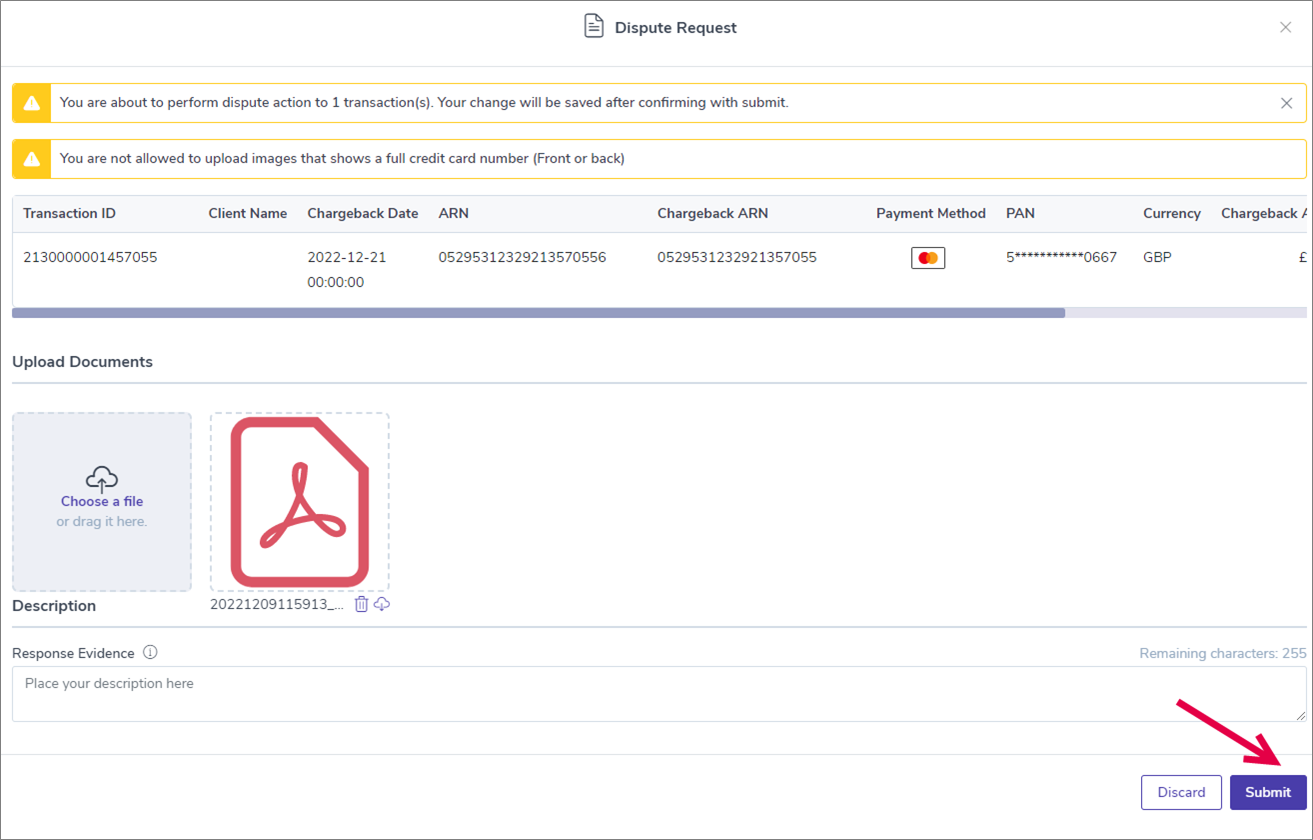

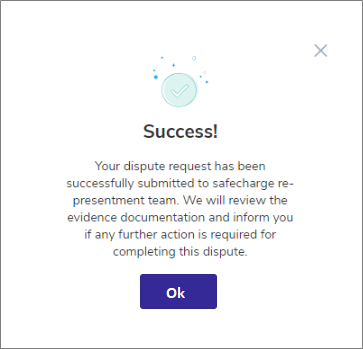

If a Merchant wishes to contest a dispute, this can be done through the Chargebacks Report page in the Nuvei Control Panel.

The feature is available for all Nuvei Acquiring banks and card brands and correlates with Nuvei’s Dispute Team’s queue.

To initiate a Dispute request, you must follow the below steps:

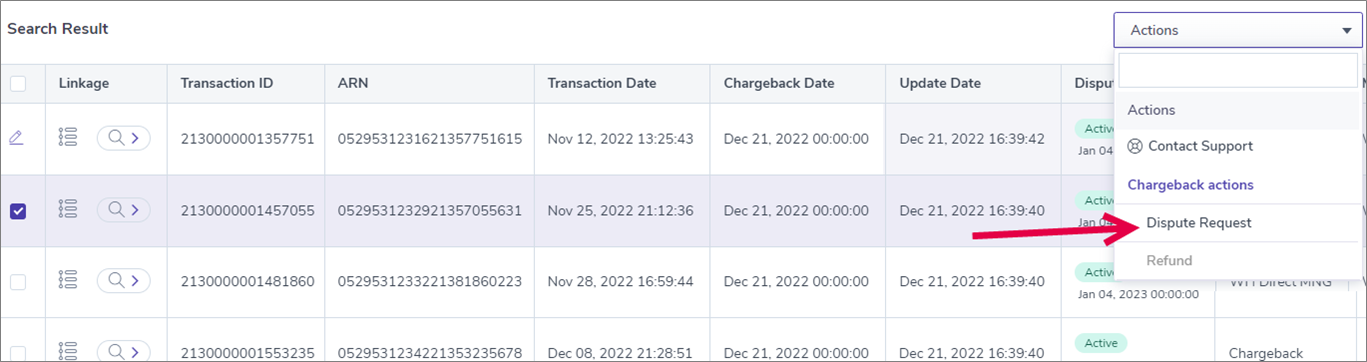

- Select the Chargebacks you wish to dispute – From the Chargebacks Report page or the Chargebacks Summary Report page, select the chargeback(s) you wish to dispute (including a bulk selection if the chargebacks belong to the same PAN and Acquiring bank):

- Select the Dispute request button – On the lower left-hand corner of the screen and a Chargeback Dispute pop-up appears.

- Attach evidence documentation – Drag and drop the relevant document(s) in the Upload documents section and enter relevant free text in the Response evidence section of the Chargeback Dispute pop-up.

- Submit the request – Select Yes, submit and a confirmation appears. An edit icon is displayed instead of the checkbox in the respective chargeback row in the chargebacks report. You can press the icon to edit a previously opened dispute.

Requested representments are updated and tracked in Chargebacks Reports.

Once a request is submitted, it is reviewed by our Dispute Team. If there are any issues with the documentation, the Merchant is contacted by the Dispute Team.

For existing disputes, you can view an audit of evidence already submitted, and you can amend the request.

Requirements

- The file types for uploading are JPEG and PDF.

- Bear in mind that for Mastercard cases, only a PDF of up to 19 pages is acceptable.

- Each file should be with maximum size of 2 MB.

- You can upload maximum of 5 files per case.

- Filling information in the free text field is mandatory. There you can state your position on the case.

- Only cases with status Retrieval and Regular Chargeback can be represented.

- For Bulk re-presentment, the transactions should be processed with the same card and through one Acquirer only. If chargebacks from one card are processed through different Acquirers, they should be sent in a separate request.

- Supporting documents must be in English or include an English translation, unless both the issuer and the acquirer share a common language. Please note that any dispute-related documentation must be translated into English for the arbitration stage.

Chargeback Reason Codes and Documentation

In the section below, you may find information about all Chargeback reason codes as per the card scheme rules and the required documentation for each Chargeback reason code.

VISA

CHARGEBACK REASON CODES

| Chargeback Category | Chargeback Reason Code | Reason Description |

|---|---|---|

| FRAUD | 10.1 | EMV Liability Shift Counterfeit Fraud |

| 10.2 | EMV Liability Shift Non-Counterfeit Fraud | |

| 10.3 | Other Fraud-Card Present Environment | |

| 10.4 | Other Fraud-Card Absent Environment | |

| 10.5 | Visa Fraud Monitoring Program | |

| AUTHORIZATION | 11.1 | Card Recovery Bulletin |

| 11.2 | Declined Authorization | |

| 11.3 | No Authorization | |

| PROCESSING ERRORS | 12.1 | Late Presentment |

| 12.2 | Incorrect Transaction Code | |

| 12.3 | Incorrect Currency | |

| 12.4 | Incorrect Account Number | |

| 12.5 | Incorrect Amount | |

| 12.6 | Duplicate Processing/Paid by Other Means | |

| 12.7 | Invalid Data | |

| CONSUMER DISPUTES | 13.1 | Merchandise/Services Not Received |

| 13.2 | Cancelled Recurring | |

| 13.3 | Not as Described or Defective Merchandise/Services | |

| 13.4 | Counterfeit Merchandise | |

| 13.5 | Misrepresentation | |

| 13.6 | Credit Not Processed | |

| 13.7 | Cancelled Merchandise/Services | |

| 13.8 | Original Credit Transaction Not Accepted | |

| 13.9 | Non-Receipt of Cash or Load Transaction Value |

As per Visa Core Rules related to chargebacks for domestic US traffic, even though transactions are processed in 3D Secure, the merchants from the following industries are liable for the chargebacks.

Below is a list of industries identified as high risk:

- 4829 (Wire transfer money orders)

- 5967 (Direct Marketing – Inbound teleservices merchant)

- 6051 (Non-financial institutions – Foreign currency, non-fiat currency/cryptocurrency, money orders, travelers checks, and debt repayment)

- 6540 (Non-financial institutions: Stored value card purchase/load)

- 7801 (Government licensed online casinos/online gambling)

- 7802 (Government licensed horse/dog racing)

- 7995 (Betting, including lottery tickets, casino gaming chips, off track betting, and wagers at racetracks)

DISPUTE REQUIRED DOCUMENTATION

FRAUD

Reason Code 10.1 – EMV Liability Shift Counterfeit Fraud

Description:

The Cardholder denies authorization of or participation in the Transaction, and the Card is a PIN-Preferring Chip Card, but EMV authentication was not performed as required.

Supporting Documentation:

- A credit or Reversal issued by the Merchant was not addressed by the Issuer in the Dispute.

- The Cardholder no longer disputes the Transaction.

- The Dispute is invalid.

- Compelling Evidence proving the transaction was instructed by the Cardholder (US region). For a US Domestic Card-Present Environment Transaction that is key-entered and did not take place at a Chip-Reading Device, either:

- Evidence that the same Card used in the disputed Transaction was used in any previous or subsequent Transaction that was not disputed.

- Copy of both:

- Identification presented by the Cardholder.

- Receipt, invoice, or contract with information that links to the identification presented by the Cardholder.

- For pre-Arbitration attempts in US region, the following Compelling Evidence is needed for a delayed charge Transaction:

-

- Evidence that the Transaction relates to a prior stay, trip, or rental period (for example, a parking violation that occurred during the rental).

- Evidence that an Imprint was obtained at a Chip reading device during the same stay, trip, or rental (including any approved Authorization containing an Electronic Imprint).

-

- In all other regions, for a delayed charge Transaction evidence of one of the following:

-

- Evidence that the Transaction relates to a prior stay, trip, or rental period (for example, a parking violation that occurred during the rental).

- Evidence that an Imprint was obtained at a Chip reading device during the same stay, trip, or rental (including any approved Authorization containing an Electronic Imprint).

-

Reason Code 10.2 – EMV Liability Shift Non-counterfeit Fraud

Description:

The Cardholder denies authorization of or participation in the Transaction, and the Card is a PIN-Preferring Chip Card, but EMV authentication was not performed as required.

Supporting Documentation:

- A credit or Reversal issued by the Merchant was not addressed by the Issuer in the Dispute.

- The Cardholder no longer disputes the Transaction.

- The Dispute is invalid.

- Compelling Evidence for a delayed charge Transaction, both:

- Evidence that the Transaction relates to a prior stay, trip, or rental period (for example, a parking violation that occurred during the rental).

- Evidence that an Imprint was obtained at a Chip reading device that was EMV PIN-Compliant during the same stay, trip, or rental (including any approved Authorization containing an Electronic Imprint).

Reason Code 10.3 – Other Fraud-Card Present Environment

Description:

The Cardholder denies authorization or participation in a key-entered Transaction conducted in a Card-Present Environment.

Supporting Documentation:

- A credit or Reversal issued by the Merchant was not addressed by the Issuer in the Dispute.

- The Dispute is invalid.

- The Cardholder no longer disputes the Transaction.

- Compelling Evidence for a delayed charge Transaction, both:

- Evidence that the Transaction relates to a prior stay, trip, or rental period (for example, a parking violation that occurred during the rental)

- Evidence that an Imprint1 was obtained during the same stay, trip, or rental (including any approved Authorization containing an Electronic Imprint)

- For a US Domestic Card-Present Environment Transaction that is key-entered and did not take place at a Chip-Reading Device, compelling evidence is either:

- Evidence that the same Card used in the disputed Transaction was used in any previous or subsequent Transaction that was not disputed

- Copy of both:

- Identification presented by the Cardholder

- Receipt, invoice, or contract with information that links to the identification presented by the Cardholder.

- In all regions except US, for pre-Arbitration attempts for a delayed charge Transaction compelling evidence is both:

- Evidence that the Transaction relates to a prior stay, trip, or rental period (for example, a parking violation that occurred during the rental).

- Evidence that an Imprint1 was obtained during the same stay, trip, or rental (including any approved Authorization containing an Electronic Imprint).

- Or evidence of an imprint

- A pencil rubbing or a photocopy of a Card is not considered as valid imprint.

Reason Code 10.4 – Other Fraud-Card Absent Environment

Description:

The Cardholder denies authorization of or participation in a Transaction conducted in a Card-Absent Environment and the transaction was not properly authenticated.

Supporting Documentation:

- Evidence that one of the following:

- A credit or Reversal issued by the Merchant was not addressed by the Issuer in the Dispute.

- The Cardholder no longer disputes the Transaction.

- Compelling Evidence

- For pre-Arbitration attempts for a delayed charge Transaction both:

- Evidence that the Transaction relates to a prior stay, trip, or rental period (for example, a parking violation that occurred during the rental).

- Evidence that an Imprint was obtained during the same stay, trip, or rental (including any approved Authorization containing an Electronic Imprint).

- For pre-Arbitration attempts the same Payment Credential was used in 2 previous Transactions that the Issuer did not report as Fraud Activity to Visa and was processed between 120 and 365 calendar days prior to the Dispute date, all of the following:

- A detailed description of merchandise or services purchased for the disputed Transactions and the 2 previous Transactions.

- Certification of all of the following:

- Date/time the merchandise or services were provided

- The device ID, device fingerprint, or the IP address and an additional one or more of the following in the undisputed Transaction(s) are the same as the disputed Transaction, as applicable:

- Customer account/login ID

- Full delivery address including house number, street name, city, zip/postal code, and country

- Device ID/device fingerprint

- IP address

- For pre-Arbitration attempts for an Airline Transaction, evidence that the Cardholder name is included in the manifest for the departed flight and matches the Cardholder name provided on the purchased itinerary.

- Photographic or email evidence to prove a link between the person receiving the merchandise or services and the Cardholder, or to prove that the Cardholder disputing the Transaction is in possession of the merchandise and/or is using the merchandise or services.

- For a Card-Absent Environment Transaction in which the merchandise is collected from the Merchant location, any of the following:

- Cardholder signature on the pick-up form

- Copy of identification presented by the Cardholder

- Details of identification presented by the Cardholder

- For a Card-Absent Environment Transaction in which the merchandise is delivered, evidence that the item was delivered to the same physical address for which the Merchant received an AVS match of Y or M. A signature is not required as evidence of delivery.

- For an Electronic Commerce Transaction representing the sale of digital goods downloaded from a Merchant’s website or application, description of the merchandise or services successfully downloaded, the date and time such merchandise or services were downloaded, and 2 or more of the following:

- Purchaser’s IP address and the device geographical location at the date and time of the Transaction

- Device ID number and name of device (if available)

- Purchaser’s name and email address linked to the customer profile held by the Merchant

- Evidence that the profile set up by the purchaser on the Merchant’s website or application was accessed by the purchaser and has been successfully verified by the Merchant before the Transaction Date

- Evidence that the Merchant’s website or application was accessed by the Cardholder for merchandise or services on or after the Transaction Date

- Evidence that the same device and Card used in the disputed Transaction were used in any previous Transaction that was not disputed

- For a Transaction in which merchandise was delivered to a business address, evidence that the merchandise was delivered and that, at the time of delivery, the Cardholder was working for the company at that address. A signature is not required as evidence of delivery.

- For a Mail/Phone Order Transaction, a signed order form

- For a passenger transport Transaction, evidence that the services were provided and any of the following:

- Evidence that the ticket was received at the Cardholder’s billing address

- Evidence that the ticket or boarding pass was scanned at the gate

- Details of frequent flyer miles relating to the disputed Transaction that were earned or redeemed, including address and telephone number that establish a link to the Cardholder

- Evidence of any of the following additional Transactions related to the original Transaction: purchase of seat upgrades, payment for extra baggage, or purchases made on board the passenger transport

- For a T&E Transaction, evidence that the services were provided and either:

- Details of loyalty program rewards earned and/or redeemed including address and telephone number that establish a link to the Cardholder

- Evidence that an additional Transaction or Transactions related to the original Transaction, such as the purchase of T&E service upgrades or subsequent purchases made throughout the T&E service period, were not disputed

- For a virtual Card Transaction at a Lodging Merchant, evidence of the Issuer’s payment instruction sent through Visa Payables Automation, containing all of the following:

- Issuer statement confirming approved use of the Card at the Lodging Merchant

- Payment Credential

- Guest name

- Name of the company (requestor) and either their phone number, fax number, or email address

- For pre-Arbitration attempts for a Card-Absent Environment Transaction, evidence that 3 or more of the following had been used in an undisputed Transaction:

- Customer account/login ID

- Delivery address

- Device ID/device fingerprint

- Email address

- IP address

- Telephone number

- Evidence that the Transaction was completed by a member of the Cardholder’s household or family

- Evidence of one or more non-disputed payments for the same merchandise or service

- For a Recurring Transaction, evidence of all of the following:

- A legally binding contract held between the Merchant and the Cardholder

- The Cardholder is using the merchandise or services

- A previous Transaction that was not disputed

- In the Europe Region: Evidence that the initial Transaction to set up a wallet was completed using Visa Secure but any subsequent Transaction from the wallet that was not completed using Visa Secure contained all wallet-related Transaction data.

- For pre-Arbitration attempts for a delayed charge Transaction both:

Reason Code 10.5 – Visa Fraud Monitoring Program

Description:

Visa notified the Issuer that the Transaction was identified by the Visa Fraud Monitoring Program and the Issuer has not successfully disputed the Transaction under another Dispute condition.

Supporting Documentation:

- A credit or Reversal issued by the Merchant was not addressed by the Issuer in the Dispute.

- The Cardholder no longer disputes the Transaction.

- The Dispute is invalid.

AUTHORIZATION

Reason Code 11.1 – Card Recovery Bulletin

Description:

The Merchant did not obtain Authorization, or on the Transaction Date, the Account Number was listed in the Card Recovery Bulletin for the respective region.

Supporting Documentation:

- Evidence that one of the following:

- A credit or Reversal issued by the Merchant was not addressed by the Issuer in the Dispute.

- The Cardholder no longer disputes the Transaction.

- For a dispute involving a Transaction at a Car Rental Merchant, a Cruise Line Merchant, or a Lodging Merchant for which multiple authorizations were obtained, evidence that the Account Number was not listed on the Card Recovery Bulletin on the following dates, as applicable:

- For a Lodging Merchant, the check-in date

- For a Car Rental Merchant, the vehicle rental date

- For a Cruise Line, the embarkation date

Reason Code 11.2 – Declined Authorization

Description:

An Authorization Request received a Decline Response or Pickup Response and the Merchant completed the Transaction.

Supporting Documentation:

- Evidence that a credit or Reversal issued by the Merchant was not addressed by the Issuer in the Dispute.

- Evidence that the Cardholder no longer disputes the Transaction.

- The Dispute is invalid.

- Evidence that the Transaction was Chip-initiated and offline-authorized, if applicable.

- For a dispute involving a Transaction at a Car Rental Merchant, a Cruise Line Merchant, or a Lodging Merchant for which multiple authorizations were obtained, certification of all the following:

- The check-in date, embarkation date, or vehicle rental date.

- The checkout date, disembarkation date, or vehicle return date.

- The dates, authorized amounts, and Authorization Codes of the approved Authorizations.

Reason Code 11.3 – No Authorization

Description:

Authorization was required but was not obtained as required.

Supporting Documentation:

- Evidence of any of the following:

- A credit or Reversal issued by the Merchant was not addressed by the Issuer in the Dispute.

- The Cardholder no longer disputes the Transaction.

- Evidence that the Transaction Date in the Clearing Record was incorrect and that Authorization was obtained on the actual Transaction Date.

- For a dispute involving special Authorization procedures where all the following apply:

- The first Authorization Request included the initial/Estimated Authorization Request indicator.

- Subsequent Authorization Requests included the Incremental Authorization Request indicator.

- The same Transaction Identifier was used in all Authorization Requests.

- Clearing Records were submitted within the necessary time frames.

Both:

-

- The Transaction Receipt or Substitute Transaction Receipt.

- Certification of all the following:

- The date the Transaction was initiated.

- The date the Transaction was completed.

- The dates, authorized amounts, and Authorization Codes of the approved Authorizations.

PROCESSING ERRORS

Reason Code 12.1 – Late Presentment

Description:

The Transaction was not processed within the required time limit for clearing.

Supporting Documentation:

- Evidence that a credit or Reversal issued by the Merchant was not addressed by the Issuer in the Dispute.

- Evidence that the Cardholder no longer disputes the Transaction.

- The Transaction Receipt or other record with a Transaction Date that disproves late Presentment and obtained the required authorization.

Reason Code 12.2 – Incorrect Transaction Code

Description:

A credit was processed as a debit, or a debit was processed as a credit, or a credit refund was processed instead of a Reversal or an Adjustment.

Supporting Documentation:

- For a credit processed as a debit or a debit processed as a credit, either:

- Evidence that a credit or Reversal issued by the Merchant was not addressed by the Issuer in the Dispute.

- Transaction Receipt or other record that proves that the Transaction code was correct.

- For a credit refund that was processed instead of a Reversal or an Adjustment, either:

- Evidence that a Reversal issued by the Merchant was not addressed by the Issuer in the Dispute.

- Explanation of why a Credit Transaction was processed instead of a Reversal or an Adjustment.

Reason Code 12.3 – Incorrect Currency

Description:

The Transaction Currency is different than the currency transmitted through VisaNet or Dynamic Currency Conversion (DCC) occurred and the Cardholder did not expressly agree to DCC or was refused the choice of paying in the Merchant’s local currency.

Supporting Documentation:

- Evidence that one of the following:

- A credit or Reversal issued by the Merchant was not addressed by the Issuer in the Dispute.

- The Cardholder no longer disputes the Transaction.

- Transaction Receipt or other record that proves that the Transaction currency was correct

- For a Dynamic Currency Conversion (DCC) transaction, either:

- For a Dispute Response in the Merchant’s local currency, both:

- Acquirer certification that the merchant is registered to offer DCC.

- A copy of the Transaction Receipt showing the Merchant’s local currency.

- For a Dispute Response in the DCC currency, all the following:

- Evidence that the Cardholder expressly agreed to DCC.

- Acquirer certification that the Acceptance Device requires electronic selection of DCC by the Cardholder and that the choice cannot be made by the Merchant.

- A copy of the Transaction Receipt showing the Merchant’s local currency (the local currency of the country where the Branch is located).

- For a Dispute Response in the Merchant’s local currency, both:

Reason Code 12.4 – Incorrect Account Number

Description:

The Transaction or Original Credit Transaction was processed using an incorrect Payment Credential.

Supporting Documentation:

- Evidence that a credit or Reversal issued by the Merchant was not addressed by the Issuer in the Dispute.

- Evidence that the Cardholder no longer disputes the Transaction.

- Transaction Receipt or other record to prove that the Account Number was processed correctly.

Reason Code 12.5 – Incorrect Amount

Description:

The Transaction amount is incorrect or an addition or transposition error occurred.

Supporting Documentation:

- A credit or Reversal issued by the Acquirer was not addressed by the Issuer in the Dispute.

- The Cardholder no longer disputes the Transaction.

- Transaction Receipt or other record to prove that Transaction Amount was correct.

Reason Code 12.6 – Duplicate Processing/Paid by Other Means

Description:

A single Transaction was processed more than once using the same Payment Credential on the same Transaction date, and for the same Transaction amount or the Cardholder paid for the same merchandise or service by other means.

Supporting Documentation:

- Evidence that a credit or Reversal issued by the Merchant was not addressed by the Issuer in the Dispute

- Evidence that the Cardholder no longer disputes the Transaction.

- For a Transaction that is not an ATM Transaction, either:

- Two separate Transaction Receipts or other record to prove that separate Transactions were processed.

- Evidence to prove that the Merchant did not receive payment by other means for the same merchandise or service.

Reason Code 12.7 – Invalid Data

Description:

Authorization was obtained using invalid or incorrect data, or the MCC used in the Authorization Request does not match the MCC in the Clearing Record of the first Presentment for the same Transaction.

Supporting Documentation:

Evidence of one of the following:

- A credit or Reversal issued by the Merchant was not addressed by the Issuer in the Dispute.

- The Cardholder no longer disputes the Transaction.

- The Authorization did not contain invalid data.

CONSUMER DISPUTES

Reason Code 13.1 – Merchandise/Services Not Received

Description:

The Cardholder participated in the Transaction, but the Cardholder did not receive the merchandise or services because the Merchant or Load Partner was unwilling or unable to provide the merchandise or services.

Supporting Documentation:

- A credit or Reversal issued by the Merchant was not addressed by the Issuer in the Dispute.

- The Cardholder no longer disputes the Transaction.

- Documentation to prove that the Cardholder or an authorized person received the merchandise or services at the agreed location or by the agreed date/time.

- For an Airline Transaction, evidence showing that the name is included in the manifest for the departed flight and it matches the name provided on the purchased itinerary.

- If the Dispute relates to canceled future services, the Dispute is invalid because the services were not canceled.

Reason Code 13.2 – Canceled Recurring Transaction

Description:

The Cardholder withdrew permission to charge the account for a Recurring / Installment Transaction.

Supporting Documentation:

- A credit or Reversal issued by the Merchant was not addressed by the Issuer in the Dispute

- The Cardholder no longer disputes the Transaction

- The Cardholder requested cancelation for a different date and that services were provided until this date

- The Merchant posts charges to Cardholders after services have been provided and that the Cardholder received services until the cancelation date

- Documentation to prove that service was not canceled.

- Documents to prove Merchant was not notified that account was closed.

Reason Code 13.3 – Not as Described or Defective Merchandise/Services

Description:

The merchandise or services did not match what was described during the purchase, were damaged or defective, or the Cardholder disputes the quality of the merchandise or services received.

Supporting Documentation:

- Evidence that one of the following:

- A credit or Reversal issued by the Merchant was not addressed by the Issuer in the Dispute.

- The Cardholder no longer disputes the Transaction.

- All the following:

- Evidence to prove that the merchandise or service matched what was described (including the description of the quality of the merchandise or service) or was not damaged or defective

- Merchant rebuttal to the Cardholder’s claims

- If applicable, evidence to prove that the Cardholder did not attempt to return the merchandise or certification that the returned merchandise has not been received.

- For a Dispute where a travel agency using a Visa Commercial Card Virtual Account has a contractual agreement with a T&E Merchant that covers the terms for specified services, evidence to prove that the terms of service included in the contractual agreement were as described or honored by the Merchant.

Reason Code 13.4 – Counterfeit Merchandise

Description:

The merchandise was identified as counterfeit by the owner of the intellectual property or its authorized representative, a customs agency, law enforcement agency, or a third-party expert.

Supporting Documentation:

- Evidence that a credit or Reversal issued by the Merchant was not addressed by the Issuer in the Dispute

- Evidence that the Cardholder no longer disputes the Transaction

- Documentation to support the Merchant’s claim that the merchandise was not counterfeit

Reason Code 13.5 – Misrepresentation

Description:

The Cardholder claims that the terms of sale were misrepresented by the Merchant.

Supporting Documentation:

- Evidence that a credit or Reversal issued by the Merchant was not addressed by the Issuer in the Dispute.

- Evidence that the Cardholder no longer disputes the Transaction.

- Evidence that the terms of sale were not misrepresented.

- For a Dispute relating to a Transaction in a Card-Absent Environment where merchandise or digital goods have been purchased through a trial period, promotional period, or introductory offer or as a one-off purchase, both:

- Proofs that, at the time of the initial Transaction, the Cardholder expressly agreed to future Transactions.

- Proofs that the Merchant notified the Cardholder of future Transactions at least 7 days before the Transaction Date.

Reason Code 13.6 – Credit Not Processed

Description:

The Cardholder received a credit or voided Transaction Receipt that was not processed.

Supporting Documentation:

- A credit or Reversal issued by the Merchant was not addressed by the Issuer in the Dispute.

- The Cardholder no longer disputes the Transaction.

Reason Code 13.7 – canceled Merchandise/Services

Description:

The Cardholder canceled the services and the Merchant did not process a credit or voided Transaction Receipt. The Merchant did not properly disclose or did disclose, but did not apply, a limited return or cancelation policy at the time of the Transaction; or in the Europe Region, the merchandise or services relate to an off premises, distance selling contract (as set out in the EU Directive) which is always subject to a 14-day cancelation period.

Supporting Documentation:

- Evidence that a credit or Reversal issued by the Merchant was not addressed by the Issuer in the Dispute

- Evidence that the Cardholder no longer disputes the Transaction

- The Transaction Receipt or other record to prove that the Merchant properly disclosed a limited return or cancelation policy at the time of the Transaction

- Evidence to demonstrate that the Cardholder received the Merchant’s cancelation or return policy and did not cancel according to the disclosed policy.

Reason Code 13.8 – Original Credit Transaction Not Accepted

Description:

An Original Credit Transaction was not accepted because either the recipient refused the Original Credit Transaction, or OCTs are prohibited by applicable laws or regulations.

Supporting Documentation:

- A Reversal issued by the Merchant was not addressed by the Issuer in the Dispute.

- The Dispute is invalid.

Reason Code 13.9 – Non-receipt of Cash or Load Transaction Value

Description:

The Cardholder participated in the Transaction and did not receive cash or received a partial amount.

Supporting Documentation:

- A Reversal issued by the Merchant was not addressed by the Issuer in the Dispute.

- The Cardholder no longer disputes the Transaction.

- A copy of the ATM Cash Disbursement Transaction or Load Transaction.

- A record containing at least the following:

- Account Number

- Transaction time or sequential number that identifies the individual Transactions.

- Indicator that confirms that the ATM Cash Disbursement or Load Transaction value was successful.

Compelling Evidence

Visa requires the compelling evidence elements to have the following characteristics:

- Customer account / login ID:

- Must contain only one value

- Must be a unique identifier that the cardholder used to authenticate on the merchant’s e-commerce site or application at the time of the transaction, and must be a value that the cardholder recognizes

- Must be in clear text and not hashed

- IP address:

- Must be the cardholder’s public IP address

- Must be in clear text and not hashed

- Must meet prevalent industry formats, which are currently IPV4 and IPV6

- Device ID:

- Must be a unique identifier of the cardholder’s device that the cardholder can verify, such as a device serial number (e.g, International Mobile Equipment Identity [IMEI])

- Must be at least 15 characters

- Must be in clear text and not hashed

- Device fingerprint:

- Can be derived from a combination of at least two hardware and software attributes such as the operating system and its version or device model, etc.

- Must be at least 20 characters

- May be hashed

- Shipping address:

- Must be the cardholder’s full shipping address, including the street address, city, state / province / region (if applicable in the cardholder’s country), postal code and country

- Must be in clear text and not hashed

Mastercard

CHARGEBACK REASON CODES

| Chargeback Category | Chargeback Reason Code | Reason Description |

|---|---|---|

| Authorization-Related Chargebacks | 4807 | Warning Bulletin File |

| 4808 | Requested/Required Authorization Not Obtained | |

| 4812 | Account Number Not on File | |

| Fraud-Related Chargebacks | 4837 | No Cardholder Authorization |

| 4840 | Fraudulent Processing of Transactions | |

| 4849 | Questionable Merchant Activity | |

| 4870 | Chip Liability Shift | |

| 4871 | Chip/PIN Liability Shift | |

| Errors in Processing or Procedure | 4802 | Requested/Required Item Illegible or Missing |

| 4831 | Transaction Amount Differs | |

| 4834 | Duplicate Processing | |

| 4846 | Correct Transaction Currency Code Not Provided | |

| 4850 | Installment Billing Dispute | |

| 4863 | Cardholder Does Not Recognize – Potential Fraud | |

| Cardholder Disputes | 4841 | Canceled Recurring Transaction |

| 4853 | Cardholder Dispute – Defective/Not as Described | |

| 4854 | Cardholder Dispute – Not Elsewhere Classified (U.S. Region Only) | |

| 4855 | Goods or Services Not Provided | |

| 4859 | Addendum, No-show, or ATM Dispute | |

| 4860 | Credit Not Processed | |

| 4999 | Domestic Chargeback Dispute (Europe region only) |

DISPUTE REQUIRED DOCUMENTATION

Authorization-Related Chargebacks

An authorization-related chargeback may be submitted in one of the following situations:

- Authorization was required but not obtained.

- The primary account number (PAN) does not exist.

- An offline chip-approved purchase transaction or other transaction not requiring online authorization by the issuer was presented in clearing more than seven-calendar days after the transaction date (meaning day eight).

- A refund transaction was presented in clearing more than five-calendar days after the transaction date (meaning day six). For a refund transaction, the transaction date is the date on which the merchant agreed to provide a refund to the cardholder (the refund transaction receipt date, or if the refund transaction was authorized by the issuer, then the refund transaction authorization approval date).

- The authorization chargeback protection time period had expired for the presentment (meaning seven days for final or undefined authorizations and 30-calendar days for pre-authorizations) and one of the following:

- For a transaction occurring at a merchant located in the Europe Region, the account was permanently closed before the chargeback was processed.

- For a transaction occurring at a merchant located in any other region, the issuer deemed the account not to be in good standing (a “statused” account) before filing the chargeback.

- A card-not-present authorization was declined by the issuer and subsequently approved through Stand-In processing or X-Code with an approval response with the following exceptions:

- The issuer generated a decline response that included a value of 02 (Cannot approve at this time, try again later) in DE 48 (Additional Data-Private Use), subelement 84 (Merchant Advice Code).

- The issuer generated an approval response after previously declining the transaction.

- The merchant can prove that the cardholder initiated the authorization request.

4807 – Warning Bulletin File

Description:

A magnetic stripe transaction under MCC 4784, 5499, 7523, 7542; or the transaction amount was greater than the CVM limit (EUR 50 in Europe / USD 40 in rest of the world); or it occurred with an invalid card number / listed in the Warning Bulletin; or a positive online authorization was required in Europe region.

Supporting Documentation:

- Correct Merchant Location: The transaction date was incorrect or missing, and the acquirer can provide the correct date and show that the account was not listed on the correct date in the applicable Electronic Warning Bulletin.

- Authorized Transaction Face-to-Face: If Authorization was obtained via the magnetic stripe through the Mastercard Network, the acquirer can substantiate that the transaction was card-read because the Authorization shows the account number was electronically obtained from the card’s magnetic stripe, and that the cardholder account number was identical to the account number in the Authorization Request/100 message and First Presentment/1240 message were identical.

- Authorized Transaction Non–Face-to-Face: The acquirer properly identified the transaction as a non–face-to-face transaction in the Authorization record, and it received Authorization as specified in the Authorization Manual. For example, a properly identified non–face-to-face transaction must have a TCC of T in the Authorization request.

- Chip-DE 55 Not Provided in First Presentment/1240 Message:

- The acquirer can prove that the transaction was a valid chip transaction.

- The transaction did not require online Authorization and DE 55 and related data was not provided in the First Presentment/1240 message.

Account Number Not Listed in Region, Country, or Sub region of Electronic Warning Bulletin File- The acquirer can show that the account number was not listed in the applicable region, country, or sub-region of the Electronic Warning Bulletin File as of the transaction date.

4808 – Requested/Required Authorization Not Obtained

Description:

- Authorization was required, but was not properly obtained. A transaction may have multiple authorization or clearing records, e.g., several airline ticket transactions may be combined into one authorization record.

- The transaction occurred at a merchant located in the Europe region and the issuer permanently closed the account before processing the chargeback.

- The authorization was identified as a preauthorization and the transaction was presented or completed in more than 30-calendar days after the latest authorization approval date.

- The transaction occurred at a merchant located in any other region and the issuer deems the account not to be in good standing (a “statused” account) before processing the chargeback.

- The authorization was not identified as a preauthorization and the transaction was presented more than seven-calendar days after the authorization approval date.

- A Card-Not-Present authorization was declined by the issuer and subsequently approved in Stand-In or X-Code.

Supporting Documentation:

- Must be provided proof that the transaction has been Authorized by the issuer, CHIP, or stand-in (STIP).

- If the POS terminal has been offline and the amount of the transaction is equal or below 50 EUR/USD, the data record must state “POS Device not online”.

- Acquirers are not required to provide Authorization logs.

- Only airlines may split an Authorization into multiple presentments.

4812 – Account Number Not on File

Description:

The original transit transaction declined by the issuer was not a properly identified contactless transit aggregated transaction; or the issuer declined the original contactless transit aggregated transaction or a subsequent transit debt recovery transaction using a DE 39 (Response Code) value categorized as “Not Claimable”; or the acquirer or merchant did not fulfill the criteria for submitting an FRR claim transaction.

Supporting Documentation:

- Copy of imprinted TID.

- For card-read transactions that occurred at POI terminals that were not Authorized using the Mastercard Network, the acquirer must provide sufficient documentation to establish the card’s presence; for example, the acquirer’s Authorization log, electronic data capture log, or magnetic stripe reading (MSR) or hybrid terminal printer certification. The acquirer must explain clearly all such documentation in content and in usage. If the transaction occurred at an attended POI terminal, a copy of the printed terminal receipt must accompany the supporting documentation mentioned previously.

- An Authorization screen print and issuer fax, if available, to verify that the transaction was an Emergency Cash Disbursement.

In addition, the below representment options are available for all authorization-related chargebacks:

- PAN Mismatch: The Primary Account Number (PAN) in chargeback supporting documentation differs from the PAN included by the acquirer in the clearing record.

- Expired Chargeback Protection Period:

- The transaction was properly identified in authorization as a preauthorization, the transaction was presented within 30-calendar days of the preauthorization approval date, and was not reversed.

- The transaction was not properly identified in authorization as a preauthorization, the transaction was presented within seven-calendar days of the authorization approval date, and was not reversed.

- The transaction was properly identified in authorization as acquirer-financed or merchant-financed installment payment.

- The transaction was properly identified in authorization as a Mastercard contactless transit aggregated or transit debt recovery transaction.

- The transaction occurred at one of the following:

- A Europe region merchant location and the issuer has not permanently closed the account.

- A merchant located in any other region and the issuer has not “statused” the account (that is, the issuer considered the account to be in good standing at the time of the chargeback).

- Multiple Authorization Requests: Evidence of one of the following:

- The issuer-generated decline response included a Merchant Advice Code of 02 (Cannot approve at this time, try again later).

- The issuer generated an approval response after previously declining the transaction.

- For a card-not-present transaction, the merchant can prove that the cardholder resubmitted the online order.

- One Authorization with Multiple Clearing Records: Both of the following:

- One of the following indicators was present in DE 25 (Message Reason Code) of the First Presentment message

- 1403 (Previously approved authorization—partial amount, multi-clearing)

- 1404 (Previously approved authorization—partial amount, final clearing)

- The total of all clearing records submitted in connection with the approved authorization did not exceed the approved amount.

- One of the following indicators was present in DE 25 (Message Reason Code) of the First Presentment message

- CAT 3 Device: The transaction was not a magnetic stripe transaction identified as occurring at a CAT 3 device and the PAN was not listed in the applicable Local Stoplist or Electronic Warning Bulletin File on the date of the transaction and one or both of the following:

- The transaction was properly identified in clearing as a CAT 3 terminal.

- The transaction amount was equal to or less than the applicable maximum transaction amount.

- Credit Previously Issued: The merchant issued a credit to the cardholder’s account.

- The account received, and did not dispute, a Send Gaming Payment Transactions identified with C04-Gaming Repay in DE 48 (Additional Data: Private Use), sub element 77 (Transaction Type Identifier) that occurred after the disputed funding transaction.

- Other representment options:

- The combination of Primary Account Number and Acquirer Reference Data contained in the chargeback record does not match the information contained in the first presentment record;

- Duplicate Chargeback: The issuer processed a first chargeback for the same transaction more than once. Mastercard recommends that the Merchant provides the processing date and chargeback reference number of the original chargeback with its second presentment;

- The issuer’s first chargeback is processed past the time frame specified for the chargeback;

- Invalid Chargeback:

- The first chargeback does not meet the prerequisites for the message reason code.

Fraud Related Chargebacks

This section provides information in handling a dispute when the cardholder states that the cardholder did not engage in the transaction.

4837 – No Cardholder Authorization

Description:

The cardholder states that they did not engage in the transaction.

Supporting Documentation:

- PAN Mismatch: The Primary Account Number (PAN) in chargeback supporting documentation differs from the PAN included by the acquirer in the clearing record.

- Two or More Previous Fraud-related Chargebacks: The issuer approved the transaction after submitting two or more chargebacks involving the same Mastercard card account (for this purpose, “account” means primary account number [PAN], or PAN and expiration date).

- Fraud-related Chargeback Counter Exceeds Threshold: The issuer submitted more than 35 chargebacks involving the same card account (for this purpose, “account” means primary account number [PAN], or PAN and expiration date) for message reason codes.

- Not Reported to the Fraud and Loss Database: The transaction was not properly reported to the Fraud and Loss Database in the Fraud Center application on Mastercard Connect on or before the chargeback date. Mastercard allows three days from the reporting date for this.

- Contactless Transaction Unattended Terminals: The transaction was a contactless transaction equal to or less than the applicable CVM limit.

- PIN Transaction: A PIN was present in the Authorization Request

- Authenticated Transaction: The Authorization Request Response/0110 message reflected the issuer’s approval of the transaction and Electronic Commerce Security Level Indicator and UCAF Collection Indicator contained any of the following values of 211, 212, 215, 217, 221, 222, 225 or 242. For intraregional Europe transactions: The UCAF did not contain the Mastercard-assigned static Accountholder Authentication Value (AAV).

- Account Takeover: The merchant can provide evidence that the transaction resulted from an account takeover. Evidence may contain a statement from the cardholder confirming that the account was in fact taken over and that fraud subsequently occurred; or the transaction was reported as such by the issuer.

- Addendum Charges: Documentation substantiating the cardholder has participated in the original transaction and documentation to establish the cardholder is responsible for the addendum transaction. For example, the original rental agreement or hotel folio.

- Address Verification Service (AVS) Transaction: Both of the following:

- The Authorization Response/0110 message included a positive Address Verification Service (AVS) response of X or Y.

- The address to which the merchandise was sent was the same as the AVS-confirmed address.

- Compelling Evidence for non-face-to-face Airline Transactions: At least one of the following documents and, when necessary, an explanation:

- Flight ticket or boarding pass showing the passenger’s name.

- Flight manifest showing the passenger’s name.

- Additional transactions connected with the disputed flight, such as upgrades, excess baggage charges, and in-flight purchases.

- Passenger identification documentation showing a link to the cardholder.

- Credits of frequent flyer miles for the flight, showing connection to the cardholder.

- Proof of receipt of the flight ticket at the cardholder’s billing address.

- Compelling Evidence for non-face-to-face Recurring and Installment-based Repayment Transactions: All of the following:

- A description of the goods or services being provided and documentation proving that the cardholder was informed of and agreed to the recurring or

installment terms and conditions. - The start date of the recurring payment or installment-based repayment arrangement, including the original transaction authorization date, authorization approval code, and if present, the customer-initiated transaction (CIT) value, and SLI value of 212 or 242 or the CVC2 response included a value of M.

- A description of the goods or services being provided and documentation proving that the cardholder was informed of and agreed to the recurring or

- Compelling Evidence for E-commerce and MOTO Transactions: one of the following documents and, when necessary, an explanation:

- A receipt, work order, or other document signed by the cardholder substantiating that the goods or services were received by the cardholder, or the cardholder’s written confirmation of registration to receive electronic delivery of goods/services; or copies of written correspondence exchanged between the merchant and the cardholder (such as letter, email, or fax) showing that the cardholder participated in the transaction; or a merchant statement including a description of the goods or services purchased in the initial transaction, date and authorization approval code for the initial transaction; and the initial transaction was not disputed or was an authenticated e-commerce transaction ( SLI value of 212 or 242 or CVC2 with response M); or

- Documentation confirming the cardholder or authorized user is registered to purchase goods with a password and completed other undisputed purchases prior to, or after, the alleged fraudulent transaction; or the cardholder or authorized user completed the disputed transaction from a registered device and IP address; details of the purchase; signed proof of delivery; email addresses to support digital download delivery; the cardholder or authorized user registered the disputed goods or services. For example, registration for purposes of warranty or future software updates; the disputed goods or services were used; a transaction or Account Status Inquiry request message containing cardholder authentication data was used to register a PAN for future transactions.

- Invalid Chargeback: the issuer submitted documentation that failed to support the chargeback.

- Guaranteed Reservation Service (“No-show”): The transaction was the result of a “no show”. Supporting documentation must contain all of the following:

- The primary account number (PAN).

- The cardholder’s name present on the card.

- The confirmation number provided at the time the reservation was made.

- Chip Liability Shift: All of the following:

- The transaction was between Customers that participate in the appropriate Chip Liability Shift Program.

- The transaction was face-to-face, occurred at an attended a hybrid terminal with card-read (not key-entered) account information.

- The transaction was initiated with a non-EMV chip card.

- Chip/PIN Liability Shift: A transaction between Customers that participate in the Lost/Stolen/NRI Fraud Chip Liability Shift and the acquirer can show that the transaction occurred at a hybrid terminal equipped with a PIN pad, while the card was not PIN-preferring.

- Credit Previously Issued: The merchant issued a credit to the cardholder’s account.

- Other representment options:

- The combination of Primary Account Number and Acquirer Reference Data contained in the chargeback record does not match the information contained in the first presentment record;

- Duplicate Chargeback: The issuer processed a first chargeback for the same transaction more than once. Mastercard recommends that the Merchant provides the processing date and chargeback reference number of the original chargeback with its second presentment;

- The issuer’s first chargeback is processed past the time frame specified for the chargeback;

- Invalid Chargeback: The first chargeback does not meet the prerequisites for the message reason code.

4840 – Fraudulent Processing of Transactions

Supporting Documentation:

- Acquirer needs to provide copies of the legitimate and disputed TID’s and a merchant explanation.

- If the Second presentment is valid but the issuer still suspects fraud, must be provided another Cardholder letter disputing the merchant’s claim and consider processing an Arbitration Chargeback.

4849 – Questionable Merchant Activity

Description:

The merchant is listed in a Mastercard Announcement for violating the Questionable Merchant Audit Program or the merchant is determined by Mastercard to be performing coercive transactions.

Supporting Documentation:

- PAN Mismatch: The Primary Account Number (PAN) in chargeback supporting documentation differs from the PAN included by the acquirer in the clearing record.

- Not Considered in Violation of Mastercard Rule for Coercion Claim: One of the following:

- The claim of coercion was not substantiated against the merchant as determined by Mastercard.

- The issuer did not include the written notification from Mastercard advising of the substantiated claim of coercion as Supporting Documentation.

- Late First Chargeback Submission: The issuer submitted the first chargeback more than 30-calendar days after the date of the noncompliance confirmation letter from Mastercard for claims of coercion.

- Not Reported to the Fraud and Loss Database: the transaction was not properly reported to the Fraud and Loss Database in the Fraud Center application on Mastercard Connect on or before the chargeback date. Mastercard allows three days from the reporting date for this.

- Ineligible Fraud: the fraud type under which the transaction was reported in the Fraud and Loss Database is not eligible for chargeback (e.g., Account Takeover).

- Not Listed in Mastercard Announcement: One of the following:

- The merchant in question was not listed in a Mastercard Announcement.

- The transaction did not occur within the period specified.

- Credit Previously Issued: The merchant issued a credit to the cardholder’s account.

- Other representment options:

- The combination of Primary Account Number and Acquirer Reference Data contained in the chargeback record does not match the information contained in the first presentment record;

- Duplicate Chargeback: The issuer processed a first chargeback for the same transaction more than once. Mastercard recommends that the Merchant provides the processing date and chargeback reference number of the original chargeback with its second presentment;

- The issuer’s first chargeback is processed past the time frame specified for the chargeback;

- Invalid Chargeback: The first chargeback does not meet the prerequisites for the message reason code.

4870 – Chip Liability Shift

Description:

The cardholder states that they did not engage in the transaction and the card was an EMV chip card and fraudulent transaction resulted from the use of a counterfeit card at a non-hybrid terminal or the PIN data was not present as required in the authorization message.

Supporting Documentation:

- PAN Mismatch: The Primary Account Number (PAN) in chargeback supporting documentation differs from the PAN included by the acquirer in the clearing record.

- Two or More Previous Fraud-related Chargebacks: The issuer approved the transaction after submitting two or more chargebacks involving the same Mastercard card account (for this purpose, “account” means primary account number [PAN], or PAN and expiration date).

- Fraud-related Chargeback Counter Exceeds Threshold: The issuer submitted more than 35 chargebacks involving the same card account (for this purpose, “account” means primary account number [PAN], or PAN and expiration date) for message reason codes.

- Not Reported to the Fraud and Loss Database: The transaction was not properly reported to the Fraud and Loss Database in the Fraud Center application on Mastercard Connect on or before the chargeback date. Mastercard allows three days from the reporting date for this.

- Issuer Authorized Transaction: The transaction was authorized online and did not involve a valid EMV chip card.

- Technical Fallback: The transaction was the result of technical fallback.

- Chip Transaction-DE 55 Not Provided-Did Not Require Online Authorization: The transaction did not require online authorization and DE 55 was not

provided in the First Presentment/1240 message and one of the following:- The acquirer can prove that the transaction was completed with chip and PIN.

- Completed with chip while the card was not PIN-preferring.

- The result of CVM fallback.

- Chip Transaction-Offline Authorized: All of the following:

- The transaction was completed by reading the chip.

- The transaction did not require online authorization.

- DE 55 was provided in the First Presentment/1240 message.

- DE 55 Was Provided: Both of the following:

- DE 55 was provided in the First Presentment/1240 message.

- The transaction was completed with chip.

- Invalid Chargeback: The transaction involved an issuer or acquirer located in a country or region without an applicable domestic, intraregional, or interregional chip/PIN liability shift.

- Credit Previously Issued: The merchant issued a credit to the cardholder’s account.

- Other representment options:

- The combination of Primary Account Number and Acquirer Reference Data contained in the chargeback record does not match the information contained in the first presentment record;

- Duplicate Chargeback: The issuer processed a first chargeback for the same transaction more than once. Mastercard recommends that the Merchant provides the processing date and chargeback reference number of the original chargeback with its second presentment;

- The issuer’s first chargeback is processed past the time frame specified for the chargeback;

- Non-receipt of the required documentation for more than 8 calendar days;

- Documentation received was illegible;

- Supporting documentation does not correspond to the transaction being charged back (for example, the documentation concerns a different transaction) or is incomplete.

4871 – Chip/PIN Liability Shift

Description:

- The cardholder states that:

- The cardholder did not authorize the transaction.

- The card is no longer, or has never been, in the possession of the cardholder.

- Both the issuer and the acquirer are located in a country or region participating in a domestic, intraregional, or interregional lost/stolen/NRI fraud chip liability shift.

- A fraudulent transaction resulted from the use of a hybrid PIN-preferring card at a magnetic stripe-reading-only terminal (whether PIN-capable or not) or at a hybrid terminal where the PIN pad is not present or not working. Or a fraudulent contactless transaction exceeding the applicable CVM limit resulted from the use of a contactless-enabled hybrid PIN-preferring card or access device at a contactless enabled POS terminal not capable (at a minimum) of performing online PIN verification, or where the PIN pad is not present or not working.”

Supporting Documentation:

- PAN Mismatch: The Primary Account Number (PAN) in chargeback supporting documentation differs from the PAN included by the acquirer in the clearing record.

- Two or More Previous Fraud-related Chargebacks: The issuer approved the transaction after submitting two or more chargebacks involving the same Mastercard card account (for this purpose, “account” means primary account number [PAN], or PAN and expiration date).

- Fraud-related Chargeback Counter Exceeds Threshold: The issuer submitted more than 35 chargebacks involving the same card account (for this purpose, “account” means primary account number [PAN], or PAN and expiration date) for message reason codes.

- Not Reported to the Fraud and Loss Database: The transaction was not properly reported to the Fraud and Loss Database in the Fraud Center application on Mastercard Connect on or before the chargeback date. Mastercard allows three days from the reporting date for this.

- Authorized Online Transaction: Both of the following:

- The transaction was authorized online.

- Did not involve a valid EMV chip card.

- Chip Transaction-DE 55 Not Provided-Did Not Require Online Authorization: The transaction did not require online authorization and DE 55 was not

provided in the First Presentment/1240 message and one of the following:- The acquirer can prove that the transaction was completed with chip and PIN.

- Completed with chip while the card was not PIN-preferring.

- The result of CVM fallback.

- DE 55 Was Provided in the First Presentment/1240 Message: DE 55 was provided in the First Presentment/1240 message and one of the following:

- The transaction was completed with chip and PIN.

- The transaction was completed with chip while the card was not PIN-preferring.

- The transaction was the result of CVM fallback.

- Invalid Chargeback: The transaction involved an issuer or acquirer located in a country or region without an applicable domestic, intraregional, or interregional chip/PIN liability shift.

- Credit Previously Issued: The merchant issued a credit to the cardholder’s account

- Other representment options: